Definition of real wages. Nominal and real salary: differences and relationship. What is the difference between the nominal salary and its real magnitude

For each employee, not only the size of the salary is important, but also its quality. And here is not meant the quality of the bill, another thing is important - how much the income of the employee allows you to satisfy its needs in the context of the modern economic situation.

In this connection, the salary can be divided into real and nominal. What is the essence of each concept and what they differ - tell in our material.

Nominal salary: concept and types

Nominal wages are a fee established remuneration, guaranteed income amount, which is due to an employee. As a rule, the employer pays a fixed amount that depends on the spent time and the amount of work performed. No external factors do not affect it: inflation growth, price changes for goods and services, etc.

When calculating the value of the nominal salary, the following components are taken into account:

payment for spent time, performed work (depending on the form of wages);

surcharges for work in the night and overtime;

premium and stimulating payments;

vacation pay.

There are two types of nominal earnings:

Accrued salary is the amount formed on the basis of the accounting system adopted. It includes all the allowed payments, surcharge, surcharges and premiums.

The paid salary is this cash that a person will receive in the hands after all tax deductions and deductions, such as NDFL, alimony.

What is a real wage

This is the size of material benefits, products or services that a person can get a nominal earnings. If for a certain time the nominal salary remains unchanged, and the level of inflation has grown over the same period, this means a decrease in real salary, which reduces the purchasing power of the employee, worsens its financial situation.

The calculation of the real wage directly depends on the economic situation in the country or in the region, especially from the level of inflation, the growth of consumer prices. It is closely interconnected with a nominal earnings. This value reliably reflects the ability of people to satisfy their material requests at the expense of nominal remuneration.

Expert Experts 1C-Wiseadvice Experts provides both the competent remuneration of workers and the solution of complex or non-standard situations, for example, the calculation of salary with northern surcharges.

Order service

The main income of a person working on hiring is its salary. From the point of view of economic theory, income can be calculated both on the basis of the expended labor of the employee and on the basis of its real expenditures on maintaining a normal life level. Therefore, in the economy there are two concepts - nominal wages and real wages.

Under the nominal wage is a fundamental remuneration in a fixed size, which the employer pays the employee or for a certain amount of produced goods or works performed for a fixed time, or for the number of hours spent. The same concept also includes various premium accruals and incentive payments. The size of the nominal salary of the employee is recorded in the employment contract with the employer, or in the settlement statement, where the salary is reflected for a certain time segment.

Types of wages

Nominal wages are standardly subdivided into two types: accrued and paid. Nominal salary accrued is a fee for the work of the employee, calculated in accordance with the accounting system adopted at the enterprise. The nominal salary paid is the amount of money left after the payment of tax deductions from the accrued wages, and issued to the hands of an employee according to the statement.

The calculation of the nominal wage is made on the basis of several calculation systems:

- Sklad. According to such a system, the employee receives a salary in the amount of salary fixed in the staffing schedule.

- Timeless. The basis for the calculation is the time-spent time, which is paid on the established tariffs.

- Piecework. Here, the base is either an individual contribution of an employee to the overall production (produced by the volume of products) or its share in the general development of the brigade.

- Particularly timeless. In this case, in addition to the fulfilled standard, the employee can get stimulating payments for overfulfing the planned plan.

- Accordable. Within the framework of this system, the employee receives a fee on the basis of a shift-worked shift. The salary is issued both upon completion of one of the stages of the production process and at the end of the work.

- Planned timeless. This calculation system provides for a remuneration for the fact that the employee made a certain product rate and put in the time allotted at this time.

- Mixed. All of the above methods in various combinations can be used in a similar system.

Real wages

Real wages

Real wages are the number of cash bills, within which the employee has the opportunity to purchase the various goods necessary for comfortable existence. That is, it is the money that the hired worker received on the hands of a certain working period and can now spend on food, medicine, clothing, utility bills, education and recreation. This salary is a human welfare level indicator.

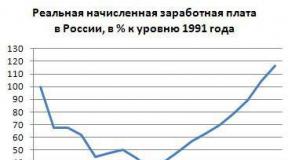

The real salary is defined as high or low relative to current prices on the goods necessary for life with services. As for the price level, then in the economy of capitalist type it is a constantly variable value, and in the Russian economy the change is mainly in the direction of increasing. Accordingly, over time, the real salary of most Russians can hardly be assessed as high.

Difference and interconnection

Similarity

And the nominal and real wages are the cost of labor. And the one and another type of salary will have a monetary expression, and treat in the currency in which the employer makes payments to its employees. Both of these types of wages cannot have the same amount, since the deductions of the state are made at the expense of the employer, respectively, it lays these costs in wages of its employees.

Difference

What is the difference between real wages from nominal? The fact that the real salary is tightly tied to existing prices of consumer goods and services, and nominal is just a certain specialist earned amount without taking into account inflation and taxes, the amount of which does not reflect the real economic situation. That is, the first is formed in the form of a set of goods that can be purchased on the resulting amount, and the second is expressed in the value of a certain type of work performed or worked hours.

Communication

Simple curve Phillips

In order for the nominal salary to become real, it is necessary to take all tax and retirement deductions from its magnitude, which manufactures an employer. Accordingly, the size of the nominal wage can often be calculated by the employer, based on its own costs. Since the business owner is forced to do considerable tax deductions to the state, it is quite clear that it will strive to save on the work of expenses for the wage of employees. At the same time, the question is whether the worker can comfortably exist on the money that he is paid in fact, it is unlikely to worry the employer.

Place in economics

The so-called purchasing power of the population is calculated precisely on the basis of a real salary. The size of the purchasing power has the opposite dependence on the consumer price index or PHI. If consumer prices grow, then purchasing power, respectively, will fall down. The economy practices the use of measures to compensate for the influence of inflation by changing the values \u200b\u200bof the PCL in the direction of increasing.

The difference between the levels of nominal and real salaries will be an indicator of inflation. The nominal wage index is the ratio of the level of the current salary to the level of wage of last year, multiplied by 100. The calculation of the so-called real salary index is so - the nominal wage index is divided into the CPI and is multiplied by 100.

Inflation rate

If the size of the nominal wage does not change, and inflation is growing, then the purchasing power of the population is also decreasing, since the person earned will not be enough for the payment of goods and services necessary for the life.

Under conditions of constantly growing inflation, the size of a real salary will still be reduced even with an increase in the level of nominal wage. This is observed in an artificial increase in wages by compulsory indexation from the state. At the same time, the degree of satisfaction with the social status of the population will fall.

On the contrary, an increase in the nominal wage in a relatively stable economic situation will indicate an increase in the level of welfare of citizens. And a slight increase in the price index will not be critical at the standard of living of citizens and it will even be an additional incentive to employers to raise the nominal salary.

By the way, the nominal value of the work done by the worker, which is a great mathematical significance, is not yet an indicator that the salary has a high employee. During the period of the 90s, the salaries were calculated by millions, and it was nowhere to spend these mad sums due to the deficiency of the TNP.

Factors of influence

Factors affecting the calculation of the nominal wage

Below are the factors affecting the calculation of the nominal wage:

- Personal contribution to the employee in production. This is its experience, qualifications, available skills, the quality of work produced, as well as the volume performed.

- Various promotions for high-quality work done. These are surcharges for overtime, the growth of labor productivity and the quality of goods.

- The complexity of working conditions. This is the harmfulness of production, heavy working conditions and intensive work schedule.

- Methods for calculating wages - by salary, a certain tariff, per unit of working time or produced goods.

- Number of spent time or production rate.

- Minimum wage - minimum wage. This parameter is the minimum threshold for accrualing the nominal salary and depends more than the decisions at the state level.

Harmful working conditions

Factors affecting the calculation of real wages

Consider these factors:

- tax load currently. The greater the tax rates and the size of the deductions in the PF, the lower the size of the real wage. In addition to the income tax, the employee's employees still pays the ESN, whose share in the amount of tax payments occupies an overwhelming part;

- changing the cost of consumer goods and services. This leads to the depreciation of funds actually received by the employee;

- the growth of tariffs for the payment of housing and communal services - these costs "eat" every year "eat" the increasing part of the employee received for their money;

- demand for certain specialties in the labor market. If any specialty becomes in demand, and professionals are missing, the level of wages will increase;

- indexing the size of wages - to a greater extent applies to budget organizations. Private organizations do not seek to revise the salaries and tariff rates of employees;

- discrimination on gender and national signs - women compared to men in the same position will pay less. Migrants will pay the minimum salary on "black" or "gray" schemes;

- delay in paying wages on hand. At the same time, the salary is accrued and even taken into account in statistical calculations, and the employee did not receive it;

- the issuance of a part of the salary is not with cash, but a native - that is, products. This method was widely practiced in the post-Soviet period. For the state system, such a factor is simply destroyed - with barter operations, which were forced to engage in workers, taxes do not come. It is possible that under current crisis conditions the influence of this factor may increase.

Real and nominal wages in the current conditions of economic development are completely different things. Both of these indicators depend on each other, and each of them has an impact on the economy.

The real salary directly affects the purchasing power of the population, and the nominal - on the size of the real wage. Theoretically, it is possible to artificially fit the level of real salary to the threshold of nominal, but under current conditions this will not give growing inflation.

Nominal wages are a remuneration paying for employees for the performance of certain types of labor. The amount of funds he earns in one day, week, month and she constitutes his nominal income for the work done by him. These funds it can spend on everything he wishes (food, dressing, furniture, travel, all sorts of services, etc.).

With the invariance of prices for food products acquired by workers, the growth of the nominal. Wages would be considered a positive factor for the worker, but t. In the whole world, prices for the types of all sorts of goods and services are constantly changing, two types of wages should be distinguished - nominal and real salaries.

Rated wage growth

With the growth of the nominal wage, as a rule, the following factors are associated: the automatic wages indexing, in the results of the official price increase index, changes in legislation, growing demand for consumption from the organization or company, growing skills of a specialist, services for years in organizations and so on.

Growth of social benefits and nominal wages increases demand for all goods and servicesAnd therefore, leads to a new push for inflation. Such a phenomenon is called the "Universal Economy Engine". Very often, the growth of the nominal wage is observed, due to the conclusion of contracts between large trade unions and entrepreneurs.

Sometimes an increase in the nominal wage may be associated with, as well as improved quality of products manufactured by the company and other factors.

The increase in real wages is possible as due to the growth of Mr. salary and due to the reduction of state retail prices.

During a decrease in the nominal wage, unemployment occurs, a decrease in demand for labor, and, accordingly, the increase in low-paid specialties.

Dependence between the real and nominal wage

Nominal wages stimulates workers' salaries, conditions and procedures for paying money. As if causing his desire and desire to work. This is the most affecting the qualifications of the worker and, accordingly, to increase his real pay for labor. The real salary is calculated and based on the size of the nominal salary and therefore these two types of wages are dependent broadcast.

Real wages

Real wages of labor This is the cash paid by the employee for the work performed by him, taking into account the deduction of all costs for its content in the workplace (taxes, nutrition, specials. Clothing, transport, insurance, etc.). The real salary paid by the employee can be spent on any purpose (payment for utilities services, food, entertainment, acquisition of equipment and other goods).

What is the difference between real wages from nominal

Nominal wages are a fee for the employee's labor activity accrued by his head without taking into account the deduction of all taxes, insurance costs, expenditures on work clothes and nutrition. And the real wage is the amount expressed in the monetary equivalent, paid by an employee in hand, taking into account all tax fees and costs for its content.

Average monthly salary

The average monthly salary refers to timeless pay. This type of wage is perhaps the most common along with all other types. It is most efficient it is used in those workplaces, where the discharge of the working contingent does not exceed 3 levels. This type of wage is particularly often found on official places that cannot affect an increase or decrease in trade or any other interest of the organization. As a rule, these are state budget organizations.

Usually there are temporary accounting of the working day on them, and not a fine accounting, as in private organizations: small and medium-sized businesses, such as factories, plants, marketing, and so on.

The average monthly nominal salary is calculated by dividing the fund of the accrued salary of working personnel on the average number of workers and for the number of months in a separate period. The benefits received by workers' staff from state social extrabudgetary funds are not included in the average monthly salary.

Nominal and wage formula

The difference in the cost of life is calculated by the price index prices for consumer goods and all kinds of services. This ratio between the nominal, real salaries and the price index is determined by this formula:

Index nom. Salary \u003d Real index. Salary * 100 / price index consumption and services.

Let us give an example: nom. The salary for a certain period of time has increased by 4.5%, and Real. The salary decreased by 2.1%, it follows that the price index is: (100 + 4.5) * 100 / (100-2.1) \u003d 104.5 * 100 / 97.9 \u003d 106.7;

It turns out that the value index value \u003d 106.7, respectively, it increased by 6.7%.

Living wage

This is the minimum level of consumption of the most important social goods and services that guarantee the maintenance of the human body in active and physically strong condition.

The subsistence minimum includes: Food Expenditures, Social Services, Taxation and Required Payments. The cost of living, it is customary to count on both one person and family. Given the presence of young children by age up to 6 years and adolescents up to 15 years, pensioners.

Any enterprise is forbidden to pay to their employees who have worked for a full-time month salary below the subsistence minimum or minimal wage established by government agencies.

Nominal wage index

Calculated on the basis of the factors below:

- Expenses for the maintenance of the employee (nutrition, ensuring it all the necessary consumables for quality work).

- Payments for the work done.

- Taxation spent on the employee.

- Fees and premiums.

- Costs for insurance.

- The amounts of funds spent on professional training, social. Services, travel cards, workwear and much more.

The expenses of managers in their employees include salary and all add. The costs associated with the use of this workshop.

What receives a worker

An employee operating on a particular enterprise receives income for the work done by him, established by his leader. Whether a piecework, hourly or monthly salary. It is calculated directly in terms of the size of the nominal and real wages, the qualifications of the specialist, its experience in the selected direction, the quality and volume of the work performed and many other factors.

A man who received wages has the right to dispose of earned funds at its discretion. What enhances his desire to continue to work at the enterprise chosen by him or organization to improve their financial well-being.

Not every employee knows what it is - a nominal wage and how it differs from real. However, this indicator, as well as the index of the nominal wage or the average monthly nominal wage, is extremely important both for the employees themselves and, first of all, for their employers and employees of the personnel and accounting department.

Nominal wages - what it is

The concept of nominal wages is wide enough and often used in labor relations. Usually under it implies earnings of an employee who receives in accordance with the documentation and before subtracting compulsory taxes and fees from it, without actually binding to the purchasing ability of currency and other indicators.

In Russian legislation, the concept of nominal wages, as well as real separately is considered. At the same time, almost always under the salary of the employee, it is precisely the average monthly nominal wage.

Due to the lack of direct regulation of the concept of nominal salary, this term is primarily not legal, but theoretical. And, accordingly, it may have a different interpretation in a different context of its consideration. So, the nominal wages can be divided into the following types:

- Accrued nominal wages. The average monthly nominal accrued wage includes all means actually appropriate employee wages to any deductions from it.

- The rated nominal wage. Under it implies a specific amount of funds received by the employee, however, without taking into account the real purchasing power of these funds.

Often paid nominal wages may not be considered nominal, and on the contrary - to relate to real wages, depending on the point of view of the specialist considering this issue.

It should be noted that the lack of direct legal regulation creates various controversial issues in determining the concept of real or nominal wages. However, in relation to the net nominal salaries of disputes, there is practically no - most economists consider it exactly the exact amount of all employee rewards before actually subtracting from it necessary payments and without actual comparison with the purchasing power of money.

Nominal salary is expressed in itself during research usually in national currency, although international studies can also use binding and to global currency, which can lead to a significant difference in indicators.

Than nominal wages differs from the real

In most situations, the concept of nominal wages is considered together with the antonymic definition - a real wage. The difference between these two concepts is fundamental. So, if the nominal salary involves the general actual size of the funds accrued, then the real salary involves a specific amount of benefits that the employee can afford, or simply the specific amount of funds received by the hand.

It is necessary to understand that the nominal wage differs from the real and the fact that this indicator is used. Thus, the nominal indicators cannot fully reflect the economic situation in the country without binding them to the real size of earnings. At the same time, real wages cannot indicate the state of the national currency system and other important macroeconomic indicators.

It is necessary to understand that the concept of real wages also does not have accurate legislative definition and regulation, so this theoretical concept may also have different interpretation. In more detail about the real wage, you can read in a separate article.

Where the nominal wage is used as an indicator

It is necessary to understand that the nominal wages is an extremely important indicator for accounting, personnel specialists and the majority of settlements. So, it is based on the average monthly nominal wage "

At the same time, the nominal wage itself includes all types of remuneration for labor. Including premiums, surcharges for the development, salary or pay rate pay rate, interest from sales or other methods of money, as well as non-monetary remuneration of workers when the salary is issued in nature. In addition, it is the nominal wage relate to the following indicators:

- Mrot . The minimum wage in Russia is set precisely about the nominal wages of employees, and not real.

- NDFL and insurance fees. The deductions of taxes and obligatory fees are held from the nominal salary.

Payment of compensation character, benefits, funds received within the framework of state support and ensuring material assistance are not included in the calculations of the nominal salary.

Since the nominal wages actually always turns out to be higher in the monetary equivalent, the employers most often seek to point out the level of the nominal salary in the vacancies, since taxes and fees are accrued. And by itself the sum of the nominal salary looks more attractive for employees and applicants due to their larger size.

Nominal wage index

Under the index of the nominal wage primarily implies a separate indicator that characterizes the change in the nominal wage accrued to employees in the country or a separate institution. The index of the nominal salary itself, as an indicator is practically not used, or is applied to find a similar index for real earnings.

Not always the growth of the nominal wage index can mean improving the welfare of the population. Conversely - a decrease or even drop in the index of the nominal salary does not always mean the deterioration of the economic situation.

The nominal salary index uses only absolute wage growth rates in national currency and does not take into account the growth index of consumer prices. Accordingly, it cannot reflect the actual improvement or deterioration of the well-being of the population by itself. For example, if the national currency has strengthened significantly, and inflation was minimal or deflation was observed on the market, even a decrease in average wage sizes could lead to an increase in the welfare of the population. And on the contrary - in the case of hyperinflation, the nominal salary index may be huge and exceed tens of thousands of percent, while the well-being of the population and its purchasing power will only deteriorate.

Salary is the most important element of the life support of most citizens. For Russians, it is often the only source of income. But not everyone understands the difference between the number and quality of the money received. To understand this, it should be understood that such a nominal and real wage, and how they are interrelated with each other.

Nominal wages: concept and calculation of the index

Nominal wages displays the number of money received for the completed work. It is a quantitative indicator. When calculating the value of the nominal salary, the following components are taken into account:

- payment for spent time, performed work (depending on the form of wages);

- surcharges for work in the night and overtime;

- premium and stimulating payments;

- compensation;

- hospital;

The size of the majority of wages or the rate (the cost of the labor day, an hour, which made% of profits) is indicated in the employment contract and an order for employment. Monthly amount received in hand and will be a nominal wage. This indicator is used by statistical authorities to compare the level of wages.

To determine the quantitative wage gain, a special indicator is used - the nominal wage index. For calculation, the formula is used:

And NWP \u003d average monthly zp forn. year / average monthly zp fork. year * 100%

The final value shows how much% increased or decreased wages. For clarity, we give an example of calculation.

|

The average value of zp |

And NZP to the previous year |

And NZP by 2014 |

|

|

45 000/35 000*100% = 128,57% |

45 000/35 000*100% = 128,57% |

||

|

40 000/45 000 = 88,89% |

40 000/35 000 = 114,29% |

Conclusion: In 2016, the salary decreased by 11.11% compared with 2015, but increased by 14.29% compared with 2014.

But the calculation of this indicator does not allow to qualitatively assess the level of wages in different years. For this purpose, the concept of real wages is used.

Real wages: what is it for what is it necessary for?

The size of real wages displays the volume of goods and services that can be bought on the money received in the form of salary. A similar definition is given in the decision of the State Statistics Committee of the Russian Federation No. 148 of September 12, 1995.

Such a type of wage is a qualitative indicator. It demonstrates the purchasing power of the money received from the employer. But the head of the organization does not displays a real wage, so the calculation should be made independently. For this, the following indicators will be required:

- And NZP;

- CPI - consumer price growth index or inflation rates.

The formula for calculation will be like this:

And RZP \u003d and NZP / IPTS X 100%

If in the given example, take the CPI for 2015 at the level of 110%, then compared with the previous year, the index of real wages will be equal to:

And PPP \u003d 128.57/110 x 100% \u003d 116.88%.

This suggests that the real wage increased by only 16.88%, and nominal at 28.57%.

To calculate the level of its well-being compared with the previous year, it is necessary to take not nominal, but real wages. Only so you can understand whether a person has become more actually.

Dependence between the nominal and real salary

There are no conceptual and real salaries in the tax and accounting records. They are used in general economic and statistical purposes. Comparison of indicators may be interested in an ordinary person, because nominal and real wages are important criteria for assessing the level and growth / decline in wages. The main difference between them is that the real value is calculated taking into account inflation, and the nominal nominal. The values \u200b\u200bof these indicators are closely linked. The following dependence may be established between them:

- Straight. It is characteristic of a situation where the size of the nominal salary is growing faster than consumer price growth index. For example, labor payment for the year increased by 15%, and the rate of inflation during this period is 5%. Then the real salary will increase by 9.52% (115/105 * 100% \u003d 109.52%). This will allow the citizen in the current year to acquire 9.52% of goods and services more than in the previous one.

- Inverse. Reflects the situation when the nominal wage is growing slower than inflation rates. For example, a salary for the year increased by 20%, and inflation increased by 25%. In this case, real labor pay will decrease by 4% (120/125 * 100% \u003d 96%). Even despite the growth of the quantitative indicator of salaries, a person will be able to buy goods and services less than in the previous year, which signals a reduction in living standards.

Salary in statistical reporting

Nominal and real salaries are used to obtain statistical indicators. Formulas for their calculations are used not only on the state, but also at the international level. The results obtained provide states that are members of the Eurasian Economic Union, to compare the standard of living of the population of different countries.

Read also ...

- The work of "Alice in Wonderland" in a brief retelling

- That transformation. "Transformation. Attitude towards the hero from the sister

- Tragedy Shakespeare "King Lear": the plot and the history of the creation

- Gargantua and Pantagruel (Gargantua et Pantagruel) Francois Rabl Gargantua and Pantagruel Brief