Registration of OS 6. Characteristics of the fixed assets accounting card. What uniforms are available now?

When an item of fixed assets arrives at the enterprise, an inventory card is created for it. There are three unified forms: OS-6 - issued for one object, OS-6a - issued for a group of objects; , filled out by small businesses. In the article we will dwell in more detail on the OS-6 inventory card, the form of which can be downloaded at the end of the article.

We invite you to familiarize yourself with the features of filling out the OS-6 form; you can download a completed sample inventory card below.

All transactions performed with the fixed asset, starting from the moment of acceptance for accounting, are recorded in the inventory card. The first entry in Form OS-6 is made when registering an object and putting it into operation. Further, as any actions are performed with the object: movement (), repair, revaluation, disposal, write-off, etc. sections of the inventory card form are filled out. The form must be filled out in a single copy.

Rules for filling out form OS-6 - sample

After completing the title page of the form, we proceed to filling out its sections. Entries are made on the title page of the OS-6 form on the basis of the transfer and acceptance certificate OS-1, OS-1a or OS-1b, on the basis of which the fixed asset was accepted for accounting. You can download a sample of filling out the OS-1 form, and the OS-1a form - in.

1. Information about the OS on the day of transfer

The section should be completed if the fixed asset was previously in use. Entries are made on the basis of the OS acceptance and transfer certificate. For new fixed assets, this section does not need to be filled out.

2. Information about the fixed assets on the day of acceptance for accounting

Here you should indicate the cost at which the object is accepted for accounting (the sum of all expenses minus VAT on these expenses). The useful life is established by the organization independently, depending on the depreciation group to which the fixed asset belongs.

3. Revaluation

Revaluation is the process of recalculating the value of a fixed asset so that it corresponds to average market prices. During the recalculation process, the initial cost of the fixed assets at which the object is recorded in account 01 changes. There may be either an increase in value or a decrease. The new cost is called replacement cost and is reflected in column 3 of the table in the third section.

In addition to recalculating the cost, accrued depreciation is also revalued, for which a conversion factor is used, which is calculated as follows: the replacement cost is divided by the original cost and multiplied by the accrued depreciation. The resulting coefficient is reflected in column 2. The first column indicates the date of the revaluation, usually the end of the year.

4. Information on acceptance, movements, disposals of fixed assets

Entries are made in chronological order, starting with the receipt transaction. The lines of this section are filled in on the basis of the following documents: acceptance certificate, write-off act (for one object, for vehicles, form OS-4b for groups of objects).

5. Change in the initial cost of the OS

The section is intended to reflect the costs of major repairs, reconstruction, modernization, completion, and partial liquidation. The resulting costs from these operations increase the initial cost of fixed assets. The object received after modernization, reconstruction, repair is accounted for on the basis of the acceptance certificate form OS-3 ().

6. Repair costs

This section of the inventory card form is intended to reflect information about the costs of current repairs. These costs do not increase the cost of the object, but are written off towards the cost of products and goods.

7. Individual characteristics

Any information describing the fixed asset item in more detail is entered. In particular, there is a table for indicating the content of precious stones and metals in the composition of the OS.

The OS-6 inventory card form is signed by the person responsible for its maintenance. As a rule, this is done by an accountant.

A fixed asset is an expensive accounting object intended for long-term use in business activities. These include buildings, units, machines, land plots and other objects with a value in accounting more than 40,000 rub., and at NU – 100,000 rub. and service life more than 12 months.

The rules for reflecting transactions with fixed assets are prescribed in PBU 6/01. The unit of account is inventory object. At the time of acquiring fixed assets, the accountant debits account 08 or 07.

After the asset is ready for commissioning and operation, wiring is done Dt 01 Kt 08(if equipment that requires assembly and installation was initially purchased, then preliminary wiring is Dt 08 Kt 07). From the moment the OS is designated in accounting the inventory card opens (OS-6).

Now the fixed assets object is included in the non-current assets of the organization and, starting from the month following the entry, will occur.

Determination of the OS-6 form

Inventory card – OS parametric passport. The document is systematized register of basic data on the fixed asset: manufacturer, service life, cost, movements within the organization and others.

Inventory card – OS parametric passport. The document is systematized register of basic data on the fixed asset: manufacturer, service life, cost, movements within the organization and others.

Resolution of the State Statistics Committee No. 7 dated January 21, 2003 approved the recommended form OS-6 (OKUD code 0306005). It is not mandatory for use in organizations.

You can develop your own form with more characteristics, or shorten it. The document is secured for use in accounting policies. When independently creating a standard document structure Don't forget about the required details, specified in Part 2 of Art. 9 of Law No. 402-FZ of December 6, 2011

Procedure

The inventory card is compiled for each element separately upon commissioning in BU and NU. Further, when carrying out current and major repairs, modernization, reconstruction or relocation of the OS, all information is entered into the appropriate columns of OS-6.

If a company has a large assortment of non-current assets, separate accounting of units and registration of an inventory card becomes difficult.

It is acceptable to use an inventory book (OS-6b) or a group card (OS-6a).

How to fill out the front side

First line of the title page is the name of the owner company. Next, the structural unit (if any) is indicated.

Top right corner in table grid go:

To the left of the tabular part, you must fill in the serial number assigned to the inventory card and the date of its compilation, as well as indicate the accounting object directly.

OS data at the time of transfer

This category is for filling information about the operation of the facility by another organization: dates of commissioning, repairs, details of relevant documents, as well as remaining service life, cost and amount of depreciation charges.

If the OS is new, this section does not require completion.

Information as of the date of acceptance for accounting

These fields must be filled in initial cost(costs of acquisition and bringing to a state of readiness) and useful life of the OS.

Revaluation

This part must be filled in with information about object revaluation procedure. The date, coefficient, and new cost are indicated. It is recommended to conduct it regularly, but not more than once a year based on the results of the reporting period.

It is imperative to reflect each operation in OS-6.

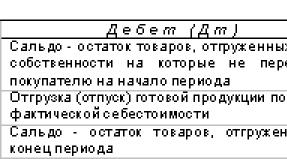

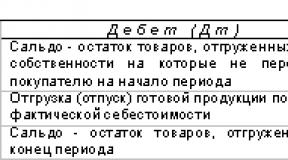

Acceptance, movement, disposal

The graph group is intended to reflect information on internal movement between structural divisions, facts of disposal of fixed assets(gratuitous transfer, sale, accident).

Separate records of a specific transaction are kept line by line with the obligatory indication of the date, division, book value and financially responsible person.

Reverse side of the form

The reverse side of the OS-6 form is presented in the following sections.

Change in original cost

Serves to systematize and accumulate information on deviations (increases or decreases) in the book value of fixed assets following the results of modernization, reconstruction, or partial liquidation.

Serves to systematize and accumulate information on deviations (increases or decreases) in the book value of fixed assets following the results of modernization, reconstruction, or partial liquidation.

Modernization- This set of events for qualitative improvement of the object (for example, an additional milling unit is installed on the machine, allowing new operations to be performed).

Reconstruction – non-drastic change in the OS structure, leading to an improvement in the quality and volume of work (saw blades have been rearranged, which will allow cutting products according to other parameters).

Partial liquidation – write-off of a component while keeping the entire object registered(for example, the destruction of a third of the building’s area following a fire).

It is required to indicate the type of operation, the date it was performed, and the amount of costs incurred.

Repair

Object parameters

This part indicates following OS parameters:

- full technical or design name;

- list of constituent parts and components;

- the share of precious metals and stones in the structure of composite links;

- other distinctive features and parameters of the OS;

- physical parameters of the object as a whole and in the context of structural elements;

- other information.

The final stage of registration of OS-6 is the affixing of the signature and decoding of the position and initials of the person responsible for the registration and accuracy of the information in the card.

Sample

To visually familiarize yourself with the structure of the document and the rules for filling out individual columns and fields, we provide approximate situation and form for filling out OS-6.

On November 29, 2016, the Lumiere LLC company purchased a specialized cutting machine from the Maxima JSC company worth 1.5 million rubles, incl. VAT RUB 228,813.56 Serial number 238541, date of issue – 10/01/2016. By order No. 55 dated 12/01/2016, the object is included in the OS, depreciation group 5, useful life is determined at 85 months, OKOF - 330.28.41.3.

The object was transferred to the warehouse to the chief engineer A.N. Stepanov for storage. On 07/01/2017, the main cutting saw broke down, about which defect sheet No. 12 was compiled. Repairing the damaged part cost RUB 10,000.00. (excluding VAT).

Do I need to print it?

So, OS-6 is document of analytical accounting of fixed assets, containing information about all changes regarding the cost measurement, location.

So, OS-6 is document of analytical accounting of fixed assets, containing information about all changes regarding the cost measurement, location.

To initially fill out the inventory card, you need following registers:

- act of form OS-1 (transfer and acceptance);

- product passport from the manufacturer;

- design documentation (if provided by the seller);

Further entry of information into the OS-6 form is carried out at document database:

- act of disposal;

- (during repairs, modernization, reconstruction);

- OS-2 (invoice for internal movement).

The OS-6 form can be filled out manually or using a specialized program.

For each OS unit, a one copy inventory card, which is printed and stored in the accounting department.

The main purpose of accounting for fixed assets is increasing the efficiency of their use. OS-6 allows you to monitor the presence, safety and location of OS.

The form combines all information about changes in quality and cost characteristics. The user will quickly and clearly find all the necessary information about the fixed assets object.

How to reflect the receipt of fixed assets in 1C - in this instruction.

Accounting for fixed assets owned by the company and moving within its structural divisions must be maintained by issuing a special inventory card.

In accounting, such a card must be created in one copy, and depending on the number of objects or the type of the enterprise itself, only the form in which it should be issued changes.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

At the same time, the current legislation on this issue regularly undergoes various changes, and therefore many people do not know how a fixed assets accounting card should be drawn up in 2019 and what its main features are.

Terms and purpose of the document

All issues that are relevant to the management of the law are very precisely reflected in the current legislation, but in order to correctly understand and interpret the various norms, it is worth considering the basic requirements that they use:

| Fixed assets | Basic objects that are used directly during the manufacture of products or the gradual generation of income by a company, while maintaining their natural form. |

| Primary accounting documentation | A list of papers reflecting information on all kinds of banking transactions. Such documents are drawn up immediately at the time of a transaction or any business operation. |

| The procedure for reflecting data on the financial activities of a company in special tables. | |

| Tax accounting | The procedure for reflecting data on the financial activities of the company, on the basis of which the amounts of transfers to the budget are calculated. |

| Gradual transfer of the cost of fixed assets into production processes, which is reflected in the relevant reports using an inventory card. |

Maintaining an inventory card in itself allows you to solve a fairly large number of problems, including:

- simplify the procedure for analyzing data on fixed assets;

- generate statistical data as quickly as possible;

- organize information.

When conducting all kinds of checks, tax officials always pay special attention to these cards, so the algorithm for filling them out should be studied by authorized company employees in as much detail as possible, since if there are errors, a large fine may be imposed on the organization.

Mandatory points

The registration of an inventory card is subject to certain rules that any authorized person must know, and in particular, this applies not only to the procedure for registration, but also to the content of this document.

Main information in the contents

In the OS-6 form, you must include information about:

- receipt of fixed assets;

- movements between internal structural divisions;

- repair work;

- modernization or reconstruction of fixed assets;

- revaluation procedures;

- write-off or disposal.

Example of OS-6 form

In the header of the document you must indicate the full name of the organization, the fixed asset object, its location, as well as codes for OKUD, OKOF, and serial number. In addition, the date of acceptance of the fixed assets and their deregistration is also indicated.

The main part of the document includes seven sections-tables, and at the time the object is accepted for accounting, the following sections are filled in:

All other sections must be completed at the time of direct operation of this object, and they include the following data:

The completed form must be signed by the responsible person.

If the company has decided to retire fixed assets for one reason or another, then in this case, in accordance with the written-off act, a special note must be made in the inventory card. In this case, inventory cards for any retired objects must be kept for the period established by the head of the organization (at least five years).

It is worth noting that even if the card was issued in electronic form, after that it will be necessary to draw up a document in written format at the time of certain operations or upon their completion, if this was not possible before.

How to fill out a fixed asset accounting card

It is worth noting several features that are typical for the procedure for filling out the fixed asset accounting form:

- It is necessary to fill out information about fixed assets at the time of their transfer only if they have already been used previously, and entries must be made in accordance with the documents of fixed assets. If we are talking about new equipment, this item is no longer necessary to fill out.

- When filling out information about fixed assets at the time of their acceptance for accounting, only the cost of accepting this object is indicated.

- Revaluation involves an increase or decrease in the original value of the object, and the price that was changed then acquires the status of replacement price. In addition, accrued depreciation is also revalued.

- Information on acceptance, write-off and movement of fixed assets. Entries are made in order, that is, starting with the data on the receipt of the OS. In this section you need to indicate data based on documents such as acts of acceptance, transfer, write-off and other papers.

- Information on adjustments to the starting cost of fixed assets represents data on the costs necessary to carry out major repairs, adjustments or improvements, which allowed to increase the value of fixed assets. Indicated on the basis of the data recorded in the OS-3 form.

- In expenses for repair work, it is necessary to indicate information about what funds were spent on routine repairs that do not affect the cost of the object and are written off towards the cost of the product.

- Individual indicators include any information that characterizes an item of fixed assets.

Ultimately, accordingly, the signature must be put by the one who is involved in the preparation of this document and bears full responsibility for it.

Maintaining records and accruals

For fixed assets, depreciation is calculated in the following order:

- on a real estate object at the time of its acceptance for registration upon the fact of state registration of ownership rights to the real estate object, provided for by current legislation;

- for property with a value of less than 40,000 rubles inclusive, depreciation should be calculated as 100% of the total book value of the object at the time of its acceptance for accounting;

- For property with a value of more than 40,000 rubles, depreciation must be calculated in accordance with depreciation rates previously calculated in the prescribed manner.

If we are talking about movable property, then depreciation on it must be calculated somewhat differently, namely:

- for library collection objects with a cost of less than 40,000 rubles inclusive, depreciation is calculated in the form of 100% of the book value that was registered at the time the object was put into operation;

- for fixed assets with a cost of more than 40,000 rubles, depreciation must be calculated according to accepted depreciation standards;

- for fixed assets whose cost is less than 3,000 rubles inclusive (not counting library collection objects and intangible assets), depreciation cannot be calculated;

- for other fixed assets, the cost of which is in the range of 3,000-40,000 rubles inclusive, depreciation should be calculated in the form of 100% of the book price registered at the time the object was put into operation.

Thus, the rules for calculating depreciation directly depend on what type of property the property in question belongs to and what its value is.

Principles of inventory and storage

Inventory cards of fixed assets belong to the category of primary reporting documents, and therefore they are subject to the usual rules, and in particular, this applies to the duration of storage of documentation - at least five years. After this period of time has expired, the documents must be disposed of in the prescribed manner.

This rule also applies to any inventory cards for recording fixed assets, but in some cases the storage duration may be slightly longer, and everything here depends on the type of fixed assets.

An inventory of inventory cards must be carried out every few years, the main purpose of which is to register inventory cards. By carrying out this procedure, confirmation of the safety of all available documentation is ensured, and registration must be carried out in full accordance with the information specified in the budget accounts.

It is necessary to submit, because... all details of contracts, books and accounts need to be adjusted.

Each inventory item has its own inventory number, as well as an inventory card - a “passport” of the fixed asset. The inventory card contains all the information about the object: characteristics, information about internal movements of the object, repairs and repair costs, etc. Form OS-6 is a unified form of inventory card for recording fixed assets. The unified form of the OS-6 form was approved by Decree of the State Statistics Committee of January 21, 2003 No. 7. You are not required to use an official form - you can draw up the document yourself, and use the unified OS-6 card as a sample for filling out. Please note that the developed form must contain all required details.

Inventory card for accounting of fixed assets

If your organization has a small number of fixed assets, you have the right not to fill out the OS-6 inventory card separately for each object, but to take them all into account in the inventory book, indicating all the necessary information there (form OS-6b).

It is necessary to fill out the OS-6 inventory card or book on the basis of an act or invoice on the acceptance and transfer of fixed assets, technical passports of the object and other documents for the acquisition. Please note that if you lease an asset, it is also recommended to create an inventory card for the asset.

Sample filling OS-6

In the header of the inventory card for accounting for fixed assets, fill in the name of the company, the asset, the location of the object, the form code according to OKUD - 0306005 (do not confuse it with the inventory card for accounting for non-financial assets - 0504031), code according to OKPO, OKOF, numbers (factory, inventory, etc. .), date of acceptance and write-off from accounting.

The main part of the inventory card of the OS-6 form consists of 7 sections - tables. At the time the object is accepted for registration, the following sections must be completed in the OS-6 form:

- Section 1, which contains information about the object as of the date of transfer;

- Section 2, which contains information about the object as of the date of its acceptance for accounting;

- Section 4, which contains information about the acceptance of the object;

- Section 7, which contains the characteristics of the object.

The remaining sections of the OS-6 form should be completed during the operation of the facility:

- in section 3, information about the revaluation of an asset is filled in;

- Section 4 contains information about internal movements of an object between divisions of the enterprise and its write-off;

- Section 5 contains information about changes in the original cost. Filling out this section of the OS-6 form, for example, is necessary when upgrading a facility, reconstructing or completing construction;

- Section 6 displays the costs of repairing the facility.

The completed form of the fixed assets inventory card is signed by the responsible person. If the enterprise makes a decision to dispose of a fixed asset for any reason (operating conditions were violated, an accident or emergency occurred, or for another reason), based on the write-off act, a corresponding mark is made in the inventory card in the OS-6 form. Inventory cards for objects that have been retired must be stored for a period established by the head of the company, but not less than five years.

If you are filling out the OS-6 inventory card for the first time, familiarize yourself with the filling out sample and pay attention to the procedure for filling out the OS-6 form. A sample of filling out OS-6 is given below.

When an object is registered with an organization, a special inventory card is created for it. This card is issued in the OS-6 form. You can learn more about it from the following article.

Cards are used to keep records of fixed assets, as well as record their movement within the company. The card must be issued for each OS listed in the company. It is recommended to have them even for rented properties.

An inventory card is issued in the following cases:

The card consists of a title part and seven sections. The card form in OS-6 form is given below.

Title part

The cover page of the card contains the following information:

- Name of the company and division where the object is accepted;

- Card number and date of its generation;

- OS name;

- Factory, passport and inventory numbers;

- Date of acceptance of the object for accounting;

- The name of the manufacturing company of the object.

First section

This section is completed on the basis of the transfer and acceptance certificate generated when accepting the fixed assets for accounting. This section must be completed only for those operating systems that have already been used previously. If the object is new, then filling out the card starts from the second section. The columns in the table of this section are identical to the columns in the table of the acceptance certificate.

Second section

This section of the OS-6 inventory card is very similar to the second section of the transfer and acceptance certificate. It is filled out as follows:

- 1 – the initial price at which the OS is accepted as a debit to account 01 (all expenses for purchasing the OS);

- 2 – SPI of the object (for new ones - according to the classifier, for used ones - the difference between the period according to the classifier and the period of actual use).

Third section

It is filled in only for those operating systems that have been revalued:

- 1 – date when the revaluation was carried out;

- 2 – conversion indicator;

- 3 – the current price, which was obtained as a result of the revaluation (increased - in case of revaluation, decreased - in case of discounting).

Fourth section

It reflects the movement of an object within the company. It is filled in in the following order:

- 1 – name, number and date of the document on the basis of which the operation is carried out;

- 2 – type of operation performed;

- 3 – name of the unit in which the object is registered;

- 4 – residual price of the object;

- 5 – Full name of the employee responsible for filling out the section.

Fifth section

The fifth section of the inventory card of the OS-6 form contains information about the modernization, liquidation and reconstruction of the facility, as a result of which the price of the fixed assets changes.

It is worth noting that information on repair costs is not included in this section, since the price of the object does not change.

Sixth section

The sixth section contains information about the costs of ongoing repairs. Such expenses do not affect the price of the object; they are written off against the cost of production.

Seventh section

This section describes a small individual characteristic of the OS. Also, it contains a table for entering information about the presence of dredges in objects. metals and precious metals stones.

The accountant is responsible for generating and signing cards.