Financial literacy training. How does a person with high financial literacy behave? Passive income and investments

Financial literacy is what separates the rich from the poor. The statistics say if a financially literate person does not have money, he will soon have it. And vice versa, if a financially illiterate person has money, he will soon lose it!

Why this happens, and how to improve your financial literacy - read further in this article.

What is financial literacy and where is the line between literacy and illiteracy.

In simple terms, then financial literacy – this is a sufficient level of knowledge and skills that allows you to make informed and effective decisions in various areas of personal finance management, such as savings, investments, real estate, insurance, tax and retirement planning. Financial literacy also includes an in-depth knowledge of financial concepts such as personal financial planning, compound interest, how credit instruments work, efficient savings practices, consumer rights, and an understanding of the relationships between various economic processes and events.

Lack of financial literacy can lead to making unwise financial decisions that can have an adverse impact on a person's financial condition and even drive them into debt. Therefore, in developed countries, governments create special educational resources for people who want to become financially literate.

Modern research shows that financially literate people are more efficient and successful in life, regardless of in which country, in what positions and in what area they work. It is safe to say that knowledge of the basics of financial literacy improves the quality of life and positively affects the well-being of people. That's why, financial literacy is for everyone! I encourage all readers to take some time to improve their financial literacy.

Unfortunately, historically, the issue of financial literacy of the population in Russia has never been given due attention. In the Russian Empire, there was no other institution for teaching financial literacy other than the family. Therefore, wealth, along with knowledge, was passed down for centuries from generation to generation. During the Soviet Union, there was also no need to teach ordinary people financial literacy - salaries and pensions were set and guaranteed by the state, there were no risks of loss of income, and the number of financial instruments legally available to the people could be counted on the fingers. Along with the advent of a market economy in Russia, it became necessary to understand economic processes by every market participant, every person.

The need to educate the population in financial literacy has only recently become apparent at the state level. Before that, many people managed to step on the "rake" of financial illiteracy and lose their savings in various financial pyramids, during the default of Russia in 1998, due to the global financial crises in 2000 and 2008.

Nevertheless, the financial literacy of the majority of Russians and residents of the post-Soviet countries still remains at an extremely low level, because there are catastrophically few qualified specialists capable of teaching people the basics of financial literacy. Fortunately, now on the Internet you can find enough information in the form of books, articles and publications and improve your financial literacy on your own. Remember your well-being directly depends on the level of your financial literacy.

It is never too late to start learning in this area. There are 5 simple ways to increase financial literacy available to everyone. Here they are:

1. Read special books dedicated to the basics and principles of financial literacy. For beginners, I recommend the following books for mandatory reading:

George S. Clason - "The richest man in Babylon."

Vladimir Savenok - “How to make a personal financial plan. Path to financial independence»

Vladimir Savenok - "How to implement a personal financial plan, or How much money is needed for happiness"

2. Read feature articles- many financial advisers, including yours truly, maintain their own blogs in which they share "secret knowledge" about personal finance with a wide range of readers. You can read already published articles on my blog, as well as subscribe to receive new articles by e-mail. This method of improving financial literacy is good because it does not require much time from you. Finding 5-10 minutes during the day to study one article is not difficult even for the busiest people.

3. Play financial literacy games.

There are various business simulation games, as well as investment activity simulators, which allow you to learn the basics of personal finance and investment in an easy game form. This method of developing financial literacy is one of the most effective, because it involves the practical application of skills and makes it possible to see and feel the result of their application almost immediately. Today, the most famous and popular business simulator is the game " Cash flow". There are both desktop and computer versions of the game. There are other online games that develop the ideas of "Cash Flow", for example, the game CashGO.ru. Among the investment simulators, one can single out the www.chartgame.com service, which allows you to hone your investment and speculation skills on real historical charts of American stocks and compare the results of your trading with a passive "buy and hold" investment strategy.

Games allow you to test various assumptions and strategies in practice, while the result of your actions you can observe almost immediately, and mistakes and failures do not affect your financial well-being. Therefore, developing financial literacy through games is an effective and enjoyable way of teaching financial literacy, which is suitable for both adults and children.

4. Attend seminars, webinars and financial literacy courses.

At the same time, it is necessary to pay attention to which institution or company conducts financial literacy courses. For example, similarly named seminars from some brokerages and banks have the real purpose of getting you as a client and selling you their specific products, so they should be treated with some caution. But financial literacy courses organized by universities and independent financial advisers can be extremely useful. Especially if you don’t just listen to them, but start applying tips and recommendations in your daily life.

5. Develop good financial habits.

For many people, developing just four healthy financial habits can be enough to change their financial situation for the better. Here are 4 good habits:

Avoid debt and credit - live within your means

Start keeping track of income and expenses. Plan your expenses for the month ahead.

Always immediately save and invest at least 10% of the amount received immediately after receiving income. And from the remaining money, pay for your usual expenses, starting with the most important.

Be sure to consult your financial advisor before investing in any project or investment vehicle.

I recommend trying this method of improving financial literacy for yourself. It is not as simple as all the previous ones, as it requires more real effort from you and a change in your usual lifestyle. But you will immediately observe the effect of it: your well-being will increase along with the level of your financial literacy.

What skills does a financially literate person have?

1. Maintains a balance between consumption and investment.

Living well today and still saving and investing enough money to ensure a comfortable standard of living in the future is not an easy task. If you don’t save anything for the future, then a miserable beggarly pension from the state awaits you. If you save and invest to the maximum, and now live half-starving "on breadcrumbs and water" - there is a risk of not living up to that very "bright future" or paying too high a price for it - in the form of a hated past. Therefore, it is very important to maintain the "golden mean", which will allow you to live comfortably now, and in the future - no worse.

2. Effectively manages personal finances. Plans income and expenses in advance.

Nowadays, there are various services for accounting for income and expenses, for example Easyfinance, home money, Drebedengi, Zenmoney etc. All of them allow you to enter information about expenses and incomes literally in a couple of minutes a day from the phone screen. If you do not want to trust this kind of information to various third-party services, you can use regular Excel. You can use a template file for maintaining a personal or family budget.

At the same time, it is important to plan expenses for the next month, as well as analyze, compare the plan with the fact for the past period. 30 minutes a month devoted to planning and analyzing your personal budget allows you to find holes in the budget, determine exactly where the money is flowing, and make the right decisions to increase the amount of money in your wallet.

3. Sets clear financial goals and successfully achieves them.

Who among us does not like to dream about an expensive sports car, a house by the sea, a yacht or financial independence. A goal differs from a dream in that it has specific deadlines for implementation, cost, priority, and a host of other parameters.

For example, “I want a house by the sea” is dream, but " buy a two-storey house with an area of 150 sq. meters with a garage and a swimming pool, two blocks from the sea on the southern coast of Spain, worth 250 thousand euros in 15 years” is a very specific financial goal. And if right now we start saving monthly and investing in reliable instruments on the stock market for 598 euros with a quite moderate average return of 10% per annum, then exactly in 15 years we will reach our goal and buy our house for 250 thousand euros.

4. Plans his future 10-20-50 years ahead and follows his personal financial plan

If you don't have a plan on how to get rich, then chances are you're planning on being poor. You just don't realize it." (R. Kiyosaki)

Personal Financial Plan (PFP) is your best friend and assistant in achieving your financial goals. Those people who follow a personal financial plan are guaranteed to achieve financial well-being. Work with LFP is built in several stages:

Analysis and assessment of the current situation: Income and expenses, Assets and Liabilities.

Setting goals and determining specific actions for their implementation.

Choosing the right financial instruments for every purpose

Implementation of the plan.

Annual analysis of movement towards goals and adjustment of the plan.

5. Uses various financial instruments to achieve various goals.

Nowadays, there are hundreds of different financial instruments available to a wide range of people. All of them have different properties and parameters, such as profitability, reliability, stability, liquidity, recommended investment period, entry threshold, etc.

It is obvious that it will not work to solve short-term financial problems with the help of long-term instruments - for example, if you know that you will need money within 3 months, you should not run to buy an apartment now or invest it in shares of a particular campaign - for short-term investment it is better to use banking deposits, because they have the maximum liquidity.

6. Has multiple sources of income.

It is very dangerous to have only one source of income these days, especially if not only you, but also your loved ones depend on this source. In this case, you are putting yourself and your family at too much risk. When a person has several different sources of income, he lives much more comfortably. The feeling of stability, security and confidence in the future of your family is priceless. The benefits of creating new sources of income are also evidenced by the fact that with the growth of the number of different sources, the amount of money that comes to you regularly increases, and therefore the standard of living and well-being increases. Financially literate people try to create 1 new source of income every year.

Now you know all 6 secret skills of financially literate people, which means you can implement them in your life and quickly improve your financial literacy.

Great attention is paid to the financial literacy of the population today, and this is done at the state level. Business trainings and promotions are often held that can attract people to improve their level of education in the economic sphere. A financially literate person is a godsend for society and the state as a whole, since he is able to more successfully overcome the crisis and keep abreast of events taking place in the country's economy. The ability to get around an economically unstable situation and be ready to bear responsibility for the decisions made distinguishes a financially literate person from an illiterate one, but the former, unfortunately, are in the majority.

Minimum understanding of financial literacy

The art of managing expenses and income is not taught at school, in higher education institutions they give only theoretical ideas, and business training provides exactly half of the knowledge. The best way to become financially literate is to educate yourself and practice as much as possible. Financial literacy helps a person feel more confident in situations of economic instability, and not rush at the last moment under the influence of panic.

The minimum level of financial literacy includes:

- The concept of fraud in the financial market;

- Calculation of own budget;

- Making savings.

Having an idea of financial literacy in the countries of the world, you will be able to analyze your own level of preparation and decide for yourself how ready you are to keep track of your own expenses and income, how it is possible to make savings and increase their amount, spending minimal time on work.

In an economically difficult situation, the problem of financial literacy, or rather, illiteracy, is ripe not only in the regions, but also in large cities. People lack financial knowledge! It is worth remembering the panic attack of appliance stores when consumers buy up necessary and unnecessary refrigerators or sales of clothes. This is not a profitable investment in a discount product, but, on the contrary, a waste of money.

Despite the fact that a Russian person most often focuses on the Western standard of living, there is not a single European country in which residents know how to properly distribute their income and control expenses. Unlike the Asian regions, Australia and New Zealand are far advanced in terms of the level of financial literacy of the population. Chinese culture originally meant savings, but analyzing the current economic situation, one can begin to doubt this. In the Netherlands, over 60% of the population have not heard anything about the pension system, and in the UK and the USA, young people aged 16-17 are already “indebted”, which, fortunately, is not allowed by law in Russia. If you want to take another new gadget, young people do not think about saving and decide to put aside part of the monthly profit to pay off debt, but there is not always enough money. A person who grew up in the Soviet Union continues to console himself with the idea that the state takes responsibility for solving private financial problems. If an unsuccessful investment was made, 40% of Russians believe that the state should compensate for the costs - a common mistake that prevents many from getting out of the web of debt.

Don't fall into the hands of scammers

Guaranteed honest earnings are funds received in exchange for your own work. When there is a possibility of getting rich with minimal investment, be on your guard, as this is most likely a scam. The only way to invest with a low level of risk are stocks, bonds and investments. The financial pyramid is also an alternative way of earning, bringing every month up to 100% of the initial contribution. It would seem that the system is extremely simple: bring 100 friends who are willing to invest and get benefits from each. The question arises: is it likely to have time to bring the required number of participants before the closing of the financial pyramid? Having reached its climax, the pyramid, most often, crashes, taking away all investments. You are left with nothing, having experienced the most unpleasant experience. The only chance to benefit from this type of income is to calculate the time that is worth spending on promoting the pyramid and, anticipating its collapse, stop in time.

Guaranteed honest earnings are funds received in exchange for your own work. When there is a possibility of getting rich with minimal investment, be on your guard, as this is most likely a scam. The only way to invest with a low level of risk are stocks, bonds and investments. The financial pyramid is also an alternative way of earning, bringing every month up to 100% of the initial contribution. It would seem that the system is extremely simple: bring 100 friends who are willing to invest and get benefits from each. The question arises: is it likely to have time to bring the required number of participants before the closing of the financial pyramid? Having reached its climax, the pyramid, most often, crashes, taking away all investments. You are left with nothing, having experienced the most unpleasant experience. The only chance to benefit from this type of income is to calculate the time that is worth spending on promoting the pyramid and, anticipating its collapse, stop in time.

Today, under the financial pyramids are network games, the essence of which can be briefly described in two stages: investing a certain amount of money and inviting new participants. As in financial pyramids, games with real money withdrawal are won by the one who is the most active and is among the first. People who came, as a rule, at the time of the heyday of the so-called "business", are left with nothing.

Financially literate people anticipate the likelihood of ruin and do not settle for quick earnings. Only by long waiting would you have the opportunity to get rich, so it is better to opt for safe investments.

About investing: is risk a noble cause?

Since investing is the long-term investment of capital in the economy with the aim of obtaining benefits in the future, you can always count on spare funds at a critical moment. Thanks to deposits, you have the opportunity to make a profit without working, but there are certain risks. If you decide to invest, invest only your funds, which are not the last, but spare. The investor will suffer losses along with the company if it fails. Risk management technologies have been improving in recent years, but even if something stops you, remember that risk is a noble cause, and even if the first experience is unsuccessful, it will bring you closer to a double win - there is no other way! Since investing has the trinity of “save - multiply - receive”, you need to prioritize and decide for yourself if you are ready to take risks and receive a return that is ten times higher than your initial investments? Are you ready to secure an independent future for yourself, protect yourself from financial risks and leave behind a real legacy? By the method of carrying out a banal calculation, it can be revealed that by investing just one dollar at 26% per annum today, you will receive 10 billion dollars in 100 years.

Since investing is the long-term investment of capital in the economy with the aim of obtaining benefits in the future, you can always count on spare funds at a critical moment. Thanks to deposits, you have the opportunity to make a profit without working, but there are certain risks. If you decide to invest, invest only your funds, which are not the last, but spare. The investor will suffer losses along with the company if it fails. Risk management technologies have been improving in recent years, but even if something stops you, remember that risk is a noble cause, and even if the first experience is unsuccessful, it will bring you closer to a double win - there is no other way! Since investing has the trinity of “save - multiply - receive”, you need to prioritize and decide for yourself if you are ready to take risks and receive a return that is ten times higher than your initial investments? Are you ready to secure an independent future for yourself, protect yourself from financial risks and leave behind a real legacy? By the method of carrying out a banal calculation, it can be revealed that by investing just one dollar at 26% per annum today, you will receive 10 billion dollars in 100 years.

A financially literate person, having decided for himself to try to live on deposits, must remember the following rules:

- Rationally distribute your income;

- Take risks in investments only after receiving a decent income;

- Invest in risky investments only the money that you do not mind losing;

- Invest 10-20% of income.

Mark Twain also said: “You can avoid investing only in two cases: if you have money or if you don’t have it at all!”. If you still decide that investing is for you, remember that the degree of risk depends on the size of the deposit and income.

It's no secret that about 90% of citizens do not keep a budget and do not see the areas of expenditure where money "leaks" in the truest sense of the word. People are surprised that literally in the first days after receiving a salary, funds diverge to no one knows where. Of course, you need to relax and pamper yourself with expensive acquisitions, but it is more important for everyone to know when to stop. Not everyone realizes that at least 10% of the budget can be saved. Refuse to pay in a restaurant for your colleague, prefer not to borrow from unreliable people, and wait for the seasonal sale, and you will immediately feel how much your monthly income will increase by reducing expenses. Try to cut unnecessary expenses and start saving now by investing or making vital purchases.

It's no secret that about 90% of citizens do not keep a budget and do not see the areas of expenditure where money "leaks" in the truest sense of the word. People are surprised that literally in the first days after receiving a salary, funds diverge to no one knows where. Of course, you need to relax and pamper yourself with expensive acquisitions, but it is more important for everyone to know when to stop. Not everyone realizes that at least 10% of the budget can be saved. Refuse to pay in a restaurant for your colleague, prefer not to borrow from unreliable people, and wait for the seasonal sale, and you will immediately feel how much your monthly income will increase by reducing expenses. Try to cut unnecessary expenses and start saving now by investing or making vital purchases.

The presence of savings is especially important in a situation of economic instability, when a person is unable to predict what may happen to him tomorrow. Often, even successful people can lose their jobs by taking on loans - a situation that absolutely everyone can face with no savings. As international practice shows, as a permanent savings, you should have a minimum three-month income in reserve. This is the so-called "financial airbag", which you can turn to for help at any time. If you want to reduce the degree of risk, use insurance services so that at any unpleasant moment you have support in the form of insurance payments. If you're still confident in your place of work, don't let that stop you from saving monthly in case of trouble, or, conversely, if you have to make a useful contribution or organize a grand event.

The presence of savings is especially important in a situation of economic instability, when a person is unable to predict what may happen to him tomorrow. Often, even successful people can lose their jobs by taking on loans - a situation that absolutely everyone can face with no savings. As international practice shows, as a permanent savings, you should have a minimum three-month income in reserve. This is the so-called "financial airbag", which you can turn to for help at any time. If you want to reduce the degree of risk, use insurance services so that at any unpleasant moment you have support in the form of insurance payments. If you're still confident in your place of work, don't let that stop you from saving monthly in case of trouble, or, conversely, if you have to make a useful contribution or organize a grand event.

From childhood, we are taught to go to work in order to earn money on which to live or survive. If you think about it, it is easy to understand that in order to get more profit, you must either increase the quality of work, or the number of hours devoted to it. A person may encounter certain difficulties that may affect the receipt of the desired salary. Agree, not everyone can rise to the position of director of the company, and the quality of work of an ordinary employee, even the most successful one, is much lower than the quality of a director. As it seems at first glance, the solution can be found in increasing the number of hours, but is it worth sacrificing free space to follow the lead of work? The meaning of life is not to leave early in the morning for work, come and go to bed. Human capacity for work has a certain limit, which implies minimal fatigue, so it is important to reduce the time you spend on work while increasing income. Ask how? First, decide for yourself who you are according to Robert Kiyosaki, an expert in the field of financial literacy.

From childhood, we are taught to go to work in order to earn money on which to live or survive. If you think about it, it is easy to understand that in order to get more profit, you must either increase the quality of work, or the number of hours devoted to it. A person may encounter certain difficulties that may affect the receipt of the desired salary. Agree, not everyone can rise to the position of director of the company, and the quality of work of an ordinary employee, even the most successful one, is much lower than the quality of a director. As it seems at first glance, the solution can be found in increasing the number of hours, but is it worth sacrificing free space to follow the lead of work? The meaning of life is not to leave early in the morning for work, come and go to bed. Human capacity for work has a certain limit, which implies minimal fatigue, so it is important to reduce the time you spend on work while increasing income. Ask how? First, decide for yourself who you are according to Robert Kiyosaki, an expert in the field of financial literacy.

- A person is an employee who has a job (working capacity for 40 years, 40 hours a week; by retirement, at best, receiving 40% of the total income for life).

- A person is a business owner with his own company and people who work for him (minimum employment in the company's affairs; 99% of free time and full disposal of the funds earned by employees);

- A person is the owner of his company and works for himself (employment is about the same as that of an employee; a solid% of retirement income is again invested in business);

- A person is an investor for whom money works (complete independence from funds and time; by retirement you have a solid capital for yourself and your descendants).

Each of us is in at least one of the four categories, our place is a source of cash. Some are employees and work for a salary, some rely only on themselves. The world of business is made up of different people, so it is unthinkable to imagine at least one of the categories empty. It is important to understand that financial freedom can be found in any of the four categories, and need not be limited to just one.

Financial freedom is achieved from the categories "person - business owner" and "person - investor", and people from the categories "person - owner of the company" and "person - employee" should also try their luck.

Financial literacy is a step to success

If you patiently read this article to the end, it means that you care about how much you earn now, how you can save and exaggerate your income and invest it in your future. If you have patiently read the article, then you are ready to slowly but surely wait for the money to start working for you, and at the same time continue to improve yourself in the field of finance. It is up to you to decide who to become now - an employee or a manager of your own business. Do not fall for the bait of scammers and choose the most guaranteed way to earn money, and then you will be able to ensure a happy future not only for yourself, but also for your descendants.

Ecology of consumption. Business: As a rule, financial literacy comes through a huge number of mistakes and trials, gradually gaining experience...

Properly managing your finances, you can not only significantly reduce costs, but also significantly increase the thickness of your wallet. As a rule, financial literacy comes through a huge number of mistakes and trials, gradually gaining experience and ignoring the wise advice of financiers.

Here are a few key points to pay attention to on the path to financial literacy.

1. "Airbag"

The vast majority of people believe that some kind of accumulation is absolutely useless: you will lose everything anyway, so why save up if you can spend everything right now and buy some necessary thing?

Perhaps, for a particular moment of life, this decision may seem right, but after a while you may need some money for unforeseen expenses: minor repairs in the office, price increases at suppliers, etc.

How to pay these expenses if there are no savings at all? A loan may not be issued, and it often takes several days or even weeks to receive it, and you may not have this time.

That is why it is important to remember the first rule: you should always have savings in the amount of 3-6 monthly expenses for an unforeseen event.

2. Savings "under the mattress" instead of the bank

In Russia, less than 50% of the population uses bank deposits and up to 5% are investors in the stock market. And all for the reason that few people trust any financial instruments, preferring to keep savings at home under a pillow / mattress / in a nightstand, etc.

In fact, this type of "investment" gives a guaranteed income minus 10-13% per annum! The reason is simple - inflation. So, your current 500 thousand rubles, put in a bedside table, in 5 years will turn into 310 thousand rubles. with inflation of 10% per year.

Therefore, the second rule: do not store savings in a nightstand - it is better to place them at least on a bank deposit in order to save from inflation. Are you afraid of bank failure? Teach that when placed in one bank up to 700 thousand rubles. when you revoke his license, you are guaranteed to return your deposit safe and sound thanks to the deposit insurance system.

3. Incorrect loan parameters

Deciding to take bank loan, it is important to remember that it must be in the currency in which you receive your profit. Most often it is rubles. If you give in to the temptation to take out a loan in foreign currency at a lower rate, you can then get an increase in your monthly loan payments by 30-50% due to the depreciation of the ruble.

Be not too big: take a loan not "with a margin" just in case, but for the amount that you need. Please note that by taking the extra 50 thousand rubles. on credit, you will have to return to the bank already 75 thousand or more.

Therefore, it is better to take a loan in rubles, for the most necessary amount and for the minimum period, so that the loan payment is up to 20-30% of your income.

4. Investment without a term

It is impossible to invest intelligently if you do not know for what specific purpose it is being done. At the same time, "earning" is not the goal. The goal should have a timeframe, a cost, and a priority. Only by clearly defining it, you can correctly select the right investment tools for you.

So, if you are investing with the goal of saving up for some important goal in 1-3 years, then it is better to prefer bank deposits and highly reliable bonds or bond funds.

If we are talking about a goal in 3-10 years, then, in addition to deposits and bonds, you can add up to 50% of stocks or equity funds to your portfolio. Well, if you invest for 10 or more years, then you can increase the share of shares to 70-80%.

5. Take risks wisely

If your colleague or neighbor is investing in stocks and enjoys a return of 20% per annum or more, this does not mean that you need to urgently buy them. The fact is that each person has his own level of risk appetite. And if your neighbor is sometimes ready to endure a drop in the value of his shares by up to 50%, then you may not be ready for this, sell shares just at the most inopportune moment, take losses and be disappointed in investments.

That's why it is very important to correctly determine your risk appetite: If you are not ready for significant drops in the value of your investments, place most of the funds in deposits and safe bonds. If you are ready for sharp fluctuations in the size of your savings, you can place a significant part of them in stocks.

6. Financial plan

If a person thinks only about buying a car in a year, does not plan to buy an apartment in 3 years and pay for his son’s education in 10 years, then he will buy the required amount for a car, but will be left without a down payment. Due to large loan repayments, he will not be able to save up the amount needed to educate his son, and he will not enter the best university in order to get into a free department. There is no need to talk about retirement. This whole unfavorable scenario was realized because the person had one goal in front of him, and not a full-fledged financial plan.

7. Neglect of insurance

In Russia, insurance of apartments, cars, and even more so life is unpopular, because. most believe that nothing can happen to them. The costs of repairing an apartment, compensating flooded neighbors below, restoring one's own health are in most cases unexpected and require significant expenses, for which not everyone is ready. Therefore, property, liability and life insurance is a guarantee of confidence in the future of every person.

8. Start saving for retirement a couple of years before retirement.

You need to think about retirement at least 10 years before it.

9. Neglect of tax breaks

Not many people know and enjoy all types of tax deductions. Meanwhile, anyone can receive up to 15,600 rubles annually on their account if they paid for education, treatment, invested in their pensions or did charity work. If you bought an apartment or a house, you can get up to 260 thousand rubles to your account. plus additional compensation for interest on a loan for the purchase of real estate. published

Study your home budget. Find out how much income comes from different sources, how much money is spent, and where the money is spent. To do this, you can take the following steps:

- Pay attention to your bank statements. See how much money goes into the account and how much is spent on different purposes (except for monthly bills).

- Look at monthly bills. You need to know exactly who, for what and how much you pay.

- Examine all statements of credit card transactions in the most thorough way. Find out how much you pay for the cards, what is the balance on each of them, and what the funds are spent on.

- Keep track of loans. Find out what the total amount of all debt obligations is and how long it takes to repay loans in order to calculate monthly payments.

- View investment income reports. Find out what your funds are invested in and what annual income these investments bring.

- Examine the information of your annual credit history. In the United States, every person has the right once a year to receive a free copy of their credit report for the year for a year by contacting one of the three major credit reporting agencies. To get the information you need right now, go to http://www.annualcreditreport.com.

Set budget goals. It is easier to maintain financial discipline if you need to achieve a certain goal. You can set any task (make a bathroom renovation, buy a new TV or car, and so on). The right motivation is the basis of your success, and if you personally want to achieve the goal, saving money is much easier.

Develop a budget and stick to it. So, you have learned the number of receipts and expenditures, and also set goals. Develop an acceptable financial plan that will achieve this goal. When preparing it, adhere to the following recommendations:

- Keep track of monthly expenses for several months. Include the cost of food, gas, clothing, restaurants, dry cleaning, school expenses, and so on. You need to make sure that this information reflects the real situation.

- Compile the expenditure part of the budget, focusing on the records of previous periods. You can cut inflated expenses, and some items can be eliminated altogether.

- Revise the budget as needed. Adjust the budget if income changes or regular monthly bills appear/disappear. To achieve the goal, you need to stick to the budget, but it must be flexible enough to respond to external changes.

Discuss financial matters honestly and openly, without deviating from such conversations. As a rule, one of the spouses is responsible for finances, but this does not mean that he should bear the burden of financial planning alone. Both spouses must know what the money is spent on in order to share responsibility in financial matters. Of course, control does not mean that you or your spouse have to account for every penny spent. The main thing is that you both navigate the financial situation of the family, participating in decisions about large expenses.

Learn the difference between good and bad credit. Debt commitments vary, and you need to look at the following points to determine loan quality:

- Credit is considered good if it creates wealth-enhancing value. A good example is mortgages. As the loan is repaid, the value of the home increases and you create real estate assets for yourself. Another example is a student loan. In return for a loan, a person receives a diploma and an education that will be useful in his life.

- A sign of bad credit is an increase in debt obligations while reducing the cost of the purchased item. A typical example is credit card payments. The purchase quickly depreciates or is eaten up, and the interest on the debt increases. Bad credit includes loans to buy cars, because the value of a car falls faster than the loan is repaid.

Avoid the most common fund management mistakes. Income must exceed expenses. As a rule, this balance is disturbed by ordinary situations when a frivolous or spontaneous decision on expenses is made, depending on the person himself.

- Life on credit. A person breaks away from living within their means when they start shopping with a credit card or loans to purchase expensive items. This is how bad credit begins to accumulate, and a person gradually digs a debt hole, from which he will not be able to get out later.

- Lack of financial goals. This is a very important point. If a person has no reason to save, the motivation to control financial flows is much less. The financial goal determines the future, and also disciplines the present in order to achieve what you want.

- Don't call luxuries necessities.

Get trained in personal budget management. In any community, there are organizations whose activities are aimed at increasing financial literacy. The form of assistance can be different - articles, lectures or special courses.

- Ask about training programs at banks and credit unions, non-profit organizations, courses for company employees, religious communities.

- Be sure to check with your local college/university to see if they offer courses in personal finance or family economics.

Learn to identify sources of false information (including information from the Internet - the same basic rules apply here).

- Reliable information sources include colleges and universities, local/regional governments, prominent national organizations (such as the National Society for Cancer Research), and trade journals and peer-reviewed publications. Websites of trusted organizations often end in .gov, .org, or .edu. These domains usually point to governmental, non-profit and educational organizations.

- Unreliable sources include self-proclaimed professionals using blogs, personal web pages, social networks, Internet forums, and websites of unknown organizations. In general, use a double filter: information is unreliable if published in an unknown publication and/or the author is not an expert.

Keep learning. There is always something to learn in the field of personal finance. It is also very good to pass on the acquired knowledge to children and other descendants. You can find out how to teach finance to children on the website of the tax administration or even in the Ministry of Finance. These organizations have even developed simulation games for children to teach about finance. Visit page

Economics, finance, accounting, taxes - for many, these are complex and unfamiliar concepts that need to be studied for many years. On the other hand, financial literacy is a means to control personal income and expenses, the ability to profitably manage money and reach a new level of material well-being. Success is achieved by one who has comprehended the art of not only earning, but planning his expenses and investments. It is quite possible to learn this in a few months and then apply it for the rest of your life.

What is financial literacy

According to the famous business coach Robert Kiyosaki, economic literacy should include:

- knowledge of the basics of tax legislation;

- ability to use and understand accounting;

- the ability to draw up a simple financial plan;

- have an idea of what money is and how to work with it.

Do not think that it will take a lot of time to learn this, it is a matter of several weeks. The main thing is to understand that this is necessary for your own success and apply the basics of economic literacy in practice. Those who work and constantly strive to implement new useful skills are successful.

The value of financial literacy for a modern person

Many believe that if they are not professional economists and accountants, then they do not need to have knowledge of economics. Such illiteracy can lead to sad consequences:

- making decisions that adversely affect well-being;

- taking rash loans, participating in pyramid schemes;

- inefficient investments, including pensions;

- inability to use the advantages of the investment and finance market as a tool for enrichment;

- decrease in personal income.

Who needs the ABC of finance

A successful population is the key to the well-being of the country. The ABC of finance is needed not only by the townsfolk, the state will only benefit if a person learns how to properly allocate his finances and use all opportunities to achieve haste. A high level of knowledge in the field of economics and finance leads to an increase in the involvement of the population in consumption, which leads to sustainable economic growth. An increase in material well-being increases the investment opportunities of citizens, which leads to the development of banking structures and the overall standard of living in the state.

The main thing is that financial literacy is necessary for the person himself. Understanding the process of saving money, creating passive income, managing spending - all this will help increase your savings. Do not forget about the regulatory framework, an economically savvy person always pays taxes on time, which makes him a law-abiding and successful citizen.

What does it mean to be financially literate

Interestingly, on the basis of numerous studies, state structures have already compiled a generalized portrait of an economically literate person. So he:

- keeps written or electronic records of income or expenses;

- lives within its means, does not take rash loans;

- knows where to look for relevant information on economic issues;

- before investing money, studies all options and checks them for a degree of reliability;

- postpones for a "rainy day", the so-called airbag in case of illness, job loss, force majeure.

How to learn financial literacy

Do not think that financial literacy is just the ability to count money and save every month from your salary. This is a broader concept, which includes knowledge of the basics of macro and microeconomics, knowledge of credit institutions, the ability to set strategic goals and successfully fulfill them. It will be beneficial to study the biographies of successful people, their personal successful experience.

You can learn this in several ways:

- independent study of works on economics and finance;

- obtaining information about the current situation in the country, changes in Russian legislation;

- self-control of income and expenses with the help of specialized programs;

- studying books and video courses on personal economic literacy,

- Attending lectures and classes to improve personal economic literacy.

Where to begin

You must always start from the beginning, and in this case - with a change in attitude towards money. The vast majority of people refer to them as a means to buy food, clothes, cars, real estate. Consumer psychology does not lead to success, it turns out that money is earned in order to spend it. It is necessary to break this vicious circle and go beyond the limits of philistine instincts, to make your own means work for your success.

Fundamentals of financial literacy at school

The state understands that its well-being depends on the economic literacy of the population, and already in 2019 introduces the subject "Fundamentals of Economic Literacy" into the federal school curriculum, as part of the subject "Social Studies". Students will receive basic knowledge in lessons on investing, interacting with credit institutions, strategic planning and passive income. Perhaps in the near future, children will teach their parents how to properly manage their own funds.

How to improve financial literacy

Study, study and study again - regardless of the attitude to the personality of the author, this statement is 100% true. Without additional knowledge, it will not be possible to improve your financial education. Various books, seminars, business press, video courses, webinars - now there are hundreds of them, if not more. Absorb new information, but question everything, because in practice everything will be done with your own funds, do not forget about your own experience and common sense.

Books on economics and finance

Literature is one of the most effective ways to learn new information. Some authors conduct detailed research on the topic of profitable investments and increasing personal income, others talk about their own experiences:

- Robert Kiyosaki "Rich Dad Poor Dad"

- Napoleon Hill "Think and Grow Rich";

- T. Harv Ecker "Think Like a Millionaire";

- George S. Cason "The Richest Man in Babylon";

- Bodo Schaefer "The Path to Financial Freedom";

- Vicki Robin, Joe Dominguez "Trick or Treat"

- Alexey Gerasimov "Financial Diary";

- Ron Lieber "Unspoiled"

Seminars and trainings

There are more than a hundred different seminars and trainings that will help you feel confident in the world of the economy and improve the quality of life:

- Online course by Robert Kiyosaki. It is clear that the training is not conducted by the author himself, but by his certified students, for example, Sulev Pikker, Ilya Brusnitsky.

- Course from TopTraining Group Personal financial plan. Increasing economic literacy.

- Economic literacy trainings from Mikhail Korde. And at a symbolic cost.

- Training on economic literacy from the state program "Genius of Life".

financial literacy in life

Applying the basics of economic literacy in practice is good because it is not necessary to completely change your lifestyle for this, quit your job and become an entrepreneur. Financial literacy teaches you how to make money on your assets, as well as how to properly allocate finances without breaking away from your main activity.

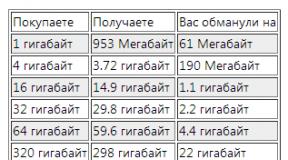

Relations with banks

Many of us forget that financial companies themselves are interested in competent and economically savvy clients. There is an opinion that the only thing for a bank is to deceive and sign for a loan that is beneficial for it, but large credit institutions do not practice this. Long-term mutually beneficial and comfortable relationships with specific clients are important to them, who will not only be served by the bank themselves, but will also recommend it to acquaintances and friends. As economic literacy increases, the fact is realized that the bank is not the enemy of savings, but a partner with whom one can increase capital.

Personal finance planning

There are a lot of programs that help keep track of personal income, choose your own taste. Another thing is that they all have common principles that will help you better understand your tools:

- verification of income and expenses;

- cutting off unnecessary expenses;

- indication of basic expenses (rent, food, essentials, birthday gifts, if any);

- distribution of funds;

- setting aside some money for investments.

Control of income and expenses

The main rule for accounting for expenses and income is regularity. This should be done every day, making it a habit to record the exact amount of spending. The most convenient way to do this is with mobile applications, here are the most popular ones;

- "Daily expenses";

- "AndroMoney";

- money manager;

- Toshl Finance;

- "FinancePM";

- "Wallet - finance and budget"

- "MoneyFy"

How to save and save

It is clear that the best way to manage your money wisely is to earn more than you spend. For many, this is an impossible task, a person himself cannot understand where his money has flown. The most effective way to control this is to record and analyze all expenses without exception. Another interesting point is bank cards, from which money often leaves faster than we would like. Try to take only a certain amount of cash with you, and leave the card at home.

Financial assets and liabilities

This concept was proposed by Robert Kiyosaki, already mentioned above. So, a financial asset is earned money that you can put in your pocket or use it to receive passive income, for example, investing in stocks or bank deposits. A liability requires constant investments (loans, taxes, housing, schools, hobbies, etc.). The ability to correctly distribute earned money between liabilities and assets helps to manage your income and earn on it.

How to create passive income

Other definition of passive income is investment, putting money into a certain area of activity for the purpose of making a profit. It does not depend on labor activity, the main thing is to find where to invest. Do not forget about the main rule of investing - there should be several sources of passive income, do not put all your eggs in one basket.

Examples of investing money to generate passive income:

- bank deposit - the higher the amount of the deposit, the more profitable the rent;

- buying shares, playing on the stock exchange, do not forget about diversifying your investment portfolio.

- income from advertising on your own website;

- investment in commercial and residential real estate;

- investing money in a business (own or partner);

- creation of copyright programs, applications, books and receiving dividends from them.

Investment diversification

The term "Diversification" means to profit from investments from different sources, to reduce the risk of losing money. Experts do not recommend directing cash flows to one area, such as the purchase of shares or real estate, in order to ensure the safety of funds. It is better to adhere to the principle of diversification - if you buy shares, then high-yield ones can make up no more than half of the investment portfolio, the rest is better to be directed to more reliable mutual funds, shares with a minimum return.