Where better to take a cash loan. The most trouble-free banks on loans. Requirements for the borrower

How to get a loan with a bad credit history if you refuse everywhere? Where urgently can be credited with cash on repaying other loans? In which bank without failure, you can take a loan for a small percentage?

Hello, friends! Eduard Stembol and Dmitry Shaposhnikov again welcome you.

Today we will talk about loans. Money (small and large amounts) may be needed at any time: everyone has their own circumstances.

In situations where to take money from friends there is no possibility, you have to take a loan in banks or companies involved in microloans.

We also consider many other questions - where to get a loan without a guarantor, how to take a loan over the Internet and how not to take extra loans to not fit into debts.

So, let's begin!

1. What is important to know about the current loan market and loans

How to get a loan at a minimum rate? Where to get a cash loan and non-cash? In the life of a person, situations often arise when money is needed urgently and in large quantities.

In such cases, a loan is not the only way to solve the problem with finance quickly and efficiently.

The only thing to remember when taking a loan is about the need to return a loan.

There are many ways to obtain a loan: each of them has pros and cons. You can take a loan in a bank, in a microfinance organization, in Lombard - further in the article every option will be considered in all details. The main thing is to approach the case soberly and reasonably assess our own financial potential as a borrower.

Before taking into debt, experts advise to take into account several important points and respond to a number of topical issues:

- Think, do you really need this loan so much? Are you ready to increase the financial burden? If you buy an expensive thing with the help of a loan taken, decide - really this thing you need?

- Decide with the loan amount. It is especially good to think if you decide to take a mortgage calculated for several years (and sometimes even decades).

- Turn on the mind and drop emotions: In cash, only a sober calculation should be guided.

- If you take a loan in a bank, take care of all documentsthat will help you get money in debt with a minimum interest rate.

- Decide in advance for the purpose of loan: Banks often offer targeted loans (for a wedding, training, buying a car and apartment). Find out what bank you are more willing the car loans, and in what it is more profitable to make a mortgage. Many banks offer consumer loans for urgent needs - on such loans from you will not require a report, what goals do you intend to spend finance.

- Decide, in which bank to take a loan. If you already have a salary account or discovered in any bank, its employees will more readily consider the issue of the loan. In this case, the interest rate will be more satisfied, and information certificates and other documents are not required in some cases, since the information is already on your account.

- Each solid bank in its office or on the site places important information for customers - carefully read all points of the Borrower's Memo: This will help you competently make a loan.

- Be sure to find out in the bank, how can I pay a loan. It is important that this method is most convenient for you. Sometimes delay in payments arise due to the inconvenience of debt repayment.

Observation of life

If the Bank's employee with whom you advise about the loan registration, responds to your questions evasively, reluctantly or often finds it difficult to answer, do not hurry to draw up a contract - for sure you will find some "pitfalls" after its conclusion.

However, banking services are not the only way to solve their financial difficulties. Below we will look at other ways to take money urgently, without guarantor and references.

2. Bad and good loans - what's the difference

Some people relate to any loans negatively. But it is not entirely true.

It is important to know that the loan loan is mink. The fact is that not many know that there are good and bad debts.

Let's explain what the difference is.

for example

You took a car loan, took advantage of the car loan (at the same time your car can make money to you and take them away).

Then you have 2 versions of the car:

- For fun. You rice friends (girls), travel to travel. At the same time, for insurance, gasoline and maintenance you pay in any case. But these expenses are added to your credit payments. That is, your car is an eater for you or differently - passive. In this case, your loan is bad.

- For work. You are professionally engaged in private wrapping, work in a taxi. Then a month, suppose you earn with the help of a car of 45,000 rubles, and give 15,000 rubles by car loans. Then your car is an asset, that is, the property that increases your income. In this case, your loan is good.

Conclusion: If you take a loan to earn more, that is, your profit will be higher than payments on the loan, it can be called good.

If you take money in order to improve the mood, "finally" and so on, then such loans are poor.

If you want to learn how to earn with good loans and effectively manage your personal finances, we recommend you play the game "cash flow".

On our site there is a popular article on this topic :. In this article, Alexander Berezhov, our colleague on the project Khitirbobur.com is divided by his experience in participating and holding this game.

3. How to get a loan without failure - 7 real ways

Get a loan without failure and urgently possible, you just need to know where to turn. We chose 7 real ways to obtain cash and non-cash loans.

Method 1. Microfinance organizations

Microcredits are a relatively new financial service. This is a cross between private and bank loans. Microfinance organizations are in debt more willingly than banks, and do not require a report from the Customer's goals and other items. The only negative is the small size of loans loans compared with banking.

Microloam - This is a loan in the amount of up to 50,000 rubles for a specific time. Under standard conditions, this is a month from the date of registration of the contract.

To take a loan, only a passport is needed (no guarantors are required) and a decent appearance. Micro-finance organizations are an option to get a loan to the unemployed or person without credit history.

Pluses of microloans:

- Fast decoration: The application is issued in 5-10 minutes, you will not have to spend time collecting certificates;

- The guarantor is not needed;

- You can make a deal in online mode at home;

- You can return debt within a month or earlier.

This is the most convenient option when money is needed right now. Microloans are an alternative way if you refused to the bank (due to the lack of necessary guarantees). Microfinance companies will help those who want to get a loan promptly and without numerous questions from the lender.

Most firms providing such services work both in the "ground" clauses of applications and through the worldwide network.

You simply register on the portal and receive money without collateral, guarantors, revenue documents, information about financial history and other "problems". On the resource you need to fill out the questionnaire, leave the phone number and go to your personal account.

After that, it remains only to choose the desired amount, the deadline for the return of debt, agree with the terms of the company and apply for a loan.

It follows only as much as you need: you should not give in to the persuasion of employees of a microfinance organization to take the amount greater than you wish (say 10 thousand instead of 8). The difference in several thousand, with delay, will grow into tangible interest payments.

If there is a QIWI-wallet, get a loan will be even easier: the money will be transferred to the account almost instantly after the application is issued.

True, the initial loan on the card without the provision of financial history will be small ( up to 5,000 rubles.), But the subsequent amounts will increase repeatedly. With early repayment of the loan, the size of the board will be minimal.

If working with the site will seem too difficult to you, you can take a passport loan in your home the microfinance company's office. The solution on your request is made literally in 5 minutes.

What does the interest rate on loans depend on? From two points - the amount and maturity of the debt you choose.

Microloans have disadvantages. The biggest minus - Accrued percentage. The bets in microcredit are usually higher than when making a bank loan.

Especially high overnight overpays will be if you for any reason are paying the payment time.

Example from life

Our friend took 20,000 rubles to a salary for a gift to the girl. A salary should have been listed literally in a week. However, a delay had happened to the translation, and then money urgently needed to other needs. As a result, a small draw in a few weeks cost him in almost 15 thousand overpayments.

Output

microcredits are a convenient way to take a day for urgent needs, but it is always necessary to pay on them on time.

Method 2. Private loans for receipt

Where to get a loan without credit history? How if they refused to the bank and in the microfinance organization (it happens)?

There are two options - take away from relatives (friends) or in an outsider private person.

The first way is not considered: let's say, relatives denied, and friends, as it came out, no cash at the moment. Consider the second option - to occupy a private person who is completely unfamiliar to you.

Ads of this type can be found at any stop or even at the door of their own entrance: "Money from a private person", "Let's in debt without guarantors."

Sounds pretty strange - how long did the face suddenly decide to give money to another strangers? Immediately pop up thoughts about free cheese. In reality, such an operation is quite safe and it is completely legal if it is executed properly.

A guarantee of returning funds on a private loan is legally competently decorated, and a sequence certified in the notary.

It looks like this document as follows:

We suggest you download the receipt form in receipt of money

If you think about, a borrower is exposed to more risk in this situation, and not the lender. Private investors always take into account the probability of non-return of debt, therefore, they take impressive interest for their services. Sometimes they are 2 times superior to banknotes on loans.

And one more minus: if for some reason the client does not pay within the amount of funds taken into debt, the investor can contact the collector firm that will have the right to deprive the borrower of collateral. Lenders may have others, even less pleasant ways to return money.

That is why this way to quickly take a loan should be practiced only when you totally sure that you will return the money for sure on time .

Pluses of the option obvious:

- Availability - many proposals that give the opportunity to choose the most profitable option;

- Operation: decided, issued a deal, took a loan;

- Transparency of registration. The minimum set of necessary documents and the understandable form of registration is a long-lasting.

Proposals from private traders can be found on the Internet. Many people who have big money, do not mind lending their finances to everyone.

Before issuing a contract, carefully examine its conditions, especially items written by the smallest font.

Method 3. Credit Card

Credit card (it is "credit card") - a bank payment card, which can be quickly issued almost in any bank. According to such a map, you can carry out payment transactions within the limit provided by the Bank.

Restrictions on the amount is established according to the solvency of the client, which is determined by bank employees.

The card can be used as a substitute for consumer loan or credit for urgent needs.

The main advantage of a credit card is the ability to use a loan without giving a report to the bank about its targeted use.

Another plus is a constant renewal of credit opportunities after paying off debt.

Also, most cards have a so-called interest-free loan repayment period. That is, if you replenish her balance in time until the initial, then the percentages are not accrued.

More useful information - in the article "".

Method 4. loan secured by property

There are loans without collateral and loans secured by property. For a non-tax loan, guarantors are needed and a large amount of official salary. The total revenues of your guarantors should allow paying loans if it is difficult to you.

On the security are issued, as a rule, larger loans. In the case of which the Bank has the right to remove and dispose at its own discretion by collateral.

As a collateral, you can use:

- The property;

- Personal car;

- Securities;

- Land;

- Another valuable property at the discretion of the Bank's staff and participants in the contract.

Lowable housing should be suitable for accommodation. If it is in equity property, the Bank requires the official consent of all the participants in the contract.

Throughout the period of loan payment borrower has no right dispose of (selling, giving) own property.

Remember that banks always reduce the real value of the collateral property ( sometimes up to 50%) - In this way, they insure themselves from the risks of untimely repayment of the loan, in the case of which it is profitable to sell property.

Method 5. Lombard - Fast Cash Lending

Most people have valuable things that can be handed over to the pawnshop, getting cash for them. These institutions willingly take jewels, gold and antiques, however, not always an assessment of such things adequate to their real value. If the thing is expensive to you as a family relic, take care of its timely redemption from the pawnshop.

If you have not succeeded in buying your property on time, it is departed to the ownership of the pawnshop - then the office referred to things at its discretion. Usually such things the organization sells the same fans of valuable things directly from its admission.

Some companies on the buying of valuable things are taken, along with jewels, modern mobile devices, expensive equipment in good condition, sometimes even cars. Such companies call themselves the pawnshops of digital technology.

In any case, any valuable thing, whether it is an expensive mobile phone, an LCD TV or a gold ring, can bring you money even without being sold.

What you need to consider when working with pawnshops:

- operations for the delivery of property in Lombard can be made only adults;

- necessarily the presence of a passport;

- for storage, the Commission is charged;

- the return of property is carried out after making (return) of the total amount of borrowed funds;

- unprocessed stones (single-finished products of diamonds) Lombards do not accept.

A significant minus pawnshop upon receipt of the loan is an assessment of your thing below the real value of things due to the specifics of the business.

Method 6. Credit Brokers

Credit broker is a kind of mediator between banks and borrowers. The broker selects optimal lending schemes, interacts with estimates and insurance companies, fully accompanies financial projects of its customers.

For their services, the broker, of course, takes a certain fee, measured as a percentage of credit transactions. Based on individual contracts with banks, brokers can offer their customers more attractive conditions.

Example from life

Our friend Andrey had the need to get a large amount of money in the bank. At the same time, he had to be present on a business issue in another city: he simply did not have time for the design of the transaction and collect the necessary documents.

Andrey decided to entrust his affairs to the reliable broker (consisting in the Broker Association) and was not mistaken: saved in time and at the same time he received a more profitable interest rate.

Method 7. To occupy from friends

Also, by the way, the option of obtaining a loan. If you respect the peace of mind of your friends and relatives, it is possible to issue a loan officially, assuring the notary.

Friends are unlikely to take interest on loans from you, but if it came about a solid amount and long-lasting return period, worth thank your creditors with a good gift.

And at the end wanted to show you a clearly comparative table of various credit options:

| № | Time spent | Cash costs (overpayment) | |

| 1 | Bank loan | 1-5 days to collect documents | 10-28% |

| 2 | Microloam | 5-30 minutes | 15-50% |

| 3 | Pawnshop | On the day of appeal | 5-10% commission |

| 4 | Credit brokers | From 1 day | by agreement |

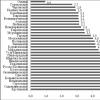

4. Where can I get a quick loan - Top 7 proven banks

We present a list of banks that offer adequate interest rates, work promptly and rarely refuse to customers.

1) Tinkoff Bank

Accelerated loan design up to 70,000 rubles. This microfinance organization works exclusively over the Internet. The client is enough to make an application by filling out several mandatory fields, and loans will be available for a period of 5 to 18 weeks. If during this time you will not have time to pay off debt, you have the right to extend the credit periods.

Early repayment of the loan is not rebored. For every day of use of the funds, the company is credited with 1.85%. The first loan is up to 10,000 rubles. If you have exercised a loan in a timely manner and completely, you will be available to larger amounts. For documents you will need only a passport. Funds are listed on the card instantly after the approval of the loan.

Example from life

Natalia (familiar to our acquaintances) is already a third loan in a row for the purchase of technological innovations. She needed the first loan to buy the newest model of a well-known company smartphone.

The second was spent on the purchase of a tablet of the same company. Now it's time to purchase a new laptop. Salary in the cosmetic salon is enough only to repay one of 3 loans. What to do with two others Natalia has not yet invented.

Why is this happening? Is it really difficult to master at least the basic concepts of financial planning? Psychologists argue that the reasons should be looking much deeper.

People who take loans for momentary needs subconsciously believe that they will not be able to make such purchases in the future - in other words, they do not believe in themselves.

6. Conclusion

Let's sum up, friends!

We told you about getting a loan, about types of loans, methods for their receipt and alternative versions. In conclusion, add that you should not be afraid of loans, of course, not, but also a frivolous attitude towards them is also dangerous.

List of banks in which you can take a loan with a small percentage in 2020: crediting conditions, requirements for the borrower, the necessary documents, as well as advice, what to do to get a minimum loan rate

What banks give a loan with a small percentage? We have made a list of banks in which you can take a consumer loan with a minimum interest rate! Loan rates in these banks are less than the average market or within the middle minimum. Banks from this list do not require guarantee or pledge, with the exception of mortgage loans (on the example of individual proposals from Sovcombank). Overview of the conditions under each bank will help you find the most profitable loan.

Also in the list for some banks there are credit card offers with an interest-free period.

Bank Home Credit is included in the "dozen" leaders in the issuance of loans to individuals and offers at the very lowest loan rate from 7.5% per annum. You can get up to 1 million rubles for 1-7 years in cash or transfer to the client's bank card (online without visiting the bank).

Of the important requirements of the bank, it is worth noting the age of the borrower - 22-70 years, the presence of a stationary phone and a permanent place of work with experience at least 3 months. But the bank's certificates do not require bank.

The same requirements for the borrower act on the credit card home loan freedom, the map is very popular. The limit on the map is up to 300 thousand rubles, the rate is from 17.9% per annum, the interest-free period is 51 days, there is also a installment time to 1 year to buy from partners.

Raffaisenbank proposes to issue a consumer loan up to 2 million rubles with a percentage rate from 14.9% from 8.99% to 13.99% per annum For up to 5 years. If you do not want to make a credit with insurance, then add another 4% per annum for the rate.

To get a loan, you should be from 25 to 64 years old, your work experience in the last place should be from six months, and s / n is at least 25 thousand rubles per month.

Raffaisenbank often choose borrowers with good credit history that are looking for low loan rates, and the Bank may offer such conditions.

You can also issue a credit card in this bank with a credit limit to 600 thousand rubles, an interest-free period of 110 days. The rate outside the grace period is from 19% per annum. The first 2 months cash withdrawal from cards for free Next, 3% + 300 rubles.

You can issue a card if you have 23 years old, your income is at least 15 thousand rubles per month (and in Moscow time and St. Petersburg - from 25 thousand rubles), work experience in the last place is from 3 months.

Sovcombank offers a loan under the lowest percentage - from 11.9% per annum, and for active users - 0% per annum (but you still pay a loan according to the schedule at your rate, just at the end of the period bank will return to you paid interest, plus it is impossible to refuse insurance). The maximum amount of such a loan is 1 million rubles. By the way, for conscientious borrowers, the bank offers a gradual decline in the rate, also the rate can be reduced by 5% for those who translate their salary or pension to Sovcombank.

Low bet warranty! If within 90 days you will receive a cheaper loan offer, you can refuse a loan in Sovcombank with a refund of paid money.

To get a loan with a small rate of 11.9%, it is necessary to provide a 2-NDF help certificate, work at the current job of at least 4 months, and your age must be at least 20 years.

For customers with age from 20 years or who need larger loan amounts, Sovcombank offers:

Renaissance Credit - Bank proposes to issue a loan to 700 thousand rubles for a period of 2 to 5 years with a percentage rate from 15% of 9.5% per annum.

Either, if you already have 24 years old and you have experience in the last place for more than 3 months, you can issue a free credit card with a credit limit of up to 200 thousand rubles at the Renaissance Bank until 200 thousand rubles for 24.9% per annum and surprising period 55 days.

For the removal of cash from the credit card, the commission is charged 2.9%.

Or you can make a cash loan in 5 minutes at 12% per annum, the amount is up to 2 million rubles for up to 5 years.

If you are from 21 to 76 years old, you work at least 12 months at the last place of work, you can make a cash loan under 16% 9% - 24.9% per annum in East Bank. The loan amount is from 25 thousand to 3 million rubles for a period of 1 to 5 years.

The bank also has a line of credit cards with a credit limit of up to 300 thousand rubles for 24% per annum and an interest-free period of up to 56 days.

Promsvyazbank refinance or issues a cash loan in rubles only under 9.9% per annum, subject to the connection of financial protection, otherwise 13.9% per annum, in the amount of up to 3 million rubles for up to 7 years. On the same conditions, restructuring (refinancing) of other bank loans is available.

From the second year, if you did not admit the rate will be reduced by 1%, and for three years. The rate can be 6.9% per annum.

To get such a loan, you will need a certificate of income and a copy of the workbook with a common experience of 1 year, your age must be at least 23 years old and you should not have an IP.

In OTP Bank, you can get a cash loan from 15 thousand to 4 million rubles for up to 5 years with a percentage rate - 21.9% 10.5-35.7%.

The loan requires a permanent source of income.

If you need an inexpensive cash loan from 50 thousand to 1.5 million rubles, pay attention to the Bank of Uralsib. The bank credits at a rate of 9.9% per annum when making insurance, a loan without insurance is issued from 15.9% per annum.

Mandatory requirements of the Bank: age from 23 years and experience at the current place of work from 3 months.

Also in Uralsibe with the same bets, you can take a loan to repay other loans (refinancing). The Bank refinances loans to 2 million rubles for up to 7 years. Requirements for the borrower are similar to those indicated above.

In the bank, the opening of the first year operates a fixed rate of 8.5% per annum, and then depends on your credit history: from 10.5% to 23.0% per annum with insurance or from 11.9% to 24.3% per annum - without it . You can take from 50 thousand to 5 million rubles for up to 5 years.

For current customers of the Bank, special conditions: the rate for the first year is 7.5% per annum.

To become a borrower of this bank, you should be at least 21 years old, work experience in the last place is at least 3 months with a general experience of at least 1 year, and s / n should be from 15 thousand rubles per month. There should be no IP yet.

You can get a decision in opening online in just 3 minutes.

In Skb-Bank, you can arrange a consumer loan to 1.3 million rubles with a percentage rate from 9.9% per annum for up to 5 years. To get a loan, you should be from 23 to 70 years old, have an experience in the last place of work from 1 year.

If you need a loan with a low rate for refinancing loans in other banks, In Skb-jar, you can take a special loan to 1.3 million rubles for 19.9% \u200b\u200bper annum.

Mail Bank offers a consumer loan in cash under 12.9% -23.9% per annum, and for pensioners and users of maps Post Bank the rate below - from 9.9% per annum. The bank is ready to issue an amount up to 1.5 million rubles for up to 5 years at the same time from documents requires only passport and SNILS. Pre-decision on the loan When sending an online mail application, the Bank promises to give in 1 minute. Money is listed on the bank mail card, you can remove them in an ATM or use it.

The Ural Bank for Reconstruction and Development (Ubrir) issues a loan to a bank card without commissions to those aged 21 to 75 years, the loan amount is up to 1.5 million rubles for a period of 3 to 7 years. The interest rate depends on the credit history of the client: the minimum 9.5% per annum, the maximum - 26% (however, if the borrower will regularly pay the loan, then during the year the rate is reduced to 15-17%) Compulsory conditions are the lack of overdue and certificate of income from the current official place of work (with experience from 3 months), while there is a general experience of being at least a year. With a loan amount of 50-200 thousand rubles just need a passport!

Also, Ubrir has a "120 days" credit card, the credit limit on it is up to 300 thousand rubles, the rate is 30.5% per annum, the period is 3 years, an interest-free period for buying and removing cash - up to 120 days. Getting such a map can face 25-55 years with good credit history and working at least six months in the last place of work.

Alfa Bank launched a new cash loan without commissions and guarantors from 50 thousand to 1 million rubles under 16.99-27.99% 7.7-24.42% per annum. The term of lending for such a proposal is from 1 year to 3 years. To obtain a loan, the 2-NDFL certificate will be required, the borrower's age should be at least 21 years, work experience in the current place is at least six months.

Alpha Bank also has a profitable offer - a credit card with an interest-free period of 100 days and a credit limit from 500 thousand to 1 million rubles under 11.99% per annum or higher. The interest-free period acts on the removal of cash to 50 thousand rubles per month, the commission for removing within this limit is not. The map is issued to persons from 18 years with an official job.

Card service is paid - from 590 to 5,490 rubles per year (depends on the size of the credit limit).

Or Cash Back credit card, only with a credit limit of up to 700 thousand rubles from a rate of 25.99% per annum, but 60-day interest-free period for purchases and cash withdrawals (but with a commission of 4.9%). The cost of service card is 3,990 rubles per year. The map is popular with motorists, as it has a cachek on a gas station of 10%.

If you earn a month less than 50 thousand rublesYou can contact the Russian Standard Bank for Cash Cash to 500 thousand rubles, while some categories of already existing bank customers can count up to 2 million rubles. The interest rate on the loan is from 11% to 27% per annum, But the minimum rate of the bank gives only some applicable customers, the average approved rate for new customers is 25% per annum.

The age of the borrower should be 21-65 years, the necessary documents besides the passport - one to choose from: passport, SNILS, W / y, pension certificate.

It is able to offer customers a consumer loan with a low interest rate - from 8.99% per annum, and its amount ranges from 50 thousand to 3 million rubles for a period of up to 5 years. Moreover, the maximum rate on this loan is limited to 18.99%. At the rate of 10.99%, it is possible to count on the amount of the loan from 1.5 million rubles and life insurance.

According to our statistics, this offer enjoys not bad demand among borrowers.

In the Loco-Bank, you can make a consumer loan without insurance at a rate of 14.9% per annum (with insurance - from 15.4%), the loan amount should be from 500 thousand to 5 million rubles. Credit can be issued for up to 7 years.

At the same time, the Bank may issue a loan at a reduced rate up to 9.4% per annum, for this it will be necessary to arrange insurance, to provide a pledge car and make monthly payments no later than 10 days before the planned payment date.

If you are not less than 21 years old (and for men - from 27 years old, if there is no military ticket), the Asia-Pacific Bank (ATB) can offer you a consumer loan from 5 thousand to 3 million rubles for up to 5 years. The loan rate depends on its sum: 30-100 thousand rubles - from 8.8% per annum, from 5 thousand to 1 million rubles - 19.9-23.8%, from 1 to 3 million rubles - 19.9%.

With small amounts, ATB issues passport money But the experience in the current place of work should be at least 1 month, and the borrower itself - with stable income.

The bank works only in the regions: Altai region, Republic of Altai, Amur region, Buryatia, Irkutsk region, Kamchatka region, Kemerovo region, Krasnoyarsk region, Magadan region, Primorsky Krai, Sakhalin region, Khabarovsk region, EAO, Khakassia, Transbaikal region, Chukotka JSC, Yakutia.

In MTS Bank you can get up to 5 million rubles for 5 years at the rate from 9.9% to 25.9% per annum. The online application is easy to send with the help of the account at the public services.

The minimum age of the client is 18 years old, but better more, the experience is from 3 months. From the documents you need a passport and a second document to choose from.

does not give loans to Crimea, Dagestan, Ingushetia, Kabardino-Balkaria, Karachay-Cherkessia, North Ossetia, Stavropol Territory and Chechnya.In MTS-Bank, customers also have a very popular credit card, it has a grace-period of 111 days and a large cachek in supermarkets, cinemas and gas stations - 5%! Card credit limit is 299,999 rubles. Card service for free, but for a fee of its manufacture - 299 rubles (filmed after the first purchase). There is no grace period for removal.

Requirements for the borrower are similar as a loan.

If you need a loan with a low rate without collateral and guarantors from 50 thousand to 3 million rubles, then we also recommend linking bank. Interest rate in this bank is from 9.9% to 15.5% per annum With insurance, without insurance - from 11.9%. Money can be taken for a period from 6 months to 7 years.

Get a loan can face from 21 years old at the current place of work from 4 months with a general experience - from 1 year. I need a certificate of income and a copy of the work or a certificate from the place of work, as well as a home or working phone.

Gazprombank also offers some of the lowest consumer loan rates: from 7.5% to 17.5% per annum With a sum from 50 thousand to 3 million rubles, a period of up to 7 years. At the same time, salary customers may arrange a loan under 9% per annum. The loan rate without insurance ranges from 15.5%, for salary customers - from 15%.

To get a loan in Gazprombank, a borrower should be at least 20 years old, have experience in last place from 6 months (a total experience of at least 1 year), lack of negative credit history. The bank requires a certificate of income and a copy of the workbook.

Have you heard about the bank "Let's go"? This bank is in many regions of Russia and is popular. Very popular loan "Hands with a bid!" At 100-200 thousand rubles for 11 months at 8% per annum (of course, the rate may be greater, it depends on your credit history).

You can also get a consumer loan "Wo'wo!": From 300 to 500 thousand rubles for up to 3 years under 19-19.8% per annum.

There is a loan for pensioners in the amount of from 30 to 299 thousand rubles for a period of up to 5 years under 19.8-33% per annum.

Receive such loans can face 22-75 years, which have worked at the current place for at least 3 months (or pensioners) and at least 1 year as a whole. From the documents, in addition to the passport, we need a second document (SNILS, INN, military ID, a passport), and with the amount of loan more than 200 thousand, no certificate of income (not needed pensioners).

Zenith Bank issues Credited under 9.9-21.9% per annum worth 50 thousand to 3 million rubles for up to 5 years. The minimum rate of 9.9% can receive salary customers of the bank, and for them a loan period is more - up to 7 years. The service rate for servicemen is 11.9-19.9% \u200b\u200bper annum.

To get a loan in the zenith, you should be not less than 25 and no more than 54 years (Other borrowers get a loan will be much more difficult to get a loan), the experience at the current job site (except for pensioners) is from 4 months, and the common one. Credit up to 100 thousand rubles can be taken only on the passport, in other cases, if you are not a salary client and not a pensioner, I need a certificate of income from s / n from 30 thousand rubles, a copy of the labor or employment contract / contract, document to choose from (SNILS, INN, V / U, passport).

It is important to add that the bank is loyal to the proceedings not more than 60 days, in the last 180 days, but should not be current overdue. In Zenith, you can take a loan, even if you have already 5 existing loans.

From 13.5% to 15% per annum without insurance - Such a bet offers ESB-Ai Bank (SBI Bank), this is one of the most profitable loans for today, since there are no additional fees and hidden payments. But the loan offer is valid only in 4 regions: Moscow, Moscow Oblast, St. Petersburg, Leningrad Region.

The loan amount ranges from 100 thousand to 5 million rubles, from 1 year to 5 years, the demand for the age of the borrower - from 21 to 65 years. It is also important that the borrower has experience at the current job place for at least 4 months, and from only 6 months.

The loan is issued on the Bank map (removal of free), which the courier can deliver. Therefore, you do not need to visit the bank office, the loan can be made online: from the application before receiving.

Conclusion

How to get a minimum loan rate?

In most cases, the demands of banks to potential borrowers are not always final (interest banks on credit depends on a number of factors: your credit history, income, including work experience and profession, marital status and much more), and this can also be changed. As a rule, banks offer the lowest interest rate on the loan to customers from 27 years having a positive credit history. The more documents the borrower will provide, the lower interest rates on loans. A preliminary online loan application also gives a decrease in the rate (on average 0.5%).

Also on the amount of interest rate on the loan affects the insurance of the borrower. Insurance is not mandatory, but its presence affects the bid: without insurance the rate is higher. However, it is necessary to pay for insurance, it is included in the amount of the loan. Calculate how it is more profitable (with or without insurance), you can only apply for a loan or using an online calculator on the bank's website, but the first option is more accurate, since the online calculator only gives a preliminary calculation.

If you want to send a request to several banks to choose the cheapest loan, send applications immediately without stretching for several days. Many do not like borrowers who send applications, but do not take credit, and when the banks may not see them, since the information in credit history is not updated immediately.

If you have unpaid fines, receipts for housing and communal services with delay and other outstanding obligations, before sending the application to pay off all debts, as they also affect the decision of the bank! And we do not recommend having more than one credit card at the time of applying for a regular loan.

You can take a loan in Moscow in a large bank with a multi-year story or in a small institution. Money can be issued in cash or with enrollment on. In 2020, more profitable interest rates in the first case. For individuals, there is an opportunity to independently select the program, taking into account the requirements, amounts and deadlines.

Consumer loans to individuals

2020 rather quickly decide on approval or refusal to issue money. The most popular are ruble loans. They can be issued:

- on the day of appeal.

You can take a consumer loan in Moscow for any purpose, while raising the chances of approval easily by selecting insurance, providing a certificate in the form of the bank.

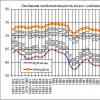

Consumer loan rates in Moscow

They are selected individually taking into account:

- personality applicant;

- jobs;

- credit history;

- the presence of payable loans in other banks.

Interest rates on consumer loans in Moscow can be reduced if you use. Large Moscow banks often go towards customers who previously issued credit cards. Interest rates depend on the duty repayment time. Basically, they range from 6 months to 5 years.

Ways of registration for credit: online or in the bank of Moscow

Most people prefer. It can be:

- fill out at any time of the day;

- send in several banks at several banks;

- choose the best offer among institutions.

In which bank is it better to take a consumer loan?

Cons. A loan in Moscow is quite simple with our site. You can easily choose if compare interest rates, timing and maximum limits. For convenience is provided. With it, it is not only possible to sort proposals for certain parameters, but also explore the most relevant offers. Credit for consumer needs in Moscow is easy to get after the online application on credit.

Banks always offer potential borrowers individual conditions, so we propose to submit applications at once in 2-3 banks. Thus, you will increase your chances of a profitable offer.

Minimum interest on cash loans.

| Bank | Percent | Request |

|---|---|---|

| from 7.5% | ||

| from 8.99% | ||

| for 1 hour | from 9.5% | |

| Without refusal | from 9.9% | |

| from 9.9% | ||

| from 12% | ||

| from 12% | ||

| from 14.9% | ||

| up to 7 years old | from 15.5% | |

| from 15.99% |

Take a loan of less than 10% per annum in East, Raiffeisen and Renaissance credit, the advantage of these banks will be what they are considering applications without providing help from work. Tinkov, Sovcombank also do not require confirmation of income, but their minimum plank - from 12% per annum. Get money under a relatively low percentage of 15% is quite real in Ubrir.

Best cash loans

Alpha Bank is the largest Russian private bank, is included in the top 10 of the most significant credit institutions.

Universal Bank, carrying out all major types of banking operations, serving private and corporate clients, investment banking business, commercial financing, etc.

Cash loan in the amount of up to 3,000,000 rubles is issued in Alfa-Bank with a percentage rate from 9.9% for a period of 1 to 5 years.

Consumer loan up to 1,000,000 rubles is issued at a rate of 14.99%, the first 100 days are not accrued interest for the use of money. Only a passport is needed.

Alpha Bank has a huge selection of credit and, options for mortgage lending and deposits, free services for savings, programs and loans secured by property.

The percentage of approval of applications is high.

Summary: Alpha Bank is a reliable bank holding leadership positions and offering various services on favorable terms.

Credit for a low percentage

Bank "Home Credit" - loans to 1,000,000 rubles from 7.9%!

Bank Home Credit is the leader in the market of consumer loans at sales points. For registration of online applications and obtaining a loan, only a passport is needed.

Wide range of products for customers of various social status. Permanent customers additional favorable conditions. Customer deposits are insured.

The bank actively participates in the social life of society.

Summary: Home Credit Bank ranks first in the consumer loan market, thanks to low interest, customer focus and modern services and services.

Credit loan

Renaissance Credit - up to 700,000 rubles under 11.3%

Bank with minor interest rates, where you can issue a consumer loan for two documents. It works in almost all major cities of Russia, issues cash on the day of circulation for up to 5 years, has a special program for pensioners.

Summary: Renaissance Credit is a bank with the lowest interest rates in which you can make a loan on two documents.

Cash Credits for Low Percentage

Raiffeisen Bank - a single rate of 10.99% per loan amount up to 2 million rubles

The bank in the work follows the highest standards of quality, so customers trust him and agree on long-term cooperation.

To make a loan to 300,000 rubles, only a passport is needed; up to 1,000,000 rubles - passport and income confirmation; up to 2,000,000 rubles - passport, income and employment confirmation. Term of use of 1 year to 5 years.

The online application decision is accepted in 2 minutes. You can get an approved credit in the department or with free courier delivery.

Summary: Raiffeisen Bank issues loans for large amounts at a reduced interest rate.

Low interest loans

Eastern Bank - Low interest and high chances

In our opinion, in the Eastern Bank, there are not the smallest bets, but here the maximum chances of approving the application even in borrowers with a bad credit history. In this bank, you can take a credit loan, without an income certificate and any additional documents. Applications are accepted online, and are considered within 5-10 minutes.

Summary: Bank "East" - not the smallest interest, but the maximum chances of approving the application.

The lowest percentage of the loan

SKB-Bank is simple and convenient lending.

SKB-Bank issues consumer loans to 300 thousand rubles without certificate of income, up to 1.3 million rubles in the presence of reference. Interest rate from 9.9%. Loan term from 1 to 5 years. The loan application is considered up to 2 working days. Perhaps early repayment without commissions and fines.

Comfortable, modern and free online bank and mobile application.

Instant money transfers between maps of any banks.

Summary: "SKB-Bank" - low interest on loans for any purpose; Universal online service.

Take a loan small

"Sovkom Bank" is included in the top 10 banks with the most profitable loans in 2018.

In the Sovkom Bank you can take a loan in the amount of 5 thousand to 1 million rubles for a period of 1 to 5 years. Interest rate - from 12% per annum. For a loan in the amount of up to 40 thousand rubles, only a passport is needed. The best offer is a loan of 100,000 rubles for 1 year at 12% per annum. You can place an online application in 2 minutes.

Special credit programs for pensioners operate. A large amount can be obtained secured by a car or real estate.

If there is a bad credit history, the Bank offers the program "Credit Doctor".

Summary: Sovkom Bank is a large financial organization with attractive conditions of consumer lending.

Take a consumer loan under the minimum percentage

Tinkoff Bank is a modern and practical bank with a full range of financial services.

Credit up to 2 million rubles for 1-3 years is issued without references, guarantors and visits to the bank. The interest rate on the loan from 12%.

All applications are issued online, the card will deliver a courier from 1 to 7 days to any place. Perhaps partial early repayment - at any time by phone. Free replenishment of 300,000 points in Russia. There are mortgage lending programs.

The first Russian bank, which completely refused the offices. Banking operations are instantly held by phone or via the Internet.

Summary: Tinkoff Bank is the best retail online bank with various credit and debit cards for any needs.

Credit Consumer Best Terms

"Mail Bank" is a new retail bank with branches in Russian Post Offices.

In the "Post Bank" you can make a loan to 1.5 million rubles for a period of 1 to 5 years. We need only a passport and SNILS. When payments from 10 000 rubles per month, the interest rate decreases from 12.9% to 10.9%. The decision on request is accepted in 1 minute.

Credit card Bank "Element 120" allows you to make purchases with payment within 120 days. Bank has special conditions on loans for education and.

Summary: "Mail Bank" is a universal retail bank with accessible loans for different purposes.

Credit bank banks

Rosbank is part of the Societe Generale group - a leading universal European bank.

The bank offers a loan "just money" without providing in the amount of 50,000 to 3,000,000 rubles with a percentage rate from 13.5% to 19.5% for a period of from 13 to 84 months. Passport and income certificate is needed if the amount exceeds 400,000 rubles, the Bank requests additional data. Credit limit can be increased upon presentation of additional income. More attractive conditions are offered for borrowers who receive wages at the Rosbank, employees of partner companies, pensioners, state employees, etc.

In "Rosbank" approves 8 out of 10 submitted loan applications.

Summary: Rosbank offers credit programs at rates above average.

Profitable credit

"OTP Bank" is a universal credit institution that is an incoming International Financial Group OTP (OTP Group).

In OTP Bank, you can make a loan in the amount of 15,000 to 4,000,000 rubles. Rates vary from 10.5% to 14.9%, are determined by the Bank, taking into account the level of client's risk. Loan term up to 7 years. The time consideration of the application is from 15 minutes to 1 working day. There is a paying service "Transfer of payment date".

Bank offices in 3700 settlements of the country. In addition to individuals, the Bank collaborates with representatives of small businesses and medium-sized businesses, develops credit solutions for corporate clients, a reliable partner for financial organizations.

Summary: OTP Bank exercises crediting corporate clients and individuals, the interest rate is determined individually.

Take a bank loan under the minimum percentage

"Ubrir" is the largest bank in Russia, offering quality service and ordinary financial decisions.

The bank offers three types of credit products:

● Credit "affordable" - up to 200,000 rubles with a percentage rate from 11% without references and guarantors only on the passport;

● Credit "Outdoor" - up to 1,500,000 rubles, the rate from 11%, you need a passport and income certificate;

● "120 days" - from 30,000 to 299,999 rubles for 3 years. Interest for the use of the loan is not charged the first 120 days, by expiration of the grace period, the rate of 28-31%. For registration, you need a passport and income certificate.

Commission for maintaining a card account and removal of funds. Early repayment - free.

Summary: "Ubrir" provides loans for different requests at affordable interest rates.

How to make a consumer loan under a low percentage?

Start with your "your" bank. If you get a salary on the map, please contact the bank that has released this card. You will probably have reduced interest rates and minimal package requirements. For example: Standard consumer loan in Alpha Bank 15.99%. And if you get a salary on the card, then the interest rate is reduced to 13.99%

To raise the chances of finding the most favorable conditions, consider several options. Apply in two or three places at the same time, find out your individual bid and select a bank that will offer the most favorable conditions.

Collect documents. Many banks issue cash loans without certificate of income, and sometimes just on a passport of a citizen of Russia. It is convenient, but if you are counting on low interest, try to confirm your financial position with some documents. Best is the help of a 2-ndfl form and a copy of the workbook.

Reasons for refusal and how to avoid them

If you have already decided, in which bank is better to take a cash loan from the proposed list, you must be prepared for a possible failure. There may be several reasons:

- A spoiled story on past loans. It is both completely paid debt, and not in time the paid payment. For example, for the bank's mail a critical moment is a draw from 5 days.

- Sometimes the age of the client may affect the fact that to take a small loan to young people until 21 years will be difficult. However, there are exceptions to the rules.

- Unreliable data, such as wages, fake references or documents.

- The appearance can also serve as a reason for refusal, especially in a state of alcohol or narcotic intoxication.

- During the decision-making, the Bank takes into account costs, and if there are already current loans, it is worth saying a bank employee.

- Returning to the theme of wages: it should be higher than a possible monthly payment twice. And this is a minimum.

- The bank will not approve a cash loan for a low percentage if the borrower does not even have temporary registration where the department of the financial organization is located.

- And you should not discount the fact that the bank without explanation may refuse to issue a profitable loan. Before it, the application will happen if the automated system missed it.

Place a cash loan for low interest easily.

Enough: enough:

- If there is no registration - make it. And remember: the longer its validity period, the greater the amount of the loan, and, accordingly, more organizations where it is more profitable to take a loan.

- If the salary is low, you can either find guarantors (wife-husband, brother sister, cohabitant cohabitant, and so on), or provide a deposit (apartment, car).

- If you have already made a choice, in which bank is cash on credit, but you have existing loans, they. Some organizations according to the documents provided pay debts, and the person receives the balance of the approved amount. Others provide independently close contracts in other banking institutions. And in the case of the provision of documents within one or three months, credit rates can be reduced.

Problems with BKA and several solution options.

The first problem that may interfere with the person beneficial interest rates on loans - the complete lack of credit history. It happens most often with young people. The financial organization carries large risks, so get profitable loans even with high wages it is unlikely to succeed.

Exit - registration of a pair of small or commodity and repayment without overdue loans. Another option is to issue a credit card, payments on which are also taken into account in the Bureau of Credit Stories (BKI).

Bad credit history is the second problem. Credit under a low cash percentage not to get. And it is spoiled, it can be both the fault of the borrower and the fault of the bank. Solutions of the problem - several:

- Banking rates on loans if the plastic card is executed, above, but this is an output. Due to the so-called grace period, it is possible, for example, to remove several tens of thousands of rubles from the card, and in 2-3 days before the end of this period, put them back.

- Before looking for banks that give consumer loans with a low interest rate, read the contract if you have already issued loans. There must be a bureau of credit stories, where your payments will be recorded. It is advisable to contact in advance to request a report that will come in format.pdf. Moreover, 2 times in 1 year it can be asked for free.

It happens that due to the fault of the bank, the Bureau is replenished with not true information. And here there is already a problem not in which bank is better to take a loan, but how to fix the story, especially if you are not sure that there were no such dedication. Excellent if checks are preserved, but they will be needed only in case of problems with the bank.

Steps are not difficult: on the site of the BKA, a statement is given with the indication of personal data (FULL NAME, Passport), and the description of the situation with the financial organization (when the loan was taken, the contract number was whether the delay was (if yes - the number, duration), what errors were allowed ). After 30 days, the Bureau should deal with the current situation, send an answer.

It is worth emphasizing two main positions. First, ask your story. Secondly, do not give in to the persuasion of fraudsters, which for a certain amount they will be able to fix it. This is not true.

Correct history can be a bureau only if the borrower writes the application. And only in the case of really admitted actual errors. But the dialogue will already be carried out exclusively between the Bureau and the Organization issued by the loan and the accuracy of the borrower.

With bad ki, contact MFIs. If you approved in several microfinance organizations - select with the best conditions. Banks when they see a lot of loans in different MFIs, regard it as the presence of financial problems.

In which bank is it better to get cash with a bad story? Please note, for example, on Sovcombank and his program "Credit doctor". It allows you to take the amount for a short time only in order for a positive story to the Bureau. There are such programs from other financial organizations.

- Having studied in which bank what percentage of the loan, read the reviews about it. Sometimes there are advice in the comments that will help to make a loan profitable.

- If the bank where it is profitable to take a loan, salary, then it is better to first submit an application to it. As a rule, such organizations reduce the package of documents up to one passport.

- If you, answering the question whereby more profitable to take a loan, chose a bank with an open deposit in it - give up it. The situation is changing so quickly that a trustworthy bank today can already lose a license. Thus, the payment of the deposit and insurance will not be implemented until the debt is repaid.

- Solving the question, in which bank to take a loan, go to the site, examine all the conditions, even written in small font, and consider possible payments to the minimum and maximum proposed rates.

- Before deciding where it is better to take a loan, in which financial organization, fully calculate all possible situations: loss of work, loss of ability to work, and similar. Unpleasant when the bank goes to the meeting, especially with a retained credit history, and the borrower cannot pay the loan.

Take a loan, where more profitable conditions, rates, interest is the normal desire of any person. We hope that the information you read will help do it with the smallest loss of time.

A list of banks in which you really take a loan without references, guarantors and collateral: the most loyal banks for receiving a consumer loan and a credit card.

If all banks refuse a loan due to bad credit history, it may be easier to get a credit card. Banks are loyal to bad ki when issuing credit cards, but the amount of the limit will be low. Additionally helps in obtaining approval Opening a debit card or account.

- Interest rate - from 17.9% to 34.9% per annum, depending on the age of the client and its credit history. There is a chance to extend a bet to 0% by shares with a halva card;

- Age - from 20 to 80 years.

Credit card Tinkoff Bank:

- The amount is up to 300,000 rubles;

- The rate is from 24.9% from 12% per annum with an interest-free period of 55 days and by installments up to 1 year. 120 days without percent, if the card is repayed by other loans.

Credit Cash Tinkoff:

- The amount is up to 1,000,000 rubles;

- Rate - from 14.9% from 12% to 28.9% per annum;

- Term - from 3 months to 3 years.

- Loan amount - up to 500,000 rubles;

- Rate - from 9.5% per annum;

- Term - up to 5 years;

- Age - from 25 to 70 years;

- Revenue from 8,000 rubles per month, permanent job.

In the Renaissance Bank, the loan can also be issued a credit card:

- The amount is from 3,000 to 300,000 rubles;

- Interest rate - from 19.9% \u200b\u200bper annum, for cash withdrawals - 45.9%, an interest-free period of 55 days;

- Commission for cash withdrawal - 2.9% + 290 rubles;

- Age - from 24 years;

- Card service - free.

Only if you are not an individual entrepreneur and you have no overdue more than 90 days:

- Loan amount - up to 3,000,000 rubles;

- Interest rate - from 13.9% of 9.9% per annum;

- Requires certificate of income, age from 23 years, s / n from 40,000 rubles.

- Loan amount - from 5,000 to 700,000 rubles;

- Interest rate - from 8.8% to 41% per annum;

- Credit period - up to 5 years;

- Age - from 21 to 70 years;

- Work experience last place from 1 month.

- Loan amount - up to 500,000 rubles (without refusal);

- Interest rate - from 9% per annum;

- Credit period - up to 5 years;

- Age - from 21 to 75 years;

- The experience in the last place of work from 3 months, for persons under 26 years old - from 1 year.

Eastern also proposes to issue a credit card of 0% per annum by 56 days with a credit limit to 120,000 rubles. But in fact, the Bank will approve no more than 15,000 rubles, if before you were delay.

- Loan amount - up to 1,000,000 rubles;

- Interest rate - from 7.9% per annum;

- The age of the borrower is 22-69 years;

- Credit term - up to 7 years.

In the home loan it is easier to get a loan to 100,000 rubles, but you must have official place of work And the overall experience of at least one year should not be a great overwhelming.

Another bank home loan (CCF Bank) issues a credit card with an interest-free period of 51 days and by installments up to 1 year:

- Credit limit - up to 300,000 rubles;

- Interest rate - from 17.9% per annum;

- The age of the borrower is 23-64;

- The cost of the card is 499 rubles per month, but is charged only in the months of its use.

For a credit card, a passport of the Russian Federation is enough.

- Loan amount - from 50,000 to 300,000 rubles;

- Interest rate - from 15.5% to 25% per annum;

- Credit period - up to 7 years;

- The age of the borrower is from 21 to 75 years.

It is important that the bank issues a loan only on a passport and immediately, but you should not have an open overdue in other banks and overdue for more than 30 days in the past! Also, your experience in the last place of work should be from 3 months, the overall work experience is from 12 months.

If you need a credit card without a certificate of income, then Ubrir makes cards with a surprising period of 120 days, which acts on the withdrawal of cash and purchases.

- Loan amount - from 30,000 to 300,000 rubles;

- The interest rate after the end of the interest-free period is 30.5% per annum, the fee for the removal of 5%;

- Age - from 19 to 70 years;

- Service fee is 1,500 rubles per year.

- Loan amount - from 50,000 to 1,300,000 rubles;

- Interest rate - from 9.9% to 25.5% per annum;

- Credit period - from 3 to 5 years;

- The age of the borrower is 23-70 years;

- The minimum experience in the last place of work is 3 months;

- For persons under the age of 27 - a military ticket.

Take a loan without references and guarantors can be even without official work, but it is not possible to do this in every bank. There are banks that relate to such clients more loyally than others, but for such an opportunity, you have to pay increased interest rates.

To obtain a loan or card in the presented banks, you need to have a passport of a citizen of the Russian Federation, and your age should be at least 21 years. In most cases, the certificate of income (2-NDFL) is not needed, but you can fill out a certificate of income in the form of a bank, it has a positive effect on approval and lowers the bet. This method often uses customers who work unofficially.

Even with bad ki, you can get a loan!

Credit history is the main condition for issuing a loan, but the decision of the Bank also affects:

- Unpaid alimony;

- The presence of claims regarding you;

- Unpaid fines;

- A large number of administrative offenses, including traffic police fines;

- The presence of criminal record;

- LCD debts;

- Your income (Help 2-NDFL - "last century", incomes are checked through the FIU. Very good, if you have a workbook or contract. Also suit an extract from the account of the wage listing);

- Reliability of information in a loan application! The slightest lies can deprive you of the opportunity to get a loan not only now, but also in the future.

The bank can give you a loan if you even had a delay, but you should not have problems at the above points. Otherwise, the maximum that you can count on is the refinancing of your loans or a credit history improvement program. If you do not give credit banks, take a long-term loan in MFIs, rates on such loans are much lower than "before salary", and chances to get money in MFIs more than in the bank.

Banks that do not check credit history

It is a myth! Absolutely all banks check credit history, but there are nuances.

Part 3.1 of Article 5 of Federal Law No. 218-FZ dated December 30, 2004 "On Credit Stories" obliges each bank to cooperate at least with one credit history bureau (BKI) for the mutual exchange of information about borrowers. Before approving a loan, the bank is obliged to evaluate the borrower to the risk not to return the money.

At the same time, the bank it is not always possible to get full information About the loans of the borrower, as this information happens "Raskidan" at different bureaus. This means that the lender may not receive information not only about the delay, but also on loans paid, which positively characterize the client.

The bank may indicate on its official website, with what BKI he cooperates. But we do not recommend abuse, as banks are comprehensively assessing customers. You can get a loan with a bad credit history if you do not attempt to deceive the bank and clearly confirm your ability to return a loan on time.

If there are no problems with credit history

Credit card "100 days without%" with a limit of up to 500,000 rubles is now one of the most popular products. For customers with a zero credit history or with delay in the past, it is advisable to indicate in the application the amount of a limit of no more than 30,000 rublesIn the future, in the absence of overdue on the map, the limit can be increased. The map is suitable for refinancing other loans, the rate according to it is from 11.99% per annum. after an interest-free period. From the card you can shoot up to 50,000 rubles per month and also without percent for 100 days.

The map is issued to persons from 18 years. Map maintenance costs from 1,490 rubles per year.

If you need a large amount of cash, you can apply for a loan in cash to 1,000,000 rubles. The bet is the same as on the map - from 8.8% per annum. But for a loan tougher requirements: age from 21 years and experience is current work for at least 6 months.

The loan rate in the bank discovery begins from 10.5% per annum with insurance, from 12.9% - without. But the first year bet is one for all: 8.5% per annum. You can take up to 5,000,000 rubles for 5 years.

Requirements for the borrower: age from 21 years old, work experience - from 3 months, common - from year to year, there should be no IP.

Even in the opening there is a credit card with an interest-free period of 55 days, further 19.9% \u200b\u200bper annum. The limit on the card reaches 500,000 rubles. There is a cachek 2-6%, and the card itself is free, issued to persons from 21 years.

In Raffaisenbank, you can easily get a loan to 2,000,000 rubles at the rate from 8.99% to 13.99% per annum For a period of 1-5 years. But such an opportunity is, if you are not less than 25 years old, you earn from 25,000 rubles per month at work, where we work at least 6 months.

Important service: Without certificates in Raffaisenbank, you can get up to 300 thousand rubles.

Raffaisenbank still has a credit card of 110 days without interest with which you can withdraw cash without commission for up to 2 months. The limit on the map is 600 thousand rubles. The cost of service is free of charge when spending from 8,000 rubles per month, otherwise 150 rubles per month.

Bank requirements for receiving a map: age from 23 years, work from 6 months with an income from 15,000 rubles (for MSC and St. Petersburg - from 25,000).

MTS is not just a mobile network, but also a bank. MTS Bank issues up to 5,000,000 rubles for 5 years, but it is customers with a flawless credit history. The easiest way to get a loan to 50 thousand rubles and at least. The rate is from 9.9% to 25.9% per annum.

Requirements for the borrower: age from 27 years, employment, in addition to the passport, it is necessary to reduce, in / y or passport.

MTS Bank has an exclusive offer: a credit card with a nutritional payment. You pay 30 rubles a day for the use of the loan, pay off your loan to the 20th day of the next month. If you do not have time to pay off, the bid will be only 10% per annum. After repayment of money (30 rubles per day) are not removed.

The limit on the map is 150,000 rubles, there may be faces from 27 years.

Rosbank offers loans with rates from 8.99% to 15.99% per annum. You can take up to 3,000,000 rubles for 7 years. The rate of 8.99% applies to loans from 1,500,000 rubles with insurance, in other cases the rate will be more.

To become a borrower in this bank, you need to be older than 20 years and earn at least 15,000 rubles per month.

To make a loan in SBI Bank you must live in Moscow or MO, St. Petersburg or Lo. In other regions, the offer is still not available.

Differences of the loan in SBI, this is a low rate from 13.5% to 15% per annum despite the fact that insurance is not needed. You can take from 100 thousand to 3,000,000 rubles for 1-5 years. The age of the borrower should be from 21 to 65 years, there must be a permanent place of work at least 4 months.

Bank loyal to the proceedings, if they were no more than a month. Neither guarantors, no collateral, nor commissions - the bank does not require anything. The loan is issued without a visit to the bank.

But to confirm income to take a loan, you may need. You can do this not only a certificate of income, commemorate from an account from another bank: Sberbank, VTB, Gazprombank, Rosselkhozbank, Alfa-Bank, opening, ICD, Promsvyazbank, Unicreditbank, Raiffeisenbank.

Warning of responsibility

Banks are accrued interest for the use of a loan in the amount established by the loan agreement, but within 365% per annum. You have the right to repay the loan ahead of schedule without charging commissions.

When an overpire of a monthly payment in a contract established by the contract, the Bank charges a penalty in the amount of up to 0.05% per day (up to 20% per annum) on the amount of overdue debt. A lender may be charged a lump-sum penalty for the delay in payment.

The delay leads to an increase in debt, long-lasting delay negatively affect your credit history.

The rules for accrual interest and penalties are applied in accordance with Federal Law No. 151-FZ of July 2, 2010.

How to get a bank loan without failure?

The following information can help you get a bank loan without failure. You will learn how to fill out the application and whom banks never refuse loans.

Immediately warned if you have current delay in other loans, then to take a loan in most banks is quite problematic. This is especially true for loans with delay over 30 days. And it is unreal if the delay is more than 90 days. In this case, you can count only on credit secured by cars or real estate. Either take microloans in MFIs.

There are banks that are loyal to others relate to small proceedings up to 30 days, especially if they are already repaid. The list of loan loans is presented above.

Also note that with a bad credit history, really get a credit card than a loan. The amount on the map will be small, it can be an interest-free period and the ability to improve ki, and this is a chance to get a loan in the future.

Lifehak

Increase the chances of obtaining credit approval or map, if in a bank in which you are going to borrow money, pre-open an account or debit card. You need to use a card or account: get money on them or replenish yourself, make purchases. You need to use no less than a month. High chances that the bank will offer you a loan or credit card.

Perfect borrower

Who banks never refuse loans? Portrait of an ideal borrower.

There are no long debts for housing and communal services.

No debts by alimony. Banks and not only they do not like "aliments".

Your passport must be valid and not wanted.

You do not have the status of an individual entrepreneur (IP).

Very often banks refuse to customers with IP. In this case, you need to look for banks that give loans from IP or lending to special programs for business development.

You have a permanent job.

Banks do not issue loans to unemployed, there must be at least income without employment on the employment record (in this case, it will be necessary to provide the Bank with a certificate of income in the form of a bank, an agreement with the organization, with which you work, an account from the account / card on regular money receipts). If nothing is it, then only mortgage loans or microloans are possible.

You can provide at least 2 phone numbers: one - yours, the second is an employer (or at least a relative, friend).

You have no more than 4 active loans.

In this case, you need to refinance loans: combine them into one. When refinancing, the bank can issue additional money for any needs. For example, you have 4 loans for a total amount of 500,000 rubles, you are submitted for a loan of 600,000 rubles, of which 500,000 will go to refinancing, and 100,000 are your money. As a result, you have money and only one loan, and with a smaller rate.

The total amount of monthly payments on the current and requested loan should not be more than half of the monthly income.

If less, then you may need a deposit or guarantor, otherwise reduce the amount of the loan.

You have no debts in front of MFIs.

At the time of submitting an application for a loan in a bank, all microloans should be closed.

You were not bankrupt.

If you have passed the procedure of bankruptcy, then the loan without collateral and the guarantors will not give you.

Without convictions.

It is impossible to have a criminal record, especially according to articles related to fraud in the financial sector.

You have no more than 2 children.

A large number of children especially at low income can cause refusal.

The best age to obtain a loan approval of 23-65 years. Even if in the conditions of the minimum age of 18 years, the most desirable borrowers are faces from 23 years (persons younger to get a loan is possible, but you need more references and stable income). In some banks, the minimum threshold may be greater.

You should not look for bailiffs. Or at least, the sum of your debts on the basis of the FSSP should not be more than 10 thousand rubles, and it does not depend on loans or fines, for example, traffic police.

There are no traffic police penalties and other administrative offenses.

A large number of offenses often becomes a credit failure. Pay fines and only then send the application.

What can not be indicated in the loan application?

- Passport details of an invalid (overdue) passport.

- Other people's passport details.

- Unreliable data on work and salary. Banks make a request no longer to the employer, but to the Pension Fund (FFR), where your data on income deductions are kept (therefore, banks know your real salary) and the place of your work, experience, etc.

- Phone number that is not registered on you. For this reason, MFIs often refuse, since SMS serves as a signature in the contract. But banks can pay attention to the identity of the phone number.

- Do not leave empty fields, even if the system allows you to.

- If in the form of the application there is a field to indicate the goal of a loan / loan, then do not write that you do not have money, "there is nothing", fired from work and the like. This is a refusal! In this case, write that you need money to salary.

Even with a non-ideal credit history of chances to get a loan more if you fill out an application honestly. Fale in the application - minus in credit history! There are more chances to get a loan or card in banks, whose client you have already had (have been translated / payments, received s / n, had or have a debit card, fully paid the loan). Exclude banks in which you were delay. In this material, banks are presented, which, in general, have a high percentage of approval.

Can. You can only fix credit history in one way - repay loans and take new! If you have delayed in the past, you can make a credit card and actively use it. Later, the bank will suggest to increase the limit on the map or offer a consumer loan.

Consider that the correction of credit history is a long process. To pump your ki will take at least a year.

Beware of fraudstersOffering delete or edit your credit history. It is impossible to do this, as it is stored in protected bases of various credit bureaus, which are controlled by the Bank of Russia.

Read also ...

- The work of "Alice in Wonderland" in a brief retelling

- That transformation. "Transformation. Attitude towards the hero from the sister

- Tragedy Shakespeare "King Lear": the plot and the history of the creation

- Gargantua and Pantagruel (Gargantua et Pantagruel) Francois Rabl Gargantua and Pantagruel Brief