Forms of state regulation of the economy. Bulatov A.S. Economy Forms of state regulation of the economy Economic methods and forms of state regulation

Russian Academy Public Service

Under the President Russian Federation

Volgo-Vyatka Academy of Public Service

Faculty of Distance Learning

Course work.

Specialty: State regulation of the economy.

Theme: "Forms and methods of state

regulation of the economy "

Speciality: State

and municipal government

Completed: correspondence student

4-course training gr. 07-GMZk-45

Chernova L.N

Checked: Barinov V.V

Nizhny Novgorod

Introduction …………………………………………………………………………. 3

1. The need for state regulation of the economy ... ................... 5

1.1. Objects of state regulation of the economy …………………… 9 1.2 Objectives of state regulation of the economy ……………………… .10

2. Functions of the state in the economy ………………………………………… ..13

3. Toolkit for state regulation of the economy ................... 17

3.1. Forms of impact on the economy ………………………………………… .17 3.2. Economic methods of regulation of the economy ……………… ............ 23

Conclusion………………………………………………………………………. 35

Bibliography ………………………………………………… ... 36

Appendix A ………………………………………………………………… .38

Appendix B ………………………………………………………………… .39

Appendix C ………………………………………………………………… .40

Introduction

The state plays an important role in ensuring the normal functioning of any modern economic system. Throughout the history of its existence, the state, along with the tasks of maintaining order, legality, organizing national defense, performed certain functions in the economic sphere. State regulation of the economy has a long history - even during the period of early capitalism in Europe, there was a centralized control over prices, quality of goods and services, interest rates and foreign trade. In modern conditions, any state government regulates the national economy, with varying degrees state intervention in the economy. On the issues in what proportions state and market regulation should be combined, what are the boundaries and directions of state intervention, there is a wide range of opinions and approaches - from complete state monopoly to extreme economic liberalism. However, the need for the state to perform certain functions in the economy is not in doubt. This was once again confirmed in the course of the "Keynesian revolution", which revolutionized the classical views on the market economy and proved the impossibility of self-healing of the economic downturn.

Regardless of the prevailing economic doctrines, no one relieved national governments of responsibility for the country's economic situation. Thus, state regulation of the economy is important for the economic and social development of the country. At the same time, while regulating the economy, the state uses a wide range of means and methods of influencing the economy in such areas as the budget, taxes, monetary policy, economic legislation, etc.

In any economic system, including a market economy, the state acts in a certain sense as an economic agent, for example, in the field of tax policy, state legislation. Coercion is often justified by political philosophy, which requires the subordination of personal interests to public interests.

Be that as it may, the state has always, at all times and in all countries, exerted a key influence on the functioning of the economy, and as a result, on the development of society as a whole. Thus, government regulation is an important part of the functioning of the economy and, therefore, deserves close attention.

The refusal of state bodies to participate in the management of the economy and the transfer of all responsibility to the level of enterprises are actions that do not meet the needs of the development of modern production and are not justified. Modern market relations in almost all countries are regulated by state legislation.

The purpose of the work is to consider the state regulation of the economy.

Work tasks:

- to determine the need for state regulation of the economy, its objects and goals;

- to define the functions of the state in the economy;

- to determine the tools of state regulation, its forms and methods.

1. The need for state regulation of the economy

As historical experience shows, the state has always played a certain role in the economy. Its main functions, including the period of functioning of the economy of free competition, were: protection of national sovereignty, protection of property rights, law and order. The state also performed the function of regulating money circulation and foreign trade. Micro- and macroeconomic problems of the development of this economic system were solved through the functioning of the market as a system of relations between buyers and sellers. Market conditions, price changes as a result of fluctuations in supply demand ensured the implementation of the information, redistribution and stimulating functions of the market.

The development and complication of the processes that characterize the market economy, the increased dependence of the use of individual capitals on the general conditions for the functioning of total capital made it necessary to determine the “rules of the game” for participants in economic activity, formulated and enshrined in the form of legislative acts and providing an external environment for functioning of market entities. An institutional system corresponding to a new level of market relations has been developed, covering the provision of property rights, their transfer, political, legal and economic decision-making mechanisms.

The growing destructive power of economic crises, affecting many countries, which gives them the character of world ones, increasingly cast doubt on the assertions of representatives of classical economic theory, created at the stage of the formation of capitalism, about the possibility of the market to carry out complete self-regulation of economic processes based on competition, price elasticity, income and employment.

In A. Smith's work “Research on the nature and causes of the wealth of nations”, it is said that “free play of market forces” (the principle of “laissez faire”) creates a harmonious structure.

According to A. Smith, the market system is capable of self-regulation, which is based on self-interest associated with the pursuit of profit. He acts as the main driving force behind economic development. One of the ideas of A. Smith's teachings was the idea that the economy will function more efficiently if it is excluded from its regulation by the state. A. Smith believed that since the main regulator is the market, therefore, the market should be given complete freedom.

At the same time, the followers of A. Smith, who belong to the so-called classical school, proceeded from the thesis about the need for the state to perform traditional functions, understanding that there are areas that are beyond the reach of the market competitive mechanism. This primarily concerns the so-called public goods, i.e. goods and services that are consumed collectively (national defense, education, transport system, health care, etc.). Obviously, the state should take care of their production and organize joint payment by citizens for these products.

Among the problems that the market competitive mechanism does not solve are external, or side effects... The market mechanism often does not respond to phenomena that have become a real disaster for humanity. External or side effects can be regulated by relying on direct control of the state, i.e. the state should assess emerging problems from the point of view of social perspectives.

Economic practice has confirmed that there are situations, the so-called market fiasco, when market coordination does not ensure the efficient use of resources. The fiasco of the market is manifested not only in situations related to externalities and public goods. The most important reason is the inherent tendency of the market towards monopolization. In these conditions, in order to ensure competition, as the conditions for the most complete identification of the regulatory functions of the market, the development of antimonopoly legislation and its application by the state have become vital.

In addition, outside of market regulation are issues of fairness and equity. Market distribution, fair from the point of view of market laws, leads to income inequality and social insecurity. It should be borne in mind that when the market distribution does not suit the majority of the population, it is fraught with serious social conflicts.

The realities of economic life have convincingly proved that the market, based on its inherent mechanism of functioning, is not able to provide automatic self-regulation. The need in connection with this increase in the regulatory role of the state was put in the basis of Keynesian economics theory.

Keynes's theory can be called “crisis”, as he considers the economy in a state of depression. According to his theory, the state should actively intervene in the economy due to the lack of mechanisms in the free market that would really ensure the economy's exit from the crisis. Keynes believed that the state should influence the market in order to increase demand, since the cause of capitalist crises is the overproduction of goods. He offered several tools. This is a flexible monetary policy, a new budgetary and financial policy, etc. Flexible monetary policy allows you to step over one of the most serious barriers - inelasticity wages... This is achieved, Keynes believed, by changing the amount of money in circulation. With an increase in the money supply, real wages will decrease, which will stimulate investment demand and employment growth. With the help of fiscal policy, Keynes recommended that the government increase tax rates and use these funds to finance unprofitable enterprises. This will not only reduce unemployment, but also relieve social tension.

The main features of the Keynesian model of regulation are:

High share of national income redistributed through

state budget;

Creation of an extensive zone of state entrepreneurship in

the basis of the formation of state and mixed enterprises;

The widespread use of budgetary and financial and credit and financial

sovial regulators to stabilize the economic environment,

smoothing cyclical fluctuations, maintaining high rates

growth and high employment.

In practical terms, economic policy reflecting Keynes's ideas, when aggregate demand was regulated through appropriate monetary and financial instruments, was pursued by most of the developed countries of the world after the Second World War. It is believed to have contributed significantly to mitigating cyclical fluctuations in the economies of these countries.

According to J.M. Keynes, only a combination of a self-regulating market mechanism and government regulators is able to provide an aggregate effective demand in accordance with the produced national product, i.e. stable economic development.

The modern market economy is inseparable from the state. Despite different approaches to assessing the role of the state, in all developed countries there is state regulation of the economy.

The factors that determine the need for state regulation of the economy are presented in Appendix A, Table 1.

The proposed classification of factors that determine the need for state regulation of the economy is conditional, since all three groups of factors are interconnected. Thus, the creation by the state of general favorable conditions for the stable development of the economy undoubtedly contributes to overcoming the negative features of the market mechanism and solving social problems.

The development of a market economy in the second half of the twentieth century revealed a clearly defined tendency to expand the scope of the state's activities and strengthen its role in the economy. At the same time, it is generally recognized that the greatest economic efficiency is achieved under the conditions of a competitive market mechanism. The goal of the state in a market economy is not to adjust the market mechanism, but to create conditions for its free functioning: competition should be ensured wherever possible, the regulatory influence of the state - wherever necessary.

1.1. Objects of state regulation of the economy.

Revealing the reasons for the need for state regulation of the economy to a decisive extent predetermines the objects of influence of the authorities.

Objects of state regulation are primary links in the sphere of production and services, industries, regions, socio-economic processes, i.e. what the attention of state bodies is directed to to ensure the conditions for the effective functioning of the national economy.

The main objects to which the influence of the state in the sphere of the economy is directed are:

Denationalization, privatization, demonopolization processes;

The structure of the forms of ownership;

Social, sectoral, sectoral, regional and reproductive

the structure of the national economy;

Economic cycle, reproduction process;

Public sector of the economy;

Conditions and sources of capital accumulation;

Money turnover;

Prices, anti-inflationary processes;

Competitive environment;

Entrepreneurship;

Investments;

Social sphere, labor relations, mechanisms of protection of the population;

Employment, personnel;

Payment balance;

Foreign economic activity of the country;

Environment.

The list of objects of state regulation indicates that they cover various spheres of the economic life of society at both the micro and macro levels, including international economic relations. Scheme B 1. gives an idea of the need for state influence on separate, grouped objects.

1.2. Objectives of government regulation.

Determining the objects of its influence, the state also formulates the goals that it sets for itself.

The set of goals is a certain system, including the main, general goals, as well as specific goals associated with the implementation of one or another economic, social process and contributing to the achievement of the main goal.

The main goal of state regulation of the economy is to ensure socio-economic stability in society. Specific goals can be grouped into certain blocks that determine the achievement of the most general goals. The totality of the main and specific goals can be represented as follows.

Ensuring economic stability, alignment of long-term cyclical and short-term market fluctuations:

Regulation of the sectoral and regional structure of the national economy;

Ensuring economic growth;

Supporting the stability of the national currency;

Full employment;

Foreign economic equilibrium.

Providing framework conditions for the functioning of the national economy:

Ensuring territorial integrity;

Providing the legal basis for the functioning of the economy;

Maintaining internal order;

Ensuring social stability:

Social security of various segments of the population;

Provision of social services;

Provision of the population with public goods.

Coordination of economic activities:

Providing information on market conditions, development prospects

National economy;

Development of a motivational mechanism, a system of incentives and sanctions.

Supporting a competitive environment:

Creation of economic, legal conditions, rules of the system of competitive relations, protection of the competitive environment;

Fight against unfair competition;

Fight against monopoly;

Development of strategic and tactical measures for the development of entrepreneurial activity (financial, tax, customs, etc.);

Support for small and medium-sized businesses.

Public sector management in the economy:

State Enterprise Management;

Management of state property (explored minerals, government securities, blocks of shares, government credit funds).

Many specific goals arise from the main goal, without the implementation of which the main goal cannot be achieved. These specific goals are inextricably linked with the objects of state regulation of the economy. The goal, that is, the alignment of the economic cycle, is aimed at the object. More often than not, one goal cannot be achieved independently of others. For example, securing additional capital investment for the modernization of coal mines can be an intermediary goal for: stabilizing and reducing costs in the domestic coal mining industry; reducing the import of solid fuel and improving the fuel and energy balance; maintaining employment in the industry; removal of social tension in these areas; putting pressure on the prices of oil and gas companies. It follows from this that specific goals are subject to the main goal and interact with each other.

2. Functions of the state in the economy .

State intervention in the economy pursues certain functions. As a rule, it corrects those “imperfections” that are inherent in the market mechanism and which the market either cannot cope with, or its solutions are not effective. The state assumes responsibility for creating equal conditions for rivalry between entrepreneurs, for effective competition, for limiting the power of monopolies. It also takes care of the production of a sufficient amount of public goods and services, since the market mechanism is not able to adequately meet the collective needs of people. State participation in economic life is also dictated by the fact that the market does not provide a socially fair distribution of income. The state should take care of the disabled, the poor, the elderly. He also belongs to the sphere of fundamental scientific research. Since the market does not guarantee the right to work, the state has to regulate the labor market and take measures to reduce unemployment. The market economy does not solve and many others actual problems... And the state should take care of all this. The prerogative of the state is to ensure a reliable law and order in the country, and this, in turn, is the basis for the development of the economy.

In general, the state implements the political and socio-economic principles of this community of citizens. It actively participates in the formation of macroeconomic market processes.

Depending on the type of economic system - a market economy of free competition or an economy of imperfect competition, traditional, administrative-command - the functions of the state are formed.

The state is entrusted with the following main functions:

1. Creation of a legal basis for making economic decisions. The state develops legislative and regulatory documents that regulate the mechanism of functioning of the economy as a whole and its individual subjects.

The creation of a legislative framework is the establishment of rules for the behavior of economic agents, legal principles of economic communication, which all economic agents - producers, consumers and the state itself - must adhere to in their actions. Among these rules, one can note legislative and regulatory acts that protect private property rights and determine the forms of entrepreneurial activity, the conditions for the functioning of enterprises, their relationship between themselves and the state. Legal norms cover product quality and labor safety issues, issues of relations between trade unions and administration, etc.

2. Stabilization of the economy, i.e. sustainable development of the economy, when the main macroeconomic indicators are achieved and maintained at the optimal level: the volume of the gross national product, national income, the rate of inflation and unemployment, budget deficit, maintaining a stable level of prices and the national currency. To ensure the stabilization of the economy, the state is obliged to use all the levers and methods at its disposal through the implementation of appropriate fiscal, financial and credit, scientific, technical and investment policies.

If the state does not seek to stabilize the economy, then this will significantly negatively affect the country's economy as a whole, the social situation and other processes;

3. Provision of social protection and social guarantees. The state is obliged to pursue an active social policy, the essence of which is the guaranteed provision of all workers with a minimum wage, old-age and disability pensions, unemployment benefits; in providing various types of assistance to the poor; in the implementation of the indexation of fixed incomes due to inflation, etc.

Pursuing this policy, the state thereby ensures the minimum subsistence level for all citizens of its country and does not allow social tension in society:

4. Socially-oriented resource allocation. The state organizes the production of goods and services that are not dealt with by the private sector. It creates conditions for development Agriculture, communications, transport, determines the costs of defense, science, forms programs for the development of education, health care, etc .;

5. Antimonopoly activity of the state is one of the most important areas of application of state intervention. Regulation is developing in two directions. In those few markets where conditions impede the efficient functioning of the industry in competition, that is, in the so-called natural monopolies, the state creates public regulatory bodies to control their economic behavior. In most other markets where monopoly has not become a necessity, public control has taken the form of antitrust laws.

To prevent the consequences associated with imperfect competition, the state, on the basis of monopoly legislation, uses measures of state regulation, establishing control over prices, resorting to the division of large firms, preventing their merger. It can seize illegally obtained profits in court, etc.

Protection of competition as the basis for the functioning of a market economy is not limited to regulating the rules of behavior of monopolies or combating them. The most important condition creating a competitive environment is the availability of reliable information about the market situation and the state of the economy as a whole.

Antimonopoly legislation is a package of laws that acts as a means of maintaining a balance between competition and monopoly by the state, as a means of establishing official “rules of the game” in the market. The specific nature and content of antitrust laws in different countries have their own characteristics, however, it is possible to distinguish the foundations of this legislation common for all countries: protection and promotion of competition, control over firms occupying a dominant position in the market, price control, protection of consumer interests, protection of interests and promotion of the development of medium and small businesses.

Modern antitrust law has two principal directions: control over prices and control over mergers of companies. Antitrust laws primarily prohibit agreement on prices. It is illegal to conspire between firms to set prices. Dumping sales practice is pursued by law when a company deliberately sets more low prices in order to drive out competitors from the industry.

It follows from this that the state acts as an arbiter, which chooses the optimal (and most effective) ratio between monopolies and competitive industries. In different periods of history for different countries, this ratio was different, adjusted to the peculiarities of economic development, and the state must skillfully and effectively use this mechanism.

3.Instruments for state regulation of the economy

The world experience of countries with developed market economies shows that in conditions of economic reform, in crisis situations, the role of the state increases; in conditions of stability and revitalization, it decreases. But in all cases, the state must adhere to the basic rule - to influence the country's economy in such a way so as not to destroy the market basis and prevent crisis phenomena.

The application by authorized state bodies, institutions of a system of legislative, executive and regulatory measures aimed at achieving certain socio-economic goals, and constitutes state regulation of economy.

State regulation of the economy is directly related to economic policy and is aimed at its implementation. To realize the goals of its economic policy, the state uses various forms and methods, which form the toolkit for state regulation of the economy.

The choice of instruments for state regulation of the economy, the nature and mechanism of their use, cannot be accidental. The regulation tool is determined by the most optimally chosen strategies and ways of economic development. The set of instruments for government influence on the economy may be the same in different countries.

3.1. Forms of influence on the economy .

An analysis of Western theories and world experience allows us to speak about both the formation of national models and the established standard set of social forms and methods of state regulation, state intervention in the economy. First of all, two main forms are distinguished: direct intervention through state ownership of material resources, lawmaking and management manufacturing enterprises and indirectly - through various measures of economic policy.

Direct intervention is carried out by means of administrative and economic influence. The indirect method of regulation is implemented only by economic means.

Administrative methods of regulation include a variety of "measures" of control over income, accounting interest, quotas, licensing, etc. Administrative methods of regulating the economy include measures such as prohibition, permission, coercion.

Administrative methods are used by the state when economic methods are not effective enough in solving a particular problem. As world practice has shown, administrative methods are most effectively used in the following areas:

Natural state monopoly (railway transport, communications, fundamental science);

Environmental protection and resource use;

Certification, standardization, metrology;

Social policy, first of all, is the definition and maintenance of the minimum acceptable parameters of the population's life (guaranteed minimum wages, unemployment benefits, etc.).

State legal regulation is carried out on the basis of economic legislation through a system of norms and rules established by it.

Direct economic regulation includes various forms of irrevocable targeted financing of territories, enterprises, industries - these are subventions or direct subsidies, which include various kinds of subsidies, additional payments from special budgetary and extra-budgetary funds of various levels. This also includes soft loans.

At the junction of administrative and direct economic methods of regulation, there are such forms of state regulation as program-targeted approach, project financing and lending.

The economic (indirect) methods of regulation include the policy pursued by the state in the field of credit and financial, foreign exchange, foreign economic (including customs) relations, tax systems, depreciable property, etc. It follows that the state, using economic interests and incentives, affects the economic behavior of business entities acting as producers and consumers.

The state influences the market mechanism through its expenses, taxation, regulation and state entrepreneurship.

1. Government spending is considered one of the important elements of macroeconomic policy. They affect the distribution of both income and resources. Government spending consists of government purchases and transfer payments. Public procurement is, as a rule, the purchase of public goods (defense costs, construction and maintenance of schools, highways, scientific centers, etc.). Transfer payments are payments that redistribute tax revenues received from all taxpayers to certain segments of the population in the form of unemployment benefits, disability payments, etc. It should be noted that government procurement contributes to national income and directly uses resources, while transfers do not use resources and are not associated with production. Government purchases lead to the redistribution of resources from private to public consumption of goods. They enable citizens to use public goods. Transfer payments have a different meaning: they change the structure of production of goods for individual consumption. Amounts taken in the form of taxes from some strata of the population are paid to others. However, those to whom the transfers are intended spend this money on other goods, which results in a change in the structure of consumption.

2. Taxation. Taxes are the main source of budgetary funds. In the states of the market economy, various types of taxes are levied. Some of them are visible, for example, income tax, others are not so obvious, since they are imposed on producers of raw materials and affect households in an indirect way in the form of higher prices for goods. Taxes cover both households and firms. Significant sums go to the budget in the form of taxes.

One of the main problems is the fairness of the distribution of the tax burden. There are three main systems based on the concept of the progressiveness of taxation - the ratio of the amount levied in the form of tax from the income of a particular employee to the amount of this income:

Proportional tax (the amount of the tax is proportional to the employee's income);

Regressive tax (in percentage terms, the tax is levied the lower the higher the employee's income);

Progressive tax (as a percentage, the higher the income, the higher the tax).

The fairest is a progressive tax, but the percentage increase in the tax should not be significant, so as not to weaken the incentives to work, and therefore to higher earnings. As a rule, the income tax is based on this principle. However, sales taxes and excise taxes are actually regressive, since in most cases they are passed on to consumers, in whose income the same amount occupies a different and different share.

The task of the state is to collect taxes in such a way as to meet the needs of the budget and at the same time not to cause discontent among taxpayers. If tax rates are too high, massive tax evasion begins. At the present stage, such a situation is taking place in Russia. The state does not have enough funds, it raises taxes, entrepreneurs more and more often avoid paying them, therefore, fewer funds go to the budget.

3. State regulation. State regulation is intended to coordinate economic processes and link private and public interests. It is carried out in legislative, tax, credit and subvention forms. The legal form of regulation regulates the activities of entrepreneurs. An example is antitrust laws. Tax and credit forms of regulation provide for the use of taxes and credits to influence the national volume of production. By changing tax rates and incentives, the government affects the contraction or expansion of production. When the terms of lending change, the state influences the decrease or increase in the volume of production.

The subventional form of regulation involves the provision of state subsidies or tax benefits to certain industries or enterprises. These usually include industries that create general conditions for the formation of social capital (infrastructure). On the basis of subsidies, support can be provided in the field of science, education, training, and in the solution of social programs. There are also special, or targeted, subsidies, which provide for the spending of budget funds for strictly defined programs. The share of subventions in the GNP of developed countries is 5-10%. By providing subsidies and lowering tax rates, the state thereby changes the allocation of resources, and the subsidized industries are able to recover costs that cannot be covered at market prices.

4. State entrepreneurship. In the modern market economy, the state is not only a coordinator and controller, but also an entrepreneur. State entrepreneurship is understood as activities aimed at the systematic receipt of profit from the use of property, the sale of goods, the performance of work or the provision of services by state organizations.

State entrepreneurship is carried out in areas where economic activity is contrary to the nature of private firms, or a huge investment and risk are required. The main difference from private entrepreneurship is that the primary goal of public entrepreneurship is not to generate income, but to solve social and economic problems, such as ensuring the necessary growth rates, smoothing cyclical fluctuations, maintaining employment, stimulation of scientific and technical progress, etc. This form of regulation provides support for marginal enterprises and sectors of the economy that are vital for reproduction. These are, first of all, the branches of the economic infrastructure (energy, transport, communications). Problems solved by state entrepreneurship also include the provision of benefits to the population in different areas social infrastructure, assistance to vital science and capital-intensive sectors of the economy in order to accelerate scientific and technological progress and strengthen on this basis the country's position in the world economy, the implementation of regional policy - the construction of industrial enterprises in economically backward regions, the creation of workers places, environmental protection, through the introduction of waste-free technologies, the construction of treatment facilities, the development of fundamental scientific research, the production of goods, which are, by law, a state monopoly.

State entrepreneurship should develop only in those areas where there is simply no other way out. The fact is that compared to private, state-owned enterprises are less efficient. A state-owned enterprise, even if endowed with the broadest rights and responsibility, always lags behind the private in the degree of economic independence. In the activities of the state-owned enterprise, there are certainly both market-based and non-market motives coming from the state. Political motives are changeable, they depend on the government, orders of ministries, etc. Therefore, state-owned enterprises often find themselves in a complex and unclear environment, which is much more difficult to predict than a market tour. It is much easier to predict the likely fluctuations in demand and prices than to predict the behavior of a new minister or official, whose decisions often determine the fate of an enterprise. They can be backed by political goals that have nothing to do with market behavior (the desire to increase budget revenues, the desire to retain states and raise wages, etc.).

As a rule, state-owned enterprises are not ready for market competition, since they rely not only on themselves, but also on special treatment from the authorities (subsidies, tax incentives, sales guarantees in the framework of government orders). State-owned enterprises have no obligations to shareholders; they usually do not face bankruptcy. All this negatively affects the dynamics of costs and prices, the speed of mastering new technologies, the quality of production organization, etc.

If the economy is burdened with an excess of state-owned enterprises, their workers are in a difficult position. It is they who become the first victims of government policies aimed at overcoming emergencies... Usually people working in the public sector are the first to feel the wage freeze. This is probably why the wave of privatization that swept through the economies of Western countries in the 1980s did not provoke widespread protests from the bulk of those employed in the public sector. People hoped that, freed from state pressure, they would be able to fully use the advantages of the market economy, and become co-owners of private enterprises.

3.2. Economic methods of regulation of the economy

To create normal conditions for entrepreneurial activity, stabilization and recovery of the economy, the state must pursue an appropriate economic policy, which consists of fiscal, scientific and technical, investment, price, depreciation, monetary and other types of policy, when implementing which it uses in a complex both economic and administrative.

Fiscal policy

Fiscal policy is the deliberate application of government spending and tax functions to achieve certain macroeconomic goals.

Fiscal policy is regulated by the state budget and taxation in order to stabilize and revive the economy.

The main lever of the state's fiscal policy is to change tax rates in accordance with the goals of the government. Carrying out fiscal policy is the prerogative of the country's legislative authorities, since it is they who control the taxation and spending of these funds.

Fiscal policy consists of the so-called discretionary fiscal policy and automatic. Discretionary fiscal policy refers to the deliberate regulation of government spending, taxes and the state budget balance in order to influence the real volume of national production, employment, economic growth and inflation.

During a downturn, a stimulating discretionary fiscal policy consists of:

Increases in government spending;

Tax cuts;

Combining increased government spending with tax cuts.

During a downturn in production, in order to increase aggregate demand, the state increases its costs for organizing public works (construction of roads, bridges and other objects) and for the implementation of various state programs, thereby revitalizing many industries and firms. The state can influence the growth of the economy by reducing its income, i.e. reducing taxes on individuals and businesses. Demand for consumer goods is increasing among the population, and enterprises have more opportunities for investment, which should ultimately lead to a revival of the economy. The tax burden may be such that even a well-functioning enterprise will not have enough funds not only for expanded production, but also for simple reproduction. It should provide for certain tax benefits for enterprises that operate in the spheres of the economy desirable for the state; to stimulate small business; for enterprises that spend a significant part of their incomes on reconstruction, technical re-equipment and expansion of existing production. the revitalization of various government programs, thereby revitalizing many industries and firms. roads, bridges and other objects) and on

Such a fiscal policy leads in fact to deficit financing, but ensures a reduction in the decline in production.

In the context of inflation caused by excess demand (inflationary demand), a restraining discretionary fiscal policy is formed:

Reducing government spending;

Increase in taxes;

Combining government spending cuts with rising taxation.

A decrease in government spending in certain cases leads to a decrease in the government budget deficit, and, consequently, to a slowdown in inflationary processes.

This fiscal policy is guided by a positive budget balance.

However, macro regulation is not limited only to the direct actions of the state represented by its governing bodies, since the state may be lagging behind in its actions.

There are certain mechanisms of self-organization and self-regulation in the economy, which come into effect immediately, as soon as negative processes in the economy are detected. In the economic literature, they are called built-in stabilizers. They allow you to automatically make changes in tax revenues, payments of social benefits, etc. Such a stabilizer can be a progressive system of taxation, which determines the tax depending on income. As income rises, tax rates that are approved by the government in advance are progressively increased.

The fiscal (budget) policy of the state is aimed, first of all, at smoothing out economic fluctuations. Pursuing only this policy, the state cannot fulfill its functions without an appropriate monetary policy, especially in a deep economic crisis.

Monetary policy

The monetary policy of the state is a set of measures that affect monetary circulation and the state of credit in order to achieve non-inflationary economic growth and full employment.

Monetary policy is based on the principles of monetarism. Its main advantage over fiscal policy is its efficiency and flexibility. Since it is administered by the central bank rather than the country's parliament, it is less subject to political influence.

In world economic practice, the following instruments for regulating the money supply in circulation are used:

Change in the discount rate (refinancing rate), i.e. regulation of interest on loans of commercial banks from the central bank;

Change in the rate of required reserves;

Operations in the open market with securities.

The Central Bank of Russia plays the main role in the implementation of monetary policy. By adjusting the interest rate depending on the current economic situation, it expands or narrows the possibilities of issuing loans to commercial banks.

The central bank can also act by rationing the required reserves. Lowering this rate creates more opportunities for commercial banks to issue loans and vice versa.

The state can significantly influence economic growth and inflation by buying or selling its securities. When buying up securities, their holders get their own funds, which can stimulate economic growth. If the state is fighting inflation, then it sells its securities, thereby reducing the money supply in circulation.

As world practice has shown, budgetary and monetary policy should be carried out jointly and in a balanced manner, because only in this case it can effectively influence the country's economy.

Science and technology policy

Acceleration of scientific and technological progress (STP) is the most important factor in economic recovery and the transformation of the country into a powerful industrial state. So, for example, Japan's access to the most advanced positions in the world in a relatively short period of time is due primarily to the fact that in the post-war period this country correctly orientated itself and began to pursue a state policy aimed at accelerating scientific and technological progress.

The unified scientific and technical policy of the state is understood as a system of purposeful measures that ensure the comprehensive development of science and technology, the implementation of their results in the national economy.

The unified state scientific and technical policy presupposes the choice of priority directions in the development of science and technology and all kinds of support from the state in this development. The following priority directions in the development of science and technology are generally recognized: complex automation of production, electronicization of the national economy, development of new materials and technologies, biotechnology.

The choice of priorities is necessary not only in the areas of scientific and technical progress, but also among the sectors of the national economy. It is known that such industries as mechanical engineering, chemical, electric power, accelerate scientific and technological progress in all sectors of the national economy. Therefore, these industries should always be in the focus of government attention.

To implement a unified scientific and technical policy, the state uses a number of means, the main of which are: sufficient and reasonable financing of the education sector and academic science; implementation of progressive and investment policies; improvement of the system of remuneration for research workers; protection of competition; creation of such conditions when all subjects of a market economy will be interested in the introduction of everything new and advanced; active participation in international scientific and technical cooperation, etc.

An effective scientific and technical policy cannot be implemented without appropriate support from the state at a sufficiently high level of secondary and higher education, as well as academic science.

Depreciation policy

Depreciation policy is an integral part of the general scientific and technical policy of the state. By establishing depreciation rates, the procedure for its calculation and use, the state thereby regulates the rate and nature of reproduction, and, first of all, the rate of renewal of fixed assets.

When developing a depreciation policy, the state must adhere to the following principles:

Timely implementation of the revaluation of fixed assets, especially in the context of inflation;

Depreciation rates should be sufficient for a simple and extended reproduction of fixed assets;

Depreciation deductions in enterprises should be used only on the basis of functional purpose;

Depreciation rates should be differentiated depending on the functional purpose of fixed assets, as well as taking into account the period of their moral and physical wear and tear;

Possible implementation of accelerated depreciation by enterprises;

The amortization policy should contribute to the renewal of fixed assets and the acceleration of scientific and technological progress.

Since 1991, the state's depreciation policy has changed significantly: depreciation deductions began to be made only for the complete restoration (renovation) of fixed assets, and they were canceled for major repairs; depreciation began to be charged within the standard (and not actual, as before) service life of the means of labor; depreciation deductions of enterprises remain completely at his disposal; accelerated depreciation of fixed assets is allowed.

An important point in the amortization policy - the timeliness of the revaluation of fixed assets, especially in the context of inflation. According to the Decree of the Government of the Russian Federation of August 19, 1994 No. 967, all enterprises, regardless of ownership, are allowed to revalue fixed assets by indexing their book value in accordance with current prices and the conditions of reproduction, as well as to carry out the indexation of depreciation deductions by applying a correction factor corresponding to the inflation index published by the state statistics authorities. By the same Resolution, all enterprises are allowed, starting from July 1, 1994, to accept decreasing coefficients for depreciation deductions in the amount of up to 0.5 in cases when the financial and economic indicators of an enterprise and organization after a revaluation of fixed assets significantly deteriorate. Such revaluation and indexation is carried out annually. All these measures of the government should lead to the creation of favorable conditions for the active renewal of fixed assets and the acceleration of scientific and technological progress. By pursuing the correct depreciation policy, the state thereby allows enterprises to have sufficient funds in the form of depreciation deductions for simple and extended reproduction of fixed assets.

Investment policy

The investment policy of the state is an important leverage for influencing the country's economy and entrepreneurial activity.

With the help of investment policy, the state can directly influence the rate of production, accelerate scientific and technological progress, change the structure of social production and solve many social problems.

A significant decline in production for the period 1991-2003, during the period of reforms, was largely due to a significant reduction in capital investments in material production. During this period, capital investments decreased three times, and their share in national income fell to 15%, which did not provide even a simple reproduction of public capital. In industrialized countries, the share of investment in national income is up to 40% or more.

In the context of the transition to a market economy, the main task is to free the state from the function of the main investor and create such conditions for the private sector in the economy to be interested in investment activities. To do this, it must first of all ensure the stability of the economy and its predictability in development. In conditions of inflation, and consequently, high interest rates of bank loans, the volume of investments, especially in medium-term and long-term projects, is sharply reduced, since the theoretical dependence of the volume of investments on the value of the interest rate is known, according to which - the higher the percentage rates, the lower the amount of investment.

In general terms, the state can influence investment activity using a variety of levers:

Credit, financial and tax policy;

Providing a variety of benefits to enterprises investing in the reconstruction and technical re-equipment of production;

Depreciation policy;

Creation of favorable conditions for attracting foreign investments;

Scientific and technical policy, etc.

The future of the country's economy largely depends on the investment policy pursued by the state.

State entrepreneurship

One of the most important forms of direct state intervention in the economy is state entrepreneurship. It forms a special type of entrepreneurial activity that is carried out within the public sector and is associated with the participation of state enterprises in the production and sale of goods and services.

The state acts as an independent economic entity, realizing certain national goals: restructuring production, mitigating sectoral and territorial disparities, stimulating scientific and technological progress, increasing the efficiency of the economy.

State entrepreneurship is a direct intervention of the state in the reproduction process. It is especially necessary in low-profit industries, which are traditionally not of interest to private capital, but the development of which determines the general conditions of reproduction. These are, first of all, the infrastructure sectors: transport, communications, energy.

Until recently, the degree of nationalization in our country was extremely high by world standards, which negatively influenced the development of the economy. As a result of the reforms, and in particular privatization, the share of the public sector began to decline noticeably, but still remains quite high. Therefore, the process of further implementation of privatization for our country is very relevant - it is necessary to bring the share of the public sector to the optimal level.

State forecasting, planning and regulation

Forecasting, planning and regulation are the most important levers of the state in managing the country's economy. With the transition to market relations, the role of forecasting and regulation does not decrease, and planning methods change significantly. Directive planning, when a predetermined production program and consumers were established for each enterprise, is replaced by indicative planning. Its essence is that the state, on the basis of a detailed analysis of the functioning of the economy for the previous period and based on the available resources, sets the main macroeconomic indicators for the planning period: the growth rate of the gross national product and national income, the level of inflation and unemployment, the minimum wage fees, budget deficit, interest rate, etc. All these indicators together characterize the state of the economy for the planning period. At the same time, the state should also include in the plan macroeconomic indicators, which together would have a positive effect on the development of the country's economy and the living standards of the population. Indicative planning involves not only the development of planned macro economic indicators(indicators), but also ways to achieve them. That is, the fiscal, scientific and technical, credit and financial, investment and social policies of the state are predetermined in advance in order to achieve the planned indicators.

State planning should be continuous, supported by the presence of short-term, medium-term, long-term long-term plans. Short-term programs are usually developed for a period of 1 to 3 years. Medium-term programs cover a period of 3-5 years. Long-term programs are drawn up for a period of five or more years, which makes it possible to develop an economic strategy of the state and thereby carry out annual planning, taking into account the implementation of both annual and long-term plans. a state with fewer resources to achieve the intended goals, and, consequently, to continuously increase the efficiency of public production.

Closely related to planning is regulation. The state carries out regulation only if the planned macroeconomic indicators in the course of their implementation are not met.

In many developed countries, planning at the state level takes the form of developing and implementing certain programs.

By planning and regulating the sphere of internal and external relations, the state seeks to achieve the necessary coordination of reproduction flows in various sectors of the economy in accordance with the needs of the national economy as a whole.

Price policy

Pricing is one of the most effective levers of influence on the economy. Using the pricing policy, the state influences supply and demand, the redistribution of income and resources, the provision of a minimum subsistence level, as well as anti-monopoly, anti-inflationary and other processes in the direction it desires.

The state should pursue a policy in the field of pricing, primarily with the aim of ensuring price stability, which is the basis for the fight against inflation, the revival of investment and the recovery of the national economy.

It is known that in conditions of market relations, prices for most goods are free, i.e. are determined by supply and demand. For some of the most important goods and essential services, prices and tariffs are regulated by the state. This is the practice of almost all countries in the world with developed market economies. Although the share of goods and services, prices for which are regulated by the state, is insignificant - only 10-15% of the total commodity mass, but this is of great importance for maintaining the minimum subsistence level of the population.

Administrative control of the state over prices is sometimes necessary to eliminate the costs of a market economy, especially in cases where economic methods do not give the desired result.

The state can have a significant impact on entrepreneurial activity by pursuing an appropriate foreign economic and social policy.

By implementing foreign economic policy (customs tariffs, protectionism; adoption of laws that create favorable conditions for foreign investment and free entry of domestic entrepreneurs to the world market, and other measures), the state can significantly expand its export opportunities, improve the export structure, obtain positive trade balance, create conditions for competition and improve the quality of domestic products, attract foreign investment in the domestic economy, and also get significant benefits from the international division of labor.

In general, the toolkit for state regulation of the economy is presented in Appendix C, Table 1.

Conclusion.

Above, the main methods and instruments of state regulation of the economy were considered. It can be seen that in the arsenal of the state there is a wide range of means and methods for regulating the economy, from regulating economic legislation, thereby establishing the rules of behavior of economic agents, to influencing the money market using the policy of the discount rate. It is very difficult to determine unequivocally where the line is between civilized regulation of the economy and gross interference in market mechanisms. No wonder there are many opinions on this matter. With all confidence, one can only conclude that state regulation of the economy is necessary and only the degree of state intervention and its methods should be discussed. Perhaps the most correct principle here will be the following - competition should be ensured wherever possible, the regulatory influence of the state - wherever necessary. And of course, measures of “physical influence” on market mechanisms that can undermine the entire economic system are unacceptable.

In general, it is difficult to overestimate the role of the state in the economy. It creates conditions for economic activity, protects entrepreneurs from the threat from monopolies, meets the needs of society for public goods, provides social protection for low-income strata of the population, and solves issues of national defense. On the other hand, government intervention can in some cases significantly weaken the market mechanism and bring significant harm to the country's economy.

For today's Russia, in the period of transition to the market, state regulation is especially important. After decades of total dictatorship of the state in the economy, opinions are being expressed about a complete rejection of state intervention in the economy. Apparently, the truth, as always, is somewhere in between. That is why, for Russia, the world experience of state regulation of the economy is important, which should be studied.

Bibliographic list.

1. State regulation of the economy / Ed. Kushilina V.I. M .: JSC NPO Economics, 2000.- 735s.

2. Korsakov A.S. "State in a market economy", M., Postscript, 2002

3. Kuchukov R.A. “State regulation of the economy and social processes.” - M .: Gardariki, 2004. - 288s.

4. Dontsova L.V. Issues of state regulation of the economy: main directions and forms // Management in Russia and abroad. - No. 4, 2000.

5. Varga V. “The role of the state in the market economy”, MEiMO, No. 11, 1992.

6. Economic theory: MACROECONOMICS: Tutorial, guide to the study of the discipline, workshop, curriculum / Moscow University of Economics, Statistics and Informatics. - M., 2005 .-- 290s.

7. Aranovich M.S. “Planning and mixed economy”, M., Fact-M, 2001.

Appendix A

Table 1

Government regulation factors

| Group of factors |

|

| 1) Problem-solving factors market sector of the economy, smoothing the negative effects of the market mechanism |

1. Limitation of spontaneity of market processes. 2. Ensuring effective aggregate demand, market conditions. 3. Ensuring the production of public goods, public needs and needs. 4. Support for competitiveness, market openness. 5. Strengthening competitiveness in the global market. |

| 2. Factors providing economic stability, the process of expanded reproduction. |

1. Creation of general conditions for the development of the economy, ensuring the economic efficiency of the functioning of aggregate capital, the need to determine the "rules of the game" of economic entities. 2. Ensuring countercyclical development of the economy. 3.Stimulating long-term economic 4. Formation of the optimal structure 5. Maintaining macroeconomic balance. 6. Ensuring effective management of the public sector of the economy. 7. The need for public investment, low-profitable from the point of view of private capital. 8. Regulation of money circulation. 9.Promoting the development of science, scientific and technological progress |

| 3. Factors associated with solving social problems |

1. Ensuring a rational redistribution of income. 2. Ensuring the economic basis of social stability, reducing social tension. 3. Ensuring full employment of the population. 4. Formation of conditions for expanded reproduction of labor power, manifestation of human intellectual abilities (development of health care, education, retraining of personnel, etc.) |

necessitating

Appendix B

|

| Indicative planning Target programming Regulation of the tax system · Monetary instruments: Regulation of the money supply Anti-inflationary measures Interest rate regulation on operations of the Central Bank Refinancing of commercial Operations in the securities market Currency leverage: Stabilization of the national currency Open currency transactions Devaluation, revaluation national currency Attracting foreign capital Creation of joint ventures · Social politics: Social programs Providing employment for the population Social protection of the population Regulation of income Control over price dynamics and salaries Transfer payments Activities in the field of education, health, culture Foreign economic forms impact: Regulation of foreign economic activities Customs tariffs Currency regulation Subsidies |

The analysis of world experience allows us to speak both about the formation of national models and about the established standard set of social forms and methods of state regulation.

It is generally accepted to divide the methods of state regulation into legal, administrative, economic; direct and indirect.

Legal regulation consists in the establishment by the state of the rules of the "economic game" for manufacturing firms and consumers. The system of legislative norms and rules determines the forms and rights of ownership, the conditions for the conclusion of contracts and the functioning of firms, mutual obligations in the field labor relations trade unions and employers, etc.

Administrative regulation, include measures for regulation, contingent, licensing, quotas, etc. With the help of a system of administrative measures (in the form of measures of consolidation, permission, coercion), state control over prices, incomes, discount rates, and exchange rates is carried out. Currently, the scope of administrative measures is limited in most countries to the area of environmental protection, social protection of the population.

Economic methods imply an impact on the nature of market relations and the expansion of the market field within the framework of national education. This is the impact on aggregate demand, aggregate supply, the degree of capital concentration, the structuring of the economy and social conditions, the use of factors of economic growth.

By the nature of the impact on the country's economy, methods of state regulation are divided into indirect and straight.

Indirect methods have the same effect on all economic entities of a market economy, without creating any competitive advantages for anyone. These include regulation through the monetary and budget systems (changes in the discount rate of interest, tax levels, the size of the issue, overcoming the budget deficit).

Direct methods of regulation are based on power-managerial relations and are reduced to administrative impact on the functioning and performance of economic entities. Among the methods of direct GRE, various forms of non-repayable targeted financing of economic sectors, regions, firms in the form of subventions or subsidies, including grants, allowances, additional payments from special budgetary and extra-budgetary funds of the national and regional levels, as well as concessional loans, prevail. The purpose of such methods is to achieve development priorities, protect socially important sectors of the economy and population groups. In addition to the positive effect, these measures can also have negative consequences in the form of deformations of the real ratio of costs and prices, a decrease in the level of competitiveness, and a weakening of the balancing function of the market.

Practically indirect methods prevail over direct ones. Indirect methods are perceived by commodity producers as inevitable; straight lines cause a certain alertness. Methods and instruments of regulation are presented in Fig.

Direct state economic regulation includes three main elements:

Government subsidies;

State entrepreneurship;

State programming (planning).

Government subsidies can be defined as a grant loan that fully or partially covers the costs of production of its recipient. Subsidies are provided, as a rule, to sectors that are vital in the country's economic structure, where the operation of enterprises is not profitable enough or is unprofitable. This situation arises as a result of the state's setting a price limit for the products of this industry due to its social significance, or during periods of deteriorating economic conditions, when an enterprise may go bankrupt and stop supplying products important to the state (defense technology, electricity, etc.). Government subsidies are not excluded (and even necessary) during the period of major structural changes in the national economy. As a rule, some scientific institutions, educational institutions, personnel training, etc. are supported on the basis of subsidies. However, this method of direct government regulation is not free from drawbacks, the main of which is the complexity of effective centralized control over the use of allocated subsidies.

State entrepreneurship includes the creation and management of production, economic and social activities of state enterprises. State-owned enterprises arise both for political and ideological reasons, as well as due to the "insufficiency" of the market in some critical situations (caused by war or natural disasters, the destructive impact on the domestic industry of foreign competitors, lack of capital and entrepreneurial personnel, the problem of unemployment, etc.) ... State ownership of enterprises in a number of industries is determined by the fact that they are natural or unavoidable monopolies of water, gas, energy supply, railways, post offices, until recently - telephone communications).

In the world economy, there are two organizational and legal forms of state enterprises:

State-owned enterprises founded in accordance with the rules of public law;

State-owned enterprises founded in accordance with the rules of private law, the capital of which is either wholly owned by the state or mixed.

State public enterprises - these are legally independent enterprises created by special acts of the legislative body. Their capital is not divided into shares or shares, but is wholly owned by the state. The state is responsible for the debts of public enterprises, and the managers of public enterprises are not independent and are subordinate to higher authorities government controlled, focusing not on the solution of narrow commercial problems, but on the implementation of public goals. As a result, public enterprises tend to have low profitability or unprofitable.

Capital state-owned enterprises of private law divided into parts (shares or shares). Private law enterprises are most often open joint stock companies (public corporations). The state can own all the shares of such a corporation (in this case, the company is actually closed) or a controlling stake. The state is not responsible for the debts of private law enterprises. In the event that their financial situation deteriorates, the state, as a rule, does not cover losses at the expense of budgetary funds, but, like private investors, resorts to the sale of its shares on the stock market.

The management of state-owned enterprises has its own characteristics in different countries. In most of them, state-owned enterprises do not have a single control center, but are under the jurisdiction of line ministries by affiliation. Several South American countries have special ministries for SOE affairs. In some cases, state-owned enterprises are subordinate to the ministry of economy or finance.

Among the most important elements of direct government regulation in countries with market economies is state programming, which is a mechanism for the formation and implementation of a set of measures to solve a large national economic or regional problem through the creation of the necessary products or services and placement of government orders with the help of contract financing at enterprises of various forms of ownership on a competitive basis. There are the following main types of government economic programs:

Opportunistic, aimed at solving the problems of the current balance and stabilization of the economy;

Structural, aimed at solving key problems of the national or regional economy.

The planning and implementation of specific measures for state programs is carried out with the help of state order. The formation and implementation of the state order is subject to the following principles:

The customer of the products is the state, which has financial and other resources and transfers certain rights to its executive bodies;

The composition of orders is associated with the system of national needs and functions of the state in various sectors of the country's social and political life, which, for objective reasons, cannot be realized;

The volume of state orders is limited by the size of the state budget;

Orders are placed and executed on a contractual basis.

The state exerts a direct influence on the economy through investments in certain sectors of the economy. It can go in two directions: either the development of state entrepreneurship, or subsidies for enterprises in the non-state sector. The first is carried out in capital-intensive and low-profit industries, for example, such as the coal industry, railway and water transport, and road maintenance. In addition, to ensure a high level of economic development, the state invests in industries that determine scientific and technological progress at this stage, as well as training qualified personnel and conducting scientific research. State entrepreneurship is developing in areas where the use of other forms of ownership can bring negative consequences. So, in the defense industry, investment is carried out through the construction of state-owned enterprises or the nationalization of enterprises of other forms of ownership through the purchase of shares, sometimes confiscation. On this basis, mixed enterprises are created when part of the shares belongs to the state. Entrepreneurial activity allows the state to solve national issues and major social problems. At the same time, the state maintains the standard of living of the population by determining the marginal prices for energy, food, services, etc.

The state also has a direct regulatory impact on exports, freeing the exporter from paying duties on the import of raw materials or creating preferential export credits.

The state also exerts a direct influence on the national market. It can influence the size, structure and direction of market development through government orders. It is understood as a state task for a company to produce a certain type of product within a specified timeframe and in a certain amount for a unique, especially scarce product.

The above methods and tools of state regulation adequately require their complex use, which is ensured within the framework of economic policy.

Economic policy is a strategy developed by the state for the behavior of all power structures, aimed at achieving the socio-economic goals set before them. The economic policy of the government is a certain regulation of the norms and rules of behavior of economic entities through economic tools.

The main goal of the economic policy of any state is to achieve the well-being of the country's population, the growth of its income and consumption.

The economic policy of the state includes structural, budgetary and fiscal policy, monetary policy, social, foreign economic policy, programming, forecasting and planning.

Each of the components of the state's economic policy is aimed at achieving the main goal by its own means and methods. So, the structural policy developed by the government of the country, regions, city administrations and large enterprises is aimed at changing the sectoral, regional, production structure of the country as a whole and its components. The aim of the structural policy is to increase the income of the population through the renewal of the structure of production, rational and most effective use natural and labor resources, increased employment, etc.

Financial policy involves the use of fiscal and fiscal mechanisms to achieve national economic and social goals. Budgetary policy covers: regulation of government spending; implementation of public procurement; release of state domestic economies; support and regulation of state entrepreneurship. Fiscal policy assumes: regulation of taxation; introduction of taxes.

Monetary policy involves the use of the method of indirect influence of the Central Bank on the elements of the market mechanism and, above all, the optimality of money circulation. Credit policy includes: rationing of bank reserves; variation of the bank interest rate; conducting operations on the open market.

Social policy includes a set of measures aimed at meeting the state's social needs of the population, maintaining an acceptable standard of living for the country, correcting differences in income and consumption of the population, providing the population with social services, and ensuring social guarantees. Social politics includes: regulation of minimum wage rates; setting the size of pensions, unemployment benefits, etc.

Foreign economic policy means: legislative establishment of rates of customs duties, exchange rates of currencies; the use of foreign loans, investments and foreign exchange restrictions.

The highest form of government regulation is programming, forecasting and planning. Economic forecasting is a system of scientific ideas about the directions in the development and the future state of the economy as a whole, as well as its individual elements. The method of economic forecasting consists in quantitative and qualitative processing of the collected information about the socio-economic state of the national economy at the moment, identifying regular trends in its change, which make it possible to get an idea of the main directions of the state and development of the country's economy in the future. Economic forecasts serve as the basis for the development of socio-economic programs designed to be completed within the time frame provided for in the program. The program is concretized according to the spheres of state activity, tasks to be performed, quantitative parameters in each area. In addition, the program provides for obtaining the expected results from its implementation.

Indicative (from Latin indicator-pointer) planning- one of the methods of state regulation in a market economy, aimed at harmonizing the economic interests of state and market economic entities through a plan-indicator of the country's socio-economic development approved by all stakeholders with the priorities of national interests in it for the near medium term (3-6 years).

The main function of indicative planning is coordination, consisting in the development of measures and a mechanism for their implementation, taking into account the economic interests of each participant and their relationship. The main principle of reaching a compromise in the system of interests is the equal interaction of state and market structures, as a result of which the state manages to realize national economic interests, and market structures - to make a profit, following the implementation of the jointly developed economic indicators of the indicative plan.

The effective functioning of the economy is possible under the condition of forecasting and planning its development and an effective system of managing the national economy. In a market economy, the term "regulation" is used more often, because the state seeks to use more indirect levers of influence, instead of direct administrative ones, to create a greater degree of freedom for the activities of economic entities.

In practice, each of their functions of state regulation are implemented through the appropriate actions of each of their branches of government, which are classified according to forms and methods.

The form represents the general direction, the basic principles of influence on the part of the subject, represented by the relevant state body, on the object in question. A method is a way of knowing and transforming an object on the basis of certain rules and theoretical principles used in regulation (method from the Greek word methods - a way, a way of cognition, research). For each of the forms, several methods can be applied, which is determined by their accuracy, availability and a number of other conditions. Ultimately, all of them are aimed at orienting macroeconomic development and behavior in macroeconomics in the direction of the chosen movement option.

Basic requirements for this mechanism:

- - adequacy to objective conditions and the state of economic development at this historical stage;

- - consistency, i.e. all elements of regulation should be linked to each other;

- - complexity (the regulation mechanism covers all economic and social processes with a reasonable degree of "immersion").

The applied forms of government regulation are usually classified into the following three groups (Scheme 1):

- 1. Legislative (legal);

- 2. Financial and credit, including budgetary and tax and credit and monetary forms;

- 3. Administrative, which is divided into administrative-economic and organizational-administrative forms.

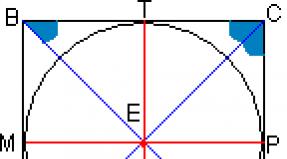

Scheme 1 - Forms of state regulation of the economy

Each of the forms is used both individually and in various combinations. Their choice depends not only on the economic state, but also on the political organization of society, traditions, goals and tasks to be solved at each specific historical stage of development.

In terms of importance, priority is most often given to the legislative (legal) form. It is a set of laws, mechanisms for their development, adoption and implementation, with the help of which the basic principles of the state and social structure, the rights and obligations of business entities, citizens and other important provisions are established, which are basic in the formation and functioning of industrial and other relations within the country and with the outside world.