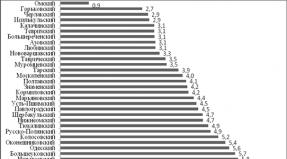

Medium zp by region. Why are small salary in Russia? Comparison of salaries by profession, regions and by year. Payment of payment can be carried out in two ways

There are no cases when tax authorities cause managers of firms and entrepreneurs on conversations (commission) in various reasons, including on the size of the average salary as a whole on the economic entity. The reason for the close attention of the IFTS to the magnitude of the wage foundation becomes the inconsistency of the average wage on the enterprise to one or several criteria for employees' income criteria. These include, for example, such:

the average salary of employees is below the level of the industry, i.e. by type of activity in the region;

the average salary is lower than the established regional subsistence minimum.

The tax authorities seek to identify companies that practice the issuance of salary "in envelopes", i.e. Bypassing the accrual of insurance premiums and NDFLs, which significantly reduces the taxable base. Such a salary level becomes the condition of entering the enterprise in the risk area to become a candidate for the on-site inspection of tax authorities (paragraph 5 of section 4 of the order of the Federal Tax Service of 30.05.2007 No. MM-3-06 / [Email Protected]). Therefore, the company's accountant is better to perform in advance the calculation of the average wage on the enterprise, and the results of the calculations are compared with the data of the statistics of Rosstat or information sites of the regional offices of the FTS.

In favor of these actions, it also says that Article 133 of the Labor Code of the Russian Federation is dictated by such a condition: the employee's salary that has spent the full monthly rate of time and fulfilling the labor tasks cannot be lower than the installed minimum wage. Given the listed aspects, it becomes clear why the settlement of the average wage on the enterprise is so important for tax authorities. For the company's head and accountant, it is equally important to competently substantiate the resulting indicator.

Calculation of average salary for the enterprise: Formula

IFTS calculates the size of the average salary by the formula defined in the FTS letter dated 25.07.2017 № UF-4-15 / [Email Protected]:

The average s / n \u003d total income paid by staff for the year (according to f. 2-NDFL) / the number of employees by f. 2-NDFL / 12 months.

It is clear from the formula that is clear that not all staff incomes are taken into account, since only fotes are taken out by insurance premiums and personal income tax is taken, and a whole block of payments are not taken into account to which payment of disability sheets, child care leaves, and not Always correctly takes into account the work of employees at part-time rates.

Therefore, when receiving an infissance infissance information about the company's expansion of the company's employees, the financial service of the company will have to provide clarifications within 10 days with an indication of the informed objective reasons for the low level of medium-sized income. Justifications of this fact the company builds on confirmation of payments to employees of social benefits (adjusting income on the amount of benefit paid), calculates the average salary, taking into account all the factors affecting its level.

How to consider average salary for the enterprise in the presence of personnel working part-day

For the enterprise it is important to double-check the summation of rates on employees in an incomplete working standard, i.e. We'll have to recalculate the average salary by finding out the total number of all staff members - external partners, employees working under civil law agreements.

Example

The IFTS doubted the figures for the calculation of the average salary of Argus LLC for 2017. By calculating the tax authorities, the average salary was 7490 rubles, which is lower than the minimum wage when dividing Fot in the amount of 1,348,200 rubles. for 15 people.

- The accountant is to calculate the number of personnel in the monthly, taking into account the summation of rates on employees at an incomplete norm. For example, from 15 people working in the company, 8 work on 0.25% of the rates. When they are summarized, there are 2 bets, which corresponds to the 2nd operating. If a similar situation continues for a whole year, then a significant amendment will be revealed in the company's average salary:

Number \u003d (15 - 8) + (0.25 x 8) \u003d 9 people.

Average s / n \u003d 1 348 200/9 people. / 12 \u003d 12 483,33 rub.

- Suppose that 8 employees worked for 0.25 rates for the first half of the year, in the 2nd half of the year - by 0.5 bets. In this case, the calculation will be as follows:

In the first half of the year, the number of employees will amount to 9 people, in the second:

Number \u003d (15 - 8) + (0, 5 x 8) \u003d 11 people.

SCC \u003d (9 x 6 months + 11 x 6 months) / 12 \u003d 10 people.

Average s / n \u003d 1 348 200/10 people. / 12 \u003d 11235 rub.

Similar calculations are more convenient to submit in a tabular version, approximately:

Number of operating

Number of rates

average salary

1 half year

Basic workers

Auxiliary personnel

Servants

Total for 1 p / g

12 568,32

Basic workers

Auxiliary personnel

Servants

Total for 2 p / g

10 516,67

Total for the year

1 348 200

11 235,00

Such an algorithm of justification is just an example, there may be a lot of them, the formula for calculating the company's average salary - the amount of income divided into the number of employees and on the number of months in the period under consideration.

Such an indicator as the average monthly wage is extremely important in labor relations - both for the employer and for the employee itself, as well as employees of accounting and recruitment department. The calculation of the average monthly wage or average monthly earnings may be required in many situations directly related to labor activity - and it will be easier to calculate this indicator with the help of simple and visual examples.

What is the average monthly salary - what is included in it

The concept of average monthly salary is extremely important in many aspects of labor relations between the employer and the employee. But what is this indicator? The average monthly salary is the average value of all rewards received for employee labor within 12 months in recalculation for every individual month.

It should be understood that the average monthly wage may include various payments, including:

- Salary employee. Regardless of the circumstances, if the employee receives a fixed salary, its dimensions are always included in wages.

- Payments at the rate. If the worker works on a piecework wage system, then the income received by it in its framework is included in the calculation.

- Interest payments. When the employment contract provides for the payment of an employee of a certain percentage of proceeds or another indicator, then these payments also take part in the calculation.

- Dumping. When the legislation provides for the payment of employees of various premises, for example, for long service, for work in the conditions of the Far North, or simply, when the salary increases to comply with the minimum wage, taking into account the district coefficient.

- Prizes and other stimulating payments. All types of premiums or other payments associated with the results of work activities are considered part of the average monthly earnings and are fully involved in the calculations.

- Additional obligatory payments. Payment for overtime, labor at night, surcharge for harmful or dangerous conditions - all these types of payments in accordance with the requirements of legislation are involved in the calculation.

It should also be remembered that when calculating the average monthly wage should not be taken into account a number of other payments, relying an employee. First of all, this concerns payments with compensation, but also affects a number of other payments. So, do not participate and are not included in the employee's income when calculating the average monthly salary of the following payments:

- Compensation of vacationbut. If the calculation of earnings occurs after the employee's dismissal, then the compensation of the unused vacation is not included in the calculation of the average monthly earnings.

- Vacations . Vacade payments themselves are also not included in the average monthly earnings of employees.

- Hospital anddecrehny . Compensation of temporary disability, as well as decrehensive payments are not included in the calculation of the average monthly earnings.

- Material aid . Amounts paid by workers as material assistance are not involved in the calculation of the average earnings.

- Daily , Travel and other payments that compensate for the employee's costs. These payments are not an employee's income in principle, but are designed to compensate for employee expenses and therefore they are not counted to the average monthly wage.

- Prizes not related to the performance of labor duties. So, payments in honor of the birthday of the employee or organization, in honor of public holidays and other premiums can not be taken into account when calculating the average monthly earnings, as they do not correlate with the employee's labor function and do not act as a work permissions.

- Other types of compensation and payments not related to the labor function. Payment of the employee's downtime or other periods during which the employee does not work, is also not included in the calculations.

If the payment of wages is partially provided in nature, which allows to make the Labor Code, then this payment is still taken into account when calculating the average monthly earnings, and is also subject to NFFL and insurance premiums, as well as cash payments.

Why need to calculate the average monthly salary

The goals for calculating the average monthly salary and grounds for it can be much, because this indicator is used in a wide variety of situations. Therefore, the question is why the average monthly wage is needed, the answer may also differ seriously. The most common situations for which the calculation of the indicator may be required are:

In some of the above situations, the average monthly earnings may not be fully used. For example, hospital with a small worker is paid not in the full amount of average salary, and maternity payments have the minimum and maximum limits of the permissible amount of payments.

Legal regulation of the average monthly wage - laws and standards of the TC RF

Since the average monthly salary may be required in many situations, how the average monthly earnings is being calculated, it is necessary to know both employees and employers, and personnel department professionals or accounting. At the same time, in these calculations, it is necessary to rely on a certain legal framework, which provides labor legislation. The legal basis for calculating the average monthly wages in this case is the following regulatory acts:

- Article 139 of the Labor Code of the Russian Federation. This article establishes the basic principles used in the calculation of the average monthly salary of employees.

- Decree of the Government of the Russian Federation No. 922 dated December 24, 2007. The commemable government ruling is more broadly and specifically considering the issues of calculating the average wage of workers, taking into account all possible nuances and features.

Despite the fact that the legal database of issues related to the average wage is quite small, its standards will be enough to each employee, accountant and an employer for accurate and fully relevant to the regulatory requirements of the calculation.

How to calculate the average monthly salary - step-by-step guide

The procedure for calculating the average monthly wage is relatively simple, but it has its own characteristics that need to be taken into account in this process. At the same time, it may be necessary to know any of the parties to labor relations. And to help this may have a simple step-by-step instruction for calculating the average monthly wage, which looks like this:

In some situations, another procedure for calculating the average monthly salary can be used, for example, when conducting a summary accounting of working time and at a flexible work schedule, it is also necessary to calculate the average hour earnings of the employee.

Example of calculating average monthly wages

The easiest way to get acquainted with how to calculate the average monthly salary on a simple example:

Citizen Sidorova S.S. Fixed to reduce the state, and therefore it has the right to receive a day off. Detachment date - 01/10/2019. At the same time, it needs to be calculated the size of the average monthly wage. Accordingly, the reporting period in this case is 12 calendar months until the moment of dismissal, not including January 2019. That is, the calculation is conducted from 01/01/2018 to 12/31/2018.

Official salary Sidorova S.S. was 20 thousand rubles. At the same time, she accrued a monthly surcharge of 4% of the official rate for harmful working conditions. In addition, twice in 2018 Sidorova S.S. Received a prize for outstanding labor results and over-fulfillment of a plan in the amount of 15 thousand rubles each. Also, she was issued a special premium to its 50th anniversary of 10 thousand rubles and material assistance in the death of a relative in the amount of 4 thousand rubles. However, financial assistance and the premium for 50 years cannot participate in the designated calculation, since they are not related to labor activity.

During this period, from 01.02.2018 to 14.02.2018, the employee was on the hospital, and from 01/09 to 06.09 - he took himself a unpaid vacation due to the death of a relative. Accordingly, in February, she worked 10 working days out of 20, which reduced its salary twice for this month, and in September she worked 17 working days out of 20, which reduced its salary by 15%. The paid leave Sidorov S.С took advantage from 01.11.2018 to 11/30/2018 and did not actually work in November. TOTAL, SIDSOVOY SS wages For 2018 amounted to:

(20,000 * 9 + 1000 + 17000) * 1.04 + 15000 + 15000 \u003d 245280 rubles.

It should be noted that for a certain time, Sidorova S.S. It did not work, which means certain periods should not be taken into account in the calculation of the average monthly earnings. Therefore, it is first necessary to determine its average daytime earnings as follows - subtract out of 247 business days for the manufacturing calendar for 2018 - 35 days of its absence at work on working days. Accordingly, its average daily earnings will be:

245280/212 \u003d 1156.98 rubles.

After that, it is necessary to determine the average monthly earnings, taking into account the number of working days within 2 calendar months, following the dismissal when dismissal - that is, from 01.02.2019 to 03/31/2019. In this period, 39 business days. Total, the output allowance should be:

1156.98 * 39 \u003d 45122.22 rubles.

The above example is used primarily by the average daily earnings, since directly in practice the average monthly indicators are practically not used. To calculate the average monthly earnings Sidorova S.S. In most cases, it is enough to simply divide the amount of its income per year - 245280 rubles for the number of months - 12, however, the actual result will eventually differ from the exact accounting amount calculated separately for each reason for the calculation of the average earnings.

Questions related to the employment of citizens of the Russian Federation are governed by the Labor Code. According to the draft law, as well as a special government decree, the rules for calculating the average monthly wage are determined.

Definition of the term

Average monthly salary - an economic indicator that reflects the average earnings during one calendar year (that is, in twelve months). The calculation of this indicator is made taking into account the amount of funds earned by the employee within twelve months and the time he spent in the workplace.

The need for determining this indicator occurs if it is necessary to calculate the amount of benefits for diseases, holidays, etc. In some cases, the employees themselves need a document that displays their average monthly salary (for example, to design a loan in the bank).

The indicator is actively used by the fiscal service when checking the activities of enterprises. With it, you can find out what salary pays the taxpayer to its workers. If it is lower than the average for the region or below the subsistence minimum, additional check can be carried out.

This method is trying to fight enterprises paying their workers wages in envelopes. In order to avoid problems with the fiscal service and for the proper remuneration of workers, you need to know how to calculate the average wage.

Situations requiring calculation

The list of cases in which the citizen of the Russian Federation is relying payments on the basis of its average monthly salary (hereinafter - SMZ) is determined by the Labor Code. According to him, CMZ can be paid:

- If a Employee is on vacation, which is paid. Such a situation falls under the rule, in which the release should be paid in accordance with the average monthly salary.

- When an employee of the enterprise is suspended from his duties, But at the same time its salary is preserved. Such a need arises when a citizen takes part in the preparation of collective bargaining, or, for example, performs special duties (can be both public and public).

- With temporary translation of the employee from the workplace Due to the need to eliminate damage caused by a disaster.

- If necessary, payment benefitsassociated with dismissal.

- When paying compensation to the employee for vacation dayswhich he did not use if the latter fits.

- When sending an employee of the enterprise to a business trip.

- When salary accrued to employees, If they passed training, involving a temporary separant of labor.

- When termination of incorrectly concluded employment contractbut. The rule acts if the mistakes were not allowed from the fault of the employee of the enterprise.

- If a worker could not fulfill his duties Or was removed from production due to the fault of the company's head.

- Each of the citizens entering the commissionwhich disassembled in labor disputes.

- Employee donor and persons sent to the passage of mandatory medical examinations (In agreement with the current legislation, they are held once during the year).

- Employees who received additional weekends Due to the need to take care of disabled children.

The above lists the main cases of the average monthly salary. In the Labor Code of the Russian Federation, other reasons for payments of the SMZ are also envisaged. So, for example, a similar measure applies to the director of the enterprise, persons who are his deputies and chief accountant if the company has launched the procedure for changing the owner.

In addition, the first paragraph of the sixth article of the Law on Military Service provides for material compensation to persons torn off from jobs due to preparation for military service, calling for military service or military fees. In this case, its size is also determined by the average monthly salary.

General rules

Before calculating the average monthly salary for the year, it is necessary to familiarize themselves with the rules placed in the Labor Code and the situation of the Government of the Russian Federation of 2007. Recently introduced edits, so the last time should be used by the version (from the tenth of December 2016). When calculating, it is taken into account:

- the salary that was accrued in twelve months before the need to make the calculation of the SMZ;

- the time spent in each month during the period described in the previous paragraph.

To calculate the average salary for the year, it is necessary to take the duration of each month, given the calendar data. That is, depending on the specific month, this parameter can be thirty or thirty-one day. February is an exception. Depending on the specific year, its duration is twenty-eight or twenty-nine days. Included the following employee income, summarized over the twelve month period:

- salary in the complex with all the allowances. Payments that were produced in non-monetary form are also taken into account. These include, for example, payment of nutrition;

- premium and other remuneration;

- other payments related to a particular company to the salary.

From the estimated period, sums and time be called when the employee:

- i received funds for an additional paid vacation (if the employee is caught by a disabled child or disabled since childhood);

- i received payouts, staying in the decree or sick leave;

- i received payouts for the period of exemption from working with salary preservation.

In some cases, the twelve-month period is taken for the calculation, preceding the last twelve months of the employee at the enterprise. Such a need arises if an employee did not work for a single day during the specified period or did not receive a wage at this time. In addition, the need to "move away" the estimated period occurs if the entire twelve month consists of time, which according to the law must be excluded during the calculations.

Algorithm of calculation

To determine the average monthly salary of the employee, you must first fold all wages received by him and surcharge over the past twelve months. At the same time, the premiums, district coefficients, premium and other remuneration, as well as other types of payments made under labor legislation, also go into account.

After determining the amount, it is necessary determine the calculation period. The duration of each month is determined by the calendar. Periods are not taken into account, during which the employee was absent (with the maintenance of earnings), was in disability or on the decree. These time intervals are excluded from the calculations, since payments have already been made taking into account the average earnings.

After all the data are collected, you can proceed to calculations. They are pretty simple. The amount earned enough during the estimated period to divide the duration of the period, which is taken into account. As already mentioned, he is twelve months.

This is how to calculate the average monthly salary. The example will help to better understand the algorithm. So, throughout the calendar year, the employee was not excluded from the workplace due to treatment or other factors, the calculation formula is as follows:

SMZ \u003d Total wages / 12.

Middle day earnings

The above formula cannot be used in the case of vacation pay or, if necessary, compensate for unused leave. In such cases, it is necessary to apply another formula that involves the calculation of the average daytime earnings.

If necessary, the payment of holidays is used as follows: salary for twelve months / (12 * 29.3).In this case 29,3 - Average number of days in a month throughout the year, taking into account February. Previously, the number took into account 29,4, But during the last changes it was fixed.

The question arises: how to calculate the average monthly salary for the year, if for twelve months the employee was absent for some time in the workplace, or if it is necessary to exclude certain periods of time? Make it harder. In this case, you must first determine how many days to take into account. For this 29,3 It should be multiplied by months with full employment and add the calendar days of those months when the worker was absent. Further, the total amount of wages is divided into the number obtained due to previous calculations.

For example, the employee received five hundred thousand rubles during the calendar year. He was present in the workplace within eleven months, but due to certain reasons in the last settlement month, only thirteen working days worked. In this case, the formula will look like this:

500 000 / (29.3 * 11 + 13) \u003d 1492,53 rubles.

Thus, the definition of average monthly salary is standard personnel and accounting practice. This parameter is necessary for the implementation of payments prescribed in the Labor Code. The calculation rules are governed by the Government Decree approved in 2007. The method of calculation for the benefits of the vacation pay is different from that for other payments. For calculation, it is necessary to enjoy the data that relate to the general payments of the employee for twelve months and the real time spent during each month. Make calculations can be made according to the formulas provided.

The employer is obliged to pay his own employee wages, the value of which is determined by the Labor Code of the Russian Federation and the employment contract.

Dear readers! The article tells about the typical ways to solve legal issues, but each case is individual. If you want to know how solve your problem - Contact a consultant:

Applications and calls are accepted around the clock and seven days a week..

It is fast i. IS FREE!

It is important to work in advance. In addition, it should be understood that it is necessary to be able to make the calculation of the average value of wages.

Since this is required to solve a variety of tasks. For example, to accrual holidays and many other purposes.

Moreover, to calculate the average wage should be approached as seriously as possible. This will avoid multiple different difficulties and difficulties.

First of all, it concerns labor inspection issues. Since disorders in the field of labor relations can cause not only fines, but also criminal liability.

Therefore, to the issue of calculating holidays, as well as other amounts associated in one way or another with an average wage, it will be necessary to understand primarily. The process of computing is standard, is determined by the current legislation in this field.

Highlights

But at the same time it should be noted that the process of computing must be carried out within the framework of legislation.

Errors are not allowed. Subsequently, when checking the tax or labor inspectorate, it will definitely be found.

Payments received by employees before, after the hospital should be calculated as accurately as possible.

Moreover, the employee itself should also make out this issue. This will allow independently, without any assistance to monitor compliance with their rights.

Remuneration for any merit is also usually calculated depending on the value of the average wage. Accordingly, the question should be disassembled primarily.

Definitions

But before proceeding with the legislative norms, it will be necessary to study a number of terms. Only in this case will be possible to prevent a variety of difficulties.

To the basic concepts, to pay attention to which it will be necessary first of all, should include:

- wage;

- average salary;

- holidays;

- hospital;

- manual;

- prize.

Under the salary implies some amount of money that a specific citizen receives as payment for his work at work.

It is important to note that the value is as defined not only, but also. Since at the moment the minimum wage is installed.

Less than which the employer has no right to pay to his employee. This moment you need to work first.

Under the average wage is meant some monetary value, which is the average for a separate period of time in monetary terms.

It will be necessary to consider the calculation as seriously as possible. Since the average salary is used to calculate a wide list of various other indicators.

For example, vacation taxes are the amount of money that the employee receives a month of vacation. Also calculated on the basis of the average wage.

Under such payments implies some amount of money that is accrued through the hospital sheet. Manual - accrual of funds in connection with certain events.

The situation is similarly like a premium - it is often accrued based on the calculation of the average wage. It should be noted that when calculating you need to carefully treat the period of spent days.

The amount of average wage will be calculated on the basis of this. Accounting for spent periods is carried out by the dates of the working calendar.

What is it for

The average wage indicator allows you to simultaneously solve a whole range of a variety of tasks. This indicator is required both to accrual various amounts and in other cases.

At the moment, the calculation of the average salary is most often required to implement the following points:

In addition, in addition to standard situations, there are many other purposes that can be achieved by calculating the value of the average wage.

This may be the preparation of statistical reporting in the organization by average wages, another.

But, regardless of the tasks that need to be solved, it will be necessary to take the maximum seriously as possible to implement the calculation process. Otherwise, problems may arise, difficulties.

Regulatory regulation

The issue of wages is quite detailed in a special legislative document - the Labor Code of the Russian Federation.

It indicates the basic, main points associated with wages, its calculation. At the same time, it is important for the worker himself in essence with all provisions.

The very question of calculating the average value of wages is determined. This article indicates all the subtleties, the nuances of the implementation of such calculation.

The process of calculation itself is completely standard, no difficulty is missing. But it is important to note a number of subtleties, specific points.

Denot to the calculation period when dismissal can be again within the framework of the NAP. This moment is set.

Accordingly, it is important to remember enough serious about the incorrect calculation of the magnitude of wages and untimely deductions.

This moment is determined. It is assumed not only administrative responsibility in the format of fines, but also a criminal.

Accordingly, the employer should not allow various kinds of violations. Since they can lead to unpleasant consequences.

The number from which the calculation will be implemented is determined according to the working calendar and legislative standards.

There is a rather extensive list of a variety of subtleties, features related precisely with the issue of registration of the magnitude of wages.

If any controversial moments arose and the worker believes that it has been violated, he needs to contact the employment inspection.

But it is possible to resolve the problem in this way if the present violation is obvious. If the question is quite complicated, it will be necessary to apply to the court to resolve the conflict situation.

It should only be noted that legal proceedings often occupy a rather extensive amount of time. As a result - if possible, it is still worth avoided.

This will allow preventing many problems, difficulties. If the question is not peaceful by regulate, it remains only to go to court at the place of permanent residence of the defendant.

How to calculate average salary for the year

The process of calculating the average value of the company's salary can be carried out in one way. At the same time, the formula is standard.

It is only important to note that the process of implementing the calculation process has its subtleties and features. An employee carrying out the calculation should be as attentive as possible.

Today everything is somewhat simplified due to automated calculation machines. But at the same time it is imperative to understand the principle of the calculations performed.

To the main issues, to disassemble that will need to be implemented by the relevant computing, the following belongs:

- what formula is used;

- how to find the average monthly zp;

- examples of calculations for the organization.

How formula is used

It is important to note that when calculating average wages, it is required to take into account all types of payments that are applied at a particular enterprise and are provided for by local acts.

Such payments may include the following:

The following positions should not be included in the calculation process:

- disease benefits;

- vacation charges;

- all premiums that will be paid at the end of the year;

- payment of leave due to bir

- payment for the passage of training, as well as advanced training.

The formula itself is sufficiently used to calculate the formula. It looks like this:

How to find an average monthly wage

Often it is required to find the average monthly wage. The formula for calculation will be quite simple enough.

This will look like this:

Examples of calculation for the organization

The easiest way to deal with the calculation of the average wage is on a simple example.

For the period from 01/01/2016 to 06.06.2016, an employee M. received the following accruals:

The size of the average wage will be:

The value indicated above will be average salary for 6 months of operation of a particular employee. Most often it is required for the calculation for this period.

Often, tax authorities cause representatives of organizations and IP (hereinafter referred to as the simplicity of organizations) on the so-called commissions, including salary. According to the criteria of employees' income in the field of view of the controllers, the taxpayer will come primarily, who has the average salary of employees below the average industry in the region in the region. That is, the type of economic activity. Or worse than the regional subsistence minimum below.

It should be noted that the tax authorities interfere with the non-tax affairs of the companies are not because they are very worried about the income of the population. And because they try to identify organizations that pay wage workers "in envelopes".

In this regard, it is clear to the desire of many accountants to understand in advance whether their organization will fall under the close attention of the controlling authorities. To do this, it is necessary to deal with how the average salary for the enterprise occurs in the IFTS.

How to consider average salary for the enterprise

All the information necessary for the calculation in each organization, naturally, is. Accordingly, nothing prevents you from yourself to fulfill such a calculation and compare its result at least with the indicators of Rosstat.

As you understand, with such a calculation of the average, the work of employees on an incomplete rate, finding them on the hospital, on child care leave, etc. Therefore, if you received an informational letter that the Specialists of the IFSS suspected you with an understatement of wages of employees, you can submit to them explanations within 10 working days, indicating such objective factors explaining the low-income (section "Preparation for the meeting of the Commission" Letters of the Federal Tax Service of Russia dated July 17, 2013 N AC-4-2 / \u200b\u200b12722).

What's next

If your arguments seem to the tax authorities unconvincing or you do not answer their informational letter at all, you will send a call notice to the Commission (Appendix N 2 to the order of the Federal Tax Service of Russia of 08.05.2015 N MMB-7-2 / [Email Protected]). There is better to come there all the way, i.e., stock up with copies of documents and extracts. However, no matter how much your conversation with checking, they will not be able to do anything on the commission itself - neither finish nor forced to see the clarifying. It will rather be similar to the conversation of the mentor and the ward.

But it is important not to ignore the commission without valid reasons. Here, for this, the head of the Organization or IP can just finish (part 1 of Art. 19.4 of the Administrative Code of the Russian Federation).

Methodology for calculating the average wage at the enterprise (for participants in the selection for granting a subsidy for organizing their own business)

information on site

Methodology for calculating average wages in the enterprise

(for selection participants to grant subsidies for organizing their own business)

I.. For employees, employed for full-time (1 bet):

Labor wage foundation for 1 month.

Number of employees in the enterprise

The company employs 3 employees with salary of 6,000 rubles per month.

Labor wage foundation for 1 month. \u003d 6000 * 3 \u003d 18 000 rubles

Average salary per month. \u003d ----- \u003d 6 000 rubles

The company employs 5 employees: 2 people. With salary 4 500 rubles, and 3 people. With salary 5 350 each.

Labor wage foundation for 1 month. \u003d 4 500 * 2 + 5 350 * 3 \u003d 25 050 rubles

Average salary per month. \u003d ----- \u003d 5 100 rubles

II.. For employees employed on full (1 rate) and not full-time (0.5 bets):

On the day, one employee works out for 4 hours, 22 working days per month, 12 months a year. The month of labor per month is 3,500 rubles (with the salary of 7,000 rubles per month).

to determine the amount of spent hours of hours per year, it is necessary : 4 hours * 22 working days per month * 12 months per year * 1 employee \u003d 1056 hours

Number of days a year * The duration of the work week, an hour. 365 days * 40 hours

Number of days in week * Number of months a year 7 days * 12 months

Number of actually spent hours 1056

Number of slave hours in the month * Number of employees 173,81 * 1

the average salary level is calculated by the formula:

Annual Foundation for Labor

Number of fact. workers worked out *

Annual Foundation for Labor Payment \u003d Warm for 1 month * 12 months \u003d 3 500 * 12 \u003d 42 000 rubles

average salary per month. \u003d ------ \u003d 6 907 rubles

TOTAL: The average salary of 1 employee, employed by 0.5 rates with salary of 7,000 rubles, is 6,097 rubles

The company employs 3 employees:

- merchander for 1 rate with salary 7,300 rubles.

- Seller at 0.5 bets with salary 5 500 rubles - labor payment per month 2 750 rub.

Calculation of average salary for a full-time employee:

Labor wage foundation for 1 month. \u003d 7300 * 1 \u003d 7,300 rubles

Average salary per month. \u003d ----- \u003d 7,300 rubles

Calculation of average salary for employees employed for part-time:

On the day, one employee works out for 4 hours, 22 working days per month, 12 months a year.

number of worked hours per year \u003d 4 hours * 22 working days per month * 12 months per year * 2 employees \u003d 2 112 hours

365 days * 40 hours

7 days * 12 months

number of actually worked months a year \u003d ------ \u003d 6.08 months.

Annual Foundation for Labor \u003d (2 750 + 2 750) * 12 months. \u003d 66 000 rubles.

average salary per month. \u003d ------ \u003d 5,427 rubles 64 kopecks.

SP - average salary for the enterprise

Fot - Fund of remuneration

In - the period of time for which the calculation is calculated

Certificate of medium salary

Do not forget that the size of the average earnings is important not only for working citizens, but also citizens who temporarily lost the main place of work. Such citizens, with the aim of recognizing them as unemployed, obtaining benefits and help in finding work are registered with the employment service bodies.

For them, the size of the average earnings received by them at the last place of work is important. After all, it is no secret that, in addition to help in finding a suitable work, many citizens hope to receive unemployment benefits. The manual itself is calculated on the basis of the average earnings of the unemployed, which he received until his dismissal. The average monthly salary, the calculation of which is made for the employment service, is calculated based on the last three months of work.

Since the employment service does not have the opportunity to receive from anywhere else about the earnings of the employee, the only source of information and stands for a certificate of average wages over the past 3 months at the last place of operation of the unemployed. This certificate is a mandatory document for the recognition of a citizen unemployed.

A certificate of average earnings for the employment service, the employer provides only at the request of the employee. Basically, such as income certificate in the last two years, this document is not issued. Refuse to provide such a reference to the employer cannot. Like any documents related to work, such a certificate must be issued at the request of the employee (former employee) within three days.

The form of this reference is not approved at the federal level. Regional authorities authorized to regulate relations in the field of employment in their subject of the federation, the recommended form of reference can be installed in such cases.

The employer, issuing a certificate in an arbitrary form, should be guided by the general requirements for paperwork. In the certificate there must be all the necessary details and signatures. The calculation of the average salary in the certificate should be made in three months.

Task number 4. Middle wage calculation

The following data on the payment of workers of small enterprises are available:

Determine the average salary of employees of enterprises using indicators:

Decision:

To determine the average wage, we use the following ratio:

a) Using the indicators 1 and 2 counts, we will build a new table of source and calculated data:

The results of 1 and 2 counts contain the necessary values \u200b\u200bfor calculating the desired average. We use the middle aggregate formula:

x i - the i-th option of averaged sign;

b) If we have only 2 and 3 graphs, the source and calculated data table will be as follows:

We know the denominator of the initial ratio of the average, but does not know its numerator. However, the wage foundation can be obtained by multiplied by the average monthly wage on the average number of employees (gr. 4 last table). Therefore, the total average can be calculated by the middle arithmetic formula:

c) now we use only indicators 1 and 3 counts:

That is, now the numerator is known in the formula for calculating the average wage, but the denominator is not known. The number of employees for each enterprise can be obtained by dividing the wage fund for the average monthly salary. Then the calculation of the average wage as a whole in two enterprises will be produced according to the formula of the average harmonic suspended:

d) Now only the indicators GR.3 and 4 are known:

This task is similar to the task b) with the difference only, the role of the number of employees in this case performs its share in general, expressed as a percentage. To calculate, we use the average arithmetic weighted:

Consequently, the average salary of employees of enterprises, depending on the source data, can be calculated according to the formula of the middle arithmetic, and medium harmonic, and the average aggregate. But the choice of a specific form of the average depends on the economic meaning of the indicator under study - from its initial relation. Therefore, when solving such a task, at the beginning should be the initial ratio of the average, which will help determine the necessary formula.

Instruction: How to calculate salary

- 29.06.2017

- Staff

Salary is not a "two business." The state participates in official labor relations. The state guarantees the right of workers to pay for labor. Salary needs to pay completely, on time and observing the order and order. The employer is responsible for administrative responsibility.

Let's start with general concepts.

What salary happens and when it is put on to pay

The salary of the employee is counting on the working time table.

When calculating the salary accountant, the calculation is guided by the main documents and regulatory and legal acts of the organization. List of following:

- internal labor regulations,

- collective agreement,

- provisions on material stimulation and wages,

- staff schedule

- items of employment agreement

- local regulations.