Accounting entries for deposits and interest. Where in the statement of cash flows to indicate own cash on deposit with the bank? Definition of a bank deposit, its features and benefits

A bank deposit or, as it is customary to call it, a deposit agreement is an obligation under which the depositor transfers funds to the bank or the relevant organization. In exchange for this the investor receives after a certain time his money and interest on it.

As a rule, the amount of interest on deposit agreements is lower than the interest that banks receive on.

As a rule, the amount of interest on deposit agreements is lower than the interest that banks receive on.

To raise funds, an organization must have a license. The deposit agreement must be executed in a written document or deposit certificate, savings book. Such documents may be provided for by law, other rules, if there is a reference to this in the law. The rules can be established both by acts of state bodies and banking rules..

A passbook can be issued to a specific person or to a bearer. It should reflect:

- Account information (number);

- Information about the institution to which the contribution was made or information about its branch;

- Information about the amounts that are deposited into and debited from the account.

Placement of funds on deposit is made for a certain period of time. Sometimes invested funds can be received on demand at any time. But such a deposit will be less favorable in terms of its conditions.

The law gives the right to withdraw the invested money ahead of time, but then the interest rate will be reduced. In accordance with the law, the rate will correspond to the rate on deposits, which can be returned on demand.

If the depositor is this, then in the absence of the right to withdraw the deposit earlier than the time specified in the agreement, early termination of the deposit is impossible.

In some cases, at the end of the term, banks resort to tricks in order not to return the invested funds, as a result, the depositor misses the deadlines, does not comply with the requirements of the procedures for terminating the deposit. The money, of course, will be returned, but part of it will be spent on fines.

Interest can be paid every month, and can be paid after the expiration of the contract once.

In terms of changing the interest rate, you need to know that banks and credit organizations reserve such a right in deposit agreements and often use it. That's why you need to be prepared for interest rate changes.

You also need to know that the higher the percentage of deposits offered, the less reliable the organization is. A high interest rate indicates a crisis in a financial institution.

Placement of funds on deposit. Other questions

Deposits, or rather their return is guaranteed by a special fund, which consists of contributions from credit institutions. Part of the fund's assets is paid by the state. However You can apply to the fund only in case of bankruptcy of the bank.

Information regarding the provision of a deposit, is a prerequisite of the deposit agreement.

But, if the organization violates the contribution, then can go to court with the requirement to terminate the agreement with the bank or the relevant organization.

The size of the interest rate will then be depending on the place of residence or the discount rate of the Central Bank.

A deposit agreement signed in favor of an outsider is possible provided that his name is indicated. He may waive the right granted. However, before the moment he claims any rights to the deposit, the person who made the deposit can use this money.

Bank deposit(or bank deposit) - the amount of money transferred by the depositor to a credit institution-bank for a certain or indefinite period in order to receive income in the form of interest generated in the course of financial transactions with the deposit.

A bank deposit of an individual means funds denominated in Russian or foreign currency, which the depositor places in a bank for the purpose of storing and earning income in the form of interest (clause 1, article 834 of the Civil Code of the Russian Federation).

A bank deposit agreement must be concluded in writing and reflect the conditions on the amount of the deposit, the currency of the deposit, the procedure for calculating interest, the procedure and terms for returning the deposit, and others (clause 1, article 836 of the Civil Code of the Russian Federation).

The deposit is the bank's debt to the depositor, that is, it is subject to return.

Types of deposits

The types of deposits currently offered by commercial banks are conditionally divided into several groups depending on the purpose of the depositor planning to place funds.

The main types of deposits offered by banks are as follows:

term savings deposits;

savings deposits;

demand deposits;

multicurrency deposits;

specialized deposits;

deposits in precious metals.

Term savings deposits

When registering term savings deposits, the deposit is placed for a certain period.

The advantages of term savings deposits are a high interest rate and the possibility of performing additional deposit management functions:

partial withdrawal of funds;

early closing of the deposit;

interest monetization.

In addition, term savings deposits provide for the capitalization of interest, that is, every month (quarter) interest on the deposit is added to the principal amount of deposits and the next accrual takes place taking into account the amount of capitalized interest.

Savings deposits

When registering savings deposits, it is possible to accumulate the necessary amount of money for certain purposes.

The advantages of such deposits are the ability to replenish the deposit at any time during the period of the deposit, and the system of prolongation of the deposit.

That is, if the depositor, upon the expiration of the term of the deposit account, did not apply to the bank, the effect of the deposit is automatically extended for the same period with the rate valid at the time of prolongation.

Demand deposits

Demand deposits are used by depositors who want to keep their money in the bank and at the same time be able to use their savings at any time.

Demand deposits (or termless deposits) do not have a strictly stipulated period for holding funds, and the depositor can access his funds at any time.

The disadvantage of such deposits is the low interest rate in comparison with other types of deposits.

Multi-currency, "specialized" deposits and deposits in precious metals

Deposits in commercial banks can be placed in national and foreign currencies and precious metals.

Multicurrency deposits

When making multi-currency deposits, the amount of the deposit in one currency can be transferred at any time at the rate of the bank to the currency of another deposit.

Deposits in precious metals

When making such a deposit, the depositor buys precious metals from the bank, which are not given to him in his hands, but are credited to the client's deposit account.

Specialized deposits

Many banks offer their clients so-called "specialized" deposits.

Such types of deposits are provided for certain categories of citizens: pensioners, single mothers, children from large families, etc.

Pension or social deposits, as a rule, have favorable conditions for placing, replenishing and saving money: a minimum initial amount, the possibility of non-cash replenishment from pension (social) accounts, an increased interest rate, etc.

Deposit retention periods

The terms of the deposit can be from one day to several years, and the longer the term of the deposit, the higher the interest rate.

Essential terms of the bank deposit agreement

The bank deposit agreement must contain the following conditions:

1. The amount of the bank deposit.

The amount of a bank deposit is the amount of money that the depositor deposits with the bank, and on which interest is accrued in accordance with the terms of the agreement.

2. The term of the bank deposit.

The term of a bank deposit is the period during which the depositor's funds are kept in the bank. The term can be specified in days, months or years.

Based on the timing of depositing funds in the bank, deposits are divided into deposits "on demand" and "term" deposits.

Demand deposits are not limited by the period of placement and are issued to the depositor on demand.

"Term" deposits are issued after the end of the period specified by the agreement (clause 1, article 837 of the Civil Code of the Russian Federation);

3. Deposit currency.

Banks can place deposits in rubles or in foreign currency.

A mixed deposit is called a multicurrency deposit.

On a multi-currency deposit, the placement of funds and the return of the deposit can be made in various currencies at the choice of the depositor.

In addition, funds can be invested in precious metals.

When opening a deposit in precious metals, the bank opens a special metal account for the depositor.

The yield of such a deposit is determined depending on the market prices for precious metals.

4. Interest on the deposit.

The agreement must specify the interest rate on the deposit, expressed as a percentage per annum.

The interest rate is the income of the depositor, which is paid by the bank for the temporary use of funds placed on deposit.

The interest rate is determined as a percentage of the deposit amount for a certain period of time.

The interest rate can be either fixed or floating.

The floating interest rate depends on the change in the variable specified in the agreement, for example, the refinancing rate (key rate) of the Bank of Russia.

Interest can be calculated in two ways:

Interest is calculated on the initial amount of the deposit without taking into account the interest accrued on it (simple interest method);

Interest is accrued on the amount of the deposit, taking into account the previously accrued interest (the capitalized interest method).

At the same time, the amount of interest on term deposits cannot be reduced by the bank unilaterally (Clause 3, Article 838 of the Civil Code of the Russian Federation).

For demand deposits, the bank has the right to unilaterally change the interest rate, unless this is prohibited by the deposit agreement (clause 2, article 838 of the Civil Code of the Russian Federation).

5. The procedure for the return of the deposit.

If the depositor does not return the amount of the term deposit at the end of the term for placing the deposit, then the agreement is considered extended on the terms of a demand deposit, unless otherwise provided by the agreement (clause 4, article 837 of the Civil Code of the Russian Federation).

If the term deposit is returned to the depositor at his request before the end of the deposit placement period, then interest on the deposit is paid as on demand deposits, unless otherwise provided by the agreement (clause 3, article 837 of the Civil Code of the Russian Federation).

6. Replenishment and partial use of deposit funds placed in the bank.

The bank deposit agreement may provide for the possibility for the depositor to replenish the deposit or partially spend the funds of the deposit.

Partial spending of funds from the deposit is carried out up to the minimum amount of the initial contribution established for this type of deposit.

If, when spent, the balance is less than the minimum amount of the initial contribution, then in this case the deposit agreement will be considered prematurely terminated.

7. Additional bank services.

Still have questions about accounting and taxes? Ask them on the accounting forum.

Deposit: details for an accountant

- Interim measures in tax disputes

... : the plaintiff's transfer of funds to the court's deposit in an amount not less than ... the form - the transfer of funds to the court's deposit - actually eliminates the effect of accepting ... an amount equivalent to additional tax charges to the court's deposit. So and so, but... . 94 of the Arbitration Procedure Code of the Russian Federation) deposits the necessary amount on the deposit of the court (what, how ...

- IFRS 16 "Leases": problematic issues in the application of the standard and automation of calculations based on the SAP product

From the terms of the contract: is the deposit returnable after its expiration of ... payments. In the first case, such a deposit should be recognized as a financial asset ... a form of right of use. If the deposit is non-refundable, then its amount must ...

- Transfer to the card is not yet income. Don't rush to pay taxes

Cash on deposit (on deposit) with the execution of documents certifying the deposit ... (deposit) to the bearer; opening a deposit (deposit) ...

- Justification of income in terms of financial and economic activities

Received in January 2020. The deposit will be credited...

- Taxation of income under loan agreements, bank account, bank deposit when applying UTII

...). Both a loan and a bank deposit (deposit) involve independent investment actions ...

- Bond by force of arrest in bankruptcy: main arguments for and against (in the context of the expected ruling of the Supreme Court of the Russian Federation on this issue)

Greetings, dear readers of the "site"! Today we will talk about a deposit: what is it, what are the deposits in banks, where and how to open a profitable deposit. After all, many are interested in ways to receive passive income, and not the last place among them is occupied by bank deposits.

From the article you will also learn:

- How is a deposit different from a deposit?

- how to become the owner of a deposit;

- which banks have the best conditions for deposits;

- how to correctly calculate the profitability of a bank deposit.

And at the end of the publication you will find answers to the most popular questions on this topic.

So let's go!

About what a deposit is in simple terms, what deposits exist in banks, how to calculate correctly and where it is profitable to open a deposit - read our articleThe bank deposit has been at the peak of popularity for many years. The main reason for this is accessibility. However, not everyone understands what are the features of this financial instrument.

1.1. Definition of a bank deposit, its features and benefits

First of all, you need to clearly understand what a bank deposit is.

Bank deposit- these are funds that the depositor voluntarily transfers for storage to a credit institution (bank).

There are several main features of the deposit:

- formalization through a contract, in writing and signed by both parties;

- opening a specialized account;

- recurrence means that the funds transferred to the bank belong to the depositor by right of ownership, the credit institution is obliged to return them;

- urgency involves the return of money to the depositor within the time limits fixed by the contract;

- payment means that the bank pays the depositor interest for the opportunity to earn on his funds.

Banks accept funds from customers in order to earn on them.

📑 Let's take an example:

Suppose the depositor deposited into an account with a credit institution 50 000 rubles under 10 % per annum. Through 12 months she will return to the client already 55 000 rubles . Accordingly, the bank's expenses will be 5 000 . If he gives the same amount to another client as a loan under 20 %, then will receive an income in the amount 10 000 . As a result, the profit of the credit institution will be 5 000 rubles. This is how the bank makes money.. Of course, the numbers in the example are conditional, but they help to understand the essence of the process.

If we consider a bank deposit from the point of view of a depositor, it allows you to get 2 main advantages:

- Lost profit fee. In other words, if you do not deposit funds, they can be used in another way. By refusing alternative options, the investor loses possible benefits. Therefore, the bank pays him compensation in the form of interest.

- Protecting savings from the effects of inflation. If you keep money in a piggy bank, they quickly depreciate. So, if the savings are 1 million rubles, and inflation - 10 %, already after 5 years of them will be the equivalent of today's 590 thousand rubles. AT past year, official inflation in Russia amounted to 4,2 % . If the savings were placed at a higher rate, their owner managed to protect them from depreciation. Read more about, in simple words and what are the reasons for its occurrence, read our article.

👉 At its core, a bank deposit is one of the most reliable ways to invest. The high level of security is due to the fact that deposits are protected by the state . They are insured in case of bankruptcy of a credit institution.

Bank deposit rate significantly below ↓ than the return on other investment methods. This is explained by the basic principle of investments: the higher the level of risk, the greater the return the owner of the capital will have to provide in order for him to transfer his funds to you for management.

If you want to earn more, you should choose other investment options. It can be , securities, real estate. However, to use such investments, you will need knowledge in the field of finance, or you will have to transfer funds to the management of a professional, for whose services you need to pay. If you ignore these rules, the risk of losing your invested funds will be too great.

Thus, the use of bank deposits is fraught with certain benefits, both for the credit institution and for the owner of the capital. Main Benefits are presented in the table below.

Table: "Benefits for the bank and the owner of capital when opening a deposit"

1.2. The history of the deposit

The word deposit is of Latin origin. depositum essentially represents property that has been deposited.

The history of the appearance of bank deposits

The history of the appearance of bank deposits Scientists associate the appearance of deposits with the ancient Babylon and Hellas. This era is called temple stage in the development of banking.

The income of the temples consisted of offerings, fines, and by transferring land for use. In order to preserve and increase their savings, the priests lent money to parishioners, receiving interest for this. Subsequently, in order to earn and increase capital, they began to attract deposits. The money received was also lent. As a result, due to the difference in percentages for receiving and investing funds, the temples made a profit.

In Russia, the first commercial bank was opened in the form of a joint-stock company in 1864. During the first 2 years of work in deposits from the population was attracted about 4 million rubles.

1.3. What is the difference between a deposit and a deposit in a bank: the main differences

Word deposit came to Russian from English (from English. deposit) . This language lacks the concept contribution. Therefore, any property that the owner transfers for safekeeping to the bank is called deposit. In Russian they are used as a word contribution , so the word deposit . However, the meaning of these terms is different.

- Contribution call the funds that their owner places in a banking organization in order to generate income.

- concept deposit more extensively. It includes not only cash and not only in the bank.

The deposit can be:

- securities transferred for storage (bonds);

- money that is transferred in favor of the customs authorities in order to secure obligations;

- contributions to the judiciary as security for judicial proceedings;

- security required to participate in auctions.

The purpose of the deposit is to preserve capital and receive income in the form of interest. In contrast, the purpose of the deposit is to preserve property.

Income on deposits does not always arise. For example, in the case of renting a bank cell to store any valuables, the owner does not receive income. On the contrary, he incurs expenses in the form of rent payments.

If we consider the banking sector, we can distinguish one more difference between a deposit and a deposit. Funds that are placed on the account by legal entities are most often called deposits. If the account is opened by an individual, both concepts can be used.

The main differences between deposits and deposits are summarized in the table below.

Table: "The main differences between deposits and deposits"

| Comparison criterion | Contribution | Deposit |

| Attachment object | Cash | Money and other assets |

| Receiving Subject | Credit organization (bank) | Banks and other companies |

| Entity opening an account | Individual | Both natural and legal person |

| Return on investment | Always formed | In some cases it is not meant |

note, in this article we will use the concept of deposit and contribution in an equivalent sense.

2. Main forms of deposits 📑

Depending on the main features, there are several forms of bank deposits. Described below 3 the most important of them: money accounts, metal bills and bank cells.

1) Cash account

Making a bank deposit without fail involves opening a cash account. If the depositor is an individual, such an account may be current or deposit .

Current accounts can be used by individuals for personal purposes that are not related to the implementation of entrepreneurial activities:

- receiving wages, pensions;

- accrual of alimony, allowances and other similar payments;

- cash withdrawal;

- settlements, transfers and various payments.

The main feature of a current account is the ability to access funds almost instantly. Most often, income in the form of interest on accounts of this type is not accrued, or it is set at a minimum level.

Some banks charge interest on loans that are used in doing business. However, a number of credit organizations require for this purpose to draw up a special additional agreement. But many customers are not aware of such a condition. As a result, banks simply do not charge interest.

Cash accounts can be issued not only in rubles, but also in foreign currency. To make it more convenient for account holders to use it, a bank card can be attached to it.

A bank card provides its owner with a number of advantages:

- the possibility of replenishing the card and withdrawing cash through the network of ATMs, which allows you to avoid standing in lines, and also makes it possible to manage the account at any time without days off;

- the possibility of replenishing the account through the terminal;

- if desired, the owner of a bank card can manage the funds, as well as control the balance on the account using online services;

- the ability to convert currencies without cashing out;

- you can make periodic payments automatic (for example, for utilities).

Some credit organizations charge for servicing current accounts commission . First of all, this applies to legal entities.

For example, the company deposited the authorized capital into the account opened with the bank. If after that you do not use the account and do not check the balance on it, you may encounter an unpleasant situation in a few months when the balance on it decreases↓. It is impossible to protest the actions of the bank to write off the commission, since all such fees are mandatory fixed in the agreement for opening an account.

Banks usually do not charge individuals for opening and maintaining cash accounts. However, this does not mean that you should not carefully study the tariffs before concluding an agreement.

📌 The fact is that credit institutions may charge individuals a monthly fee for providing access to online account, as well as one-time commissions for transactions on the account. For the transfer of funds, its amount can reach 5 %.

Many customers are familiar with the situation when a debt arises on a bank card that they did not even use. These may be the consequences of writing off commissions for SMS notifications, connection to an online account and other additional services. In order to avoid this unpleasant situation, it is important to carefully study the tariffs even before the conclusion of the contract. If there is no desire to pay for any service, it is worth clarifying whether it is possible to disable it.

At its core, a current account is a demand account. It is characterized by the accrual of interest at the minimum rate. In some cases, it is not provided at all. At the same time, the account holder can dispose of his funds at any time without restrictions.

The second option cash accounts are deposit . In this case, the credit institution opens an account used to hold funds for a certain period of time. At the same time, interest is accrued on the balance of the deposit at a rate that above than the current account.

The money is transferred to the bank for a specific period of time, determined by the contract. If the owner wants to pick them up earlier, he will not receive interest.

2) Metal account

Metal accounts are opened by the owner of the capital to carry out transactions with precious metals. These are the same transactions for depositing, storing and withdrawing from the account. However, all calculations are carried out not in units of currency, but in grams of the precious metal.

Types of metal accounts: custody account and CHI

Types of metal accounts: custody account and CHI In the bank, you can open a metal account of one of the 2 -th species:

🖍 1st view. Blocked or metal escrow account

When opening a blocked metal account, the client transfers for storage to a credit institution precious metal ingots owned by him by right of ownership. Values in a different way for example in jewelry, on this account are not accepted. To store such assets in a credit institution, you can rent a cell.

The purpose of opening blocked metal accounts is to ensure the safety of precious metals. Such agreements are drawn up when the owner of the ingot, for some reason, is afraid to store them at home.

Thus, at the end of the account term, the owner will take exactly those ingots that he transferred for storage.

Each ingot is characterized by the following features that allow you to identify them:

- name of the metal;

- try;

- manufacturer.

It is important to understand: These accounts do not charge interest. On the contrary, customers are charged in this case. The income of the investor can only be due to the increase in the price of precious metals on the market.

The owner of such an account will have to pay for the following services:

- opening and closing of an account;

- account maintenance fee;

- transfer of ingots from precious metals to the depository of another bank;

- crediting precious metals to a metal account;

- issuance of precious metals from the account.

☝ Bullion owners must understand: custody accounts are unprofitable. In addition to having to pay a number of commissions, at the time of purchase, the future owner of precious metals is forced to pay value added tax . Moreover, it is not easy to sell bullion even to the same bank. In this case, it is quite likely that there will be a loss of part of their value.

If you add together the costs, the increase in value, even over a long period of time, is unlikely to be profitable. If you want to make money on precious metals, it is much better to open an anonymous metal account.

🖍 2nd view. CHI or depersonalized metal account

At its core, an impersonal metal account is similar to traditional cash accounts. The main difference in this is that it is not the currency that is paid on it, but the equivalent in grams of the metal. When replenishing the account, the money is converted into weight at the current rate.

It's important to understand that when opening an impersonal metal account, the precious metal exists only virtually. Its physical embodiment is not provided, therefore, there are no individual signs. By the way, that is why the account is called depersonalized.

There are several types of OMS. They can be urgent and poste restante, in rubles or foreign currency. As additional conditions on the account, replenishment or partial withdrawal of funds may be allowed. Income when opening a CHI is generated both due to the growth in the cost of the precious metal, and due to the possible accrual of interest.

To make the right choice between urgent CHI and on demand, you should compare them. The main features of such accounts are summarized in the table below.

Table: "Comparative characteristics of urgent and current CHI"

Making a decision to work with metal accounts, the owner of the capital must understand: interest accrued on compulsory medical insurance is subject to taxation at the rate 13 % . In contrast, the profit received from the growth of the price of the precious metal is not subject to personal income tax.

However, before opening an anonymous metal account, you should consider: CHI does not participate in the deposit insurance system. Therefore, the choice of a reliable bank is of fundamental importance. In order to minimize the risk of bankruptcy of a credit institution and, accordingly, the loss of invested funds, preference should be given to large banks, preferably with state participation.

Some credit companies offer customers to open depersonalized metal accounts and conduct transactions on them through online banking. In this case, the client does not need to spend time on the road to the office and stand in queues. Moreover, transactions are carried out almost instantly. This is especially important during periods of instability, when the price of the precious metal changes very quickly.

Don't forget that when investing and withdrawing precious metals from the account, different rates are used. In a bank, the selling rate is always higher than the buying rate. Therefore, you should invest in CHI for the long term. During this time, the growth in the cost of precious metals will cover the exchange rate difference and other costs.

When opening an impersonal metal account, the investor can specify a specific amount of currency or the desired weight of the precious metal. Often banks are set in terms of service minimum deposit amount. It can be either one or one hundred grams of the precious metal. For comparison, the table below shows the conditions of compulsory medical insurance in 2 th largest Russian banks.

Table: "Comparative characteristics of the conditions for opening CHI in Sberbank and Gazprombank"

| Criteria for comparison | Sberbank | Gazprombank |

| Minimum deposit amount | For silver - 1

gram For gold, platinum and palladium - 0,1 grams |

Silver - from 1

kg Gold and platinum - from 10 grams Palladium - from 100 grams |

| Account opening fee | Missing | Not charged |

| The period of the conclusion of the contract | Indefinitely | On demand - no time limit Urgent CHI opens on year |

| Interest rate | Interest is not charged | For term deposits - 1

% per annum (in case of early termination - 0,1

%

For demand accounts - not provided |

* For more up-to-date information, see the official websites of banks.

Do not think that investing in precious metals can only bring profit. The course changes constantly, and not always upwards. However, in the long term, the value of precious metals is still growing. Therefore, if you buy them for a period of more than 5 years, by choosing the right moments for opening and closing an account, you can get a good income.

3) Safe deposit box

A safe deposit box is a very strong safe, which has a special lock and is located in a specialized vault in a credit institution. These safes are made of metal that can withstand explosions and fires.

To gain access to a safe deposit box, the client must rent it by concluding an agreement and paying a commission. Bank employees have access to the vault: they can enter there when there are no customers there. At the same time, they do not have the opportunity to open any cell.

The purposes of renting bank cells can be the following:

- Storage of assets (cash, jewelry, precious metals, documents, securities). To do this, most often the rent of cells is carried out in the summer during the period of mass holidays. At the same time, people are afraid that thieves can get into a house or apartment. Keeping assets in a bank is more secure. We can say that the safe deposit box is under double protection. Firstly, it is almost impossible to hack it, and secondly, the bank building itself is under armed guard.

- Ensuring the security of settlements in transactions with real estate and cars. So, in the case of the sale and purchase of an apartment using a mortgage, an additional agreement can be drawn up to the corresponding agreement, on the basis of which a safe deposit box is rented. According to the terms of this agreement, the seller of the apartment gets access to the funds placed in the cell only after the presentation of documents that confirm that the ownership has officially passed to the buyer.

A very important feature of a bank cell is that in case of bankruptcy of a credit organization, the owner does not lose the values placed in it. Such assets do not belong to the bank, therefore, they are not subject to the requirements of creditors.

In order for the client to be able to use a safe deposit box, he must conclude an appropriate agreement with the bank.

There are 2 types of agreements for the use of a safe deposit box:

- Bank cell lease agreement. At the same time, the list of assets that the client places in it is known only to him. In order to ensure the safety of property, a credit institution allows only its owner or a representative who has an appropriate power of attorney to access a rented safe deposit box. Despite the fact that bank employees do not know what is stored in the cell, when signing the contract, the client undertakes not to place various prohibited items in it, including narcotic and explosive substances, as well as weapons.

- storage agreement. In this case, an inventory of values is drawn up as an addition to the contract. As a result, the credit institution is responsible for ensuring the safety of the assets placed in the cell. Quite naturally, this option of renting a bank cell is more expensive.

In general, the cost of rent is determined by the credit institution depending on the term of the contract, as well as the size of the cell. Most often, the amount of commission for such a service is indicated in the tariffs per day. However, as the lease period increases, the cost decreases.

It should be understood: a bank cell lease agreement is concluded for a specific period. If it has expired and the client does not come, the credit institution has the right to collect a commission to open the safe. After that, the assets placed in it are transferred to the storage. If after the next month the bank's client does not appear, the credit institution receives the right to satisfy its own claims at the expense of seized valuables, that is, to receive rent, fines and so on.

It is generally accepted that the storage of valuables in bank cells is absolutely safe. However, it also happens that assets from such a safe disappear. There are cases when valuables from the cell were seized under a fake power of attorney. In such a situation, it is extremely difficult to prove anything.

Main types of deposits and their features

Main types of deposits and their features 3. What types of deposits are there - 6 popular types 📄

In addition to the forms of bank deposits presented above, there are several types of them. Below are the main ones.

[Type 1] Demand deposit

Demand deposit represents a bank deposit, which is not characterized by binding to any term. In this case, funds are issued at the first request of the account holder.

The depositor's capital is kept in a current account. At the same time, the purpose of the bank's client is not to receive income from capital. Other tasks when opening a demand deposit:

- ensuring the safety of funds;

- ensuring the possibility of using funds in case of need at any time.

Interest on demand deposits is set at a very low↓ level. Most often, it does not exceed 0,01 % per annum. In other words, by placing 100 thousand rubles, in a year the depositor will receive only 10 rubles arrived.

The reason why banks set such a low rate on demand accounts is elementary. The fact is that it is important for a credit institution to understand for how long the depositor transfers funds to it. This allows the bank to plan the placement of funds and its own profit.

Under the demand contract, the term is not determined. That is, the depositor can demand the return of their funds at any time. For the bank, this is associated with a certain risk, because it cannot plan for how long it will place this money to generate income. That is why demand accounts have such a low interest rate..

However, lending institutions love these ways of raising funds. The reason is that they are very cheap. You can get money at your disposal using demand deposits for a nominal fee. However, banks with such resources have to work much harder. It is necessary to analyze the minimum balance of funds on demand deposits, as well as the average period of storage on such accounts.

[Type 2] Term deposit

Term deposits are a type of bank deposits, the execution of which is determined by the agreement specific period of validity. Their main advantage is the ability to earn interest income.

Each bank sets its own deposit rates. However, there are several parameters that affect the size of this indicator.

The interest rate on time deposits is influenced by:

- term of the deposit;

- deposit amount;

- the presence of additional services in the form of the possibility of replenishing or withdrawing part of the invested funds.

The term of the deposit may vary. Most often it is in the range from several weeks before several years. However, the common thing for time deposits is that closing them ahead of the period fixed in the agreement it is forbidden. If the client urgently needs money, he will be able to receive it, but will lose the interest due to him.

[Type 3] Savings and savings deposits

In the financial sector, both of these concepts are used. However, an analysis of the available information and conditions of deposits in various banks makes it possible to understand that they are practically the same.

At its core savings account is one of the varieties of urgent. However, it is characterized by more flexible conditions. First of all, this concerns the possibility of replenishment and partial withdrawal of funds. In addition, there is no time limit for such deposits.

A savings account helps you keep your savings. However, it will not be possible to receive a large income with its help. One side, the interest rate on such accounts is higher than on demand deposits. On the other hand, it is lower↓ than for term deposits. In this case, interest can be accrued every month on the average or minimum balance of the account.

It is important to carefully study the clauses of the agreement that relate to the conditions for calculating interest:

- Some banks calculate them based on the daily account balance.

- Other credit institutions take into account only the full months in which the funds were on deposit. In the latter case, for the month in which the deposit was closed, the client does not receive income.

It should be understood: the savings deposit refers to current bank deposits, and not to term deposits. Therefore, according to him the credit institution has the right to unilaterally change the rate at any time. For term deposits, the interest is fixed for the entire term of the agreement.

[View 4] Target deposit

Target deposit is a bank deposit opened for a specific purpose. The most popular example of such an account is children's contribution . It is opened by parents, guardians or other relatives of the child. The deposit is at the disposal of the adult client of the bank who issued it until the child reaches the age of majority. After that, ownership passes to the child.

Today, targeted deposits are not very popular in Russia, so there are not so many offers for them.

To accumulate a significant amount using the target deposit, you will have to regularly make large deposits. Moreover, the rate should be high enough. In the examples above, the interest on children's deposits is tied to the key rate TSB RF . Taking into account the fact that today this indicator is set at the level 6 -7 %, the rate is 5 -6% per annum . In fact, this is not a very high figure. There are other, more attractive offers on the market.

Another striking example of targeted deposits are pension deposits . They are intended for the elderly.

[Type 5] Currency deposit

Most credit institutions offer their clients to open a deposit not only in Russian rubles, but also in foreign currency. Most banks available dollar deposits 💵 and euro 💶.

The advantage of a foreign currency deposit is the ability to receive 2 types of income:

- interest accrued on the deposit amount;

- profit from the growth in the value of foreign currency.

Note: interest rates on foreign currency deposits traditionally below ↓ than in rubles.

For comparison, below is a table with rates for different currencies in several Russian banks.

Thus, the main disadvantage

currency deposits is low↓ interest rate. However, if there is an active growth of the exchange rate on the market, you can turn a blind eye to such a minus.

[Type 6] Multi-currency deposit

Multicurrency deposits allow you to invest money in 3 currencies - rubles, dollars and euros. At the same time, the client can determine their proportions himself and, if desired, transfer funds from one currency to another any number of times.

Since all currencies are accounted for separately, it is opened immediately for a multicurrency deposit. 3 accounts. The income received by the client is formed from the interest accrued for each currency, as well as the growth of their exchange rate. The investor has the opportunity to increase profits by correctly assessing the market situation and transferring funds from one currency to another.

Most often, owners of multicurrency deposits can carry out conversion operations without visiting a branch of a credit institution. To do this, it is enough to use Internet banking.

Multi-currency deposits are perfect for those who are used to holding savings in several currencies, regularly carrying out conversion operations. Plus (+) such a deposit is not only no need to visit the bank, but also the ability to transfer currencies to each other without losing interest.

👆 Keep in mind: not all large Russian banks offer to open a multi-currency deposit. Similar deposits today No in Sberbank, VTB, Alfa-Bank.

In this way, There are many types of bank deposits. When choosing between them, you should first of all focus on the purpose of opening a deposit.

Stages of opening a bank deposit

Stages of opening a bank deposit 4. How to open a deposit - 4 main steps 📋

Today, in credit organizations you can find a huge number of offers for opening a deposit. Banks give their customers a wide range of deposits to choose from.

Take note: such a variety of deposit programs in the first place is only a marketing ploy. Most of the contributions are not too different from each other.

Depositors who decide to open a bank deposit may set themselves the goal of maintaining their own savings, as well as receiving a small additional income. The amount of profit, first of all, is determined by the choice of a credit institution.

To open a deposit as efficiently and quickly as possible, it is important to know some of the nuances of this procedure.. The following step-by-step algorithm will help save your time.

Stage 1. Choice of a credit organization

One side, all bank deposits of individuals are insured by the state. On the other hand, it is extremely unpleasant if a credit institution goes bankrupt. In this case, it will take a long time to wait for a refund. Therefore, you should trust your savings only to banks with an impeccable reputation.

When choosing a credit organization, the depositor should pay attention to 2 main criteria:

- The degree of accessibility. When deciding to open a deposit, it is worth choosing credit organizations that are within walking distance. It is important that you can visit a bank branch quickly and without time and financial costs. Equally important is the ability to carry out transactions with deposits online.

- Reliability level. Of great importance is the confidence of the depositor that the bank will not go bankrupt in the near future. To check the reliability, you can independently analyze the statements of credit institutions, which are published in free sources. However, it is much easier to use ratings compiled by professionals, as well as reviews from real customers.

When choosing a bank, you should also focus on past relationships with credit institutions. If a loan was previously received in any of them, a bank card or an account was opened for doing business, it is quite possible that the bank will offer more favorable terms of service for deposits. The fact is that a credit institution is always loyal to its regular customers, it tries by all means to keep them.

Stage 2. Selecting a deposit program

Today, to compare the conditions of bank deposits in various credit institutions, it is not necessary to visit a huge number of offices. All information can be found online. All deposit conditions are posted on the sites.

Moreover, it is not uncommon to find special deposit calculators . They allow you to calculate the expected profitability based on the amount, conditions of deposits. If you calculate according to different options for deposits and compare them, you can choose the best option.

The main conditions of bank deposits, which should be analyzed and compared in the first place:

- interest rate;

- conditions for calculating interest - frequency, capitalization;

- the possibility of replenishment and partial withdrawal of funds;

- conditions for early termination of the contract.

The investor must remember: when choosing a bank deposit, you cannot focus solely on the size of the interest rate. All conditions should be evaluated together. It is best to calculate the yield on different deposits using a calculator.

Of great importance contract time . It is best to choose the minimum of the suitable options. In case of early termination, the client loses interest. At the same time, most banks automatically prolong the contract. Most often, this does not even require visiting the bank office.

If you are not sure about the right choice of a bank and a deposit program, you can use special Internet services. Here, online, you can compare a large number of deposit conditions in various credit institutions. Moreover, the program can independently offer the best conditions after entering the basic data.

Stage 3. Conclusion of the contract

Signing a bank deposit agreement is inherently a standard procedure. At this stage, problems usually do not arise.

It is enough to present an identity document to an employee of a credit institution, which is usually used as passport of a citizen of the Russian Federation. You will also need to issue signature card, which will help the bank to identify the depositor in the future.

In some cases, additional documents are required, for example, resident card. To open targeted deposits, the bank may ask for a pension certificate or a child's birth certificate.

Despite the fact that each bank itself draws up a deposit agreement for each deposit, the form of such an agreement is standard.

Before signing a contract, it is worth remembering an important rule: first you should carefully read it. In this case, first of all, it is necessary to pay attention to the amount, term, interest rate and other important conditions of the deposit specified in the agreement. When the agreement is signed by both parties, one copy will remain with the depositor, and the second with the bank.

Today, credit institutions often offer their customers to make a deposit online. In this case, the signing of the contract is carried out using various methods, for example, SMS code. The contract is sent by e-mail.

Stage 4. Deposit replenishment and confirmation that it is open

At this stage, the bank client deposits cash at the cash desk of the branch of the credit institution. In return he gets accepted cash receipt, which bears the signature of the employee and the stamp of the bank, as well as the signed a copy of the deposit agreement. Exactly these 2 documents confirm the fact of opening a deposit.

The older generation still remembers how to open a bank deposit was issued savings book. Today, such a document is almost completely a thing of the past. Modern banks issue a deposit instead of a savings book plastic card. If you connect an online bank to it, you can track the balance of money on the deposit, as well as all ongoing operations, without leaving your home.

Earlier it was noted that a number of large modern credit organizations allow you to make a bank deposit online. In this case, the client saves time on visiting the bank office, as well as standing in queues.

To open a bank deposit online, first of all, you should register a personal account on the website of the selected bank. After logging into your account, you must perform the following steps:

- choose the deposit opening service;

- indicate all the necessary data;

- choose a method for depositing funds.

When the required information is entered and the money is transferred, the depositor will receive confirmation in the format of a document marked "done".

In this way, The procedure for opening a deposit is quite simple. If you follow the above algorithm, you will be able to conclude a deposit agreement without any problems. At the same time, it is of fundamental importance that the chosen program really makes a profit.

5. Which bank has the most profitable deposit for today - an overview of the TOP-3 best banks 📊

There are a huge number of banks in Russia that offer to open deposits for their clients. It can be difficult to figure out which one to choose on your own. In this situation, ratings compiled by professionals come to the rescue.

Below is TOP-3 credit organizations with the maximum volume of attracting deposits from the population and favorable conditions for deposits.

No. 1. Sberbank

Sberbank

is the largest Russian bank. This credit institution has branches throughout the country, both in metropolitan areas and in small towns.

Sberbank

is the largest Russian bank. This credit institution has branches throughout the country, both in metropolitan areas and in small towns.

Sberbank works with all segments of the population and types of companies. Here they offer one of the widest ranges of banking services in Russia.

To select the optimal conditions for a deposit, it is not necessary to go to a branch of Sberbank. It is enough to visit the site, which presents the conditions of all deposits offered for opening. Here you can not only analyze the conditions, but also open a deposit.

If a future client has questions, he can always ask them by contacting around the clock without days off for advice from a specialized service. You can do this by using the feedback form. Important advantage Sberbank is the presence of bonuses and discounts in the field of social economy, which are provided to depositors.

No. 2. Ural Bank for Reconstruction and Development

Ural Bank for Reconstruction and Development

operates on the Russian financial market almost from the beginning of its formation in its modern form - with 1990

of the year. Today it is the largest bank in the Sverdlovsk region, which is the leader in this region in terms of attracted deposits and deposits. In addition, the credit institution has offices in more than 43

Russian regions.

Ural Bank for Reconstruction and Development

operates on the Russian financial market almost from the beginning of its formation in its modern form - with 1990

of the year. Today it is the largest bank in the Sverdlovsk region, which is the leader in this region in terms of attracted deposits and deposits. In addition, the credit institution has offices in more than 43

Russian regions.

The reliability of the Ural Bank is confirmed not only by participation in the deposit insurance system, which is mandatory for everyone, but also by a high rating National rating agency. It rated the credit institution AA. This confirms the highest creditworthiness of the bank. Moreover, UBRD has repeatedly won various awards for social achievements in the Russian Federation.

The largest Ural bank offers depositors to make profitable deposits. The rate on them reaches 10 % per annum. In addition, a variety of bonuses, discounts and additional services are provided for customers in a credit institution.

If the depositor wishes to receive an increase in the rate in the amount of 1 %, he should open a bank deposit in the Ural Bank remotely. The client can indicate his phone number in the feedback form on the website of the credit institution. During 20 In minutes, a bank employee will contact him and clarify all the information about the selected deposit.

The client gets the opportunity to easily manage the invested funds using online banking. At the same time, you can pay for various services via the Internet. Moreover, the bank's Internet resource allows you to take part in various promotions and competitions with tempting prizes.

Number 3. Rosselkhozbank

Rosselkhozbank

was founded in 2000

year. During the period of its existence, it has earned the trust of customers. Today Rosselkhozbank has become a leader among credit institutions working with the agricultural sector.

Rosselkhozbank

was founded in 2000

year. During the period of its existence, it has earned the trust of customers. Today Rosselkhozbank has become a leader among credit institutions working with the agricultural sector.

The credit institution provides its clients with a wide range of various financial services. Investment and credit programs are being actively developed here, the conditions of which are primarily designed for customers living in rural areas.

Rosselkhozbank operates in all Russian regions. At the same time, customers can manage accounts and funds directly on the Internet resource of the credit institution. On the bank's website, you can get acquainted with all the conditions of deposits, take advantage of various promotions. If desired, the depositor can conclude an agreement online.

The above list of Russian banks is far from exhaustive. However, in the absence of experience, you can safely cooperate with the credit organizations represented in it. They have been successfully operating in the market for a long time and managed to win the trust of a huge number of citizens.

5 simple steps on how to calculate the return on a deposit

5 simple steps on how to calculate the return on a deposit 6. How to calculate the profitability of a bank deposit - step by step instructions + calculator 📈

Before making a decision in favor of a particular deposit program, you should calculate how much profit it will bring. The easiest option is to use deposit calculator posted on the bank's website or on our resource (at the end of this section).

If the result of the calculations of the program is not clear, you can always contact the employees of the credit institution. They will necessarily explain what are the subtleties of a particular interest calculation scheme.

💡 As is known, The bank's main source of income is the percentage of the transfer of capital on credit. To increase the volume of available funds, credit institutions attract deposits from the population. For the opportunity to use other people's money, banks pay interest. However, not all customers understand how much they will receive in the end. Let's try to present the yield calculation scheme in the form of a simple algorithm.

Step 1. Specify which scheme will be used when calculating interest

At their core, banks accrue (i.e. calculate) interest every day. However, it is most common to present the actual amount to customers 1 once a month.

In this case, 2 schemes for calculating interest can be used:

- simple. In this case, the yield is calculated very simply: the interest rate is added to the deposit amount.;

- with capitalization. To understand the second scheme, you first need to understand the definition. Capitalization is a process when interest periodically increases the amount of the deposit. Accordingly, interest begins to accrue on interest. It is quite natural that with such a scheme, the calculations become more complicated.

Step 2. Multiply the initial deposit amount by the interest rate

At this stage, simple calculations are carried out using a conventional calculator. To see the profit received for the year, it is enough to multiply the amount of the deposit by the rate.

📑 For example, when making a deposit 100 thousand rubles and rate 12 % per annum, the yield will be:

100 000 * 0,12 = 12 000 rubles

If capitalization is used, to calculate the yield, you will have to go to the third step.

Step 3. Calculate capitalization income

With capitalization, the accrued income increases the amount of the deposit, interest begins to accrue not only on the amount of the deposit, but also on interest.

One side, the more capitalization is carried out, the higher the profitability will be. But on the other side, the more capitalizations are provided during the term of the deposit, the lower↓ the rate is set by the bank. As a result, the effectiveness of such a scheme may come to naught.

- first of all, you should find out how often interest will be added to the deposit amount;

- the amount of interest for the first period must be added to the initial deposit amount;

- then the profitability for the second period is calculated and added to the amount received at the previous stage, and so on until the end of the year.

Assuming that the contribution is made 100 thousand rubles under 12 % per annum with quarterly capitalization, calculations will look like this:

Bet for 1 quarter will be 12 : 4 = 3 %

Now let's calculate the amount of the contribution at the end of each quarter:

- 100 000 + 100 000 * 3 % = 103 000 rubles;

- 103 000 + 103 000 * 3 % = 106 090 rubles;

- 106 090 + 106 090 * 3 % = 109 272,70 rubles;

- 109 272,70 + 109 272,70 * 3 % = 112 550,88 rubles.

Thus, in our example, the total income will be 12 550 rubles 88 kopecks. That is, on 550,88 rubles more than in the absence of capitalization. It would seem that the amount is not too big. But if the initial amount of the deposit and the term are longer, the difference will be even more significant.

Step 4. Determine the effective interest rate

This step is necessary if a capitalization scheme is used and the depositor does not withdraw interest, that is, they increase the deposit amount.

Effective rate is the percentage that allows you to see the final annual return.

With a simple interest calculation scheme, it makes no sense to take it into account, since it will be equal to the interest on the deposit. In order to determine the effective rate in the case of capitalization from the usual interest rate, the number of capitalizations should be specified. It is to this degree that the interest rate for the period of capitalization will have to be raised in order to determine the profitability.

In our example, the number of capitalizations per year is 4 . The total amount of the deposit in this case will be equal to the original, increased by 1,03 to the fourth degree. To calculate the profitability from the resulting coefficient should be subtracted 1 .

In our example: 1,03 * 1,03 * 1,03 * 1,03 – 1 = 0,1255 or 12,55 %

Step 5. Calculation of the final profit

S= N*(1+(Y* J/100* T)) BUT

- S– the final amount of the deposit;

- N- the initial amount of the deposit;

- Y- annual interest rate;

- J– number of days in the capitalization period;

- T– term of the deposit in days;

- A– number of capitalization procedures.

Accordingly, when using a simple interest calculation scheme BUT=1 .

📌 It should be remembered: the scheme for calculating the profitability becomes more complicated if the investor periodically uses the opportunity to replenish the deposit or partially withdraw funds.

If you don’t want to delve into the formulas, you can use our calculator to calculate the profitability of the deposit:

Accounting entries for deposits and interest, as well as for all other accounting transactions, must be drawn up correctly. After all, the reliability of financial statements and even the correctness of tax calculations depend on these records. Let's talk in our article about deposit accounts and accounting accounts linked to them, as well as what accounting entries will be required for placing money on deposit, returning it and calculating interest.

Placing money on deposit - what is it

If the organization has free cash, then so that they do not lie dead weight on the current account, the organization can make them work. Thus, money that is not involved in circulation can bring additional income. One of the ways to receive such income is to place funds on a deposit.

A deposit account is an account with a banking institution where a person places free funds, and the bank, in accordance with the terms of the signed agreement, accrues interest on them in the prescribed amount. Typically, deposit agreements are concluded for a specified period. After its expiration, the funds are returned to their owner. Funds can only be credited to this account as a deposit.

IMPORTANT! The deposit account is not intended for making settlements on it with third parties.

Which accounts are used in accounting entries for accounting for deposit transactions

The deposit account refers to the so-called special accounts in the bank, for which account 55 is intended for accounting. The Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation of October 31, 2000 No. 94n, as amended on November 8, 2010) provides for several sub-accounts. Deposits are recorded on sub-account 55.3 "Deposit accounts".

Since deposits are recognized as financial investments in accordance with clause 3 of PBU 19/02, they can also be taken into account on account 58 “Financial investments” by opening an appropriate sub-account.

NOTE! The organization fixes the method of accounting for the movement of money on deposit in the accounting policy.

Accounts 55 and 58 are active, therefore, the increase in funds on the deposit will be debited, and their decrease in the deposit account or return to the owner to the current account will be credited.

As for the entries for the receipt of interest on the current account and, accordingly, their accrual, account 91 “Other income and expenses” will be involved in them. Sub-account 1 to this account "Other income" is intended to reflect various receipts, including interest received, from activities not related to the main one.

How accounting entries are made when transferring funds to a deposit and when they are returned (receipt to a current account)

So, the organization decided to place free cash in a deposit account with a bank. For this, a bank deposit agreement is concluded (Articles 834, 835 of the Civil Code of the Russian Federation), where the following are prescribed:

- type of deposit;

- the amount credited to the deposit;

- the amount of interest accrued by the bank and the frequency of their accrual;

- the amount of the deposit account maintenance fee;

- period of keeping funds in the account;

- liability for each party;

- terms of termination of the contract;

- other conditions agreed by the parties.

After all the formalities are settled, the bank opens a deposit account, where the organization's funds are usually transferred from the current account. At the same time, on the basis of primary documents, including a bank statement, an entry should be made in the accounting:

Dt 55.3, 58 "Deposits" Kt 51.

If the transfer was made from a foreign currency account, then the entry will take the form:

Dt 55.3 Kt 51, 58 "Deposits".

At the end of the period of storage of funds in the deposit account, the bank is obliged to return them to the owner to the current account. The deposit refund will be as follows:

Dt 51, 52 Kt 55.3, 58 "Deposits".

Interest accrued on the deposit - accounting entry and its significance for tax accounting

As we have already noted, the frequency of interest accrual, as well as their rate, is one of the mandatory conditions of the contract. When accruing interest from the organization - the owner of funds on the basis of bank documents, the following entry should be formed:

Dt 76 Kt 91.1.

Interest on deposits must be taken into account as non-operating income when calculating income tax, if the organization applies the main regime, or a single tax under the simplified tax system as they are accrued (or received) - clause 6 of Art. 250 of the Tax Code of the Russian Federation.

Interest can be transferred to the current account of a person as they are accrued, or they can be accumulated on a deposit account and paid in a lump sum only after the expiration of the contract. The transfer of interest to the current account will be reflected in the correspondence:

Dt 51 Kt 76.

Results

The company can place funds on the deposit in order to receive additional income. Records will appear in the accounting using account 55 or 58, which will reflect operations for transferring money to a deposit and returning it, and account 91.1, where interest accrued by the bank in favor of the owner of the funds as part of other income will be recorded.

The article presented the main accounting entries that should appear in the accounting when recording transactions on deposit accounts.

Contents of the journal No. 20 for 2017Yu.V. Kapanina,

accounting and taxation expert

Accounting consequences of placing money on deposit

Documenting

The main document for accounting for the amount of the deposit, as well as interest on it, is a bank deposit agreement a paragraph 1 of Art. 834, paragraph 1 of Art. 836 of the Civil Code of the Russian Federation.

At the same time, such an agreement is considered concluded not from the moment it is signed with the bank, but from the moment money is deposited on a bank deposit. t paragraph 1 of Art. 834, paragraph 2 of Art. 433 of the Civil Code of the Russian Federation.

Opening a deposit is confirmed:

or a bank statement and a payment order - when transferring non-cash funds to a deposit;

or a receipt for a cash receipt signed by a bank employee with an imprint of a cash desk stamp - when depositing cash G clause 3.4 of the Regulations, approved. Central Bank 24.04.2008 No. 318-P.

Now banks provide their customers with the opportunity to open a deposit online. In this case, the bank deposit agreement in paper form is not signed. The procedure for documentary opening is that the representative of the legal entity (director, chief accountant) submits to the bank through the remote service system (for example, through the "Client-Bank") an application signed with an electronic signature, which indicates the information necessary for placing money. Thus, the company expresses its consent to the terms and conditions of deposits published on the official website of the bank. These electronic documents in the aggregate are a bank deposit agreement concluded between the company and the bank (of course, subject to the receipt of money in the deposit). A confirmation of the transfer of money to the deposit will be a bank statement.

In the contract, the accountant should pay attention to the following points that affect the reflection of the deposit in accounting:

term of the deposit;

the procedure for accruing interest and the timing of their payment;

conditions for early termination of the contract.

income tax

Placement of money on the deposit, as well as their return from the deposit will not be an expense and income of the organization. and paragraph 12 of Art. 270, sub. 10 p. 1 art. 251 Tax Code of the Russian Federation. Only the interest due to the depositor is reflected in "profitable" income.

Interest is included in non-operating income in paragraph 6 of Art. 250, paragraph 6 of Art. 271, paragraph 4 of Art. 328 Tax Code of the Russian Federation:

on the last day of each month;

on the date of termination of the contract (return of money from the deposit).

Moreover, it doesn’t matter how the agreement specifies the terms for paying interest (even if they are capitalized and paid at a time when the deposit is returned), they must be recognized in tax accounting on a monthly basis.

If interest is calculated and paid by the bank on the last day of each month, then interest income can simply be taken from a bank statement without making any additional calculations.

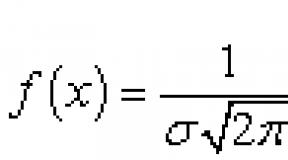

Another thing is when interest is charged, say, in the middle of the month or at the end of the deposit term. Then the amount of interest must be determined by the formula (unless the contract provides for a special procedure for calculating interest):

The calculation must be reflected in the accounting statement-calculation.

The agreement may provide for the capitalization of interest (in other words, compound interest), that is, when accrued interest is added to the total amount of the deposit with a certain frequency, as a result, the size of the deposit increases and interest is accrued already for more ´ l- amount.

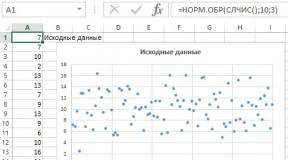

Example. Calculation of the amount of interest recognized in income

Condition. On September 4, 2017, the Company placed a deposit in the amount of RUB 1,500,000. for a period up to November 30, 2017 on the terms of monthly interest capitalization. Deposit rate - 6% per year. Interest on the deposit is accrued from the day following the day of receipt of money in the deposit, until the day of their return, inclusive. However, they are paid on the closing date of the deposit.

Solution. The calculation will be as follows.

| Months | Deposit amount, taking into account interest capitalization, rub. | Number of days of deposit placement | The amount of interest that the company will take into account in non-operating income at the end of the month, rub. |

| September | 1 500 000,00 | 26

(from 5.09 to 30.09) | 6410,96

(1,500,000 rubles x 6% / 365 days x 26 days) |

| October | 1 506 410,96

(1,500,000 rubles + 6410.96 rubles) | 31 | 7676,51

(1,506,410.96 rubles x 6% / 365 days x 31 days) |

| November | 1 514 087,47

(1,506,410.96 rubles + 7676.51 rubles) | 30 | 7466,73

(1,514,087.47 rubles x 6% / 365 days x 30 days) |

USN

Simplifiers also do not need to take into account the placement of the amount of the deposit and its return in tax expenses and income. t paragraph 1 of Art. 346.16, sub. 1 p. 1.1 art. 346.15, sub. 10 p. 1 art. 251 Tax Code of the Russian Federation.

Only interest on deposits should be included in taxable income. at paragraph 1 of Art. 346.15, paragraph 6 of Art. 250 Tax Code of the Russian Federation.

The date of recognition of "simplified" income is the day the money is received in bank accounts and (or) at the cash desk at paragraph 1 of Art. 346.17 of the Tax Code of the Russian Federation. That is, with the simplified tax system, interest is taken into account in income on the days they are received. And the amounts are taken from bank statements or warrants.

Difficulties in determining the moment of recognition of interest income may arise in a situation where the bank deposit agreement provides for the capitalization of interest. After all, the accrued interest goes to the bank account of the organization, but not to the settlement account, but to the deposit account, increasing the amount of the deposit. What date will be considered the day of receipt of income: the day of their capitalization (addition to the amount of the deposit in the deposit account) or the day they are credited to the current account? For clarification, we turned to the Ministry of Finance.

Date of recognition of income in the form of capitalized interest

The date of receipt of income when applying the simplified tax system is recognized, in particular, the day the funds are received in bank accounts (cash method e) paragraph 1 of Art. 346.17 of the Tax Code of the Russian Federation.

For taxation purposes, an account (accounts) means settlement (current) and other bank accounts opened on the basis of a bank account agreement. a paragraph 2 of Art. 11 Tax Code of the Russian Federation. At the same time, in the Civil Code of the Russian Federation, bank account agreements are regulated by Ch. 45, and bank deposit (deposit) agreements, on the basis of which deposit accounts are opened, - Ch. 44.

In addition, Art. 86 of the Tax Code of the Russian Federation states that banks open accounts, deposits and are obliged to issue certificates to the tax authorities on the availability of accounts, deposits (deposits) in the bank and (or) on cash balances on accounts, deposits (deposits), statements on operations on accounts, on contributions (deposits) of organizations.

Thus, the accounts opened on the basis of a bank account agreement and on the basis of a bank deposit agreement differ from each other for tax purposes.

Therefore, the date of receipt of income in the form of interest on a deposit, subject to their capitalization, is the date the bank credits such interest to the settlement account of the organization.

UTII

Companies using UTII can also place free funds on deposits. According to the controllers, the interest received does not apply to activities subject to UTII. Therefore, deposit interest must be included in the income tax base as non-operating income based on separate accounting data a Letters of the Federal Tax Service of March 24, 2011 No. KE-4-3 / [email protected]; Ministry of Finance dated February 19, 2009 No. 03-11-06 / 3/36.

Note that earlier the Ministry of Finance had a different position on this matter. It was believed that if the company conducts only “imputed” activities, then interest income is not subject to income tax. I Letter of the Ministry of Finance dated November 27, 2006 No. 03-11-04/3/506. However, it is safer to stick to the later clarifications of officials.

If an organization combines imputation and simplification, then the deposit interest received must be taken into account as part of the income taxed under USN Letter of the Ministry of Finance of July 6, 2005 No. 03-11-04/3/7.

Accounting

In accounting, money placed on a deposit at interest is reflected as a financial investment. th pp. 2, 3 PBU 19/02. At the same time, at the choice of the organization that needs to be fixed in the accounting policy, they can be taken into account:

or on account 58 "Financial investments", sub-account "Deposits";

or on account 55 "Special accounts in banks", sub-account 55-3 "Deposit accounts".

Regardless of the account on which the deposit is recorded, it must be shown in the balance sheet as part of financial investments. th clause 19 PBU 4/99; clause 41 PBU 19/02:

or on line 1170 in the section "Non-current assets" - if the term of the deposit exceeds 12 months after the reporting date;

or on line 1240 in the section "Current assets" - if the term of the deposit is not more than 12 months after the reporting date.

There is only one exception - a demand deposit. In the balance sheet, it is reflected in line 1250 “Cash and cash equivalent s" clause 5 PBU 23/2011.

Interest on the deposit is recognized as other income evenly over the term of the agreement, regardless of when it is actually received. s p. 34 PBU 19/02; pp. 7, 16 PBU 9/99; Letter of the Ministry of Finance of January 24, 2011 No. 07-02-18/01:

as of the last day of the reporting period. It's easier to do it monthly. Then interest accounting will coincide with "profitable";

on the date of termination of the bank deposit agreement.

Situation 1. Interest on the deposit is not capitalized and is paid by the bank upon closing the deposit. Then the accounting entries will be like this.

| Contents of operation | Dt | CT |

| Transferred money to the deposit | 58 (55-3) | 51 |

| On the last day of the reporting period, as well as on the date of termination of the contract | ||

| Interest on the deposit in the amount determined on the basis of the terms of the agreement is reflected in income | 76 | 91-1 |

| At the date of termination of the contract | ||

| Returned deposit | 51 | 58 (55-3) |

| Received interest on the deposit | 51 | 76 |