RSV 1 pfr sample filling. How to fill out the RSV correctly: instructions from the tax authorities. Field “TIN in the Russian Federation”

Until April 30, 2019, policyholders submit calculations for payment of insurance premiums for the 1st quarter of 2019. Since the new year, the calculation has once again changed its form. Let's look at the changes to the form and tell you how to correctly draw up a new report on the DAM and fill it out without errors.

Who submits the DAM for the 1st quarter of 2019

First, let's decide who is required to submit the calculation. All legal entities and entrepreneurs with employees must submit it. Departments submit the form if they themselves calculate salaries and transfer contributions. Accordingly, calculations are required from all policyholders who employ insured persons. Main groups of insured persons:

- employees who have entered into fixed-term and open-ended employment contracts with the organization;

- contractors - individuals performing work on the basis of construction contracts or service agreements;

- general director, if he is the sole founder of the enterprise.

Even if there was no activity at the enterprise during the reporting period, the calculation is still submitted to the Federal Tax Service. If payments to individuals were not made, there were no movements on the accounts, then a zero report is sent to the Federal Tax Service.

If the company has more than 25 employees (note that the number is taken into account for the entire reporting period, and not based on the actual presence of employees at the time of preparation and submission of the report), then, according to clause 10 of Art. 431 of the Tax Code of the Russian Federation, such an organization must submit a single report in electronic form and send it via the Internet. Employers with fewer than 25 employees may submit a paper report.

Draft changes to the DAM form from 2019

- Add a “payer type” field. There are two types - persons who paid income for the last 3 months and persons who did not pay income.

- Indicate in section 1 only accruals for the last quarter, and not cumulatively from the beginning of the year.

- Add a field for deductions from the taxable base to subsections 1.1 and 1.2.

- Convert subsection 1.4 into appendix 1.1.

- Remove lines from Appendix 2.2 for preferential activities and foreign workers, but add line 055 for payments to foreign citizens of the EAEU

- Change applications for beneficiaries.

Other adjustments are also provided. We will tell you about them when the order comes into force and the deadline for submitting reports for the first quarter of 2019 approaches. In addition to changes to the form, the draft specifies the procedure for filling out the calculation and the format for submitting the electronic form.

Filling out the RSV form

Until the order has entered into force, we are preparing to fill out the calculation for the 1st quarter of 2019 in the form approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551.

First step. We prepare the title page

In the “period” column, enter the period code. The code can be found in Appendix No. 3 to the Procedure for filling out the RSV. In our case, the period code is “21” (first quarter), if a report on the operation of an existing enterprise is being filled out.

The Federal Tax Service code is indicated in the column “Submitted to the tax authority (code).” In this field you should indicate your department code. You can clarify the code through the official service on the website nalog.ru.

In the “Place of Submission Code” field, enter the numbers that indicate who is submitting the report and to which tax office. The Federal Tax Service Inspectorate previously approved the codes, which can be found in Appendix No. 4 to the Procedure, approved. By Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551.

In the “Name” subsection, you must indicate the name of the organization - as it is indicated in the constituent documents. Abbreviations are not allowed. Individual entrepreneurs must provide their full name. Words are separated by one free cell.

In the “Economic activity type code” column, indicate OKVED. Check the data! Since January 1, 2017, a new classifier has been in effect - OKVED2. You need to take the codes from it. The date and signature of the authorized person are placed at the end of the title page.

Second step. We enter information about employees

To avoid errors when filling out and to enter all information correctly, when filling out the form, we recommend that you first create a calculation for each employee for whom insurance premiums were paid during the year. Thus, the next step is to fill out personalized accounting data for each employee in section 3.

Who and how to fill out the appendices to section 1

- Appendices 1 and 2 are filled out by all individual entrepreneurs and legal entities who made payments to individuals over the past year, as well as enterprises that paid contributions at additional rates.

- Appendices 3 and 4 are filled out by organizations and individual entrepreneurs who made payments for sick leave, transferred child benefits, etc.

- Appendices 5-8 are filled out by organizations operating at reduced tariffs (for example, simplified tax system)

- Appendix 9 is completed by those organizations that paid wages to foreign or stateless workers.

- Appendix 10 must be completed by those organizations that paid wages and other payments to construction team workers.

Calculation adjustment

Make an adjustment to the RSV if:

- in previous calculations the amount of contributions was incorrectly indicated;

- there are discrepancies between the total amount of contributions and the amounts accrued for each insured person;

- Incorrect personal information is provided for the employee. To avoid rejection of the report for this reason, it is necessary to regularly reconcile the personal data of employees.

The fact that the calculation is corrective must be indicated in the “Adjustment number” field on the title page. So, when submitting the initial report, the value “0--” is indicated in this field, and when submitting an adjustment, the value is indicated by the numbers “1--”, “2--” and so on.

If an adjustment report is filed within 30 days after the reporting period, that is, within the standard deadline for filing this report, the date of submission of the report is considered the date the adjustment was filed. If the tax inspectorate finds errors, then you have 5 working days after receiving the notification by email or 10 working days from the date the paper notification was sent to resubmit the report. The report is considered submitted if all changes and adjustments are made within the specified period.

Responsibility for late submission of a report

If the deadline for submitting the calculation is violated, the tax office may fine the legal entity or individual entrepreneur 5% of the amount of contributions to be transferred. In this case, the total amount of the fine will be no less than 1000 rubles, but no more than 30% of the amount. If contributions are calculated correctly, but personal data is entered incorrectly, a fine cannot be avoided. If the tax inspectorate discovers discrepancies in the amounts, then if a smaller amount is calculated, the fine will be calculated from the difference between the contributions already paid and the arrears. 5% is charged from this difference, which goes towards paying the fine.

Submit your RSV using the online accounting service. All forms in the service are up to date, the report is generated automatically based on salary data and undergoes a format and logical check before being sent to the tax office. Get rid of routine, easily keep records, pay salaries and send reports using Kontur.Accounting. The first month of use of the service is free for all new users.

In October 2019, the Russian Tax Service adopted an order that approved the form for calculating employee insurance contributions, which came into force at the beginning of 2019. This calculation was introduced instead of forms RSV-1 and 2, RV-3, as well as 4-FSS. The fact that the updated form was developed is due to the fact that the issues of calculation and payment of almost all contributions become the responsibility of the Federal Tax Service.

Taking this into account, it was decided to replace all reports that were submitted to various funds with one calculation, which the policyholder must submit to the tax office at the place of registration. It must be understood, however, that this report does not completely eliminate reporting to funds.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

Thus, the Pension Fund will have to submit a SZV-M form monthly, as well as a new reporting form about the existing work experience, which is filled out based on the results of the entire year.

The Social Insurance Fund will still have to submit information about the insurance contributions of employees that were paid “for injuries,” since it is this component that remains under the responsibility of social insurance and is not accompanied by the tax office.

Reasons for changes

Starting from this year, control over the payment of medical and pension insurance contributions, as well as contributions paid to the Social Insurance Fund in case of disability and in connection with the birth of a child, is carried out by the Russian Federal Tax Service. That is why, starting from January of the current year, it became necessary to introduce new reporting that employers provide for the payment of insurance benefits.

The RSV-1 calculation form for insurance premiums from 2019 summarizes the reports that were used previously (RSV-1 and 2, and RV-3). However, this calculation does not include information about social contributions “for injuries”, since they, as before, remained under the jurisdiction of the Social Insurance Fund. It is assumed that information on them will be submitted to the FSS in the form of a separate document.

What is different about the new form?

The main distinguishing feature of the new form from those that were used previously is the fact that it is drawn up like a tax return. This is expressed in the fact that the document includes only those figures that belong to the accruals made in the reporting period. The amount of insurance premiums that were transferred, as well as the amount of debt available at the beginning and end of the period, are not displayed in the document.

The forms that were in effect until the end of 2019 included fields in which it was necessary to indicate the amount of insurance premiums not only accrued, but also paid. This made it possible to determine the amount of debt that the policyholder has to the fund (or vice versa) on the final day of a certain period.

The new calculation form includes sections containing the following information:

- generalized information about the obligations that the contribution payer has;

- calculation of amounts intended for compulsory social insurance;

- calculation of the amount of contributions intended for medical and pension insurance, which is mandatory;

- expenses that were incurred in connection with the onset of temporary disability by the employee or due to maternity;

- decoding of those payments that were made using money allocated from the federal budget;

- Personalized information about the insured person.

Who submits the document and where?

Since 2019, the RSV-1 calculation form for insurance premiums has been submitted to the tax service by insurance premium payers, that is, individuals who pay wages and other types of remuneration to individuals. persons.

Among them:

- companies;

- individual entrepreneurs;

- separate divisions of companies;

- other individuals who are not individual entrepreneurs;

- farm managers.

Businesses must submit a new reporting form to the tax office at their location. Divisions of companies submit a report at the location of such a separate division. As for individuals, as well as individual entrepreneurs, they submit the document at their place of residence.

Structure and content of the RSV-1 calculation form for insurance premiums from 2019

The updated form is a document consisting of a title page and three sections. The first two of them contain a certain number of applications: the first contains ten, while the second section contains only one application.

Each policyholder is required to submit the following parts of the document:

- Front page.

- The first section, which contains general information about insurance premiums that must be paid to the state budget.

- Calculation of the amount of pension payments, which is contained in Appendix 1 to the first section (in subsection 1.1.).

- Calculation of amounts for compulsory health insurance – subsection 1.2. to the same appendix of the first section.

- The second appendix of the first section, which indicates the calculation of contributions in the event of temporary disability or in connection with the birth of a child.

- The third section with personalized data about the insured persons.

All other applications are completed only if the policyholder has the appropriate information to be included in them.

For example:

- expenses for compulsory social insurance for temporary disability;

- payments from the federal budget;

- calculation of amounts using a reduced tariff by insurance premium payers, etc.

When filling out the form, indicate the amounts in rubles and kopecks. Cells that are not filled in should not be left empty; dashes should be placed in them. Words in lines are written in capital letters. The Federal Tax Service has approved the procedure for filling out this calculation, enshrined in the same order that approved the form. This document should be used as a guide when preparing the report.

The form can be filled out in the following order:

| First step | Filling out personalized data in the third section. Information about all insured persons for the last quarter is entered here. If there are more than one employees, the number of information entered into the calculation must correspond to their number. |

| Second | Entering data into subsection 1.1. the first section, in which information about pension contributions is entered. To do this, the personalized accounting data that was entered in the third section is summarized and transferred to the appropriate fields. It must be remembered that the sum of personalized indicators must correspond to the indicators included in subsection 1.1. |

| Third | Subsection 1.2 is completed. the first section, which displays contributions for compulsory health insurance. This information is included exclusively in this section and is not found in other lines of the report. |

| Fourth | The second appendix of the first section calculates the amounts of insurance payments in terms of social insurance. If there were expenses for sick leave or other social benefits in the billing period, this should be reflected in the third appendix to the first section. In this regard, line 070 of the second appendix of the first section must be completed. |

| Fifth | When information on each type of contribution has been entered, the data is last entered into section 1, which is summary. It indicates the amount of insurance premiums that must be paid to the state budget. |

| The final stage | Numbering of all completed Calculation sheets indicating the number of pages in a separate line of the title. Each section must have the signature of the director and the date the document was compiled. |

Payment period

In 2019, the term for payment of contributions does not change - it is the 15th day of the month following the month in which contributions were calculated. It is important to know that the deadline for submitting reports on insurance premiums has changed. This is enshrined in paragraph 7 of article 431 of the Russian Tax Code. According to its provisions, the approved calculation regarding insurance premiums must be submitted by the 30th day following the reporting period of the month. The reporting period is each quarter of the year.

Thus, in 2019, the first report that should be submitted in the RSV-1 form is the report for the first quarter. Since the last day for submitting the report is April 30, which is Sunday, and the first working day is May 2, 2019 (May 1 is an official holiday), the calculation must be submitted exactly before May 2.

Organizations and private entrepreneurs that employ more than 25 people must provide the tax service with a calculation regarding insurance premiums electronically, sending it using telecommunication channels. Other fee payers have the opportunity to submit a report on paper.

Employers should keep in mind that from the beginning of the current year, the terms for submitting reports are not affected by the method of submitting the document. That is, those policyholders who submit a report on paper, and those who submit a calculation electronically, must provide the document no later than the 30th day of the month following the reporting period.

Responsibility for violations

If the settlement is not submitted by the policyholder within the established time frame, the sanctions specified in Article 119 of the Russian Tax Code will be applied to him. In case of failure to provide any kind of reports, including declarations, a fine of 5% of the amount of taxes that was accrued but not paid for a specific period will be charged.

The report to the Pension Fund of the Russian Federation is traditionally submitted in the form RSV-1. We'll talk about it in this article.

What is RSV-1?

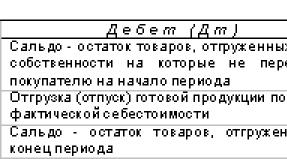

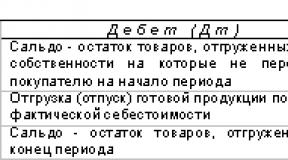

Form RSV-1 is a calculation of accrued and paid insurance premiums from the earnings of company employees and workers under GPC contracts for compulsory insurance (medical and pension). We wrote in detail about the calculation of contributions and the applied rates in the article “Insurance contributions to the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund in 2016.”

How to fill out RSV-1?

The RSV-1 form itself and how to fill it out are described in the officially approved resolution of the Pension Fund Board of January 16, 2014 No. 2p.

This document was amended on June 4, 2015, in accordance with the resolution of the Pension Fund Board of June 4, 2015 No. 194 p.

The innovations are associated with changes in the procedure for calculating contributions. Thus, since the beginning of 2015, the number of companies that have the right to apply reduced rates for insurance premiums has decreased. In addition, the maximum base for contributions to the Health Insurance Fund was abolished.

Companies and individual entrepreneurs must submit a report in form RSV-1 if they have employees. If the policyholder did not pay wages, then he needs to generate and submit a zero calculation.

Deadlines for submitting the report according to the RSV-1 form

Insurance premiums are paid by period: in the first quarter, for half a year, for nine months and for a year. Paper RSV-1 reports must be submitted within one and a half months after the reporting period ends, and electronic reports must be submitted within one month and 20 days. Submit it later and the report will not be accepted. However, if the deadline falls on a non-working day, it is automatically moved to the next working day.

Deadlines for submitting reports in form RSV-1 in 2016

- for the first quarter - until May 16 in paper form or until May 20 in electronic form;

- 6 months in advance - until August 15, paper or until August 22, electronic;

- 9 months in advance - until November 15, paper or until November 21, electronic;

- for the entire 2016 - until February 15, 2017, paper or until February 20, 2017, electronic.

In what order should I fill out RSV-1?

Form RSV-1 is a title page followed by six standard sections.

All organizations, without exception, need to fill out the title page and the first two sections. The remaining sections need to be completed and submitted only if there is data for them. IN Sections 1 and 2 contains general information about the earnings of the organization’s employees, contribution rates, accrued and paid contributions for pension and health insurance.

Section 3- filled out by companies with reduced insurance premium rates. In this section, they confirm their right to apply a reduced tariff.

Section 4- it contains data on recalculations for previous reporting periods.

Section 5- it contains information on payments and other remuneration accrued for activities carried out in the student team under labor and civil law contracts.

Section 6- individual information about employees is described here. For each employee or working under a GPC agreement, a separate page is filled out containing information about earnings, accrued insurance contributions to the Pension Fund, as well as insurance experience for the last three months of the reporting period.

Form RSV-1

On our website you can download the RSV-1 form for free using the link below:

Keep records in Kontur.Accounting - a convenient online service for calculating salaries and benefits and sending reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat. The service is suitable for collaboration between an accountant and a director.

Everyone who pays insurance premiums and payments to their wards must submit a new unified form RSV-1 to their branch of the Pension Fund. In addition, they must submit information about employees, that is, individual reporting.

More details about this document, the rules and procedure for filling it out will be discussed in this article.

What form is this

RSV-1 stands for "calculation of insurance premiums". The data in the form concerns both accrued and paid insurance contributions for pension and medical items.

Thus, the document form will contain two types of information:

- on insurance contributions for medical and pension items for a specific organization;

- information about each employee who is covered by the insurance clause.

By whom and when is it filled?

Following Federal legislation, this form must be submitted by:

- organizations;

- Individual entrepreneurs who have employees at their disposal;

- individuals who are not individual entrepreneurs, but who have entered into an employment contract with an individual.

As for when it should be taken, it should immediately be noted that the billing period in this case is the entire calendar year. It is divided into 4 periods - first quarter (3 months), 6 months (six months), 9 months, 12 months (year). That is, according to the RSV-1 form, you need to report every quarter, but without resetting the data in each new report, but adding them with new ones. At the end of the year, a final report is submitted and the data is reset.

There are clear deadlines for submission: the form must be submitted a month and 15 days after the reporting quarter, that is, for the 1st quarter it must be submitted before May 15, for the second - before August 15, for the third - before November 15 and for the year - before February 15.

If the enterprise closes, then you still need to submit RSV-1 for the last reporting quarter, and an application for registration of termination of activity should be submitted after its submission. In the case of a lawyer or notary who was engaged in private practice, but decided to cease activity, he must submit the form within twelve days after the decision by the authorized body to cease activity.

If you have not yet registered an organization, then easiest way This can be done using online services that will help you generate all the necessary documents for free: If you already have an organization and you are thinking about how to simplify and automate accounting and reporting, then the following online services will come to the rescue and will completely replace an accountant at your enterprise and will save a lot of money and time. All reporting is generated automatically, signed electronically and sent automatically online. It is ideal for individual entrepreneurs or LLCs on the simplified tax system, UTII, PSN, TS, OSNO.

Everything happens in a few clicks, without queues and stress. Try it and you will be surprised how easy it has become!

Reporting and tax period

The reporting period in this case, as mentioned above, looks very simple - one quarter, the report must be submitted one month and 15 days after the reporting quarter. One has only to say that organizations that were created in the middle of the year must still submit the RSV-1 form, depending on the time when they were registered and began their activities.

Late or non-submission of the form will result in penalties being assessed to the organization. Following the articles of the current legislation, a fine will be charged - 5% of the amount of payments that had to be contributed to the fund.

In this case, the calculation is taken for each month, that is, 5% will have to be paid for each month for which the organization has not reported. But the amount of the fine should not be less than one hundred rubles.

If you do not submit the form within 180 days (calendar, not business) after the end of the reporting period, the fine will increase to 30%. This amount is calculated from the total amount of insurance payments for the entire period for which the organization did not report. The legislation also provides for taking 10% of the total payments, starting from the 181st day for each subsequent month. The minimum fine in this case is one thousand rubles. If you do not submit this form at all, the company will be required to pay all of the above fines, all fees and, in the event of bankruptcy, close down.

Latest changes to the form

The innovations look like this:

- Individual employee information should now be included in the calculation.

- Features of payment of insurance premiums at additional rates (for example, division of payments depending on working conditions) are also taken into account.

- There is a box on the cover page for individuals who use reduced rates for their contributions. It is called “Acquisition/loss of the right to apply a reduced tariff”. If such a right was obtained, the letter “P” is placed, and if it is lost, the letter “U” is indicated. This field should not be filled in when calculating for the first quarter of 2019.

- There are now different deadlines for submitting documents in paper and electronic form. To prepare a standard report on paper, as before, one month and 15 days are allotted from the end of the reporting period. But electronic reporting can be sent after a month and 20 days. If the filing deadline falls on a weekend, returns can be filed on the first business day after the weekend.

Step-by-step filling procedure

How to fill out RSV-1? Let's look at everything step by step:

- First you need to fill out title page. The following data is displayed here:

- Name of the organization;

- her tax identification number and checkpoint;

- organization code according to OKVED;

- information about how many people are insured.

There is a special field called “Adjustment Type”. It is intended for cases when one of the employees of the company or a special commission has identified errors in filling out the form, and the organization or individual entrepreneur resubmits the RSV-1. This field indicates the clarification code:

- 1 – updated insurance premiums for compulsory health insurance;

- 2 – changes in the volume of such contributions to compulsory public health insurance;

- 3 – updated contributions for compulsory medical insurance or any other indicators that do not relate to individual accounting.

In this case, all clarifications must be accompanied by documents on personalized accounting. All documents subject to clarifications should be submitted taking into account the rules that were in force during the period in which the errors were made in the report.

- First section.

This section contains information about insurance payments paid and payments that still need to be paid. Here we should highlight contributions to the Pension Fund that were accrued and paid for 2010-2013. This information is indicated in columns 4 and 5 - information on insurance and savings, respectively. And contributions to the fund from the beginning of 2014 are shown in column 3 (there is no division into the insurance and savings part). Other contributions are reflected in columns 6, 7 and 8 (for example, those for which additional tariffs apply).

As for the information for 2010-2013, the first section has lines, each of which has its own purpose. So, line 100 reflects the debt until 2014. Column 3 contains data on debt or overpayment of contributions to the Pension Fund as of 2015. In the 120th line - payments that were accrued later, in 140 - fully paid contributions and in the 150th line - unpaid contributions for 2010-2013. - Second section.

Data on accrued payments and insurance deposits is displayed here. The section has three subsections that display data about additional tariffs and calculations for them. All employers enter information into subsection 2.1, but 2.2 and 2.3 are filled out only if the employee for whom the contribution was paid works in hazardous or heavy work, respectively. If insurance premiums in the period for which the report is provided were calculated at several tariffs, this section must be completed according to the number of tariffs that were applied. Information in paragraphs 2.2 and 2.3 is provided only by companies whose benefits are 6 or 4%, respectively.

In general, the following factors influence the size of such benefits:- type of work;

- the results of the assessment of working conditions, which was carried out by a special commission after the beginning of 2014;

- results of certification of places of work, which is also carried out after the beginning of 2014.

- Third section.

This part of the form should be filled out only by those individual entrepreneurs or enterprises that have the right to reduce contribution rates. - Fourth section.

It is not always necessary to fill out this section; there are only two cases for this:- Fund employees conducted an audit, as a result of which accruals were made to the amounts for previous periods, these accruals were reflected in the audit reports, and the corresponding decision came into force during the reporting period.

- The employer noticed evidence of understatement of insurance premiums. At the same time, if he has identified understatements in payments for the previous year, he should not fill out section 4; instead, he needs to submit an updated calculation.

The first column of this section is responsible for the serial number of the completed line, as well as the basis for the calculation. The reasons may be as follows:

- 1 – assessment of contributions occurred on the basis of desk audit reports, and prosecution occurred in this quarter;

- 2 – assessment of contributions occurred on the basis of on-site inspection reports, and prosecution occurred in this quarter;

- 3 – the employer independently identified errors and calculated the amount of contributions.

- Section 5.

This section is filled out only by those insurers who pay certain amounts to students working in student groups. Such payments do not require additional contributions to the Pension Fund, but certain conditions must be met:- the student studies at a higher or secondary vocational institution;

- the student is a full-time student;

- information about the student squad in which he works is entered in the federal or local register;

- An employment contract has been concluded between the policyholder and the student.

For such a benefit to be confirmed, it must be supported by two documents:

- student's certificate of membership in the student group;

- certificate of the student's form of education.

These documents should be submitted along with the rest of the RSV-1 form papers.

To learn how to correctly compose a document in the 1C program, watch the video:

In 2019, by a separate order of the Federal Tax Service, a new form for calculating insurance premiums was approved, which is to be used from 2019. The new form actually replaces several previous ones at once.

This change is associated with the transfer of powers to control and verify reporting on assessments of contributions from the Pension Fund of the Russian Federation and the Social Insurance Fund to the fiscal authority of the Russian Federation. The only exception was information on injuries, which is still subject to submission to the Social Insurance Fund. Thus, for 2019, organizations will prepare calculations and report to the tax authorities using a new form.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

It's fast and FOR FREE!

The Pension Fund also retained some powers related to the submission of the current monthly report, and another type of annual report on employee experience was added.

Calculation of insurance premiums

According to paragraph 7 of Art. 431 of the Tax Code, the new form RSV-1 in 2019 must be submitted to the tax office quarterly, before the end of the month following the reporting month (until the 30th day), starting in 2019. The deadlines for submitting the document will be May 2, July 31, October 30 and January 30.

Depending on the number of employees, legal entities and individual entrepreneurs will submit a report in paper form (up to 25 people) or electronically (over 25 people per enterprise).

The report must be submitted by the organization at the location of the main enterprise, or a separate division (if any) to the local branch of the Federal Tax Service. For entrepreneurs, the place of filing will be the inspection closest to their place of residence. When submitting reports by a separate division, no distinction is made whether it has a separate current account or not.

The new calculation form is drawn up similarly to the tax return form, including only indicators related to the billing period - the amounts of contributions already paid and the balance of debt at various points in the reporting period are not reflected in the form.

The form is a report of three sections:

| Section 1 |

|

| Section 2 | Enter information on peasant/farm holdings indicating the amount of annual medical and pension contributions. Each type of contribution has its own. |

| Section 3 | Contains personalized information about insured employees to whom appropriate payments were made during the period. From the personal data of employees, indicate full name, citizenship, year of birth, etc. |

After completing the entire section 3 for all insured workers, the policyholder displays the final value of the calculation of contributions. This amount must correspond to the amount payable reflected in section 1 (or 2).

If there is a discrepancy in the total values of the two sections, as well as if there is a discrepancy in the information about any insured employee from section 3, the inspection officer will not accept the report. In this case, the policyholder will be sent a notification with the policyholder’s obligation to correct errors in calculations when submitting the document electronically within five days.

If the notification was sent by mail, a 10-day period is given to correct the defects. If you respond in a timely manner, the deadline for submitting the report will remain the original one, without charging a fine for late submission of the document.

Cancellation of the RSV-1 form in 2019

The main reason for the revision of all types of insurance reporting is the transfer of rights to administer contributions to the fiscal government body. As a consequence of the innovations, the previous forms 4-FSS, RSV-1 were canceled and a new unified type of reporting on insurance premiums was introduced.

The change also affected the sphere of legislative regulation: norms and provisions for the calculation and payment of contributions were added to the Tax Code of the Russian Federation. It is expected that tax employees will begin to check the new report more thoroughly than was previously done by the Pension Fund of Russia and the Social Insurance Fund.

The cancellation of the RSV in 2019 and the 4-FSS became the main event in the field of reporting on insurance premiums.

The change takes effect from the first quarterly report of 2019. A similar deadline is established for updating the 4-FSS form submitted to the FSS.

Please note that the innovations regarding the new powers of the Federal Tax Service and new forms begin to apply only with reports for 2019. For previous years, reports must be submitted in the same format and by the same deadlines: February 15 on paper, February 22 - electronically.

Unified reporting

Unified reporting on insurance premiums was approved and regulated by a separate order of the tax service No. ММВ-7-11/551 in 2019. The main purpose of the new report was to replace the vast majority of forms that were previously submitted to the Social Insurance body and the Pension Fund of the Russian Federation.

A single calculation will be made according to the established form once a quarter, thus the monthly submission of some reports has been cancelled. The document will include information from four previous reports RSV-1, RV-3, RSV-2 and 4-FSS with the exclusion of duplicate values, making the task of filling out the form easier.

A single calculation can be prepared and transmitted in paper form (for up to 25 employees) or electronically via a special communication channel with the document certified by an electronic digital signature.

From the previous monthly reports submitted to the Pension Fund, only the document in the SZV-M form and a new report on the insurance length of employees remained. All updated information for previous periods is also subject to submission to the Pension Fund.

How to make calculations

The unified calculation report consists of several sections covering the reflection of several indicators:

- title plate;

- information about individuals who are not entrepreneurs;

- information on financial obligations to pay contributions;

- calculations of accruals for compulsory health insurance and health insurance;

- calculations of contributions for compulsory social insurance, including indicators for temporary disability and maternity;

- decoding of funds paid within the framework of federal budget funding;

- accompanying applications giving the right to a reduced insurance rate;

- combined information on insurance obligations for contributions from the heads of peasant/farm enterprises;

- data on insurance premiums required to be transferred for employees of a peasant/farm enterprise, including its manager;

- personal information about all insured employees.

Not all form sheets must be turned in. The sheets are filled out in accordance with the sample, based on the specialization and area of activity of the enterprise.

The following sheets are required to be completed:

- title plate;

- section 1 (1.1 and 1.2);

- appendices 1 and 2;

- section 3.

If the policyholder pays premiums using additional or reduced tariffs, subsections of Appendix 1 (1.3.1 - 1.3.3 and 1.4), as well as Appendix 2, 5-10, are completed. If there are expenses for payments in connection with compulsory social insurance for temporary disability or maternity, appendices 3 and 4 are filled out.

To the Federal Tax Service

The procedure for submitting and deadlines for submitting a report on a single calculation is regulated by order of the Federal Tax Service dated October 10, 2016. The same document reflects information on the format for filling out information and making calculations for 2019. It should be remembered that the order does not apply to previous reporting periods, which must be submitted to the Pension Fund and the Social Insurance Fund in accordance with the previously valid rules.

To the social insurance fund

In 2019, changes are expected in the FSS body. Of all previously submitted information, only truncated information under 4-FSS is subject to control. According to Order No. 381, adopted by the FSS on September 26, 2016, of all the pages of the form, only data on injuries and payment of insurance coverage remained. Thus, there was only a partial abolition of reporting to the Social Insurance Fund, affecting payments for maternity and illness.

The injury report in 2019 retained the same form, but adopted a truncated version. As for the information for 2019, it is still submitted and reported to the FSS on the previously valid forms. The deadline for the report for 2019 is January 20 (on paper), January 25 (electronic form).

An example of filling out a unified reporting form

A single calculation must be submitted in a single file, without breaking the report into batches, as was previously accepted under RSV-1. You can download the form above.

When filling out the form, you should adhere to the following approximate sequence:

- Information about sick leave, maternity benefits, and benefits is reflected in Appendix 3, Section 1, and is also entered in line 070 of Appendix 2.

- 9 sheets of the form are required to be filled out, including the title page, section 1 and section 3, or section 2 and section 3 with the completion of appendices in the case of a reduced or additional tariff.

- The first to fill out is the title page, reflecting information about the taxpayer number and checkpoint. Subsequently, this information will be displayed on all other pages of the form.

- The pages are numbered and indicated on the form.

- Section 3 provides information about all employees insured at the enterprise, taking into account information for the last quarter.

- When filling out subsection 1.1 of appendix 1 indicating pension contributions, you should check the information; their amount must coincide with the total value for all employees (total amount for section 3).

- If information is submitted for 1 employee, the data from subsection 1.1 is transferred to section 3.

The procedure for submitting calculations in the new year

According to the new rules, a quarterly reporting procedure is provided. The last day for transmitting a single calculation to a Federal Tax Service employee is the 30th day of the month following the expired reporting period. This period is the same for all legal entities and entrepreneurs and is established in accordance with the provisions of tax legislation.

Thus, the nearest date for submitting a single calculation for the first quarter in 2019 is set on May 2. This transfer is solely due to the transfer due to non-working holidays.

If an organization employs more than 25 employees, a single calculation is prepared only in electronic form. For smaller organizations, it is possible to submit a document on paper. For officials responsible for submitting information to the Federal Tax Service, a single date for submitting calculations has been established. Regardless of the type of documentation submitted (both paper and electronic media).

Where to submit the document

Due to the absence of any transitional provisions, you should determine in advance which type of reporting should be submitted to which government agency.

Since the innovations in Chapter 34 of the tax legislation come into force only at the beginning of 2019, all previous reporting periods must be subject to accounting and control according to the previous scenario, i.e. Form RSV-1 for the reporting periods of 2019 is subject to submission to the Pension Fund.

If there is a need to make clarifications in the RSV-1 for all previous periods of 2019 and earlier, the policyholder contacts his Pension Fund branch. These forms are subject to desk verification by Pension Fund employees.

Submission of reports on contributions for compulsory insurance in case of industrial accidents and occupational diseases is subject to submission to the Social Insurance Fund. This fund retains the right to monitor and verify the correctness of expenses in relation to sickness and maternity benefits.

Possible errors and penalties

If an error in calculations is identified, the actions of the policyholder filing the report will depend on whether the amount of premiums was underestimated as a result of the error. If the contributions turned out to be insufficient, the policyholder must submit an updated calculation.

If the amount of contributions exceeds the submitted information, the submission of clarifications remains at the discretion of the policyholder. In the updated calculation, the employer fills out the same sheets that were submitted earlier. If necessary, additional sections and sheets are attached.

The updated calculation also requires the mandatory submission of personalized information for each of the insured persons who need adjustment or addition in section 3. Thus, there is no need to fill out all the information about all employees in the update. The fields in section 3 must be filled in completely.

Transition period

The law does not regulate the situation of the transition period. This means that a new report is filed from reporting periods 2019 onwards.

All previous periods, including updated reports for 2019, 2019. must be submitted in the same formats, on the same forms, to the authorities that were supervisory before the transition to the new calculation, i.e. in the Pension Fund and the Social Insurance Fund. It should be noted that December contributions for 2019 are not reflected in the 2019 documents, despite the fact that they were transferred in 2019.

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.