How to calculate the average salary of the formula. How is the average monthly wage calculated? Middle Indicator for different specialties

In general, alimony for a child in Russia according to Art. 81 Family Code are paid in fractions from actual earnings Parent (salary, monetary allowance, additional remuneration, allowance and surcharges, premiums, etc.) or its other income specified in the Government Decree of July 18, 1996 No. 841.

If an alimonymaker (as a rule, a former husband or father of a child) has an irregular income or he does not have it at all, alimony can also be appointed in a solid monetary amount.

If for some reason the payment of the appointed alimony was not (including within 3 years preceded by the lawsuit for the recovery of the executive list or certified by the notaries of the Agreement on the payment of alimony, or for the entire period, if the payment of alimony is not made due to the fault of the payer) , the debt is formed, the size of which in accordance with paragraph 4 of Art. 113 of the Family Code of the Russian Federation can be determined:

- also based on the actual salary of an alimate-bound person and other income taken into account;

- based on the size of the average wage in Russia at the moment, the corresponding debt recovery date:

- if the payer of the alimony during the formation of the debt did not work;

- if there can be presented documents that can be confirmed by the size of its earnings during this period.

The average salary is, as clearly from the phrase itself, the average value of the paid salaries of the working population as a whole in the Russian Federation. At the beginning of 2018, according to Rosstat, the average monthly wages in the country as a whole amounted to 36900 rub.

Thus, inherently, the average monthly salary is the theoretical value, but the bailiffs are widely used in practical use, in particular, and when calculating alimony debts.

When the alimony is considered from average wages in Russia?

As you know, debtors on alimony are much more than bona fide payers, and the causes of alimony debt can also be the most different: from the real absence of a place of work before the revenue of the debtor. However, such factors do not exempt the "decompositions" from the entrusted duty and do not bring special complexity to the bailiff: the debtor is formed and the alimony arrears increases monthly.

Debt for payments is formed in an alimate-bound person, regardless of which form of the collection of funds is not executed by "decompositionist":

- an aliminal voluntary notarious agreement between the payer and the recipient;

- the court's decision;

- judicial order.

An aliminal debt is determined by an authorized officer of the FSSP based on the size of the average wage in the Russian Federation, if during the debt rate of the payer:

- was unemployed;

- did not provide documents confirming earnings or other income;

- did not register at the Employment Center.

Calculation of alimony debt from average monthly salary in the Russian Federation

When the voluntary notarization agreement or the court decision on the recovery of alimony is not executed by the debtor, the bailiff must calculate the accumulated debt for payments for this person. It is done in order to:

- in the case of the subsequent employment of the debtor or to identify its other income, recover the accumulated debt in favor of the recipient of the alimony;

- based on the decree on the settlement of debt, to apply measures to the debtor to attract it to various types of responsibility (administrative, civil, criminal).

The primary value that the bailiff is used in the settlement of debt is the average monthly salary for the Russian Federation. Application of this indicator for the federal bailiff service (FSSP) regulated three regulatory acts:

- p. 4 art. 113 of the Family Code of the Russian Federation;

- p. 3 art. 102 of Law No. 229-FZ "On the enforcement proceedings";

- "Methodical recommendations on the procedure for fulfilling the requirements of executive documents on the recovery of alimony" (Approved by FSSP of Russia 06.2012 No. 01-16).

- Information on the current amount of average salary in the Russian Federation should be requested monthly in Rosstat or confirmed on its official website.

- Tax on income of individuals (NDFL), equal to 13%, when calculating debt do not hold out.

- The moment of recovery of debt is the date of the actual repayment of debt.

- Calculation of alimony debt should be made by the FSSP officer quarterly.

The debtor should remember that the alimony debt will be calculated not in the region of living The payer or a recoverer, and in terms of the Russian Federation in order to protect the rights and legitimate interests of minors, in favor of which alimony payments are accrued.

Since often "statistical" average monthly salary in the whole country is much higher than the real income of the working citizen in most subjects of the Federation, it becomes a debtor on alimony in this case. it is extremely unprofitable primarily for the payer himself. (And on the contrary, it is often more profitable for the recipient of alimony).

An example of calculating debt bailiffs from average salary

Payer Petrenko N.N. I received a monthly salary at an enterprise in the amount of 20,000 rubles, its alimony obligations for 1 child under judicial order were 1/4 share of all types of income. Since other income Petrenko N.E. did not have, the monthly payment for the maintenance of the child was 5,000 rubles.

Wanting to avoid payment obligations and hide your income, July 01, 2016, Petrenko quit from the place of work and settled in a private company informally (without an employment contract). In October 2016, he received a decree on the calculation of aril debt for 4 months from the value of the average monthly wage (SPP) in Russia in the amount of 35843 rubles. For September 2016:

- july 2016 - 8960.75 rubles. (1/4 of the SPP);

- august 2016 - 8960,75 rub. (1/4 of the SPP);

- september 2016 - 8960.75 rubles. (1/4 of SPP).

Total debt gr. Petrenko N.N. From 01.07.2016 to 01.10.2017 amounted to 26882.25 rub.It turns out if this citizen continued to officially work on this or other enterprise and conscientiously paid alimony, the amount of aliminal payments for the same period would be only 15,000 rubles. - What is almost 2 times lower.

Average salary in Russia according to Rosstat

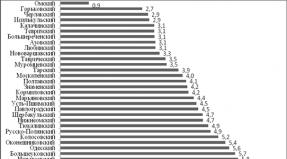

A very large variation of the average monthly salary in the regions of the Russian Federation makes it possible for payers the possibility of calculating the bailiffs of alimony, based on the magnitude of the average wage in the country for most regions of Russia.

So, according to official data of Rosstat:

- the average salary in Russia in 2017 was 36746 rub.;

- the maximum average monthly wage was registered in the Chukotka Autonomous District - 85678 rub.;

- the minimum salary was paid in the Republic of Dagestan - 19953 rub. On average for 2017.

Thus, the difference in the income level between the inhabitants of the regions with the highest and lowest average monthly salary according to the previous 2017 year amounted to 85678 - 19953 \u003d 65725 rubles.

At the same time, from 85 subjects of the Russian Federation:

- total 17 regions have a salary above the average in the country (in these regions the debt payment for alimony from the Central Russian salary is 3,6746 rubles. It may be more profitable for payers and is unprofitable for recipients of aliminal payments);

- in the rest 68 Regions The level of salary is lower than the average Russian (here the use of average salary to calculate the alimony is more profitable to the recipient and is unprofitable for the majority of payers).

Full data on the average salary in Russia in 2017 according to Rosstat data is provided in the table below.

| № | Name of the subject of the Federation | Average month salary, rub. |

|---|---|---|

| 1 | Chukotka Autonomous District | 85678 |

| 2 | Yamalo-Nenets Autonomous Okrug (YNAO) | 83832 |

| 3 | Nenets Autonomous District (NAO) | 71908 |

| 4 | moscow | 71220 |

| 5 | Magadan Region | 68584 |

| 6 | Sakhalin Oblast | 66239 |

| 7 | Khanty-Mansiysk Autonomous District - Ugra (KHMAO) | 63622 |

| 8 | Kamchatka Krai | 59923 |

| 9 | The Republic of Sakha (Yakutia) | 58504 |

| 10 | Murmansk region | 48715 |

| 11 | saint Petersburg | 48684 |

| 12 | Moscow region | 43467 |

| 13 | Komi Republic | 43427 |

| 14 | Khabarovsk region | 41401 |

| 15 | Tyumen region | 38370 |

| 16 | Krasnoyarsk region | 38361 |

| 17 | Arkhangelsk region | 38351 |

| On average for the Russian Federation (used to calculate alimony in all regions of the country) | 36746 | |

| 18 | Primorsky Krai | 36106 |

| 19 | Leningrad region | 35816 |

| 20 | Tomsk Oblast | 35459 |

| 21 | Irkutsk region | 34907 |

| 22 | Amur region | 33131 |

| 23 | Transbaikal region | 32785 |

| 24 | Sverdlovsk region | 32759 |

| 25 | Republic of Karelia | 32591 |

| 26 | The Republic of Khakassia | 32310 |

| 27 | Jewish Autonomous Region | 31963 |

| 28 | Kaluga region | 31504 |

| 29 | Chelyabinsk region | 31005 |

| 30 | Perm region | 30713 |

| 31 | Republic of Tatarstan | 30410 |

| 32 | The Republic of Buryatia | 30221 |

| 33 | Novosibirsk region | 29868 |

| 34 | Kaliningrad region | 29832 |

| 35 | Kemerovo Region. | 29828 |

| 36 | Tyva Republic | 29716 |

| 37 | Vologodskaya Oblast | 29324 |

| 38 | Tula region | 29080 |

| 39 | Krasnodar region | 28586 |

| 40 | Yaroslavl region | 28515 |

| 41 | Samara Region | 28504 |

| 42 | Omsk Oblast | 28465 |

| 43 | Nizhny Novgorod Region | 28172 |

| 44 | Novgorod region | 27901 |

| 45 | Republic of Bashkortostan | 27820 |

| 46 | Ryazan Oblast | 27495 |

| 47 | Astrakhan Oblast | 27423 |

| 48 | g. Sevastopol | 26895 |

| 49 | Belgorod region | 26873 |

| 50 | Voronezh region | 26758 |

| 51 | Rostov region | 26661 |

| 52 | Udmurtia | 26544 |

| 53 | Orenburg region | 26109 |

| 54 | Tver region | 26087 |

| 55 | Lipetsk region. | 26075 |

| 56 | Vladimir region | 25780 |

| 57 | Volgograd region | 25739 |

| 58 | Stavropol region | 25387 |

| 59 | Kursk Oblast | 25334 |

| 60 | Penza region | 25334 |

| 61 | Republic of Crimea | 25245 |

| 62 | Smolensk region | 25091 |

| 63 | Ulyanovsk region | 24369 |

| 64 | Altai Republic | 23976 |

| 65 | Kirov region | 23625 |

| 66 | Saratov region | 23492 |

| 67 | Kurgan region | 23381 |

| 68 | The Republic of Mordovia | 23379 |

| 69 | Mari El Republic | 23232 |

| 70 | Kostroma region | 22996 |

| 71 | Republic of Adygea | 22982 |

| 72 | Oryol Region | 22890 |

| 73 | Bryansk region. | 22819 |

| 74 | Tambov Region | 22762 |

| 75 | Chuvash Republic | 22736 |

| 76 | Chechen Republic | 22520 |

| 77 | Pskov region | 22264 |

| 78 | Ivanovo region | 22067 |

| 79 | North Ossetia Republic - Alanya | 22063 |

| 80 | The Republic of Ingushetia | 21569 |

| 81 | Kabardino Balkar Republic | 21489 |

| 82 | Karachay-Circassian | 21465 |

| 83 | Altai region | 21185 |

| 84 | Republic of Kalmykia | 21133 |

| 85 | The Republic of Dagestan | 19953 |

When an accountant calculates average wages (average annual, average and average daily, etc.), it deals with several basic values \u200b\u200bthat change their importance depending on the situation:

Dear readers! The article tells about the typical ways to solve legal issues, but each case is individual. If you want to know how solve your problem - Contact a consultant:

Applications and calls are accepted around the clock and seven days a week..

It is fast i. IS FREE!

- settlement period (RP);

- middle earnings (CZ);

- average daily earnings (SDZ);

- number of days in the RP payable (D);

- actual salary for spent periods of the estimated period plus premiums and remuneration (FZP);

- number of actually spent days at the estimated period (PD);

- number of fully spent months (PM);

- number of days spent in incomplete calendar months (nm).

These concepts and their use will be discussed in our article.

Normative base

The calculation of the SZ is regulated by the following regulatory acts:

- decree of the Government of the Russian Federation of December 24, 2007 No. 922 ("On the features of the calculus of average wages");

- article 139 of the Labor Code of the Russian Federation ("Calculating average wage").

Documents can be found on our website:

In what cases is required?

There are a number of cases when the accountant is required to calculate and pay the SZ for the employee.

Often you have to do this kind of calculations when:

- employee goes into;

- employee is paid;

- employee must be paid;

- and other cases (see below).

For holidays

Suppose you go on vacation. In this case, you must pay vacation money before the start of rest.

The accountant begins the calculation of this amount, without waiting for the end of the month, in parallel with the design (within two weeks before your departure).

The estimated period in this is the 12 months preceding the holiday month.

Accountant determines whether this period is fully worked out and believes the SDP.

If all 12 months have been fully worked out, then the desired number is considered as follows: FZP for this period is divided by 12 months and 29.3 - the average number of days in the month.

If these 12 months are partially worked out, then the FZP is divided by the number x.

This variable is a number of full past months (PM), multiplied by 29.3, to which the NP number (29.3 is divided into number of days in a partially spent month and is multiplied by the number of days spent).

So, when the desired number of SDZ is found, it is multiplied by the number of days you will spend on vacation. This amount will be the size of the vacation allowance.

For hospital

The amount of hospital is calculated and paid together with the salary at the end of that month in which it was provided.

The desired number is also, as in the case of vacation vessels, - SDZ. However, RP is 2 years before the year, when hospital was obtained.

FZP for this RP is divided by 730 (PD).

- 8 or more years - 100%;

- 5-8 years old - 80%;

- less than 5 years - 60%.

The resulting daily allowance for temporary disability is multiplied by the number of days that you drove.

The result will be paid by the sense allowance.

For decret payment

The calculation period to which the accountant operates in this case is equal to the same period as when the hospital benefit is accrued - 2 years before the year, when the woman went into.

But the FZP for this period is divided not by 730, but on the number of calendar days in two years minus sick leave and maternity days (and other excluded periods).

This amount is always multiplied by 100% of the insurance experience.

For the employment center

To register on the labor exchange, the unemployed is obliged to provide from the last job where information about its SZ will be indicated. It is this reference that will determine his unemployment benefit.

This amount is calculated on the basis of the last three months of work in the company going to the month of dismissal.

Website, benefits and travel are excluded from the calculation.

FZP for this RP is divided into number of days spent on the fact. Then the resulting number is multiplied by the number of working days according to the company's schedule and is divided by 3.

The amount received and is indicated in the reference, which must be provided to the Employment Center.

Certificate of average earnings for registration for accounting for the Exchange of Labor:

To calculate the pension

The calculation of pensions directly depends on a number of coefficients.

One of them is the average monthly earnings (CWC) coefficient.

KSZ is the attitude of your average earnings to the average monthly salary by country in your region for the established RP, which in this case is offered to choose from:

- from 2000 to 2001;

- for the period of 60 months in a row until 2002.

CSW cannot be higher than the set value of 1.2.

To calculate alimony

The calculation of the NW in the case of alimony is carried out only if they are debt.

The period is taken into account when the parent has not paid the alimony, and its earnings for this period.

For a business trip

To calculate the travel official, the accountant takes into account the RP in the 12 months preceding the month of his business trip. Only calendar days are taken into account without excluded periods.

FZP for this RP is divided into PD. The resulting amount is multiplied by the Number of travel days.

With abbreviation

When liquidating the enterprise or reducing state, a dismissed employee is paid output benefits.

At the time of his subsequent employment (no more than 2 months), an employee retains his SZ.

The CF with a reduction is calculated by RP in 12 calendar months preceding the start of the SZ conservation period.

The SDZ is counted again. For this, the FDZ is divided into PD. After that, the SDZ is multiplied by the number of days to be paid (e).

How to calculate average salary in 2020?

The calculation of the average wage occurs according to the formula of the SPZ * d.

However, some enterprises consider working hours not in the days, but in hours (summary working time).

In this case, the average earnings on the clock is determined by dividing the actual salary obtained for the RP on the amount of worked hours. After that, the resulting amount is multiplied by the number of working hours in the period to be paid.

What is included in the calculation?

When calculating an accountant operates by all the employee's remuneration types:

- salaries;

- piece payments;

- interest payments;

- non-monetary payments;

- remuneration;

- fees;

- surcharges and surcharges;

- prizes.

However, the accountant eliminates the following payments provided to:

- food;

- travel;

- training.

Do premiums turn on when calculating earnings for overtime work?

By the decision of the Supreme Court of the Russian Federation (No. GKPI07-516 dated 21.06.2007) it was decided not to include the prizes for overtime work when calculating the average earnings.

Are non-working holidays taken into account?

Non-working and holidays are taken into account when. These days are per SZ and payable.

Excluded periods

Excluded periods are periods for which earned money is not included in the calculation of the average earnings, that is, the time when it happens:

- salary salary;

- simple for the fault of the employer;

- provision of additional weekends for disabled care;

- exemption of the employee from working with salary.

If there were no salary

If the employee did not have payments for the RP, did not work during this period or its earnings dropped under the excluded periods, then the calculation occurs for the period preceding RP, and equal to it in duration.

If during this period did not pay payments, the SZ is considered to be on the basis of any actual employee payments.

In the event that there are no one, the calculation occurs at a tariff rate or salary.

If the salary rises

If the source of earnings at the estimated period changed its value, increased, the accountant works according to the following scheme.

The salary indexing coefficient is calculated.

This value will depend on which period rates occurred:

- per estimated period (an increased tariff rate is divided into salary of each month of the RP);

- after the estimated period (SZ, calculated for the RP, increases);

- during the preservation of the average earnings (SZ increases from the beginning of the salary increases until the end of the SZ conservation period).

After the coefficient is found, the sum of the SZ increases on the value obtained.

Estimated period

The estimated period is a non-permanent value according to which the NW is considered.

However, the RP Resolution No. 922 establishes in the amount of 12 months preceding the beginning of the period while maintaining average earnings.

One calendar month is a period of 1 to 30 (31) numbers (in February - from 1 to 28 or 29).

Method of calculation on examples

We give a table with formulas for the most common situations.

| Payment | Formula | RP |

| Middle earnings | SZ \u003d SDZ * D | 1 year |

| An average daily earnings | SDZ \u003d FZP / PD | 1 year |

| Vacation (fully spent RP) | SDZ \u003d FZP / 12/29.3 | 1 year |

| Vacation (not fully spent RP) | SDZ \u003d FZP / ((29.3 * PM) + nm)) | 1 year |

| Hospital | SDZ \u003d (FZP / 730) * Insurance experience (%) | 2 years |

| Decrehny | SDZ \u003d (FZP / PD) * Insurance experience (100%) | 2 years |

| Commander | SDZ \u003d FZP / PD | 1 year |

| With abbreviation | SDZ \u003d FZP / PD | 1 year |

We give the calculation of the average wage to pay for the hospital sheet as an example.

The driver of the Borisov organization D. I. provided a hospital sheet indicating that he had 6 calendar days in November 2020. His insurance experience was at that time 10 years, therefore, the allowance is calculated from 100% of average earnings.

In early 2008, when no one had assumed the global economic crisis, the former Russian President Dmitry Medvedev mentioned that since the beginning of the new millennium, the salaries of Russians are growing steadily. GDP growth for the same period was much more modest. Not only Dmitry Anatolyevich paid attention to the fact that it is necessary to improve labor productivity, and with another increase in wages, it is possible to postpone. Recall that 2004 was $ 242 (6,740 rubles at the time), in 2008 - $ 588 (17 290 rubles).

However, the question of why such small salaries in Russia were asked then and continue to ask now. On a straight line with the president - in the unique format of the interaction of the head of state with simple citizens - the issues of the internal economy (the level of wages, jobs, the employment of young people) became one of the main themes in 2002, 2005, 2008, in 2014-2017 the discussion was conducted annually. After the crisis and during the sanctions, the government acknowledged that the salaries in Russia are small.

Grave nineties

Why in Russia Little salary and in general, are they small, if we talk objectively? In the ninetieth standard of living, most Russians were determined exclusively salary and social payments, no additional income of speech was not. Yes, and the graphs of medium wages (especially in rubles) were distinguished by the rapid takeoffs, then crushing downs - on the face of a deep economic crisis.

In April 1991, the Central Russians amounted to 495 rubles ($ 341 at the average annual course corresponding to time), in December of the same year - 548 rubles ($ 101.6). For this amount, at the beginning of the year, 219 kg of potatoes could be bought (at that time), at the end - 182.6 kg. Next - worse. In 1992, the average salary was 5995 rubles or almost $ 24, in 1993 - 58.6 thousand rubles or $ 140, in 1994 - 220 thousand rubles or about 67 dollars.

If we talk about the interest rate of wages to the level of 1991 (before reform), then in the 1992th, incomes amounted to about 68%, in 1995 - about 45%. The biggest drawdown of graphics is observed in 1999, when the level of salaries of the population stopped at about 32-35% of the 1991 revenues. Experts argue that the nineties of the population has decreased by 1.5-2 times - to the indicators of the sixties.

Non-payment of wages

At the same time, there was a non-payment of wages. This negative process covered the majority of the population (60% of employees) in all regions of Russia and most areas of the economy. The maximum level of debt (69%) was observed in the north-west of the country, few less were debts in the Far East (67.9%), in the Urals and the North Caucasus (65.7-65.6%), in the Volga region (66%) . In Moscow and St. Petersburg, debt amounted to almost 32%.

Trend to improvements

The fact that the improvements are near, it was possible to say in late 1998 - early 1999. The demand for domestic goods increased, increased production, exports increased in physical volumes. By the beginning of the new millennium, there was an increase in real incomes of the population. According to official statistics, the number of Russian citizens who live below the poverty line has also decreased. If in 2000, such a layer of the population was almost 30%, then the Poor was 13% of the poor.

According to official data, since 1992, the increase in salaries in Russia in rubles was observed constantly (the schedule is presented below). But the domestic currency did not differ in the course stability. Another reduction in wages in dollars occurred during the world economy year, then in 2012-2014. The last time the decline was due to the world's fall in oil prices, the Ukrainian crisis and sanctions against Russia.

A brief overview of medium wages

Today, the average salary in Russia (2017) after the deduction of income tax is 30.8 thousand rubles. The minimum amount of remuneration since June of the current year is 7,800 rubles, the subsistence minimum for worm-bodied citizens is 10,187 rubles. But Russia is too much a country to speak only about general figures - salaries are significantly different in the regions, and the cost of goods, and the standard of living is generally different.

The highest salary in Russia by industry

In 2015, the highest salaries were in the oil and gas industry, financial analysts, in the field of mineral mining and in the transport sector.

In 2016, the highest average wages remained in the extractive industry - 71 thousand rubles, in the fuel energy industry - 80.9 thousand rubles, mining of minerals - 51.2 thousand rubles. This, by the way, the usual salary of the janitor in Germany.

In the transport area, the average monthly remuneration is 42.5 thousand. The driver of special equipment earns about 60 thousand, the loader - 46 thousand, the freight forwarder - 43 thousand, the mechanic - 40 thousand rubles. The driver's salary is 29 thousand rubles.

Government employees earn an average of 40 thousand monthly - this applies to the heads of departments and middle managers. Higher management can be content with much greater salary - about 68 thousand - almost like specialists working in the extractive industry. The salary of state employees in Russia is much less.

Managing staff practically in any industry earns more averages. So, for example, the head physicians, private doctors and director of pharmacies can count on 65 thousand, senior managers in the hotel and restaurant business - 60-64 thousand rubles, brigadiers, prohibitions, masts of construction and dismantling work - 50-58 thousand rubles.

Other high-paying professions:

- Non-profile specialists. Employees with narrow specialization and practical experience are harder to find work, but also the salary of them is significantly higher than in ordinary employees. So, for example, the salary of pilots of civil aviation in Russia is almost 300 thousand rubles with a tax from 85 hours per month.

- Programmers, system administrators and developers. In the nineties, there was a shortage of such specialists, the outflow of frames abroad, now the market has not been saturated with highly qualified IT experts. Professional is still lacking. The average salary of the programmer is from 60 thousand rubles.

- Internal relations managers. Such specialists are needed by major firms. Their obligations include ensuring contact between leadership and ordinary employees, providing loyal relations between employees, corporate style development, design work and so on. Professionals with experience can receive 100-250 thousand monthly.

- Accountants are considered highly paid employees, but for this you need a specialized higher education, experience of three years, the ability to focus in the laws. Corporations are ready to pay 350 thousand rubles to high-class specialists.

- A young practitioner lawyer can count on 35 thousand, more experienced colleagues earn 150 thousand per month.

- Sales and procurement managers, logists, marketers, auditors. In the first case, you need to understand the psychology of the consumer, the features of the goods, in the second - you need to know the customs system and logistics. Any specialist needs experience and vocational education. Average salary - 25-50 thousand.

Lowest salary by industry

The number of citizens with incomes below the subsistence minimum in 2016 amounted to almost 20 million people (13.5% of the population of the country). The average salary of physicians in Russia (as well as social workers and teachers) for 2016 increased by only 5%, in agriculture, textile production, forest industry and hunt - 10%.

In the processing production of the seamstress, the masters, technologists, specialists receive from 16 (clothing, textiles) to 32 (pulp and paper industry) thousand rubles. In food products, specialists can count on 28.8 thousand, manufacturers of shoes and leather products - 20.5 thousand, furniture, wooden goods - 22 thousand.

In the same limits, the utility workers and some representatives of the working specialties are earned, although it all depends on many factors. Tokary salary in Russia - 15-20 thousand rubles. But a specialist who has tolerances and experience can count on 30-40 thousand or more. The most highly paid employees (about 60 thousand monthly), who are ready for a rotational method of work.

Small salaries have to be content with the hotel and hotel business. Administrators, waiters, receptionist and maids receive from 20 to 25 thousand rubles per month. Cooks get a little more - 34 thousand.

Salary of Education Workers, Medicine, Law Enforcement

In the medical industry, the situation is not rainbow. Laboons have to be content with 14 thousand rubles per month, pharmacists and provisions - 24 thousand, nurses and younger medical personnel - 19-23 thousand. Low more get in the field of education. The average salary of the teacher in Russia is 26.7 thousand rubles, but these are really very averaged data.

The salary of the janitor in Russia is on average 15 thousand rubles according to official data, but in practice such employees can receive only 3 to 6 thousand. So many techniques and some workers of the hives? In this area, the work of the HOA or housing and public utilities is considered to be the work of the HOA or housing and communal services - 46-66 thousand rubles.

In the Ministry of Internal Affairs (as in many teachers or doctors), most of the wages make up various individual surcharges - for higher education, long service, the presence of officers, dangerous working conditions and so on. A police salary on average is 30 thousand rubles. Prize for conscientious service can be from half of the salary and higher, for risk for life and health - up to 100% salary, for special conditions (snipers or encrypters, for example) - up to 30% of the employee's salary without allowing.

So, the salary of a police officer who conscientiously carries service, works in special conditions and devoted to work for more than 25 years, can be about 70 thousand. This is also excluding military rank, higher education, advanced training and performance indicators. The salary in the Ministry of Internal Affairs is seriously amenable to statistical accounting, since many variables are influenced by the final amount.

Why "bad everyone"

From statistical data it can be seen that the average salary of an ordinary employee allows him to provide him with a normal standard of living. But why then all argue that the salaries in Russia are small? And why official statistics and other data differ so much: statistics from open sources, population surveys?

Most likely, the fact is that those who receive enough will not particularly speak, as they are satisfied. But people who have to be satisfied with low salaries, they say, as a rule, on behalf of everyone. Because it also makes the impression that "bad everyone". But actually it is not.

Russian and European salary

Especially love to mention low wages in Russia and European salary. The lowest salaries in Romania ($ 684), Bulgaria ($ 591), Latvia ($ 1039), Lithuania ($ 867), Hungary ($ 1129). Most of all receive in the Scandinavian countries (4700-5800 $), France, Belgium, Austria, Germany. Slightly less - in Slovenia, Spain, in Greece and in Cyprus (an average of $ 2500).

A police salary in Lithuania (only salary) is more than 800 dollars, in France the intern gets almost $ 2,000, and in Slovenia - 1100 dollars. By the way, rallies are often held in the same Slovenia. The protesters require the increase are also dissatisfied with insufficient salary.

Truck drivers in the Scandinavian countries receive 25-30 dollars per hour, the ordinary driver in France receives from $ 600 every month. The salary of the public bus driver in Germany is at least 1,500 dollars. The tram driver gets $ 3,500, a building machine driver - 3200 dollars. Tokary salary in the same Germany - 2.5-3.5 thousand dollars.

Monthly pilot remuneration in Germany - 5.8 thousand dollars. It is 800 dollars more than the salary of pilots of civil aviation in Russia.

Comparison of living standards

When comparing Russian salaries with European, another question is often forgotten - the cost of living in Russia cannot be equal to European. According to statistics, 27.7% of salaries spend on food, in practice - half. This is how much the same indicator in different countries of Europe is:

- Lithuania, 33.7%.

- Bulgaria, 33.2%.

- Croatia, 31.7%.

- Montenegro, 31.6%

- Romania, 31.5%.

- Latvia, 28.2%.

- Estonia, 27%.

- Poland, 24.9%.

- Hungary, 23.5%.

- Slovakia, 20.7%.

- Greece, 20.4%.

- Czech Republic, 20.2%.

- Italy, 19.5%.

- France, 16.4%.

- Spain, 15.1%.

- Iceland, 14.9%.

- Slovenia, 14.3%.

- Sweden, 13.5%.

- Portugal, 13.3%.

- Belgium, 13.2%.

- Germany, 12.8%.

- Finland, 12.7%.

- Cyprus, 12.3%.

- Ireland, 12.2%.

- Austria, 12.1%.

- Norway, 11.8%.

- Switzerland, 11.5%.

- United Kingdom, 11%.

- Denmark, 10.6%.

- Netherlands, 10%.

The leader is Luxembourg, whose citizens spend 8.6% of cumulative income per month.

The cost of living in Europe is much higher than in Russia, and not always high salaries "cover" all the necessary expenses.

Nearest GDP neighbors

So why are small salaries in Russia? In fact, Russian salaries are not at all low (there is a permanent increase in remuneration for labor), and the corresponding reality. Yes, and much more wisely compare Russia with the nearest neighbors, but not even geographically, but financially - with neighbors in the magnitude of the inner gross product.

According to the International Monetary Fund, the GDP per capita in Russia is 26.5 thousand dollars. The indicator provides the Russian Federation 48th place in the ranking. The nearest neighbors on GDP are:

- Latvia, 24.7 thousand dollars.

- Greece, 26.3 thousand.

- Hungary, 26.5 thousand

- Poland, 26.6 thousand

- Kazakhstan, 24.9 thousand.

Malaysia (26.2 thousand $), Antigua and Barbuda (24,200 $), Saint Kitts and Nevis (25,1 thousand), Seychelles (26.3 thousand) and other countries, comparison with For Russia, at least strange and incomprehensible.

So, in Hungary, for example, with the same level of GDP per capita, the average salary is $ 600 per month, in Russia the same figure - $ 589. Hungarians working in the automotive industry earn an average of $ 1500, the Russians are $ 750. Low qualifications workers can count in Hungary by $ 600 per month (just over 35 thousand rubles), high-class specialists - by $ 1200 (72 thousand rubles).

It would seem that there is a higher payment of labor, but it's time to remember European prices. In the same Hungary, rent a one-room apartment in the city center can be minimal for 15 thousand rubles in terms of national currency, in a residential area - for 7 thousand. Cost of housing and communal services - from 2 thousand rubles in summer 10 thousand rubles in winter. With the rest of the expenses the same situation.

It can be concluded that the question of why small salary in Russia becomes simply incorrect, because if we compare the economy of the Russian Federation with similar in the main indicators of the economies of Europe, the Russians live at all poorly, but at a completely decent level. Although, of course, it is impossible to deny the presence of problems in Russia.

The magnitude of the average Russian wages is used in aliminal legislation in solving the issue that arises due to the non-fulfillment of alimony claims by the debtor - periodic or systematic passing of monthly payments or payments in incomplete amount.

How are the alimony collect on average salary in the Russian Federation?

The use of the average wage in the Russian Federation to alimony is regulated by the following legal norms:

- art. 102 Federal Law No. 229-FZ of 02.10.2007 "On the enforcement proceedings";

- art. 113 SK (Family Code) of the Russian Federation;

- Methodical recommendations on the procedure for fulfilling the requirements of executive documents on the recovery of alimony of 19.06.2012 No. 01-16 (in particular, Art. 5.1). The bailiffs of the executors were encouraged monthly to request actual information on the averaged salary of Russians in Rosstat organs.

According to disappointing statistics, each third challenger of alimony in the Russian Federation faces the problem of occurrence. It happens most often due to the intentional actions of the non-payment:

- dismissal from the official workplace;

- informal employment and receipt;

- non-delivery as unemployed in the employment center at the place of residence for finding a workplace.

If the payments of alimony do not receive a recoverer in a period exceeding two months, it is worth contacting the federal bailiff service (FSSP) for reporting on this official leading enforcement proceedings.

The bailiff on the basis of the message of the recoverer on the non-dedication of alimony is obliged to calculate the debt of the defaulter, fixing it in a special document - and take the entire complex of administrative and executive measures to the debtor for.

"Uklonists" from an alimony payments should be remembered that it is extremely unprofitable to change the place of work on the unofficial in this situation, since, as a rule, the average monthly wage in the Russian Federation significantly exceeds the real incomes of the debtor with the "gray" employment, therefore, and the amount of debt will be overpriced .

Calculation of arrears for average wages (example)

With Vitaly M. recovered alimony in favor of two children in the amount of 1/3 share of wages. Being an officially working person with a size of earnings in 26,000 rubles. Vitaly paid a monthly alimony for children in the amount of 8,666 rubles. After some time, Vitaly quit from the workplace and it became unofficially (without the conclusion of an employment contract) and stopped paying funds. After 3 months, the former spouse Vitaly (recipient of alimony) turned to the bailiff with a request to calculate the alimony debt and take action to the debtor for its repayment.

The bailiff was made the following debt calculation, reflected in the table:

Total, the total amount of debt for 3 months of delay with Vitaly M. was 14 087.67 + 14 354 + 15 441.33 \u003d 43,883 rubles.

In addition, from this amount of debt, the recipient can also, and it will be accrued to debt, calculated on the basis of the average wage in Russia.

Sample decisions on calculating arrears in alimony

The ruling indicates the following information:

- periods for which debt is accrued;

- the size of the average monthly salary for the non-payment period;

- the size of the share of income that must be paid as an alimony;

- monthly debt, as well as the total amount of debt for all non-payment periods.

If one of the parties (payer or recipient) does not agree with the rusting of the bailiff, it can appeal the decision within 10 days from the date of receipt of the document.

How to avoid calculating debt from average earnings in the Russian Federation

First, in order to avoid the appearance of debt as such, it is necessary to pay alimony in the amount () in which they are established by the Executive document (agreement, executive list).

Secondly, if the debt was formed in the absence of the fault of an alimate-bound person (severe illness, circumstances of force majeure, serious difficult life situations), the payer can reduce the amount of debt or completely free from his payment, contacting this nature in the global court . 2 tbsp. 114 of the RF IC.

Thirdly, if the payer is dismissed / resigned from the official job, it is best to register to the Center for Employment of the Population as the unemployed, looking for a workplace - in this case, the debt will be accrued with, and not with averaged wage in the country, what some lower.

However, the debtor will not work for a long time - in the absence of a desire to get a job for the proposed posts during the year, the face is removed from accounting on the Labor Stock Exchange, or remains registered, but without paying benefits.

Rosstat data about the average salary in Russia in 2019

The table below shows the promulgated information of Rosstat on the size of the average earnings (SZ) of Russians in general on the economy of the Russian Federation for 2019 (on November inclusive). Information about the SPP for 2020 Rosstat will update later.