The most profitable business where to invest money. Where to invest a small amount of money. Disadvantages of this method of investment of money

The situation with Kesbury divided the lives of many people on before and after. Therefore, today we will talk about where to invest money without risk with a yield of 23-75% per annum. I will tell you about the methods known to me and supplement modern and more profitable from my point of view.

- Conclusions.

While in search of 100% of reliable sources of investment, it is necessary to understand that the smaller the risk, the lower the level of profitability from invested funds.

The most risk and reliable ways of investing money are considered:

- Buying bonds of a federal loan for the population (OFZ) issued by the state.

Protection 99.9% Due to the low level of public debt of Russia to GDP compared to the crisis 90s.

The deposit amount of 30,000 rubles. One bond costs 1000 rubles, it is necessary to purchase at least 30 pcs for opening an account.

Deposit term 3 years. A fright refund is possible until 12 months. With the loss of all profitability, later than 1 year with the preservation of income already paid. After 3 years, the amount returns.

Pros:

- Ease of attachments. Office for the population can be in Sberbank and VTB24 on the day of circulation

- The guarantor of the return of funds is the state

- Available amount for novice investors

- Revenues received from bonds of a federal loan for the population are not taxable

- Profitability higher than most bank deposits

- Revenue payment every 6 months.

- OFZ can be inherited

Minuses:

- Low yield up to 10% per annum

- Payment of commissions of the bank 1% when designing

- Loss of income in the early removal of money up to 1 year

Increase the yield of 13% of investment in OFZ by purchasing corporate bonds on the stock exchange and discovering an individual investment account (IIS) from a Russian broker.

In this case, the tax inspectorate in accordance with Art. 219.1 NK of the Russian Federation will return 13% of NFDL, held by the employer with your wage, but not more than 52,000 rubles. in year. Those. It makes sense to make no more than 400,000 rubles on an individual investment account. per year and have a pure wage more than 33,000 rubles / month. Investment deduction can be obtained every year for 3 years from the date of opening an account.

At the same time, the return of personal income NDFL can be obtained simply for the fact that money is on the account, i.e. Bonds can not even buy. But if you close iis until the end of 3 years, the amount of deduction will be kept with you when issuing money.

Thus, combining investments in the bonds of the federal loan on the stock exchange and the deductions from the IIS can be brought by yield to 20.45-27% per annum at a minimum of risks. At the moment it is one of the easiest and most effective ways to invest money without risk.

The main thing is to choose reliable brokers, because Such accounts are not insured by the state. For example, you can open Jes in Sberbank or VTB24.

If you are an IP or an organization, then for you is deduction in the form of exemption from the payment of tax from income obtained in the form of positive financial results when trading on the stock exchange.

- Bank deposits

Bank deposits are now related to risk-free investments, because deposits up to 1,400,000 rubles. insured. But not all. Therefore, when opening always check whether the contributions of the bank you are interested in. This can be done on the Deposit Insurance Agency website in the "Insurance Deposit" section - "Banks participating". The same site indicates how to obtain compensation in the event of termination of activities by the Bank.

The main advantages of bank deposits:

- Put money on a deposit can be from 3000 rubles, i.e. Available to all.

- Ease of opening in any bank on the day of circulation or online

- The possibility of rapid early return of money

- Preservation of attached tools

To select a bank and contribute to the most favorable conditions, drive into the search engine "Open Contribution (Your City)" and go to the website of banks RU. It has a convenient deposit search system, you can set parameters for the amount, partial removal and replenishment, percent capitalization.

Of the minuses of bank deposits, I note:

- Often, banks have problems with a review of the license, so it is better to choose large and proven banks.

- Low profitability

Increase return on bank deposits in several ways:

- Open deposits online.

Almost all banks can now open the contribution online via the Internet, while the interest rate on the deposit will be higher by 0.25-0.75%.

- Pay attention to the capitalization of interest.

For comparison, the Raenesian bank offers deposits: without the Online borders with the yield of 6% per annum and monthly capitalization of accrued% and Renaissance revenue online with the profitability of 8% and paying the principal amount and interest at the end of the term, without capitalization and replenishment.

| Initial sum | Deposit term | 8,25% | 6,00% |

| 100000 | 1 | 687,50 | 500,00 |

| 2 | 687,50 | 1002,50 | |

| 3 | 687,50 | 1007,51 | |

| 4 | 687,50 | 1012,55 | |

| 5 | 687,50 | 1017,61 | |

| 6 | 687,50 | 1022,70 | |

| 7 | 687,50 | 1027,81 | |

| 8 | 687,50 | 1032,95 | |

| 9 | 687,50 | 1038,12 | |

| 10 | 687,50 | 1043,31 | |

| 11 | 687,50 | 1048,53 | |

| 12 | 687,50 | 1053,77 | |

| 13 | 687,50 | 1059,04 | |

| 14 | 687,50 | 1064,33 | |

| 15 | 687,50 | 1069,65 | |

| 16 | 687,50 | 1075,00 | |

| 17 | 687,50 | 1080,38 | |

| 18 | 687,50 | 1085,78 | |

| Total accrued% for the time | 12375,00 | 18241,54 | |

| The difference between the accrued% | 5866,54 | ||

From the table it is seen that, the more deposit period, the more profitable the tariff with capitalization. The difference in 18 months amounted to about 6,000 rubles.

- PART OF CAPITAL (30-40%) Put on a currency deposit.

The rate on them is at times lower and rarely reaches 5%, but so you will win much more or insure yourself with a substantial fall of the national currency.

- Use the "Cascade" distribution on depositsTo maximize your capital.

This means that you are opening several deposits:

- The first contribution opens under the most profitable percentage for 3 years with the possibility of replenishment.

- The second deposit opens by 1.5-2 years with the same conditions.

- The third opens by 6-12 months. Under the highest% with loyal removal conditions for the occurrence of force majeure circumstances.

The essence is as follows: Banks are interested in attracting money on as much time as possible. Therefore, in deposits opened for several years percent above.

With the help of this system, you record yourself the maximum percentage of the contribution for 3 years, putting the money there that you want to scatter and increase. The deposit for 1.5-2 years forms your "airbag". The third deposit is formed by using credit cards. Those. You order several credit cards with a grace period, mostly from 55 to 120 days. Credit cards pay current costs, and put the money earned to the bank for interest. The main thing is to be no overdue for payments. With unforeseen circumstances, money from the 3rd deposit can be removed to solve current tasks, while maintaining high interest on other deposits.

By investing in this way, bank deposits cease to be simply sources of saving money from at the current level of inflation and begin to work for you. Therefore, deposit deposits perfectly fit into the list of ideas where you can invest money without risk to get good percentages.

- Investing in real estate

Attachment of money in real estate, time immemors was considered the most reliable and stable way of investing until recently.

Currently, in order to successfully and without risks to invest in real estate, it is necessary to take into account the trends and changes in legislation. therefore when investing in real estate in the second half 2018-2019g. Pay attention to the following:

- Taking into account the reduced percentage of the mortgage when purchasing new housing, the possibility of payment of the cost of the mother capital and high growth rates of the housing under construction, the demand for secondary housing has been dropped not for the first year.

therefore investigate into secondary housing makes sense, subject to a favorable transaction at a low price, for example, urgent sale, poor state of the object, hitting it under domestic housing with resettlement in the coming years or profitable location.

- Stably increases the demand for apartments of a smaller area and studios, which, respectively, more affordable by price. Therefore, it makes sense to invest in such objects.

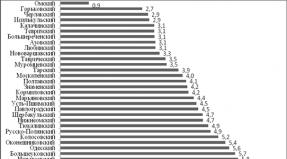

- Demand and housing prices will heighten the regions. Rising prices is celebrated in the cities where the pace of construction (Nizhny Novgorod, Vladivostok) has noticeably decreased, at the tourist resorts (Sochi, Gelendzhik). Also grow housing prices in cities with a growing flow of migration, such as Krasnodar, Tyumen, Kaliningrad, St. Petersburg.

But in Moscow, prices for new buildings due to the large pace of construction and unprepared apartments in the already paid houses began to decline, although insignificant.

- In July 2018 Amendments and additions were made to Law No. 214-FZ "On participation in the share construction of apartment buildings and other real estate facilities".

In particular, tightened the requirements for developers when using money for money investors in construction. According to experts, this will lead to an increase in the costs of developers, which will lead to the increase in prices for housing under construction. To sell housing at the "Kotlovan" stage, many developers will not benefit, which will also be affected at the cost of real estate.

- In general, real estate prices depend on factors such as infrastructure development, inflation, demand and mortgage rates. According to official data, real estate prices will grow by 6-7% per year, and in Moscow by 20% in the next 2 years. So, according to experts, until mid-2019. The most prospects will be the objects of real estate at the "Kotlovan" stage in regions with increased accommodation in housing.

- Investments in structured programs

Structured brokers programs are the fourth reliable way to invest without risk. At the moment, such large Russian brokers as BCS, discovery, finams, Sberbank have developed structural products to attract money.

The essence is as follows: You collect your individual investment product based on the assets of the protective (risk) part and income (in which you can lose some of the money, and get a big yield).

The protective component consists of investments in deposits, bonds, bills, real estate, precious metals, etc. sources subject to minimal risk of losses.

The revenue part is investment in stocks, trading in the Forex market and other risky methods with high yield.

Minimum amount of investment on average 100 000-300 000 rub.

Deposit term from 6 months.

Advantages of investment in structured products:

- The product is selected individually under each, taking into account the permissible level of risk and the desired profitability. The average yield at 100% capital protection of 9-12% per annum if the cost of assets will grow. In case of falling, only the basic yield of 3-5% per year will be paid.

- No expertise is required - depending on the purpose of investing and profitability, specialists will recommend suitable products and will carry out all operations and control over them.

- The ability to make money in the currency.

Investments in structural objects have a number of shortcomings:

- Decent for many the amount of starting capital

- In case of early output, you can work in minus

- Low yield level at 90-100% protection. Those. If you wish to get a good profitability, the likelihood of loss of part of capital increases.

This method can be considered in order to distribute risks for beginner investors, and if reduce protection threshold - in order to obtain more profitability than in bank deposits.

- Investing in cryptocurrency with hedging - A great way to get a good profitability of almost without risks.

In this case, one of the profitable investment strategies described in the article applies:

It is purchased cryptocurrency by 50% of the allocated capital. This is your asset, in the event of a cryptocurrency rate, you will get a good profit.

The second half of money will start at the expense of the forex broker offering Kryptovaya trading

To protect yourself in case of a drop in the course, postponed orders for sale below the level you bought cryptocurrency.

If the currency rate begins to essentially fall, a sale transaction opens, which overlaps a loss against loss of coins.

The advantages of investing in cryptocurrency include:

- The possibility of obtaining profitability of 25-100% in 6-12 months.

- Hedge application reduces minimum risks

- When storing money on a broker account in dollars, you can win when the national currency rate falls

- High transfer speed in money - withdraw and get money available within 24 hours.

Disadvantages of this method of investment of money:

- It is necessary to allocate time and get minimal knowledge, how to buy cryptocurrency and place transactions from a broker. It will take 5-12 hours.

- Cryptocurrency is distinguished by volatility, so with a negative forecast you need to have patience to wait for temporary drawdown.

- Creating a business.

An attachment in a business is another way where to invest money without risk, if you know what business to invest.

conclusions

As you can see, almost all embedding options are focused more on the safety and protection of capital than to increase. In this regard, if you are less than 35-43 years old, I recommend, when drawing up an investment portfolio, it is not more than 30-45% of capital on risk-free investment. Because, the main purpose of investing is to increase money, so more aggressive ways of investing money can bring large dividends.

And what attachments do you think riskless? Share in the comments.

Bank deposit (or bank deposit) is the money transferred to the storage of a loan institution (bank) so that at the end of the term of the contribution to receive income in the form of interest.

Species and conditions of deposits set. There are urgent deposits and demand deposits. In the first case, the deposit is made for a certain period and can be removed completely without loss of percent only after this period. Demand deposits do not have a storage period and return to the first requirement of the depositor, but interest on them is significantly lower.

The contribution is clear and relatively reliable investment.

Open contribution is simple. To do this, it is not even necessary to leave the house: many banks allow you to open deposits through a mobile application or your site. Of course, for this, you first need to become a client of this bank.

The main advantage of the contribution as a type of investment of free funds is the insurance coverage of deposit insurance agency in the amount of 1.4 million rubles. Within this amount, you can confidently place your contribution to any bank, which has a license of the Central Bank of the Russian Federation. If the bank is bursting, the state will return the money together with percentages on the day of the license revocation. By the way, since 2014, more than 300 banks were devoid of licenses in Russia, and their depositors were definitely suffered.

The minus of the contribution is that compared with the individual investment account, it gives sufficiently modest possibilities for increasing funds.

Individual investment account

An individual investment account (IIS) is a view of a brokerage account or the invoice of the physical person's trust management, which is directly directly at a broker or a trust manager (for example, in a bank), according to which two types of tax breaks are provided for the choice and certain limitations are provided.

The concept of "individual investment account" was legally enshrined from January 1, 2015. IIS can open as individuals - citizens of Russia and people who are not citizens of the Russian Federation, but for more than six months in its territory.

The maximum amount that can be initially put on the IIS is 400,000 rubles. During the year, the score can be replenished with an amount not exceeding 1 million rubles.

The great advantage of the IIS is the ability to receive a tax deduction.

It is paid in the amount of 13% of the amount invested in the year, but not more than 52,000 rubles. That is, with 400,000 rubles, and from 1 million rubles you can return no more than this amount. This option suits you if you have a permanent job and the employer pays taxes for you. There is another option - choose exemption from taxation.

The main disadvantage of IIS is that he, in contrast to the contribution, is not insured by anyone. However, if you open it in a reliable bank (it has long been on the market, it is located in the top 20 rating of Russian banks, there is no sanation against it) and choose the right investment strategy, you can earn much more. In addition, to use tax deductions, the investment account must be opened at least three years, during which the means cannot be output.

How much can you earn on the deposit and iis

Compare how much you can earn, if you contribute to 100,000 rubles and open an individual investment account for the same amount.

The profitability of the contribution

The weighted average interest rate on deposits from one to three years in Russia for September 2017 amounted to 6.83% per annum. If you calculate the income based on this interest rate, then in a year it will be 106,830 rubles. Reinvesting this amount, in two years you will receive 114,126.5 rubles, and after three years - 121,921.3 rubles. Net income - 21 921.3 rubles.

Yield of jes

Strategy 1: Investments in government bonds

Opening IIS, you can invest in such a reliable tool as the bonds of a federal loan (OFS), whose Issuer is the Russian Federation represented by the Ministry of Finance of the Russian Federation. The yield to the repayment of OFZ-26205 at the end of November 2017 was about 7.3%. Taking into account the tax deduction in the amount of 13% yield from investments will be 20.3% in the first year. And for three years (the score opens for a period of at least three years), the average yield will be about 11.6%. As a result, in three years you can get 138,504 rubles. Net income - 38 504 rubles.

Strategy 2: Investments in Corporation Bonds

Another reliable and rather favorable strategy is investments in corporate bonds, the yield on which is slightly higher than on the bonds of OFZ.

For example, it may be bonds Gazprom Capital and Rosneft. The average yield on the portfolio of the bonds of these companies at the time of writing the material is 7.97%. If we put 100,000 rubles on IIS and, according to the results, get a tax deduction in one year, then after three years we get an average figure of 12.3% per annum. By the end of the third year, 141,020 rubles will be on the account. Net income - 41 020 rubles.

By the way, on individual issues of bonds of these issuers, a coupon income will not be taxed since 2018.

Strategy 3: Investments in stock

The largest income can bring investments in stocks. However, this is the most risky investment instrument, because even if the shares of any company for past periods showed growth, this does not mean that such a tendency will continue to continue. The experienced investors advise to invest in several types of shares, so that the fall in shares of one company could be compensated by an increase in the shares of another company. This is called a portfolio diversification.

The most proven attachment is the shares of "blue chips" - securities of the largest, liquid and reliable corporations. Among Russian companies, they include the shares of Gazprom, Sberbank, Alrosy and others.

If in early 2016, in equal shares invested 100,000 rubles in ordinary shares of the three largest Russian corporations - Gazprom, Sberbank and Lukoil, the average profitability of whose shares at the end of 2016 amounted to 43.93%, only for one Year you would earn 43,930 rubles. To this amount, add a tax deduction in the amount of 13,000 rubles. It turns out that only for the year you would earn 56 930 rubles. At the same time, growth in three years to predict is much more complicated.

Outcome

The contribution will suit more conservative and cautious people, probably older generation. Opening investment accounts - for more risky people. This is not just a fashion trend, but a good opportunity to earn.

Where to invest money to bring income?

This is the main question of business people in Russia. Especially acute began to rise within the framework of the economic crisis. Unstable economic situation in the country makes thinking.

Instability in the financial market pushed citizens to think where can I invest money in RussiaDue to the increased risks and the lack of understanding of what is happening.

Invest dangerously stored meaningless

Precious metals (on the example of gold)

Bonds and stocks remain only securities»A temporary influence. Gold is the most stable currency among precious metals. For several centuries, this precious metal only continues to increase growth rates.

State banks maintain the value of this direction by the goldenwriter. Investor invested accumulation in goldHe sleeps calmly, knowing that the price for it will only increase.

Some features are inherent in precious metals, we assume a person decided to invest in gold, went to the banking establishment for the purchase of a gold ingot, except for the value of the goods, an 18% tax imposed on the state of the state. When selling the ingot, there is no taxation, but the percentage of overpays will not return.

Investment in precious metals on the household level

Russians consider jewelry of gold and silver - an investment. In part, this is the case, but the work of the Wizard (Jeweler) is included in the price. The second negative point is sales. When trying to sell a jeweler lombards take it at a price of scrap, significantly different from the cost of goods.

The acquisition of precious metals is a very advantageous direction of investment, one should take into account the minimum yield threshold - 3 years. Middle income from gold + 20% per annum.

Securities (bonds, stocks)

Make a share of capital in bonds can afford people are not inclined to risks. Bond is a business emission, the tool is designed to receive a fixed income, after a certain period of time expires.

Big earnings on bonds should not be expected to be called their favorable investment - the language does not turn, but as cash making mechanism, It is worth considering.

Shares

One of the most profitable forms, where you can now put rubles, protrude Shares" Along with high yield, it is associated with increased risks, depending on external influences.

Promotion - share valuable paper that gives the Statute " co-owner of the company»Allows you to count on part of the organization's profit. The connection is simple, the company develops and flourishes, the package of securities is growing in price, the co-owner receives part of the profit, if the firm suffers losses, the owner also losses.

Work is conducted through brokers. More suggestions, allows you to independently choose shares, work out strategies, predict the behavior of indicators. Low threshold for entry, high probability rapid development, constantly attracts new faces in this industry.

TOP 7 Where is not worth investing

Main in investment - acquisition of financial literacy. Keep current projects under control, predict behavior on the market, catch the subtleties of the medium - these are the main components of the competent capital investor.

Financial Pillow An integral part of the Investor

Term " financial pillow"- 6-month finance reserve, for painless accommodation, without changes in the previous state of life. This condition should be respected without taking into account other sources of income.

- Want to know what you can save money now to afford more? If so, follow this link.

Engage investment activities Without a certain cash supply - unreasonable. The only exception is to contribute to the banking institution, which in most part acts as a tool for saving current savings.

In case of delay in translation, freezing of the project, risks associated with full or partial loss of allocated funds, the airbag must be. This is not advice, it is a postulate!

Alexey 32 years old Krasnodar

Time goes, and money is depreciated. I began to search where to invest. At first opened the bill and began to trade on Forex. It came to the conclusion that this is not mine.

And here I did not lose. You look at what my course is now! For a cryptic future, it is already in stores.

Review of real options where to invest small money. We destroy the myth that investments are only for the rich.

According to the results of the research agency WORLD WEALTH REPORT, rich people prefer to invest money in financial instruments, elite residential real estate and business. And how to do those who live only on a modest salary? Where to invest small amounts? In fact, there are enough options. Many successful investors began their way with small amounts, and then earned a solid state.

📌 In this article you will learn where you can invest money so that they work for you.

From this article you will learn:

5 investment rules that need newcomers

It makes no sense to invest a small amount of money, not knowing the basics of financial literacy. Here are 5 rules, following which you can not only save, but also to increase your capital. P.S. Unfortunately, it often happens that with inept investing a person does not only earn anything, but also his loses.

Rule 1. Risk diversification

Folk wisdom reads: "Do not put everything on one card." This means that it is impossible to invest money in one asset, for example, cryptocurrency. After all, in the case of an erroneous solution or change in the market situation, you can suffer huge losses.

Council. Invest money at least in 5 different assets.

Rule 2. Creation of financial pillows

Consider how much money you spend a month for basic needs: housing pay, food, household items. Multiply this figure by 3, and better by 6. The resulting amount of money is your financial airbag. They do not need to invest, it is better to just store at home.

Airbag will allow you not to worry about tomorrow. If you lose work, get sick or come up with the replenishment in the family, you can normally live on savings.

Council. If the accumulated amount is not enough to create a airbag, temporarily give up the investment plan. It is impossible to invest the latest money. Start each month to postpone 10-20% of the income amount.

Rule 3. Drawing up a financial plan

Before deciding where to invest a small amount of money, determine our financial goals. What do you want: keep savings from inflation, quickly led the starting capital to open a business or get rich in 10-15 years? Answers will help you understand where to invest better.

Suppose, for you in priority a decent life in pensions, and you are not ready to risk much money. Then investments financially will be distributed approximately like this:

- 40% - low-risk

With a yield of up to 8% per annum and payback period of 5-10 years. These are bank deposits, real estate, bonds. - 50% - medianly english

With a yield of 9-20% per annum and payback period from 3-5 years. Shares, ETF funds, mutual effects. - 10% - high-roof

With the yield above 20% per annum and payback period from 3-6 months. The group includes cryptocurrency, PAMM-accounts, forex, investment in their or someone else's business.

Rule 4. Market knowledge

Investing money should only be in those tools in which you are well versed. Non-novice investors are the easiest way to be inserted into the proposals of banks: it is enough to compare rates% on deposits and other conditions, explore the ratings. To successfully invest money in stock, you should understand the stock market and be able to analyze the financial statements of companies.

Rule 5. Cool approach

You can not invest money on a hot head. For example, give in to screaming advertising with a promise of 20-30% income per month. Or invest 100% savings in the purchase of bitcoins, hoping to rip the big kush. Or merge investments during the periods of economic recession. If you want to invest money successfully, stick to the selected strategy.

Where to invest small money for profit - 8 options

Below in the article will consider only those directions where you can invest up to 100 thousand rubles. You will make sure: it is not necessary to be a millionaire to invest money. But if you have more savings, then I advise you to read the article about. Even if you do not have such a sum, but you are on the way to this, I strongly advise the mentioned article on familiarization.

And what profit from investing you would like to get in perspective:

Option 1. Investigation in self-education

The win-win option is to invest money in yourself. Acquired useful knowledge and skills will help you get high-paying work or open a profitable business. What to invest?

To buy good literature (for example, read the following books: M. Harrison "Skilled Investor", J. K. Bogl "The leadership of a reasonable investor", A. Damodaran "Investment Evaluation");

- passage of professional courses;

- visiting trainings, seminars and webinars;

- study of foreign languages.

Of course, 100 thousand rubles. It is hardly possible to invest in high school. But this is not scary, because the "crust" does not guarantee employment. And knowledge gives no more than self-education. In confirmation, I want to advise you to see one video that can be an impetus to the beginning of self-education.

Option 2. Deposit (Contribution) in the Bank

Option 4. The property

Is it possible to invest small money in real estate and receive rental payments? A poor person has only two options to invest accumulations.

Installing

You can buy an apartment in installments by the developer or in the secondary market. In the first case, the initial contribution is usually 30-40%, so you are unlikely to be enough 100 thousand rubles. on investment. If you are considering the purchase of only new buildings, then it is first to think better, and try to edit the amount more.

When buying real estate in the secondary market, you can agree with an individual about any amounts and order of payment. But, as you understand, if a person quickly agrees to a small initial contribution and stretched deadlines, it means something wrong with the apartment. For example, there are encumbrances. Therefore, your risks if you wish to invest extremely high.

To pay by installments, you will have to have a stable income for 10-15 years. There are no guarantees of monthly receipt of rental payments. After all, apartments (especially in small towns and on the outskirts) can idle.

IMPORTANT. Investing money by buying an apartment in installments for rental is too risky for those who have small money.

Sublease

To receive a monthly income, you can rent a one-room apartment for a period of 5-6 months, providing for the right of sublease in the contract. And then rent housing for rent in overestimated prices. Does it make sense to invest money?

Calculate potential profits:

1) 15 thousand rubles. * 6 months \u003d 90 thousand rubles. - such a sum of money you will have to invest;

2) 1500 rub. - cost per day of residence;

3) 1500 rub. * 15 days \u003d 22.5 thousand rubles. - Profit for the month provided that the apartment is idle half the lease term;

4) 22.5 thousand rubles. * 6 months \u003d 135 thousand rubles. - Revenue for the year from the delivery of the apartment in the sublease.

5) 135 thousand rubles. - 90 thousand rubles. \u003d 45 thousand rubles.

As you can see, the yield is 50% for six months, which is quite good. But the risks are high, because the apartment can stand longer than half the lease term.

Council. To reduce the risk of standing, rent an apartment in the "hot" season near the tourist center or during the session of the Vochenniki near the University building.

What stock to invest money? A beginner investor is better to choose one of two options.

- "Blue chips"

"Blue chips" call shares of the largest companies that demonstrate steady growth over long years. Examples: Apple, IBM, Coca-Cola, Amazon, Gazprom, Sberbank and others. A lot of money from the invested amount you are unlikely to get, but reliably protect the savings from inflation. Yes, and profit will be higher than when opening a bank deposit. - New and promising industries

Now the companies from the following areas: IT, pharmaceuticals and biotechnologies, mobile service, mediation, online learning are developing. If you invest money in them, you can make a profit in dozens and even hundreds of% per annum.

Example. From 2016 to 2018 Shares of the following companies increased dramatically: Beigene (+ 558.3%, biotechnology), NVIDIA Corporation (+ 530.9%, high technologies), Sodastream (+ 530.2%, production soda), Weight Watchers (+ 453% , healthy nutrition services), Scientific Games (+ 438.6%, gambling business).

- Microfinance organizations (MFIs)

Offer to invest money under 15-25% per annum. However, they rarely hurry to return them. Work on the principle of financial pyramids: Partially pay money to the first investors at the expense of the inflow of funds from new customers. Most likely, the office will close before you take the contribution and interest. - Haip, Investment (Economic) Games

It is possible to invest money in a business idea (usually "blurred" and very ambitious) or a game character, and then make a profit monthly. But the chip is that for the real conclusion of money you will have or replenish a deposit on a larger amount, or to attract new participants to the project. Income if it is, then meager. Sooner or later, all the Haipes are collapsed. - Seminars and Training on Personal Growth

You can get similar information from books on popular psychology (for example, Dale Carnegie) is 5-10 times cheaper. Or from the articles of bloggers in general for free. Believe in our hand initially and do not pay a bunch of money for motivational stories about your "creative abilities" and "uniqueness."

Conclusion

Let's summarize where to invest small money. Bank deposits in rubles and currency are suitable for saving savings from inflation. Sources of passive income in the future will be online projects, securities, business. And rapidly increase capital will help transactions for forex and cryptocal exchanges, investments in PAMM accounts, delivery of real estate in Subares. In general, the best and worst tools does not happen. The main thing is to own the "golden" rules of investment and not to invest all the money into the only asset.

Last updated: & nbsp 18.02.2020

Reading time: 22 min. | Views: 15546.

Good afternoon, dear readers of the Financial magazine "Site"! Today we will talk about investing. We will tell you what it is and what types of investment exist, whereby it is better to start and where you can invest money.

From the article you will learn:

- What is investments and what is their benefit;

- What types of investments are the most common;

- What are the advantages and disadvantages of private investment;

- What steps to take to start investing;

- What ways to invest personal finances exist.

The article will be useful to everyone who is interested in investment. Useful information for yourself will find both newcomers in the field of investment and those who already have experience.

What is investment and what types of investment are where to start and how to make investments, much better invest your money - about it and not only you learn by reading the article to the end

1. What is investments with simple words and what they need 📈

Not everyone understands that there is absolutely everything in investing in the modern world. Essentially even education is special view of investmentSince this is a contribution to the future, because it is high-quality education to help find a good job with a worthy wage.

for example, the same principle acts in sports. Regularly engaged in, a person contributes to beauty and health. If he is a professional athlete, each training is investing in future victories.

Thus, investment displays the most important rule of human life. It says: It is impossible to get anything in the future if you do nothing for this in the present.

From here you can withdraw the main meaning of investment: They are mental, monetary, material investments, which in the future will lead to income through a short or long term.

Unfortunately, in Russia, as well as countries of the former USSR, the level of financial literacy is at a rather low level. The result is the absence of the right knowledge of the prospects for financial investments.

Most of the inhabitants of this region believe that only credit organizations, government agencies, as well as large companies can be engaged in investment activities.

It also offers an opinion that only very rich people can earn money among individuals. In fact, the investment can do absolutely everyone. For this, it is enough to have a desire, as well as theoretical and practical training.

First of all, it is worth learning concept of investment . It happened this word from Latin in-vestio. that translated means dress . It is not entirely clear how these two words are associated.

Investing in an economic sense has several definitions. We present the simplest to understanding.

Investment - This is an investment in various material, as well as intangible assets for their increase.

Investments are made in various fields of economics, as well as the social and intellectual life of people.

Investment objects, that is, property in which money is investing, may be:

- cash funds from different countries;

- various types of securities;

- real estate objects;

- equipment;

- intellectual property objects.

In the case of investing, investment is carried out once. After that, in the future, you can count on permanent profits.

Investments help overcome the main economic rule. It states that the one who keeps the cash of the house, their number is continuously reduced.

The fact is that the purchasing power of the available money is inevitably reduced. To this lead inflation, various economic crises, as well as devaluation.

Hence the most important the purpose of any investment which lies not only in conservation, but also in constant increase in capital.

2. What is the benefit of investment? 📑

Spend a minimum of time and effort to receive income is quite real. Similar option to earn money called. It is to such a way that all adequate people seek earnings. Especially it concerns businessmen, as well as manyimier, that is, people who receive income using the Internet.

One of the ways of passive earnings is investment in any profitable directions . In other words, successful investments allow us to expect that in the end it is possible to achieve the main goal of any sensible person, which is the minimum time spending on making funds.

It turns out that a person will have the opportunity to do what it is convenient for him. Ultimately, the successful investment will lead to the need to go to work every day and spend most of his time to ensure a worthy existence for himself and his family.

Instead of man himself will work his capital The investor will also have to receive regular and stable profits.

Many of these statements relate to quite skeptic. This is understandable, given that in our country, politics and economics are very unstable. But it makes sense to stop doubting, it is best to soberly assess the opening opportunities.

Important to remember that people unsure in their own power will never be able to get rid of lack of money, as well as from the heavy yard of the hired worker.

Many wonder why someone succeeds, and others can not get out of the debt pits. The case does not consist in existing talents, high performance, excellent. In fact, everything lies in the fact that some people know how to effectively dispose of themselves, and others - no.

Even those who have the same asses are the same, as a result can receive a completely different income. This is due to the fundamental difference in relation to material, as well as personal resources.

Thus, success can be achieved only if the assets are competent in the presence, in other words, to invest them.

Should be kept in mindThat said applies not only to cash and property, but also to mental abilities, energy, as well as time.

Competent and profitable investments are brought to life the following benefits:

- profit, independent of time costs;

- financial independence;

- free time for family, hobbies, travel and other things;

- a stable future in which you can be confident.

Competently intensifying the funds, it will be possible to forget about the need to spend a significant amount of time to ensure your needs. Do not count what to do absolutely nothing will have to, you will need to study , analyze , as well as to risk .

Nevertheless, sooner or later such efforts will give positive result. As it can be stable profit . First, most likely it will be only an additional income, but gradually be able to become basic .

In addition, in the investment process will necessarily be acquired by invaluable experience. He is sure to come in handy in the future, even if earning a significant money will not succeed. By the way, in one of the articles we wrote, without investments.

Classification of forms and types of investment

3. Main types of investment and their classification 📊

Investments are inhomogeneous. You can highlight a huge number of their types. At the same time, each of them has unique characteristics.

A variety of criteria, in accordance with which you can describe the investment leads to the existence of a large number of classifications. We will tell O. five Basic.

View 1. Depending on the investment object

One of the most important characteristics of the investment is the object in which funds are invested.

This feature is based as the following classification:

- Speculative investments It is implied to the acquisition of any asset (securities, foreign currency, precious metals) for subsequent implementation of their implementation after an increase in value.

- Financial investments - Investing of capital in different financial instruments. Most often, securities are used for this purpose, as well as mutual funds.

- Venture investment - Investments in promising, actively developing, often recently created companies. In this case, it is expected that in the future they will begin to bring huge profits. Read more about our magazine in a separate article.

- Real investment Supplement investment in various forms of real capital. It may be the acquisition of land plot, investment in the construction, purchase of a finished business, copyright, license.

View 2. For the term of investment

For investors, it has great importance to what period of their funds will be limited in the possibilities of use. In other words, the term is important, that is, the time for which the money will be invested.

Depending on this, the feature is allocated the following types of investment:

- short-term, the time of investment on which does not exceed the year;

- medium-term - investments for 1-5 years;

- long-term - Money will be invested more than 5 years.

In a separate group, you can also highlight annuity investment which can be made for any time period. At the same time, the profit from them arrives periodically.

The bright example is bank deposits with a monthly percent transfer to a separate account.

View 3. Depending on the ownership

If we consider as a criterion to classify a subject that invests funds, you can allocate:

- private investment - investments are carried out by an individual;

- overseas - funds are invested by foreign citizens and companies;

- public investment - The subject is the various government agencies.

There are situations when not all invested money belongs to one subject. In this case, talk about combined or mixed Investments.

for example The part of the nested money belongs to the state, the rest - a private investor.

View 4. Risk

One of the most important indicators of any investment is the level of risk. Traditionally, it is directly dependent on profitability. In other words, the higher the risk, the bigger profit will bring an investment instrument.

Depending on the level of risk, all investments are divided into three groups (arranged in ascending order of the degree of risks):

- conservative;

- moderate risk;

- aggressive investment.

Despite the fact that investors exist, who in pursuit of high profit agree that their investments are at high risk, the majority still avoid high-risk investments. This concerns as newbies, so I. experienced investors.

Solving the problem can be diversification which although it does not help completely eliminate the risk, but allows you to significantly reduce it. Under diversification, the distribution of capital between several types of investment is understood.

View 5. For investment purposes

Depending on the target, traditionally allocate the following types of investment:

- direct investments implies investment in the field of material production, the sale of goods and services, the investor usually receives a part of the authorized capital of the company, which is at least 10%;

- portfolio Investing funds in various securities (usually stocks and bonds), active investment management is not assumed;

- intellectual implies the investment by the management of funds in the training of employees, conducting various courses and trainings;

- non-financial investment - Money is invested in various projects (equipment, machines), as well as rights and licenses.

Thus, there are several investment classifications depending on the various criteria.

Due to the variety of species, each investor can choose the type of investment that is perfect for him.

4. Advantages and disadvantages of private investment 💡

Like any other economic process, private investments have their own pros and minuses . It is even important before the start of any investments carefully examine them. This will help further improve the efficiency of the process.

Pros ( +) private investment

The following benefits of private investment can be called:

- Investing is one of the types of passive earnings.This is the most important advantage of investments. It is for that passive income Most people are starting to invest. To obtain equivals in cash, the investor spends significantly less time and effort than the one who actively works as a hired employee.

- The investment process is very interesting, and also helps learn the new one.Cognition of investment activity is to increase financial literacy, acquire experience with various investment instruments. At the same time, traditional hired labor is different with monotony, in many ways that is why it becomes hated. In this regard, investments are significantly won.

- Investing allows you to diversify the income received.Traditionally, each person receives income from one source - wages from the employer or pension. Less likely to them add another one or two sources, for example, income from rental apartments. At the same time, investing allows you to distribute the capital between an unlimited number of assets, which will give the opportunity to receive income from various sources. Thanks to this approach, it is possible to increase the safety of a personal or family budget. It turns out that in the case of loss of income from one source, the means will continue to flow from others.

- Investing provides an opportunity to realize yourself, as well as achieve its goals.Practice proves that investors are most of all chances to achieve their goals, as well as become successful. This is due to the fact that investing allows you to achieve material well-being, as well as release a significant part of the time. This time can be spent on family, hobbies, self-realization. It is investors most often occupy the tops of the ratings of the richest people.

- Theoretically, the income received during the investment process is unlimited.Indeed, the size of active income is always limited to how much time and strength was spent. At the same time, there are no such restrictions with passive income. Moreover, if the income in the investment is not removed, but to re-invest, the profitability of investment will increase by the formula of complex interest.

Minuses ( -) private investment

Despite the significant number of advantages, investments have disadvantages.

Among them you can select the following:

- The main disadvantage of investment is the risk.Regardless of which investment tool is used, there is a possibility of full or partial loss of attached capital. Of course, if you invest in reliable assets, the risk will be minimal, but still he save .

- Investing is associated with nervous stress.This is especially true for newcomers. Often the value of the tool in which the funds were invested, is not moving in the direction where the investor would like. Naturally, it leads to the formation of a loss, even if temporary. In these situations, investors are exposed to serious psychological tension.

- For successful investment requires a large amount of knowledge.It will be necessary permanent learn and self-improvement. On the one hand, the acquisition of additional knowledge is a useful process and no one will be anyone. On the other hand, this will require a lot of time to spend. Moreover, iMPORTANT AVAILABILITY AND SAMPIPLINES that is not all. At the same time, in the absence of the necessary knowledge, private investment becomes like a wandering in the darkness.

- The investment process most often does not guarantee the receipt of permanent profits.Very few tools that give a guarantee of receipt of income. Much more often, investors have to focus on the forecast values, which, in case of changes in the market situation, it is not always possible to achieve. Moreover, sometimes private investments lead to education loss . In comparison with investments, various options for active earnings give more guarantees to obtain a permanent amount of income.

- To start investment, cash capital will need.At the same time, if from the resulting profit it is planned to live with adequate and maintain a family, the amount of investments will need quite significant. A significant amount of time and strength can be made to create such capital.

Thus comparing advantages and limitations investment, we can conclude that pros still outweigh cons .

Of course, it should be solved by the investment of capital, everyone should himself. However, we believe that it is better to invest.

First you can use small amounts and tools with minimal risk.

How to invest money for 5 steps - instructions for beginners (kettles)

5. How to invest money - Step-by-step investment guide for beginners 📝

Many novice investors are wondering as well as how to start investing effectively. That is why then we give the article step-by-step instructions. She will help anyone who wants to make the first steps in investing and thereby achieve its financial goals.

Of course, the initial situation for each investor is individual. Nevertheless, you can allocate general rules that need to follow, they are useful for all cases and every investor.

To start investment it is required to overcome eight Consecutive steps. To achieve success, you should not pass any of them.

Step 1. Assessment of the existing financial situation and bringing personal finance

First of all, you should describe your revenues . At the same time, it is necessary to determine the source of income, as far as they are regular and stable. In addition, their size should be fixed.

Further estimated costs They should be recorded by articles. At the same time, they necessarily mark the category of expenses, that is, whether they are obvious, regular or irregular.

The next point of financial plan - Description of available available asset . It can be car, flat, bank deposits, land and country sites, securities, shares in authorized capital etc. It is important to designate the cost of each of the assets, as well as the amount of profit from it.

After that, it is calculated profitability of each assetwhich is equal to the ratio of profit by them to the cost. Most likely, all or most of the assets will be uncomplicable or additional costs. At this stage, this situation is quite normal.

After the assets are described, it is also important to draw up a list. passives . These may be any obligations - loans, including mortgage, as well as other debts, eg, taxes and insurance contributions.

At this stage it is important to estimate the amount of expenses that are paid according to the relevant commitments. annually. It is also worth assessing a percentage of the ratio of the amount of expense to the total amount of obligations.

Now the budget should be assessed by calculating two coefficients:

- Investment resource - the difference between income and expenses;

- Pure capital - The difference between assets and liabilities.

Ideally, the value of the first indicator should be at least 10 -20 percentage of income amount. If the size of the investment resource has not achieved this value, or was less than zero, before starting investing will have to resort to the measures of financial rehabilitation of the budget.

During the preparation and analysis of the financial plan, you should be as honest as possible, it is impossible to try to embello on the current situation. Important in the budget describe everything exactly how is it really.

It is important to understand that it is the budget drawn up at this step is the basis The future financial plan, without which the qualitative plan will not be able to.

Thus, the result of the first step should be an understanding of where does the funds come from your budget, and also how they are spent .

In addition, it can be understood how many tools remains after making basic payments, and how much time will be able to exist if the receipts from the main source of income will cease.

Step 2. Creating a Financial Reserve

For use in the event of unforeseen situations, you should create financial reserve . It should be understood that he is important not only in practical Plan, but also in psychological. Such a reserve gives a very strong sense of confidence as well as stability.

Awareness that a person has a small supply of money in case of unforeseen life circumstances makes life psychologically much more comfortable.

As a result, the financial reserve is affordable, but at the same time a very effective way to make life more comfortable, and also significantly reduce the level of stress.

In practical terms, the financial reserve ensures the execution of two functions:

- Payment of regular expenses In the event that for any reason the main source of income will no longer replenish the budget;

- Financing small unforeseen spending - repair of household appliances, services of a doctor and other things.

The ideal amount of the financial reserve must ensure payment of permanent costs over the period of equal three months before six months .

Store the created reserve follows in the currency in which the main cost is paid. At the same time, it is best to invest money to the bank.

It follows such a credit institution that meets the following criteria:

- participation in ;

- the credit institution is not less than the fiftieth place in terms of assets or is a branch of a large international company;

- a convenient location, as well as the work schedule will allow you to use the banks of the bank without spending on this all day.

For accumulation, you should not choose card accounts, as in this case the temptation is greatly used to spend the means not as planned. Best open current or savings account. However, in this case, too low percentages on the balance on the account.

The ideal option can become deposit . But it should be noted that it corresponds to the following criteria:

- the minimum amount of replenishment must be comfortable for monthly accumulation;

- if necessary, you can remove some of the funds without losing interest;

- ideally, interest should be accrued and capitalized monthly.

It turns out that when choosing a bank, the interest rate should not act as a decisive condition. But it should be noted that it is neither the lowest nor the highest among existing on the market.

Once the bank and the contribution will be selected, you need to replenish the score to the amount of the calculated financial reserve.

Step 3. Development of goals as well as investment tasks

At this stage, it should be declared that the future investor wants to do in life, what to get what property to purchase. At the same time, for each purpose it is necessary to determine how much money will need money, in what currency. In addition, it is important to determine how the point should be achieved.

After the goals are defined, they should run That is, numbered, descending importance and priority. Thus, it becomes clear where funds should be directed first of all.

Step 4. Determining acceptable risk

The future investor at this stage determines what financial risk he agrees to withstandTo achieve the goals set. Also at this point is determined which situations in investment will be unacceptable.

In other words, some investors are calmly relate to the time drawdown of capital even 40%. Other on the contrary, feel absolutely uncomfortable even if the loss occurs within 10 %.

Step 5. Development of an investment strategy

At this point, it is important to determine for yourself the following points:

- the amount of the investment of the amount;

- investment frequency - once either regularly;

- the occurrence of which type of risks is unacceptable, and should be in advance formed;

- what part of the personal time the investor is ready to spend on to manage investments;

- the forbidden financial instruments are determined - someone fundamentally invests in the alcohol and tobacco industries, someone prefers to finance foreign companies and the like;

- resolved, in which types and types of assets will be invested;

- what taxes may arise how they can be minimized.

After the conditions designated above are determined, it is necessary to clearly register how investment solutions will be made. That is, it is necessary to decide which moments take into account, and which ignore. In addition, it is important to determine what actions should follow in the event of certain events.

It is equally important to determine how often and influenced by analyzing the current investment strategy, and under what circumstances should be revised and changed.

Step 6. Stress testing of the developed strategy

At this stage, testing developed in the previous step strategy on the principle "what if?" . To do this, ask yourself the maximum number of questions and how true you can answer them.

The beginning of the questions should be as follows: what It will happen with the investment goals set me. The second part of the question ( if a) Depends on the circumstances of the investor's life and for each individual.

Examples of the end of the issues can be:

- if I lose work;

- if I get seriously ill;

- if the machine breaks.

The result of such testing should be the development of a protective investment strategy. Its main task is to determine the possibilities that will not give up the implementation of the investment strategy even with an unfavorable coating of circumstances.

Many difficulties can not only be designated in advance, but also insure against their occurrence.

Step 7. Choosing an attachment method

At this point it will be necessary to determine:

- through which company will be investing;

- how will the cash will be made;

- how to remove earned profit;

- whose benefit and in what amount will require payments (commissions and taxes).

Step 8. Formation of the investment portfolio

Only after all previous stages of preparation for investment will be overcome, you can start forming investment portfolio . In other words, only at this point you can go directly to the cash investment.

At this step, you will need to do the following:

- select certain tools that will comply with the developed investment strategy;

- invest money in selected assets.

Many will say that the given instructions are too complicated, it is not necessary to overcome such a large number of steps. In fact, only the sequential execution of all eight stages can lead an investor to the next result:

- Will be able to understand the personal financial situation;

- A financial reserve will be formed, which will help to keep afloat for six months;

- There will be a sense of confidence in the future, as well as insuredness from surprises and minor troubles;

- A concrete action plan will be developed, which will increase their own funds;

- A competently structured financial portfolio appears.

Those who will manage to overcome these uneasy, at first glance, steps can be expected to be confidently positive result from investment.

Verified methods much better invest money to work

6. Where to invest money - Top 9 best ways to invest personal finance 💰

There is a huge amount of investment tools. Choosing an ideal direction for yourself, you should proceed not only from your own preferences regarding the level risk and profitability . It is also important to agree on the way investing with the economic situation in the country.

We offer you the most popular and reliable options for cash investment.

Method 1. Bank deposits

- One of the most affordable, and therefore the most popular investment options. Theoretically, they can proceed 10 % per annum. However, today interest in most credit institutions are reduced, therefore, choosing a bank for investing, you need to hold careful analysis.

Bank deposits are conservative investment option. In addition to the fact that this is the most intuitive way, it is also the least risky.

Among the advantages of deposits, you can select the following:

- state insurance;

- the term of investments, as well as the profit and profit is known before the investment;

- availability;

- low risk level, that is, reliability.

Consider the most reliable banks, the rates in which the highest.

Method 2. Investing in precious metals

Investments in precious metals already during the origin of commodity and money relations could bring the income to their owners. As valuable metals are traditionally used gold, silver, platinum, as well as palladium.

There are several circumstances, thanks to which for many years the price of precious metals is preserved at a fairly high level:

- lack of corrosion influence;

- limited amount of metals in the world.

In the long term, the cost of precious metals is invariably increasing. At the same time, various economic crises, as well as other changes in the economy, practically do not affect the price of precious metals.

According to statistical data, only over the past decade in Russia, the value of gold (in rubles) has grown almost 6 times. At the same time, experts believe that there are no factors capable of turning this trend in the coming years.

Investment in precious metals can be in several ways:

- buying a gold ingot;

- acquisition of gold coins;

- opening of metallic accounts in the bank;

- acquisition of shares of gold mining companies.

The most reliable option is physical acquisition of metal . But it is worth considering that these are investments on long term. From such investments to get a tangible profit in the next five years it is unlikely to succeed.

Those who need rapid income is best to open metal bills . At the same time, physically gold or other precious metals are not bought. The bank opens an account on which funds are credited in terms of metal grams.

Profit can be obtained pretty quickly - the amount is regularly recalculated on the contribution of the new value of the metal.

Opening of metallic accounts - The safest way to invest in precious metals. This is especially true of banks in which contributions are insured.

METHOD 3. FUND INVESTMENT FUNDS

FUT INVESTMENT FUNDS OR FUNDS - This is a way of investing, which is essentially transferring funds to trust management.

Foundation United shareholders invest in various financial instruments. The resulting profits are distributed among the participants of the Foundation. But the founders of the FIF will not be in a loss - they also receive their percentage.

Features of the interaction of shareholders with managers are reflected in the contractual conditions. In mandatory, the shareholder should carefully examine such an agreement yet before how to invest in the foundation.

The scheme of the shared fund is very simple. Shareholders buy parts of the Foundation, which are called pai. . The invested cash is available at the disposal of the manager who are engaged in their investment.

Governors are interested in obtaining as much profit as possible, as they themselves receive income in the form of commissions that are calculated as a percentage of profits.

PAIs can be quite simple buy and sell. Therefore, such investments relate to highly liquid.

Among the advantages of the mutages can be allocated:

- management of means is carried out by professionals;

- FIves are available to everyone;

- income is not taxed;

- funds are controlled by the state.

At the end of a certain period, the profitability of the foundation is calculated. The resulting income is distributed between the shareholders in proportion to the share of each of them in the Foundation.

Often the profitability of the pee is approaching to 50 percent. It is almost five times more profitable than bank deposits. On average, the profitability of the foundation is about 30 %.

Method 4. Investments in securities

One of the most popular investment methods - investments in securities. But do not forget that work with this tool requires serious knowledge in the field of finance and economics.

For those who hope for long-term profits, to invest in the first shares in the first shares are far from the best option.

To investment in securities brings real profit, you need to have serious knowledge in the field of economics or have experience. If there are no such knowledge and skills, you can transfer capital to trust management of a pilot broker.

When investing in securities it is impossible to ensure profit. However, if investments are successful, you can get a tangible income. He can reach 100 %.

Moreover, profit from investments in securities is practically not limited. Some successful investors managed to get order 1000 % In just a few years.

📣 Please note that the output to the financial market occurs through a broker. One of the best is this brokerage company.

Method 5. Investing in real estate

Real estate is also a very popular option for investing. This is explained simply - the demand for apartments, houses and even non-residential premises will be always . People need property for life, as well as business. In addition, such a tool will never fully depreciate.

By deciding to invest in real estate, it should be remembered that its value, as well as liquidity, is determined by a large number of factors. These include, eg , Economic situation in the state and regional position.

There are two ways to receive income from real estate investment:

- Rental;

- Subsequent resale.

Rent Perfect one of the types of passive earnings. The cash owner of the premises receives, practically without spending time and strength. To obtain income in this case, enough property rights.

Sale The object of real estate can bring the income if its value will increase. However, today there are difficulties with profitable real estate sales. In most Russian regions, the demand for this asset today is much less than the offer.

Nevertheless, in some cases, investors manage to earn a good profit on selling real estate.

About possible ways to invest in real estate, see the video below:

There are several ways to increase the income:

- acquisition of an object at the time of falling prices in the market and selling only after their growth;

- buy real estate at the stage of bookmark the foundation or at the initial stages of the construction, and the sale after readiness;

- acquisition of apartments in a deplorable state, high-quality repair, sale with a surcharge to the cost, which, among other things, pays for repair costs.

To date, the market situation has developed in such a way that experts recommend refrain from investment in real estate. They believe that the most reasonable to wait for a substantial economic downturn.

In detail about, as well as the pros and cons of this method of investing money, we have previously told in our article.

Method 6. Investing in business

Theoretically, it is the investment in business that are one of the highest bars. In essence, the opening of a successful company is able to provide a hazardous future not only to the owner itself, but also his descendants.

In practice, business success is determined by a large number of circumstances. Among them can be allocated:

- the niche in the market is chosen correctly;

- professionalism of the entrepreneur;

- how original is the idea;

- literacy of the actions.

According to statistical data, most firms become bankrupt already at the initial stage. Therefore, it is much better to open your own business, buying a franchise. About us, we have already told in the previous material.

You can also invest funds in a finished company. In a separate article, we wrote about, and also put startups in Russia where you can invest your money.

Method 7. Investments in startups

- These are unique innovative projects in the social or commercial sphere. In the future, they laid a fairly high level of profitability.

In other words, if you correctly choose a project for investing funds, you can get good profits.

But it is worth considering that only about 20 % similar projects bring real investors profit. The rest are found unprofitable Or require additional infusion of funds.

Today to invest in various startups is not so difficult. On the Internet there are a huge number of sites on which start-up owners present their projects, attracting investors.

At the first stage, you can make minimal investments that make up several thousand rubles. This will allow to explore the investment mechanism.

Advantages of startups It is possible to invest a huge number of business areas. Geography is also practically limitless - can be invested in metropolitan, european projects, as well as those that are in the investor's presence region, and even located only on the Internet.

Method 8. Investing in Internet projects

The Internet today is one of the most popular and very actively developing areas of business. Specialists working here are called maimmakers .

A huge number of online businessmen already earn money on the Internet. At the same time, every day there are more and more. You can find on our website.

Investors who dream of becoming online businessmen should hurry. It is necessary to take a niche for activity before others will occupy.

For earnings on the Internet can be used:

- the shops;

- groups on social networks;

- informational resources;

- blogs;

- entertainment sites.

At the same time not necessarily. You can also buy a ready-made project created by someone. It is important that the resource is as attended as possible. In this case, it will be possible to make a profit from advertising, affiliate programs, as well as direct sales.

If it is decided to create your own project, you should consider that a non-standard approach is appreciated on the Internet. It is necessary to draw up your site as unique as possible. This will bring to him the maximum visitors.

Method 9. Forex

If you say simple words, Forex - This is the World Market, where free-forming prices are exchanged for various currencies.

In principle, get income in the foreign exchange market for everyone who will pay this time will spend strength and invest. It is also important to choose a reliable brokerage digging. Many successful traders work through of this broker.

You can trade yourself and transfer funds to control via PAMM accounts. Details about described in one of the past issues.

To make it easier to compare the above investment methods, we reduced them to the table:

| Type of investment | Optimal investment period | Benefits |

| Bank deposits | From 1 year | High reliability |

| Precious metals | Long-term - over 4 years | Stable growth in the value of precious metals |

| PIFES. | From 3 months | Means are managed by professionals |

| Securities | Any | Not limited |

| The property | Long-term - more than 3 years | High liquidity |

| Business | Long - a few years | High profits |

| Startap | From 6 months | A large number of projects for selection |

| Internet projects | Any | Active development |

| Forex | Any | Fast recoupment |

🔔 On our site there is also an article in which it describes in detail about - we recommend it to reading.

Poll: Where to invest money?