What is financial literacy of the population. Problems of financial literacy of Russians

Financial literacy can be defined as the ability to make informed decisions and take effective action in areas related to financial management in order to achieve life goals and plans for the current and future periods.

Financial literacy includes the ability to keep track of all income and expenses, the ability to manage money resources, plan for the future, choose financial instruments, create savings to secure the future and be prepared for undesirable situations, including job loss.

Financial literacy is a complex area that involves understanding key financial concepts and using that information to make smart decisions that promote economic security and people's well-being. These include making spending and saving decisions, choosing the appropriate financial instruments, budgeting, saving money for future goals, such as getting an education or a secure life in adulthood.

Knowledge of key financial concepts and the ability to use them in practice enables a person to competently manage their money. That is, keep track of income and expenses, avoid excessive debt, plan a personal budget, create savings. As well as navigate the complex products offered by financial institutions and purchase them on the basis of a conscious choice. Finally, use savings and insurance instruments.

Being financially literate in today's world is important:

Financially literate people are more protected from financial risks and unforeseen situations. They are more responsible in managing personal finances, are able to increase the level of well-being by allocating existing financial resources and planning future expenses. Equally important, they can positively influence the national and global economy.

The world of finance today is more complex than ever. Understanding what checking and savings accounts are is just a small part of what you need to know to be financially literate. Opportunities for investing, saving, lending are huge, and it is difficult for a person who does not understand these issues to determine what he needs to pay attention to when using financial instruments, and how to find out which opportunities are the best choice for him personally.

People with “financial sound judgment” make decisions that help ensure their personal financial security and well-being, contribute to the economy, and contribute to the sustainable development of the global economic system.

It should be noted that its economic development largely depends on the general level of financial literacy of the country's population. The low level of such knowledge leads to negative consequences not only for consumers of financial services, but also for the state, the private sector and society as a whole. Therefore, the development and implementation of programs to improve the financial literacy of the population is an important area of public policy in many developed countries, such as the United States, Great Britain and Australia. A high level of financial awareness among residents contributes to social and economic stability in the country. The growth of financial literacy leads to a reduction in the risks of excessive personal debt of citizens on consumer loans, and a reduction in the risks of fraud by unscrupulous market participants.

In Russia, financial literacy is at a low level. Only a small part of citizens is oriented in the services and products offered by financial institutions.

According to the World Bank and subsequent monitoring by the National Financial Research Agency, 49% of Russians keep their savings at home, and 62% prefer not to use any financial services, considering them complicated and incomprehensible. 45% of the adult population of Russia are aware of the deposit insurance system, and half of this number have only heard this name, but cannot explain it. Only 25% of Russians use bank cards. At the same time, there is a low level of knowledge among credit card holders about the risks associated with this product. Only 11% of Russians have a savings strategy for the period of retirement age (compared to 63% in the UK).

As for consumer loans and payday loans, they are not large. Therefore, bank customers do not read the details of contracts too carefully, and at the slightest delay, the bank charges them large fines.

Most of our fellow citizens make decisions about managing their finances not on the basis of an analysis of the information received, but on the recommendations of acquaintances or interested employees of financial institutions. It should also be noted that in Russia there is a low awareness of the population about what rights a consumer of financial services has and how to protect them in case of violations. For example, over 60% of families are not aware of the obligation of banks to disclose information on the effective interest rate on a loan, only 11% are aware of the lack of state protection in case of loss of personal funds in investment funds. About 28% of the population does not recognize personal responsibility for their financial decisions, believing that the state should reimburse everything.

Such statistics show that it is necessary to increase the financial literacy of the population at the state level.

For the first time this problem in Russia was discussed in 2006 at a meeting of the G8 finance ministers in St. Petersburg, after which measures to develop financial literacy in the country were reflected in a number of documents of the President and the Government of the Russian Federation.

For example, in the Concept of long-term socio-economic development of the Russian Federation for the period up to 2020, improving financial literacy is designated as one of the main directions for the formation of an investment resource. In the Strategy for the Development of the Financial Market of the Russian Federation for the period up to 2020, it is considered as an important factor in the development of the financial market in Russia.

The Ministry of Finance of the Russian Federation, together with a number of federal executive authorities and with the participation of the World Bank, is developing a program to improve the financial literacy of the population. The program is designed for five years and at the first stage will be implemented in several Russian regions. It will include the preparation of specific training programs and products, the improvement of legislation in the field of financial services and consumer rights. Also, this project should, if possible, unite, ensure coordination of programs and initiatives in the field of financial literacy that are already being implemented and are being prepared for launch at different levels. The total cost is $110 million. The main part (80%) will be financed from the federal budget, the rest - at the expense of the World Bank.

Today, as before, the majority of Russians receive theoretical knowledge in the field of finance on their own, through specialized Internet sites, TV shows, literature, news, attending courses and trainings, and gain experience from their own mistakes.

The state program to improve the level of financial literacy of the population is designed for five years (2011-2015). It involves federal and regional executive authorities, public organizations, insurance companies, banks - all those involved in one way or another in improving financial literacy. "This or that measure" is equal to $113 million, of which $88 million was allocated from the budget of the Russian Federation. One of the mandatory conditions is co-financing - funds for the implementation of the program are allocated not only from the federal, but also from the regional budgets.

Volgograd, Kaliningrad and Tver regions were selected as regional polygons.

In addition to the above, the International Public Organization "Guild of Financiers" and the non-profit partnership "Community of Financial Market Professionals" SAPFIR "with the support of the Ministry of Finance of Russia and the Expert Group on Financial Education under the Federal Financial Markets Service of Russia organize the All-Russian campaign "Financial Literacy Day in Educational Institutions" 7 and 8 September as part of the All-Russian professional holiday "Day of the financier".

If in some countries even prisoners are taught financial literacy, then in Russia they are just beginning to introduce such lessons in schools. In continuation of our conversation with Guzelia Imaeva, CEO of the NAFI think tank, we explored whether it is possible to teach Russians not to get bogged down in debt as successfully as many of us have learned to do the opposite.

How does Russia look at the world level in terms of financial literacy?

Russia among the G-20 countries ranks 9th. She is in the middle of the rankings in many respects. So we're not all bad. The leaders are Canada and France, while the laggards are the countries of Latin America.

Who needs financial literacy?

It is a big misconception when they say that financial literacy is for people who have surplus money that needs to be invested and multiplied. Increasing financial literacy, first of all, is necessary for an ordinary person. This is his way to improve the quality of life.

As practice shows, even people with a low level of income, with a competent attitude to money and financial instruments, have the opportunity to get out of the current life situation and improve their standard of living in the future.

This is beneficial for people, it is beneficial for the financial market, where the people's consumer, domestic long-term investor comes, and for the state as a whole. This gives a global effect.

How relevant is the increase in financial literacy among Russians? Read in our conversation with Andrey Bokarev, curator of the project of the Ministry of Finance to improve financial literacy

How can one study such a multidimensional concept as financial literacy?

It was a difficult task to clearly understand, interpret and operationalize the concept of financial literacy in order to measure it. We have come a long way, and together with our colleagues from international development institutions, nevertheless, we have come to a consensus on what financial literacy is and how it can be measured.

Today we are studying three groups of indicators. The first is the level of knowledge about financial services and concepts. For example, understanding what inflation is, that money has its value over time, understanding the essence of diversification (this is about not putting all your eggs in one basket), a person’s ability to do financial arithmetic.

The second group of indicators is aimed at understanding how a person uses his knowledge in practice. Does the family budget plan, if so, how does it work with income and expenses, does it form a “safety cushion”, if yes, then these are only savings or other decisions. Here we are talking about behavior.

And the third group of indicators is the attitudes of a person, his value block, which is formed by generations, each of which had its own unique experience. For example, does he have an orientation towards long-term planning of his life formed in the family. It largely depends on how a person behaves. If he understands that there are life cycles, then today he will take care of what will happen in 20 years.

Anna Zelentsova, strategic coordinator of the project of the Ministry of Finance to improve the financial literacy of the population, believes that in financial education, Russians “harness for a long time, but they will quickly go”

Is there an understanding of how knowledge, attitudes and human behavior are interconnected?

We have serious developments on this issue, but there is still no complete picture inscribed in the real life context, and research work in this direction is still required. But we can definitely talk about the serious influence of attitudes on financial behavior and a person’s willingness to learn new knowledge. Almost all countries that implement financial literacy programs, including Russia, consider children and youth as the main target audience for which efforts are directed. Most educational programs are being introduced into the system of preschool and school education. The right attitude to finance should be formed from an early age.

To what extent are financial programs in demand by people?

The peculiarity of our country lies in the fact that people, for the most part, are passive, and they develop their financial practices mainly through forced loyalty. For example, in 2004 we had OSAGO. Before that, no one knew about insurance, about general civil liability, but when it was introduced as mandatory, people began to understand what insurance is and think that it is convenient to insure something. Since 2010, salary cards have been distributed to everyone. Employers began to teach them to optimize their costs. The consumer, perhaps, did not really need it, but then everyone got used to it and began to actively use plastic cards. If you look at our history, we have always pushed the consumer, integrating him into new realities. As a rule, there was no request "from below".

The Russians took 9th place according to the results of measuring the level of financial literacy among the residents of the G20 countries

But what about entrepreneurs? Isn't there a request for training from them or from other active groups of the population?

All economic dictionaries say that entrepreneurship is associated with risks. But our research shows that domestic entrepreneurs are ready to receive a small income, but stable. Like the rest of the population, they are paternalistic and do not even think about the opportunities that financial markets or educational programs give them. Despite the fact that the level of their financial literacy for their kind of activity is low. But how to motivate them so that they themselves want to learn? is a question that has yet to be answered.

Do I understand correctly that the future of the financial sector lies in the formation of a request for its development “from below”?

You know, today there are many educational projects and the big challenge facing those who implement these programs is how to motivate a person to start mastering them. Often, everything around finance is perceived by people as boring and complicated. Therefore, elements of gamification, involvement, and interactivity should be integrated into educational programs. This is a field for development, which requires the joint efforts of specialists from the field of behavioral economics, sociology, and psychology.

Interviewed by Evgeny Khan

Guzelia Imaeva

General Director of the NAFI Analytical Center

Education: Department of Sociology, Russian State Social University, Moscow International Higher School of Business MIRBIS. Presidential program for the training of managerial personnel. Specialization: "Marketing: strategic stability of an enterprise in a competitive market." Advancia-Negocia Business School (Chamber de commerc et d'Industrie de Paris (CCIP)). ANO "Institute of Financial Planning", advanced training program "Methodology of personal financial consulting".

Member of the Expert Council on Financial Literacy of the Bank of Russia, the Russian Society of Sociologists (ROS), the Expert Council of the Deposit Insurance Agency (DIA).

Member of the Board of the Service Quality Monitoring Association (AMCO), ESOMAR (European Society for Opinion and Marketing Research, Marketing Guild).

Author of more than 20 scientific publications, dozens of articles in the field of financial behavior of the population and business, Hirsch index - 5 (RSCI data). Co-author of the books “100 facts about the financial behavior of Russians”, “Encyclopedia of the financial behavior of Russians”, “Financial Inclusion in Russia: The Demand-Side Perspective”, “Children and Finance”.

Winner of the IX All-Russian competition of business women "Success", 2013.

Financial literacy tutor.

Financially literate people are people who have a sufficient level of knowledge and skills in the field of managing money. It allows you to give correct assessments of the situation and make appropriate decisions. Consider the basics of financial literacy of the population in this article.

Financial literacy of the population: problems and prospects

Financial literacy includes the ability of citizens to manage their own. They are aware of the responsibility for the decisions they make. Such knowledge can be mastered without much difficulty. Basic information on the topic "fundamentals of financial literacy" is available in the specialized literature. Lectures and seminars are held. How to take the first steps, as well as what is the importance of financial literacy, we will consider further.

Decree of the Government of the Russian Federation of September 25, 2017 No. 2039-r On the approval of the Strategy for improving financial literacy in the Russian Federation for 2017-2023

The appearance of this government document aims to consider that the relevance of the development of financial literacy among the population takes place. This is especially important internationally. The factors that serve as the basis for the emergence of the strategy are:

- the possibility of crises;

- complication of financial products;

- discrepancy between the knowledge of the population and the dynamics of the market;

- ensuring universal access to information.

The Order sets out the state of the level of financial literacy and sets the goals of the strategy. It also indicates directions for the implementation of tasks.

The impact of financial literacy on the level of material well-being

An increase in the level of financial literacy of the population is facilitated by familiarity with the basic monetary concepts, skills in applying them in life. Criteria for assessing financial literacy suggest that a person who properly manages his funds:

- does not allow large debts;

- plans;

- makes savings.

Financial literacy refers to the ability of people to navigate financial products, no matter how complex they may be. They consciously acquire them. Citizens with skills and theoretical knowledge can correctly apply insurance and accumulation tools. The government promotes the level of financial literacy of the population.

Informing the public about financial literacy issues and ways to protect the rights of consumers of financial services

Most residents of the Russian Federation manage money according to recommendations, and not by analyzing the available information. Financial literacy training is also required in terms of consumer rights when using monetary products. Many do not know how to protect them, they need assistance to improve the level of financial literacy of the population.

So families should be informed by banks about effective rates on loans. And also about the availability of protection from the state in case of loss of money in investment funds. At the same time, about 30% of the population believes that the state will compensate for the losses incurred due to the lack of their personal responsibility. All these aspects require improving the financial literacy of the population.

The work of the financial literacy program

Financial literacy of the population and its level is reflected in the economy of the state. The lack of this sphere entails negative consequences for society. Why financial literacy is needed, shows a decrease in the risks of non-payment of loans, the number of cases of fraud, dishonesty.

Methodological support for improving financial literacy

There are websites on the Internet designed to improve the financial literacy of the population.

- Finagram answers a lot of questions on economics. The Banking Association of the Russian Federation also formed Fingram TV, where they teach money literacy from scratch.

- The Visa payment system has created the ABC of Finance project for the population of the Russian Federation.

- Banki.ru is the largest resource of the Russian Federation in the field of the banking system. There is a section "Banking Glossary" with an explanation of terms and recommendations.

- Methodological materials on financial literacy are also available on the City of Finance portal, formed under the federal program.

Cooperation with financial institutions

The relationship with the banking system in practice also implements the basics of financial literacy. Such organizations are very interested in clients who serve themselves, and also recommend it to their friends. Under such circumstances, they are partners with people making savings.

Priority target populations

It is believed that the financial literacy of the population in the Russian Federation is low in terms of level. Not many people can navigate in money, services. Criteria for assessing financial literacy were derived on the basis of monitoring. The results show that not everyone understands the principles of deposit insurance and uses bank cards. Only 11% have clear ideas about how to secure their old age.

Government Decree No. 2039-r dated September 25, 2017 indicates the strategy for improving financial literacy. The target groups are:

- development potential of the Russian Federation;

- average income and below, risk group;

- retirement age and people who find it difficult to improve financial literacy for health reasons.

Financial Literacy Courses

The financial literacy of young people and persons of any other age can be improved in courses conducted in a paid and free form. Such events are organized at universities and through private initiatives, educational and methodological programs. The Internet provides a variety of resources on the topic: the basics of financial literacy:

- introduction to seminars;

- attending lectures online;

- training to acquire the necessary skills, teaching them;

- courses, video tutorials:

- other .

Classes on the Internet are often conducted in such a way that a person does not need to leave home. Almost everyone has the opportunity to master the basic rules of financial literacy.

Formation of financial literacy of schoolchildren in the course of studying Russian literature

Is it possible to obtain the required information in literary works? Most likely yes. Some books contain in their plots a description of the right habits in relation to money. As well as methods to increase financial ingenuity and experience in the successful disposal of funds.

Preparing citizens for life in old age

The federal program includes the development of strategies that will improve the financial literacy of people of retirement and pre-retirement age. Thus, in the Government Decree on the strategy, low awareness of the population about the protection of rights under social benefits was noted. Tasks include:

- formation of competent behavior in people;

- the importance of financial literacy - developing the ability of citizens to plan their funds;

- formation of mechanisms of interaction with the state.

The meaning and necessity of financial literacy for a modern person

A financially literate person is distinguished by the fact that he is not inclined to make rash decisions that can have a deplorable effect on well-being. He is usually in writing, for which he sometimes uses programs. The basics of economic literacy presuppose the obligatory presence of the ability for such control.

At the same time, the disposal of cash brings benefits, not losses.

It is possible not only to stabilize the level of one's well-being, but also to increase it. From this we can conclude: not so much those who have large earnings are called successful, but those who consciously spend. Such people usually make the right investments.

What financial literacy skills should everyone have?

You can indicate the following signs of the presence or absence of literacy in the management of their income.

- An illiterate person is capable of acquiring an unusable loan product, imposed on him spontaneously. Such people participate in the pyramids. A sign of literacy is to realize your capabilities and refrain from reckless scams.

- The illiterate do not get the effect of profit from their investments, they can make a mistake when choosing pension funds. At this time, it is more correct to find the necessary economic information.

- A person may not see his advantages in the market. But if you invest carefully, you will need a list of all the options that you should certainly explore.

The negative result is a decrease. But a competent person finds means to put them aside in case of unforeseen circumstances. Everyone needs to accumulate. For illiteracy will have a detrimental effect on the future life in the form of consequences.

Reading special literature on the basics and principles of financial literacy

You can acquire the knowledge of an economically literate person by reading books containing the necessary information. For instance, "How to be always with money" P. Bagryantseva contains a number of practical tips that are not discussed in ordinary educational institutions. The author shares his personal experience of his financial achievements.

It will not be difficult to choose a teaching method from the many offered. The main rules of financial literacy, as well as various subtleties in relation to money, can be comprehended in the following sources.

- Works on economics.

- E-books about the secrets of financial psychology and similar topics.

Sources of books on acquiring financial literacy for modern living standards - stores and the Internet. The most popular book by R. Kiyosaki contributes to learning "Rich dad, poor dad". It deals with the application of the concepts of assets and liabilities. The former bring money, rich people acquire it. The second only spends money.

Successful millionaires contribute to raising the level of financial awareness of people, for which they provide recommendations, advice, share experience in the form of exact numbers. Another popular book that raises the level of financial literacy is written by B. Schaeffer. Its name - "The Path to Financial Freedom". The content includes a description of undertakings in business, investments and monetary relationships, the rules for managing funds.

Attending seminars, courses and webinars to improve financial literacy

R. Kiyosaki's training "Rich Dad, Poor Dad" is recommended for all beginners to master economic and financial literacy. After reviewing this course, you can learn to look at money differently, as a wealthy person sees it. R. Kiyosaki's statement is that this literacy factor includes the following.

- Familiarity with the tax code at the level of understanding.

- Knowledge of accounting theory and practice.

- Elementary Compilation Skill.

- Acquired concept of what money is and how to manage it.

You can learn from R. Kiyosaki in just a few weeks. A successful student is able not only to increase the level of financial literacy, but also to improve the acquired skills in practice. Many practically rest with the help of economic games provided by the Internet.

Develop good financial habits

The basic rules of financial literacy are not limited to the fact that a person saves money from every earnings. It is also necessary:

- to master the basics of macro - and microeconomics;

- have an idea about credit institutions;

- be able to put in front of you, as well as fulfill them.

Such foundations of personal economic development are applicable as criteria for assessing financial literacy. The following methods will help you develop good habits.

- Control of personal funds, the use of auxiliary programs.

- Eliminate costs that don't make sense.

- Allocation of basic expenses (utility payments, food), organization of distribution of funds.

- Postponement 10%.

- Allocating part of your own for investment, increasing funds.

- Strategy for increasing financial literacy, improving skills.

- Acquaintance with changes in the legislation of the Russian Federation.

- Taking into account the provision of one's old age.

Relevance is the correct investment of funds. An example is the creation of a passive contribution that brings benefits, but is not related to the main activity. A feature is the formation of several sources to ensure it, which reduces the risk of monetary losses.

Promotion is also the practical application of acquired skills and knowledge. At the same time, it is not necessary to significantly change your own, quit your job. You can have additional income without going into formal business. Namely, on assets, to distribute money correctly. In this case, the main income will not be lost.

Everyone is obliged to learn the truth that it is a person who manages money, and not they manage it. Personal economic development is hampered by senseless acquisitions, making an imaginary status, spending. In this case, the likelihood of achieving prosperity is reduced.

financial literacy– a sufficient level of knowledge and skills in the field of finance, which allows you to correctly assess the situation on the market and make reasonable decisions.

Knowledge of key financial concepts and the ability to use them in practice enables a person to competently manage their money. That is, keep track of income and expenses, avoid excessive debt, plan a personal budget, create savings. As well as navigate the complex products offered by financial institutions and purchase them on the basis of a conscious choice. Finally, use savings and insurance instruments.

It should be noted that its economic development largely depends on the general level of financial literacy of the country's population. The low level of such knowledge leads to negative consequences not only for consumers of financial services, but also for the state, the private sector and society as a whole. Therefore, the development and implementation of programs to improve the financial literacy of the population is an important direction of public policy in many developed countries, for example, in the USA, Great Britain and Australia. A high level of financial awareness among residents contributes to social and economic stability in the country. The growth of financial literacy leads to a reduction in the risks of excessive personal debt of citizens on consumer loans, a reduction in the risks of fraud by unscrupulous market participants, etc.

In Russia, financial literacy is at a low level. Only a small part of citizens is oriented in the services and products offered by financial institutions.

According to the World Bank for 2008 and subsequent monitoring by the National Financial Research Agency, 49% of Russians keep their savings at home, and 62% prefer not to use any financial services, considering them complicated and incomprehensible. 45% of the adult population of Russia are aware of the deposit insurance system, and half of this number have only heard this name, but cannot explain it. Only 25% of Russians use bank cards. At the same time, there is a low level of knowledge among credit card holders about the risks associated with this product. Only 11% of Russians have a savings strategy for the period of retirement age (compared to 63% in the UK). Most of our fellow citizens make decisions about managing their finances not on the basis of an analysis of the information received, but on the recommendations of acquaintances or interested employees of financial institutions. It should also be noted that in Russia there is a low awareness of the population about what rights a consumer of financial services has and how to protect them in case of violations. For example, over 60% of families are not aware of the obligation of banks to disclose information on the effective interest rate on a loan, only 11% are aware of the lack of state protection in case of loss of personal funds in investment funds. About 28% of the population does not recognize personal responsibility for their financial decisions, believing that the state should reimburse everything.

Such statistics show that it is necessary to increase the financial literacy of the population at the state level.

For the first time this problem in Russia was discussed in 2006 at a meeting of the G8 finance ministers in St. Petersburg, after which measures to develop financial literacy in the country were reflected in a number of documents of the President and the Government of the Russian Federation.

For example, in the Concept of long-term socio-economic development of the Russian Federation for the period up to 2020, improving financial literacy is designated as one of the main directions for the formation of an investment resource. In the Strategy for the Development of the Financial Market of the Russian Federation for the period up to 2020, it is considered as an important factor in the development of the financial market in Russia.

The Ministry of Finance of the Russian Federation, together with a number of federal executive authorities and with the participation of the World Bank, is developing a program to improve the financial literacy of the population. The program is designed for five years and at the first stage will be implemented in several Russian regions. It will include the preparation of specific training programs and products, the improvement of legislation in the field of financial services and consumer rights. Also, this project should, if possible, unite, ensure coordination of programs and initiatives in the field of financial literacy that are already being implemented and are being prepared for launch at different levels. The total cost is 110 million dollars. The main part (80%) will be financed from the federal budget, the rest - at the expense of the World Bank.

Today, as before, the majority of Russians receive theoretical knowledge in the field of finance on their own, through specialized Internet sites, TV shows, literature, news, attending courses and trainings, and gain experience from their own mistakes.

The most famous online resources in the field of financial literacy.

1. Information portal - the largest banking site in Russia. Improving the financial literacy of the population is fully devoted to the section "Banking Dictionary", which explains financial and economic concepts and terms, gives practical recommendations to consumers of financial services." is a financial literacy project developed by the Visa International payment system with the support of the Ministry of Finance of the Russian Federation.

7. "Financial Literacy" - a joint project to improve the financial literacy of the Russian Economic School (NES) and the Citi Foundation.

Improving the Financial Literacy of the Population: International Experience and Russian Practice Bliskavka Evgenia Alexandrovna

1.6. Study of the level of financial literacy in Russia

1.6.1. Examples of studies on the level of financial literacy in Russia

Since the problem of financial literacy is relatively new for Russia, it is obvious that the development of programs in the field of increasing FG should be preceded by serious studies of its current level. The results of the study can serve as a basis for determining the most effective directions and methods for bringing financial knowledge to the public.

In order to study the level of FG of the population, studies were carried out by various organizations (the National Agency for Financial Research (NAFI), the Public Opinion Foundation commissioned by the MICEX, etc.). The results indicate the need to increase FG, since:

Up to 40% of respondents believe that the government will compensate them for possible losses associated with personal investments;

Only 9% of adults plan their finances for more than six months, and only 0.5% for more than one year;

In the 2007 survey, only 48% of respondents said they were aware of the EIR disclosure requirement;

63.5% of respondents do not trust banks;

60% are not sure that in 20 years the largest companies in the insurance market will not go anywhere. The population has little knowledge of the laws and regulations on financial products.

The results of the NAFI sociological study show that financial inclusion rather low – almost half of Russians (44%) do not use financial services (in low-income groups this figure approaches 55%). At the same time, some changes have been noted in recent years. If we talk about the most popular services and products, then the list is headed by bank plastic cards (mainly cards to which wages are transferred) - 21% and consumer loans - 19% (Fig. 1.8).

Rice. 1.8. Use of various financial services by the population, % of respondents

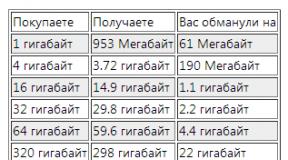

Expectations of state support for individuals carrying out operations in the financial markets are presented in Table. 1.1. The study confirmed that a large number of Russians still rely on the government to directly compensate for the losses they have suffered in the financial markets. More than a quarter of the population (28%) believe that the state should compensate their personal financial losses associated with a decrease in the market value of their share in mutual funds, the value of ordinary shares or a fall in real estate prices. There is a high percentage of respondents (32%) who have not formed their own opinion on this issue. Only 9% of respondents believe that in none of the situations listed below, the state should play the role of an insurer.

Table 1.1.

The need to cover financial losses by the state:

Let's provide indicators of the level of financial literacy studied in the survey.

1. Maintaining a personal budget. Less than half of Russians (45%) keep a systematic account of their personal funds (Fig. 1.9).

Maintaining a personal budget; % of respondents

2. Living within your means. Current expenses of 28% of Russians systematically exceed their current income (Fig. 1.10). For the low-income population, this figure is 40%. It was also noted that the poor are more likely to borrow money to make up the difference. In Russia, the ability to borrow money from relatives is still an important factor.

Ratio of income and expenses, % of all respondents*

3. Comparison of alternative financial services (products). 40% of respondents never compare terms offered by different financial service providers (Figure 1.11).

Comparison of financial services of different companies*

4. Planning for the future. Russians are not sure about their income even in the short term (Figure 1.12), and most of the population do not plan their expenses for more than 6 months (Figure 1.13).

Confidence in future income, % of all respondents*

Income planning, % of all respondents*

Concerning basic financial arithmetic skills, then 43% of respondents could not correctly answer any of the six questions that involve calculations (understanding the issue, interest rate, inflation, etc.). Only 11% of respondents answered all questions correctly (Table 1.2).

Table. 1.2.

financial arithmetic skills

1.6.2. Need for financial education and additional information

A large number of NAFI survey respondents say they would like to learn more about personal finance management. The top five topics are: avoiding scams, saving for retirement, managing personal debt, planning for the long term, and the finer points of signing contracts with financial institutions (Figure 1.14).

The study revealed long-term problems of financial literacy of Russians:

Unreasonably high expectations regarding state financial support in cases of financial losses;

Top five topics in financial education, % of all respondents

Low ability of citizens to ensure personal (family) sustainable financial health based on individual financial decisions;

Poor knowledge of the basic principles and instruments of the financial market.

In the latter case, the population, firstly, demonstrates a low ability for long-term planning; people did not respond to the urgent need to independently accumulate funds for their retirement period. While most know that the replacement rate is likely to be very low in the future (projected to be around 24% for 2020) and that pensions alone will not be enough to make ends meet, only 11% of the population have entered into some sort of shaping program. retirement savings. Over 50% of the population knows nothing about private pension funds at all. Only a small number of participants in the funded system of mandatory pension provision independently chose a management company.

Secondly, as noted above, about a third of the respondents systematically go beyond their current income. Low-income strata are more likely to borrow money to cover their financial "holes" (from close and distant relatives).

Thirdly, the majority of the population still places unreasonably high hopes on state assistance in ensuring their personal well-being. These expectations create negative incentives for long-term individual financial planning. As a result, one third of the adult population of Russia does not carry out regular expenditure planning. Those who are engaged in such planning are limited to a short-term period - from a month to six months. Only 9% of the population plans for a period longer than six months. Over half of financial consumers are not aware of their legal rights as financial consumers.

Over 60% of the population is not aware of the obligation of the lender to disclose the annual effective interest rate on the loan. Only 11% of the population knows that the state does not cover all losses resulting from a decrease in the value of investment funds' assets. Only 14% were able to correctly name the amount of insurance coverage for household deposits. 6% of the population believes that state insurance covers all bank deposits in full or up to a million rubles. In addition, it was found that people practically do not know where to look for reliable information regarding the rights of consumers of financial products and services.

Fourth, Russian consumer confidence in the financial sector is generally low. nine % non-saving consumers explained this by their “distrust of financial institutions”. Only 11% of families have insurance policies, while 21% of consumers consider it necessary to insure life, but do not do so because "they do not believe that insurance companies will actually pay out insurance in the event of their death."

Fifth, Russian consumers of financial services have a low level of confidence in the possibility of an easy and fair resolution of problems related to financial transactions. 77% consumers believe that the chances of obtaining a "fast and fair" resolution of disputes with financial institutions are "50:50" or even less. Consumers are also passive in protecting their legal rights. 8% of respondents said that in the last five years they received a financial service (usually some form of consumer credit) that did not meet their needs. And they conclude that they were deceived by the providers of this service. At the same time, over 60% of dissatisfied respondents did not take any action on this issue. Only 4% filed a complaint with a financial institution, and 3% filed a complaint with the appropriate government agency.

At sixth, Russian consumers are already taking steps to protect their interests. Over 40% of households responded that they compare the terms of a financial service before purchasing it, although 46% rely on the bank's reputation (and only 37% consider the cost of a loan) as a determining factor when choosing a lending bank. Over 80% receive financial information from newspapers, magazines and specialized television programs. However, when making a financial decision, 51% of respondents turn to family and friends for advice, and 36% turn to “advisers” who accompany the provision of this service.

At the same time, in Russia there is a high demand for financial education and a desire to learn how to protect your interests when interacting with financial institutions, as well as how to recognize and avoid fraudulent financial schemes. 3/4 of families would like to receive financial aid both to protect their financial interests and to plan their future income. 1/3 of respondents want to know about the laws that protect the rights of financial consumers, as well as what to do if these rights are violated. Over 13% would like to receive information about consumer loans to the population, and another 16% want to get acquainted with the possibilities of obtaining a loan for the purchase of housing. Approximately 26% of the adult population would like to learn how to understand the pension system, as well as learn about ways to save for old age. Another 22% of the population want to learn how to "not get caught up in too much debt when using credit." Young people are particularly interested in planning strategies for large purchases and mortgages. Elderly respondents pay more attention to pension issues. Wealthy households note the need for a clearer understanding of what information a consumer should pay attention to when signing contracts with financial institutions in order not to become a victim of fraud or unfair practices in the future. A quarter of all respondents expressed no interest in financial education of any kind. The population would like PT services to be provided by government regulators, as well as representatives of universities and non-profit organizations (HKOs).

As noted in NAFI studies, a significant part of the economically active population of Russia is not ready to take responsibility for their financial well-being. This largely explains the expectations of citizens to receive “protection” from the state, not so much in the legal aspect of “protection of rights and interests”, but in the paternalistic sense of state “guardianship and guardianship”. And as a consequence of this - low financial literacy and economic inertia of a significant part of the population.

In marketing research on the impact of the 2008–2009 crisis. the financial behavior of citizens shows that Russian citizens do not show an inclination to save (Fig. 1.15).

The period during which a household can live off its savings while maintaining the same level of consumption (%)

The same studies show that those who cannot correctly calculate interest rates on loan products and compare the loan burden with their solvency tend to accumulate credit debt and experience difficulties in repaying debts over a long period. Thus, based on the data presented above, we can conclude that the problem of financial education and increasing FG for Russia is extremely relevant. The level of financial literacy of the population is currently extremely low, and its improvement is an urgent need for everyone.

From the book Rich Dad's Guide to Investing author Kiyosaki Robert ToruChapter 15 Investor Lesson #13: REDUCING RISK THROUGH FINANCIAL LITERACY It was the early spring of 1974. I was only a couple of months away from my discharge from the armed forces. I still did not know what I would do after I left the base gate for the last time. President

From the book Expert No. 11 (2013) author Expert MagazineChapter 16 Investor Lesson #14 JUST ABOUT FINANCIAL LITERACY "Your father is constantly struggling financially because he is literate in words but illiterate in finance," rich dad often told me.

From the book Improving the financial literacy of the population: international experience and Russian practice author Bliskavka Evgenia AlexandrovnaAbout unprecedented financial literacy Alexander Privalov Alexander Privalov The Ministry of Finance proposes to introduce a new subject "Financial Literacy" in schools. The Ministry of Education agrees to recognize discipline as additional. Textbooks are being prepared for schoolchildren of all grades, from the first

From the book It's time to rise! author Kiyosaki Kim2.2. Participation of business in improving the financial literacy of the population A number of leading international banks and financial companies are actively involved in various financial literacy programs that have educational and social goals. The main target audiences

From the book Get Rich! A book for those who dared to earn a lot of money and buy a Ferrari or Lamborghini author DeMarco MJ2.3. Examples of financial literacy programs for schoolchildren A feature of foreign approaches to education in the field of personal finance and financial literacy is that many programs are aimed at school-age children. Necessity and importance

From the author's book2.5. Financial Literacy Programs in the Workplace Financial literacy programs in the workplace are becoming more common. Financial education is useful for both company employees and employers. Research shows that the data

From the author's book2.7. National financial literacy programs: the case of Poland and

From the author's bookChapter 3. Russian practice of improving financial literacy

From the author's book3.1. Overview of the financial literacy and financial consumer protection situation in Russia The financial sector is one of the most dynamically developing in the Russian economy. However, this rapid growth in financial products and services, especially

From the author's book3.2. Financial Literacy Programs for Children and Youth Youth is one of the most vulnerable social groups. The general education system does not include training in personal finance management, and parental experience is often limited or negative.

From the author's book3.6. Increasing financial literacy for start-up entrepreneurs and the self-employed As of 2008, about half of Russia's economically active population did not have access to financial services. A survey dedicated to assessing the accessibility of financial services to Russian

From the author's book3.7. Financial Literacy Training Programs (Train-the-Trainer) The implementation of projects to improve the financial literacy of the population is impossible without the participation of all sectors of society: authorities and state institutions that determine and coordinate