Debit credit how to understand with examples. Debit and credit in accounting for dummies. What does "balance" mean?

Debit and credit

Debit And credit- standardized methodological accounting techniques. They reveal the possibilities of economic processes and their direction, and they also set boundaries for these possibilities.

Debit- left side of the ledger account. For active and active-passive accounts, an increase in debit means an increase in the property or property rights of the organization. For passive accounts, an increase in debit means a decrease in the organization's own funds (sources). Comes from Lat. debet, which means "he must". The Latin word for this term is debitum - “debt”.

Credit- the right side of the ledger account. For active and active-passive accounts, an increase in credit means a decrease in the value of property or property rights of the organization. According to passive accounts, an increase in credit means an increase in the organization's own funds (sources).

There are two types of accounts: active and passive. Passive means borrowed funds; active - placed funds of a company, enterprise or bank. For active accounts, debit is income, credit is expense. For passive ones, credit is income, debit is expense.

Basic information

The left side of the accounting account, denoting (to simplify somewhat) the property or property rights of the enterprise in the context of the facts recorded in the account.

There are concepts debit balance invoices for a certain date and debit turnover accounts for a certain period of time.

Debit balance- monetary assessment of the value of property or property rights of an enterprise recorded in the account at a certain point in time.

Debit turnover- the total monetary value of all business transactions over a period of time that led to an increase in property/property rights or a decrease in the source of property formation, which are recorded on the account in question.

In active accounts, funds move from credit to debit.

In passive accounts, funds move from debit to credit.

Strictly speaking, when reflecting business transactions, debit turnover in active accounts means an increase in the amounts taken into account (active accounts usually take into account the property or property rights of the enterprise or costs). Debit turnover in passive accounts means a decrease in the amounts taken into account (passive accounts usually take into account revenue and various types of debt of the enterprise).

Frequently used term debit posting has no independent meaning; the debit of a transaction means the debit of the account that the transaction affects.

The table below indicates on which side this or that article increases or decreases (at the moment):

| Type | Debit | Credit | Explanation |

|---|---|---|---|

| Assets | + | − | If the turnover is debit, then the Property “increases”; if it is credit, it’s the other way around. The balance (balance) can only be debit |

| Commitment | − | + | If there is credit turnover, then the company’s obligations to other “market players” (companies) increase. If it's debit, it's the other way around. The balance (balance) can only be credit |

| Profit | − | + | If the turnover is debit, then this is a loss (the company received less assets than the amount of liabilities incurred). If the turnover is credit, on the contrary, it is profit. Loss reduces capital, profit increases |

| Income | + | − | Means that the firm received income from the operation (the source of the firm's new assets) |

| Expenses | + | − | Means that the company incurred an expense from the operation (where the company's assets were spent) |

| Capital | − | + | Capital decreases, it is clear that this is due to losses (excess of expenses over income) |

Notes

Links

- // Encyclopedic Dictionary of Brockhaus and Efron: In 86 volumes (82 volumes and 4 additional ones). - St. Petersburg. , 1890-1907.

Wikimedia Foundation. 2010.

See what “Debit and credit” are in other dictionaries:

magazine "Debit and Credit"- magazine "Debit and Credit" (1914) Monthly reference magazine of finance, trade and industry, published in St. Petersburg. Its publisher was V.I. Riedel. The ideas of the magazine "Debit" were taken as a basis: exposing... ... Technical Translator's Guide

MAGAZINE "DEBIT AND CREDIT"- (1914) monthly reference magazine of finance, trade and industry, published in St. Petersburg. Its publisher was V.I. Ridel. The ideas of the magazine Debet were taken as a basis: exposing criminals and debtors. Only six came out in a year... ... Great Accounting Dictionary

Accounting Key concepts Accountant Accounting Revolving balance sheet General ledger Credit Debit Cost Double... Wikipedia

- (lat. he believes) 1) in accounting means: “I must”, or “I have to issue” 2) the right expense page in the accounting books. Dictionary of foreign words included in the Russian language. Chudinov A.N., 1910. CREDIT 1) the ability to borrow money,... ... Dictionary of foreign words of the Russian language

Ushakov's Explanatory Dictionary

1. CREDIT [re], credit, husband. (lat. credit he believes) (thumping). The account of a person or institution lending something; ant. debit. Debit and credit. 2. LOAN, loan, husband. (lat. creditum debt). 1. units only Commercial trust; provision of goods... Ushakov's Explanatory Dictionary

credit- and credit. In meaning “account of debts and expenses” credit. Debit and credit. In meaning “providing valuables (money, goods) on credit; confidence; a sum of money released for something" loan. Issue goods on credit. Use credit. Loans for... ... Dictionary of difficulties of pronunciation and stress in modern Russian language

Credit- (Credit) A loan is a transaction for the transfer of material assets on loan. The concept of a loan, types of loan, registration, conditions and issuance of a loan Contents >>>>>>>>>>>> ... Investor Encyclopedia

Accounting Key concepts Accountant Accounting Trial balance General ledger Debit Cost Double entry Standard methods Cash and cumulative methods RAS / IFRS Financial statements Bu ... Wikipedia

credit- I. (basym 1 їektә). Isәp hisap kenәgәsenen chygymnar yazyla torgan yagy; kirese – debit. II. CREDIT – (basym 2 їektә). 1. Өleshlәp tүlәү sharty belәn bilgele ber srokka goods satu yaki akcha һәm matdi kyimmәtlәrne percent alu isәbenә berychka birep… … Tatar telen anlatmaly suzlege

90 account, what is reflected in debit and credit?! To understand the process, we will pay attention to some aspects of business activity based on accounting documentation.

Each enterprise undertakes to conduct monthly settlement activities for expenditure items, as well as for income and profit. There are lines in accounting documents that are used for their rational execution.

There are 3 such elements in total (90th, 91st, 99th), one of them is “Sales”. The total results for the entire reporting period are summed up, and after that the activity of the enterprise can be recognized as profitable or unprofitable.

Accounting activities are associated with a set of difficulties, but if you correctly compile alphanumeric entries, you can achieve good results and avoid various confusions and misunderstandings within this aspect.

Consistent implementation of actions will help the accounting department of the company take the company to another level of development and understand all the rules and subtleties of document accounting.

In the context of the material under consideration, we are most interested in the sales account, which is used to reflect actions related to the sale of product items, the provision of services and work.

In addition to these “merits,” this account is the main one in the entire accounting of VAT, excise taxes, and export duties, which are included in the total price of the product. Credit 90 has a large number of features that will be carefully and thoroughly studied within the framework of this material.

Why is it necessary to use it?!

Regardless of the type of economic activity that a particular enterprise conducts, all amounts characterizing profit are recorded in this account under the name “Sales”. It is extremely voluminous and has an extensive and varied structure.

It contains a large number of profitable and costly activities, which are recorded in separate analytical accounts of the balance sheet.

If an enterprise did not have the ability to collect this kind of information, it would be difficult for it to understand the sources of profit and areas of costs on its own.

By summarizing materials and grouping them on this account, a subtotal of sales is formed every month. And the result obtained at the end of the year is sent to documentation called “financial statements”.

Thus, this line is necessary in order to display all movements of working capital associated with the sale of product units.

Features and characteristics of the account!

To systematize information about profitability, the paragraph in question is used. In the counting plan, it is listed as an active-passive phenomenon, that is, it can partially be active in nature and at the same time be considered passive.

There are only a few elements by which the final amount of revenue and cost are measured:

- varieties of finished product units;

- works and services for any purpose;

- purchased goods to complete food units;

- indication of construction, installation and repair activities;

- product groups;

- cargo transportation services;

- cargo handling;

- rental of property;

- transfer of authority over intellectual property rights.

These are the characteristics of an account in transaction accounting. All of them play an important role in the process of carrying out commercial work and its accounting.

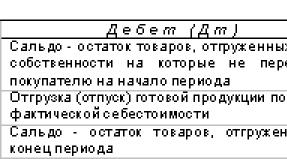

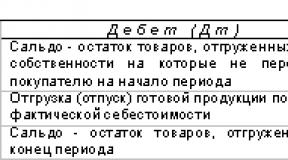

What is reflected in it in accounting?!

According to the debit of this line, the appearance of a formed expense complex associated with production activities is observed. This indicator is expressed in the cost of the product.

If this measure is reflected in the posting, the credit column may contain areas such as 41, 43, 44, 20. If we take into account credit 90, then it indicates the final indicator of the revenue that was received at the reporting time. Debit turnover in these postings is reflected in section 62.

For firms that specialize in the production of agricultural products, the observation of the dimensional cost indicator was revealed in accordance with the planned values.

There is no reflection in the balance sheet, since it is reset to zero at the end of the reporting period. This occurs according to certain economic rules, and only experienced accountants will be able to carry out this event.

If we take into account the general scheme of this direction, we can note that it looks something like this.

- Debit 90. Within this column, the reflection of expenses in the form of cost is noticeable. Value added tax and sales costs are also included in the price. The result is summed up by the total value of expenses.

- Credit 90 account shows a set of income areas expressed by revenue from the sale of product units. The balance includes the amount of income elements.

This is what this line looks like within the framework of correct and rational accounting. If you count all transactions on it correctly, then the result will be obtained quickly, and it will also be able to reflect in detail the economic reality and the main commercial parameters.

Structure and purpose of components!

Conducting activities in accounting involves taking into account its structural elements, which are also presented in a wide variety.

We will look at each of them separately to draw certain conclusions.

- Revenue. 90.1. In this case, income from sales is reflected. In this case, it does not matter which product units underwent the sales process - finished products or works, services and other services.

- Cost of units sold. The mini-account that reflects this indicator looks like 90.2. Here, accounting measures are taken for the cost of products to be sold.

- VAT. This concept often appears within the framework of accounting, but here it finds a specific application. Its reflection occurs according to 90.3. The VAT amount is expected to be displayed.

- Excise taxes. 90.4 must be used for the purposes of accounting actions related to excise taxes, which are attributed to the price of sold product units.

- Export duties. This is serial number 90.5. Such elements have a close relationship with the transferred commodity items.

- Sales profit/loss. An element that shows the total result of the enterprise’s activities at the end of each period.

It can be noted that if we are talking about income, then they are noted in the loan. If we talk about expense areas, then they are reflected in debit.

May be of interest material: " »

Features of analytical accounting

Analytics is carried out on elements that are subject to zeroing and closing at the end of each reporting period, and also transfer their residual values regarding profits and losses.

A card may have several characteristic subaccount turns.

- 1 – in relation to the proceeds;

- 2 – in relation to cost;

- 3 – in connection with the amounts of taxes;

- 4 – on accounting for excise duties;

- 5 – for payment of export duties and deductions;

- 9 – for the purpose of summing up the cumulative total.

Amounts that were accrued during the month, 1 - 4, are necessarily written off under the total amount. Next, a complete reset occurs through wiring with the 99th element.

For the purposes of analytical accounting operations, it is necessary to take into account a separate reflection for each type of product line.

Postings to the control unit

From a practical point of view, elements with serial numbers 90.3 – 90.5 are not used by all enterprises. To some extent, this has a clear mutual connection with the aspect that each tax system for an object has its own specifics, as do different areas of activity.

Typical transactions are presented in two main blocks - debit and credit. There are several groups of postings that reflect various financial activities, and we will look at the main areas.

Postings involving revenue recognition

Here are a few financial and accounting transactions that will allow you to determine revenue and properly record it.

- D76K90.1 – we are talking about companies that are considered other creditors and debtors;

- D50K90.1 - in this situation, correspondence involves an indication of the amount of income of individual divisions;

- D50 (as well as D55, 51, 52) – in the event that proceeds from certain transactions are received at the seller’s address;

- D79K90.1 - in this situation we are talking about indicating the amount of income from all transactions for the sale of various assets and finished products completed in a certain period of time;

- D98K90.1 - within the framework of this operation, it is assumed that part of the proceeds will be attributed to income related to future periods when making advance payments.

So we looked at the features of this direction. And now it makes sense to consider the list of auxiliary wiring, which are also quite often used in practice.

Additional postings

Their set is not so wide, however, it is popular and in demand.

- D90.2K41 (as well as 43, 40) - in the process of writing off commodity items or categories of finished product units;

- D90.2K42 - in the process of reflecting trade margins within the framework of accounting.

There are several additionally used records that display a set of information about commercial work.

Total sales result based on monthly results and its formation

The calculation of turnover in all areas is carried out at the end of each month according to the calendar, and after that the financial result is displayed.

It can be positive or negative, which is determined in a certain way.

- The balance is determined for all aspects, if any;

- After this, the total turnover is added up, including several other important events.

The next month, this entire procedure is repeated, and the balance is transferred to each section of the newly opened sales section.

Similar manipulations are repeated until the end of the year. So we looked at what the credit 90 account shows and what transactions are usually displayed in it.

The procedure for determining the results for the year and a sample of actions

For every accounting specialist, the approach of the year to the end symbolizes that the accumulating element numbered 90 must be brought to zero. To do this, each mini-account is closed and a debit or credit of 90.9 is used.

This list of activities is carried out according to the following scheme.

- The credit balance is subject to zero. For this, specialized wiring D90-1K90-9 is used.

- In order to reduce the debit balance to zero, the corresponding entry D90-9K90-2 is used.

- Subsequently, by analogy, the value added tax amount, which was accrued at 90-3, is written off. The exact wiring is as follows: D90-9K90-3.

- If there are duties and excise taxes, then it is necessary to determine the turnover and charge them to debit.

- Next, in the column of profit or loss from sales, the final balance is calculated, as a result of all transactions it is reduced to zero.

It turns out that we were able to fully complete the closure, and starting next year it will be opened for accounting for new transactions within the framework of business activities.

Conclusion, or summary of the above aspects!

The “Sales” column acts as an important and complex element of the accounting activities of any enterprise. It is used to maintain accounting transactions for all income and expense types of activities.

Through this element, all operations that are associated with shipments of commodity and product units are accumulated.

In addition, sections can perform other functions, for example, reflecting accrued value added tax, as well as other fees and contributions that are related to the transferred product units. It must be studied by accountants very carefully in order to rationally calculate the result of financial activities based on the results of the annual period.

Thus, following the general rules, principles and recommendations for making entries in the balance sheet will allow the company to avoid problems with the tax authorities, as well as prevent all sorts of confusion and misunderstandings in paper terms.

There are several meanings and concepts that are displayed through this account, and if the operations are carried out correctly, the accountant can be calm about the commercial activity in general and about its elements in particular.

Many people find accounting difficult to understand, confusing and even mysterious! But nothing is impossible and it is possible to understand even such a complex subject. Let's try to understand two basic terms on which, in principle, the entire accounting system rests.

Origin of terms

The words themselves " debit" And " credit"came to us from the Latin language. Word " debit" means debt, and " credit" - believe. And from an accounting point of view, a debit means an increase in an asset (cash, materials, fixed assets) and a decrease in a liability (loan obligations, retained earnings, authorized capital), and a credit, on the contrary, means a decrease in an asset and an increase in a liability. That's right, it's not just the income and expenses of the enterprise. It is worth knowing that, unlike the banking sector, where borrowed funds are called loans, the accounting term “ credit"pronounced with emphasis on the first syllable!

For the first time, the double entry system in accounting was proposed by the mathematician Luca Pacioli back in 1494. In fact, he did not invent anything new - he simply systematized the accounting system that was then accepted among merchants. In a nutshell, double entry means that one transaction action is reflected in two accounting accounts at once, using debit and credit.

Let us clarify right away - the company accounts for all assets and liabilities in accounting accounts regulated by the Chart of Accounts, approved back in 2001. In this Plan, each asset and liability is named and has its own number. Materials are accounted for on account No. 10, settlements with customers - on account No. 62. Accountants say "10th account" and "62nd account". All business transactions of the company related to its activities are reflected in these accounts using postings. What is wiring? This is exactly the same double entry using debit and credit of these accounts!

Debit and credit for dummies using an example

Let's try to understand these concepts. Let's take a separate business transaction, the example of which will clearly show how double entry is made and how debit and credit are used.

For example, an organization paid a supplier for a shipment of goods. It is obvious that her accounts receivable, that is, the amount that third parties or organizations owe her, has increased - the part of the funds transferred from the current account was debited by the accountant to account 60, “Settlements with suppliers and contractors.” At the same time, the company lost part of its assets, because a certain amount left the current account, and the asset in account 51 – “Current Account” – decreased.

Accounting is a strict, clearly structured system that does not tolerate discrepancies. Since ancient times, it has been the case that when recording a business transaction, the posting always looks like this: first there is a debit, then a credit. Now accountants actively use computer programs, but even there, when opening a business transaction, you can easily observe this posting structure - in the table we will see a debit on the left and a credit on the right.

So, our posting will look like this: Debit 60 Credit 51, “Payment to supplier for goods.”

Next, the company received the paid goods from the supplier. What happened? First of all, the asset of the organization called “Goods”, account 41, increased, because the quantity of goods in the warehouse increased. And at the same time, the supplier’s receivables to the company decreased - again, account 60 appears, but for a loan.

Debit 41 Credit 60, “The supplier delivered previously paid goods.”

This is how the double entry system works, and you can clearly see how the debit and credit of accounts are recorded.

Mezentseva Vasilisa

Instructions

To determine where debits and credits are, look at a business transaction. Typically, a debit represents what is owed to you, and a credit represents what you owe. For example, you are working with some counterparties. The amount you must pay for the goods will be reflected in the credit balance. In the event that buyers owe you, the amount owed will be taken into account as a debit.

If you see a business transaction journal in front of you, pay attention to the fact that all transactions are recorded twice, that is, there will be the name of the movement, and then two columns. To determine which of them is a debit and which is a credit, it is enough to know that debit is always recorded on the left side, and credit on the right.

To determine debits and credits, you must know that if the account is active or active-passive, an increase in the debit balance leads to an increase in the organization's assets. Whereas an increase in credit on these accounts leads to a decrease in the value of the property.

The balance is always tied to a specific period. In the “pre-computer” era, the accounting period was . The initial balance was transferred from the final month, but the ending balance of the current month had to be calculated manually. Now in accounting programs balances are displayed on an arbitrary date.

Active accounts. The reporting period begins with accounts, debit balances (Db_Start). Receipts to these accounts are reflected in debit turnover (Db_Turnover), and disposals are reflected in credit turnover (Cr_Turnover). The period ends by counting debit and credit turnover and displaying the final balance (Db_End), which will then move into the next reporting month: Db_End = Db_Start + Db_Turn – Cr_Turn

The reporting period begins with accounts that have credit balances (Cred_Start). Receipts to these accounts are reflected in the credit turnover (Kr_Turnover), and disposals are reflected in the debit turnover (Db_Turnover). The reporting period ends by counting credit and debit turnover and displaying the final balance (Kr_end), which will then move into the next reporting month: Kr_End = Kr_Start + Kr_Turnover – Db_Turnover

Active-passive accounts. Such accounts have both a debit and a credit balance. The final balance is displayed as follows: If the sum Db_Start - Cr_Start + Db_Turn - Cr_Turn is greater than zero, then it is placed in the final balance in debit, and zero is written in credit. Otherwise, the minus is removed and the received amount is written to the final balance of the loan, and zero is written to the debit.

In real accounting, each account has its own role. For example, the “Salary” account. Here the accounting period is most often a month. The incoming balance for each personal account is the unpaid salary of the previous month (debt owed by the company), or the overpayment of wages last month (debt owed by the employee). Accordingly, these are the debit and credit parts of the opening balance. You need to calculate the final balance (essentially, the salary of the current month) according to the following scheme: Debt due to the enterprise – Debt due to the employee + Accrued – Withheld. If the result is positive, you have something to receive this month.

Sources:

- ending loan balance

In accounting, a balance is the difference between the debits and credits of a particular account. This indicator is used to identify balances for a given type of economic assets for a certain period and is calculated when compiling a balance sheet. In order to find the balance, you must first determine the nature of the account.

Instructions

Make a table that consists of 7 columns. The first is intended for the name of the account on which the calculation will be carried out. In the second and third, indicate the credit and debit balances of the accounts that were recorded in the accounting records at the beginning of the reporting period. The fourth and fifth columns indicate information about turnover for the reporting period. The last two columns are used to enter data on the debit or credit of the calculated balance.

Determine the nature of the account for which you need to find the balance. Active accounts are characterized by the fact that the receipt of funds on them is recorded as a debit, and the disposal as a credit, while they characterize the state and changes in economic assets. To record the status and changes in sources of funds, passive accounts are used, in which an increase is recorded as a credit and a decrease as a debit. Active-passive accounts simultaneously reflect the properties of property and sources of formation.

Calculate the balance for the active-liability account. Sum up the debit balances and turnovers and subtract the credit amount of balances and turnovers from the resulting value. If the indicator turns out to be positive, then it is recorded on the debit side of the balance, if negative, then on the credit side without a minus.

Prepare a balance sheet every month to ensure that your accounting is done correctly. Based on the results of this table, you can easily prepare an annual balance sheet or other accounting report.

Video on the topic

Average annual turnover refers to the rate at which funds pass through the various stages of production. Moreover, the greater the turnover rate of working capital, the more profit the company will receive.

Instructions

Calculate the asset turnover and then the duration of one turnover. In turn, in order to calculate asset turnover, divide the amount of revenue by the amount of the average annual value of assets: Kob = B/A, where A is an indicator of the average annual value of assets (the sum of total capital); B is the value of revenue for the analyzed period (for example, year). The resulting value will show you how much turnover is generated by funds invested in the assets (property) of the enterprise per year. As the value of this indicator increases, business activity increases.

Divide the duration of the period under consideration by the indicator, thus you will determine the duration of one revolution. In this calculation, it should be taken into account that the smaller the sum of this value, the better for the company.

Calculate the coefficient of consolidation of assets involved in turnover. It is equal to the average amount of all current assets for the period under review, divided by the organization’s revenue. This coefficient can show you how much working capital was spent per ruble of goods sold.

Determine the duration of one operating cycle. It is equal to the duration of the turnover of materials and raw materials + the duration of the turnover of all finished products + the turnover of work in progress + the duration of the turnover of the amount of receivables. Such an indicator must be calculated over several periods. If its growth is noticed, this will indicate a deterioration in the company’s position in its business activity. At the same time, a slowdown in capital turnover is possible.

Find the duration of one financial cycle. To do this, subtract the duration of one turnover of accounts payable from the duration of the operating cycle. In turn, the smaller the value of this indicator, the greater will be the business activity of the organization.

Sources:

- Solving problems in enterprise economics

When analyzing a company's activities, economists are faced with such a concept as the opening balance. In general, the balance is calculated as the difference between the debit and credit of an account. The opening balance is determined based on previous transactions.

Instructions

To understand balance, consider a simple . Let's say you went to the store on April 30th. We bought groceries worth 2,000 rubles. On the same day you received a salary of 10,000 rubles. The next day you went shopping again and spent 1000 rubles. You need to determine the opening balance. This indicator is equal to the final balance of the previous period. Thus, on April 30 you received 10,000 rubles and spent 2,000 rubles. The cash balance at the end of the day will be 10,000 - 2,000 = 8,000 rubles. This amount will be the opening balance on May 1.

If you need to calculate the balance of an enterprise, create a card for the required account. Let's say you want to calculate the cash balance of an organization at the beginning of the reporting period. To do this, look at the balance of account debit 50 and credit for the previous period. Calculate the difference. The amount received will be the initial balance.

If you use automated programs in your work, you just need to look at the account information. Let's say you want to know the opening balance as of May 1, 2012. Create a card indicating the period from May 1st. The required indicator will be indicated in the very top line. You can also view it by setting the period to April 30, 2012, in which case the balance will be indicated at the very end.

If you want to calculate the opening balance manually, select all the necessary documents. Let's say you need to calculate an indicator for accounts payable. To do this, prepare for the previous period all invoices from counterparties, statements of current accounts and cash receipts. On a piece of paper write “Debit” and “Credit”. Everything you have given is put on the loan; everything received is on debit. Sum up your expenses and then your income. Calculate the difference. The amount received will be the balance at the beginning of the next period.

Sources:

- opening balance is

For self-checking of accounting, a balance sheet has long been invented. Balance sheet is balance, its meaning is that nothing goes anywhere in the enterprise, and assets are always equal to liabilities. The balance sheet consists of the total debit and credit turnover of the accounting accounts for the reporting period.

What are credit and debit

Credit and debit (emphasis is always placed on the first syllable) are concepts that are used in accounting to monitor the business processes of a company. There are a lot of accounting accounts, more than a hundred, they were created in order to reflect in more detail each operation of the company. Each account has its own number and name.

Debit refers to all assets of the enterprise, that is, what it has as of the current date. This could be cash in bank accounts, cash in the cash register, the total cost of materials in warehouses, the sum of the cost of fixed assets, etc. The higher the assets of an organization, the more successful it is considered.

Liabilities or credit turnover are debts and sources of asset formation. Debts include: arrears of wages, debt to contractors, depreciation, debt to the founders or owners of the company for the distribution of profits. Sources of asset formation are, for example, authorized or other capital.

What is debit and credit turnover used for?

Each account is recorded separately. It looks like this: the debit in the account section is written on the left side, and the credit on the right. Each transaction is reflected in the posting. A particular account may be used frequently during an accounting period. Amounts are recorded in the debit or credit columns, depending on the type of transaction. According to the nature of the account balance, they are divided into active, passive, active-passive.

An increase in debit turnover in active accounts or active-passive accounts means an increase in the organization’s property or the availability of claims. An increase in loan turnover, on the contrary, shows a decrease.

In passive accounts, transactions are reflected in reverse. These accounts exist so that it is clear where and through what funds the organization received funds.

At the end of the period, debit and credit turnovers are summed up separately. This results in the final balance. If the amounts of turnover on debit and credit coincide, then the account is closed as it is reset to zero. There are a number of accounts that necessarily have a zero balance at the end of the period, mainly these are accounts to which expenses are written off.

The meaning of debit and double entry. The point is in the name - twofold. That is, one transaction must be recorded twice, using two accounts. On the first account, the transaction amount goes to debit, on the second – to credit, and a balance is obtained. Therefore, the balance must always converge. If the total debit turnover does not add up

ABC of an accountant

In order to effectively conduct business activities and make the right management decisions in a timely manner, it is necessary to monitor business processes and ongoing business operations in the current time. To do this, data from primary documentation is grouped in accounting accounts, why this data is systematized, analyzed and the management of the enterprise is able to draw conclusions about the results of their efforts.

Accounting is based on the principle of double entry: each business transaction must be reflected in the Debit and Credit accounts, i.e. acquisitions must equal expenses. It cannot happen otherwise, since means move from one state to another, but cannot appear out of nowhere and disappear without a trace. It is on this principle that the entire accounting system is built, and the very concept of “balance” means equality when this rule is met.

Each business transaction affects two accounting accounts: if funds are received at the cash desk, the source of their receipt must be indicated; When these funds are spent, the accounting reflects the category of expenses: whether it is a payment to a supplier, an employee’s salary or tax payments - for each of them there is its own category in the Chart of Accounts. In addition, the double entry principle eliminates the possibility of making an accounting error: if it occurs, the balance will not be reconciled.

How to find errors in accounting?

All errors in accounting are of two types: intentional and unintentional, but more often than others the following system errors are made:

During primary accounting, when transactions are reflected in accounting without relevant documents;

- in case of untimely reflection in accounting.

- when making incorrect entries. In this case, accounting data is distorted;

- in the assessment, may be associated with violations of the rules of primary accounting, calculation of the amount of depreciation charges;

- specific errors can occur when computers malfunction, when using incorrect accounting programs, when there is a sudden power outage, or when malicious computer programs are introduced into the system.

In all cases, the most effective method for finding accounting errors is to conduct an inventory, when the actual balance is reconciled with the accounting balance. In this case, it is possible to identify facts of incorrect registration of valuables and theft. It will also help to conduct reconciliations with counterparties regarding the receipt and consumption of inventory items.

When compiling a balance sheet manually, an experienced accountant can “by eye” see incorrect entries, as well as track the movement of funds through debits and credits of accounts. In addition, it is useful to use the logical control method, with the creation of “control points”, the values of which must match in correct reporting.

Accounting for any enterprise is based on the fact that all its assets and liabilities are reflected in the accounts and balance sheet. It’s just that some fall into the category of assets, while others fall into the category of liabilities. What is this distribution based on, and how can items be correctly allocated to different balance sheet columns? It all depends on what meaning these two characteristics carry. Let's try to understand this issue in more detail.

Definition

Debit- this is the left side in the accounting account, and if the account is active or active-passive, then it reflects the increase in the property rights of the enterprise. In the case when the account is passive, the debit reflects an increase in liabilities or a decrease in the sources of the organization’s own funds.

Credit- this is the right side in the accounting account, and if the account is passive, then it reflects the increase in the company’s own funds and property rights. If the account is active or active-passive, then the loan will reflect a decrease in the value of the property owned by the company.

Comparison

Their differences must be considered through the prism of the activity or passivity of the accounts, since it is on this indicator that what these two concepts reflect depends. So, if the account is active or active-passive, then the debit reflects the increase, and the credit reflects the decrease in the property of the enterprise. For example, the debit of account 50 “Cashier” reflects the receipt of cash at the enterprise’s cash desk, and the credit of the account means their write-off, that is, an expense.

If the account is passive, then the situation is mirrored, that is, the credit reflects the increase in property rights, and the debit reflects their decrease. For example, the credit of account 66 “Settlements for short-term loans and borrowings” reflects an increase in the amount of borrowed funds, and the debit indicates the write-off or return of these funds.

As a result, debit balances on accounts fall into the assets of the balance sheet, and credit balances into its liabilities.

Conclusions website

- Debit is the left side of the account, and credit is the right.

- If the account is active or active-passive, then the debit reflects the increase in the property of the enterprise, and the credit reflects its decrease.

- If the account is passive, then the credit reflects the increase in the organization’s debt obligations, and the debit reflects their decrease.

- Debit balances for all accounts fall into the active part of the balance sheet, and credit balances into the passive part.