Accounting for completed work and their sales. Accounting for sales of products, works, services. Accounting for sales of products, works, services

The sale of products completes the circulation of the organization’s funds, as a result of which it is possible to use the proceeds received to make settlements with suppliers of materials, with employees for wages, with the budget for taxes and fees, payments to extra-budgetary funds, with the bank for loans, and other creditors.

The sale of products, works and services should allow not only to reimburse the costs of their production and sales, but also to make a profit - one of the most important sources of renewal and expansion of production.

I consider products, works and services to be sold when ownership of them is transferred from the seller to the buyer, from the manufacturer to the consumer. From this moment on, their cost is included in the volume of revenue and income of the organization. The volume of revenue from the sale of products, work performed and services provided is the most important indicator characterizing the production and financial activities of a commercial organization or manufacturing enterprise.

In current accounting, sold products are valued: at actual production costs (including all costs or only direct costs), planned (standard production costs or sales prices). If an organization applies planned (standard) cost or sales prices, then at the end of the reporting month the actual cost of products, works, and services sold is calculated. When calculating the actual cost, data is used on the balance of products in the warehouse (in shipment) and on production or shipment for the month at accounting prices (planned or standard cost, sales prices) and at actual cost. In this case, the coefficient of the ratio of the actual cost to the cost at accounting prices is calculated, which is multiplied by the cost at the accounting prices of products sold.

Products (works, services) are sold: at free selling prices and tariffs, increased by the amount of value added tax (VAT), at state regulated wholesale yen (tariffs), increased by the amount of VAT, and at state regulated retail prices, including yourself VAT. Free selling prices are agreed upon by the parties to the transaction, i.e. the seller and the buyer. If free contract prices are used in the calculations, they can be checked by the tax authorities. Prices are subject to verification if they deviate by more than 20% from the level of market prices for identical products, prices under agreements concluded between interdependent organizations, for commodity exchange transactions and foreign trade transactions.

The prices specified in the contract are checked:

on based on documented information obtained from official sources about market prices. Official sources include the following information: on stock exchange quotations and market prices published in printed publications by state statistical bodies and bodies regulating pricing, as well as opinions of experts entitled to carry out valuation activities;

resale price method. With this method, the basis for verification is the price at which the product was subsequently sold. This method is used if there are no transactions on the market for identical or similar goods;

costly method in which the market price is calculated as the sum of expenses incurred and ordinary profit for this field of activity. The normal profit margin is equal to the profitability level prevailing for similar products. Information on the level of profitability is obtained from statistical authorities and pricing authorities.

Excise tax (on excisable products) and VAT are added to the cost of products in selling yen, and when selling them for cash, sales tax is added. The amount of excise tax is determined in relation to the sales price. For VAT, the value of sales foam is taken as the taxable base, and for excisable products, excise tax is added to the foam.

When determining the tax base for sales tax, the cost of products includes value added tax and excise tax for excisable products. For VAT and sales tax, the rate is set as a percentage; for excisable products, depending on their type, at ad valorem rates (in percentage) - jewelry, cars, or at specific rates (in rubles and kopecks) - alcoholic beverages and tobacco products.

The issued settlement and payment documents indicate: price, quantity of products, cost of products at sales prices, excise duty, VAT, sales tax and total amount receivable.

An important prerequisite for organizing accounting for product sales and reliable calculation of financial results is the availability of timely and correctly executed sales contracts for primary documents, a document flow schedule, a price list for manufactured products, etc.

The tasks of accounting for sales of products, work performed, services provided include:

· control over the timely and correct execution of primary documents for the marketing and sale of products;

· timely issuance and provision of settlement and payment documents to the buyer and the bank;

· providing information on the availability and movement of products to managers of relevant departments in order to monitor the timely receipt, shipment and safety of finished products;

· control over the timely receipt of funds from the sale of products, reconciliation of mutual settlements with customers.

Sales of products are carried out in accordance with concluded contracts or through free sale through retail trade.

Contracts for the supply of finished products indicate: supplier and buyer; necessary indicators for products; prices; discounts; payment procedure; the amount of value added tax and other details.

Products are sold by organizations at selling prices.

When setting selling prices, it is indicated ex-franco, i.e. at whose expense the costs of delivering products from the supplier to the buyer are paid. Free station of destination means that the costs of delivering the product to the buyer are paid by the supplier and are included in the selling price. Free departure station means that the supplier pays costs only before the finished products are loaded into the wagons. All other costs for transporting finished products (payment of railway tariffs, water freight, etc.) must be paid by the buyer.

The basis for shipping finished products to customers or releasing them from the warehouse are usually orders from the organization's sales department.

Based on the requirements-invoices (f. 0315006), invoices for the release of materials to the outside (form 0315007), invoices, railway invoices and other documents for the release of products to the outside, the accounting department writes out payment requests in several copies for settlements with customers through the bank.

The payment request shall indicate: the name and location of the supplier and buyer; supply contract number; type of shipment; the amount of payment under the agreement; cost of additionally paid containers and packaging; transport tariffs subject to reimbursement to buyers (if provided for in the contract); the amount of value added tax, allocated as a separate line. When shipping goods, providing services, or performing work that is not subject to VAT, settlement documents and registers are issued without allocating VAT amounts and an inscription or stamp is placed on them “Without tax (VAT).”

Payment requests must be issued by the supplier and submitted to the bank for collection (i.e., an instruction to receive payment from the buyer) no later than the next day after shipment or delivery of the finished product to the consignee. A second copy of the payment request is sent to the buyer for payment.

To export finished products from the territory of the organization, representatives of the consignee are issued trade passes for the export of inventory items from the territory of the organization. The passes are signed by the head and chief accountant of the organization or their authorized persons. The pass can be copies of waybills or invoices on which special permitting inscriptions are made.

If finished products are released to the buyer directly from the supplier’s warehouse or other storage location for finished products, the recipient is required to present a power of attorney for the right to receive the cargo.

Budgetary organizations carry out work and provide services on the basis of contracts, which indicate customers and performers, the volume and timing of work, their cost and other details.

Work completed and handed over to customers and services provided are documented in acceptance certificates, on the basis of which invoices are issued for payment for work and services.

The accrual of amounts to customers in accordance with contracts and settlement documents for finished products, work performed and services rendered is reflected in the debit of account 220503560 "Increase in accounts receivable for income from market sales of finished products, works, services" and the credit of account 240101130 "Income from market sales of finished products products, works, services."

For the amount of accrued value added tax (VAT) on sold finished products, works, services, account 240101130 is debited and account 230304730 “Increase in accounts payable for value added tax” is credited. When transferring the VAT amount to the budget, account 230304830 “Reduction of accounts payable for value added tax” is debited and account 220101610 “Retirement of institution funds from bank accounts” is credited.

The actual cost of sold finished products, services provided and work performed is written off from the credit of accounts 210507440 "Reduction in the cost of finished products", 210604440 "Reduction in the cost of manufacturing materials, finished products (works, services)" to the debit of account 240101130 "Income from market sales of goods, works , services". Receipts of funds for sold finished products, performed works and services are reflected in the debit of account 220101510 “Receipts of funds from the institution to bank accounts” and the credit of account 220503660 “Reduction of accounts receivable for income from market sales of finished products, works, services.”

Profit received by an institution from business activities is subject to income tax in the amount and manner established by Chapter 25 of the Tax Code of the Russian Federation. The accrual of income tax is reflected in the debit of account 240101130 “Income from market sales of finished products, works, services” and the credit of account 230303730 “Increase in accounts payable for income tax”. Payment of income tax is recorded as the debit of account 230303830 “Reduction of accounts payable for income tax” and the credit of account 220101610 “Retirement of institution funds from bank accounts”.

When concluding accounts of the results of the current activities of an institution at the end of the year with December turnover, account 240101130 “Income from market sales of finished products, works, services” is debited and account 240103000 “Financial result of past reporting periods” is credited.

PBU 5/2001

Accounting for finished products, their shipment and sales

Finished products are products and semi-finished products that are fully processed, comply with current standards or approved technical specifications, accepted into the warehouse or by the customer.

Quantitative accounting of finished products by type and storage location

Quantitative accounting of finished products by type and storage location can be organized in two main ways: card and cardless.

In the first method, grouping statements of receipt of products are compiled according to their types and storage locations.

With the second method, daily turnover sheets are compiled (usually with the help of computers) to record the release from production and the movement of finished products to warehouses and other storage places.

The release of products from production in both the first and second methods is documented with delivery notes, specifications, acceptance certificates, etc.

Evaluation of finished products

Finished products in accounting can be assessed using one of the following methods:

- at actual production or reduced cost;

- according to the planned (standard) production cost;

- at wholesale selling prices;

- at free selling prices and tariffs including VAT;

- at free market prices.

Valuation based on actual production costs involves taking into account the sum of all product costs. Reduced cost accounting excludes general business expenses.

This method is convenient to use in enterprises with a limited range of serial products, when production and sales occur daily. The disadvantage of the method is the inaccuracy in determining production costs before the end of the reporting month.

When using the planned (standard) production cost to evaluate finished products, deviations of the actual production cost for the reporting period from the accounting price are determined and separately taken into account, i.e. planned (standard) cost.

The advantage of this method is the unity of assessment in current accounting, planning and reporting. However, if the planned cost changes several times during the year, then it is necessary to re-evaluate the finished product, which is very labor-intensive. If we take into account commodity output at the average annual planned cost, then accounting prices do not change during the year, but the cost of finished and sold products in the plan will not correspond to monthly and quarterly reports.

When valuing at wholesale selling prices, the difference between the actual cost and the wholesale sales price is separately taken into account. The advantages of this method occur at relatively stable wholesale prices. It makes it possible to compare product assessments in current accounting and reporting, which is important for monitoring the correct determination of the volume of commodity output.

Valuation based on free selling prices and tariffs including VAT is used when performing single orders and work. With this assessment option, it is necessary to separately take into account the amount of value added tax.

Finished products sold through the retail network are valued at free market prices.

When using all of the listed methods for assessing finished products, with the exception of assessment based on actual production or reduced cost, it becomes necessary to calculate deviations of commodity output in accounting prices from its actual cost. This allows, regardless of the valuation method in current accounting, to determine the actual cost of goods sold produced in a given month, as well as its balances in warehouses at the end of the month.

The calculation is usually made using a weighted average percentage, calculated as the ratio of the actual cost of the balance of products produced in a given month to the cost of the same volume of products at accounting prices.

The weighted average ratio of the actual production cost to the cost of production at accounting prices is calculated using the formula:

K st = (p 1 *q 1 + p 2 *q 2 +...p n *q n)/(p 1 *k 1 + p 2 *k 2 +...p n *k n), where p 1, p 2,...p n - the sum of the balance in the warehouse and the finished products received during the month (by type of product);

q - actual production cost of the balance and each group of incoming finished products;

k - accounting price of a unit of production

Accounting for finished products, their shipment, work performed and services provided

The following primary documents are used to account for finished products:

- delivery notes,

- acts of acceptance and delivery of works (services),

- railway receipts,

- waybills,

- payment requests-orders.

Shipment and release of finished products is carried out by the warehouse on the basis of invoice orders, which consist of two documents: an order to the warehouse and an invoice for release. An order to the warehouse is issued based on the terms of the contract with buyers, indicating the name of the buyer, quantity and range of products, and shipment time.

Upon shipment, the railway station issues a waybill, which accompanies the cargo along the way, and the sender is issued a receipt for the railway waybill. The railway waybill data is recorded in the invoice and payment documents, which are submitted to the bank or transferred to the buyer.

Accounting for the availability and movement of finished products is carried out on active account 43 “Finished products”. This account is used by enterprises in the material production industries. Finished products purchased for assembly or as goods for sale are accounted for in account 41 “Goods”.

Accounting for finished products can be carried out using account 40 “Output of products (works, services)”.

Account 40 “Output of products (works, services)” reflects information about manufactured products, works delivered to customers and services provided for the reporting period, as well as identifying deviations of the actual production cost of these products, works, services from the standard (planned) cost. This account is used when necessary.

The debit of account 40 “Output of products (works, services)” reflects the actual production cost of products released from production, works delivered and services rendered.

The credit of account 40 “Output of products (works, services)” reflects the standard (planned) cost of manufactured products, completed works and rendered services.

By comparing the debit and credit turnover in account 40 “Output of products (works, services)” on the last day of the month, the deviation of the actual production cost of products released from production, works delivered and services provided from the standard (planned) cost is determined. Savings, i.e. the excess of the standard (planned) cost over the actual cost is reversed to the credit of account 40 “Output of products (works, services)” and the debit of account 90 “Sales”. Overspending, i.e. the excess of the actual cost over the standard (planned) is written off from account 40 “Output of products (works, services)” to the debit of account 90 “Sales” with an additional entry.

Account 40 “Output of products (works, services)” is closed monthly and has no balance as of the reporting date.

If the finished products are fully used at the enterprise itself, then they can be credited to the debit of account 10 “Materials” or other similar accounts from the credit of account 20 “Main production”.

The cost of work performed and services provided is not reflected in account 43, and the actual costs for them as they are sold are written off from the production cost accounts to account 90 “Sales”.

Finished products on account 43 “Finished products” are accounted for at actual production costs.

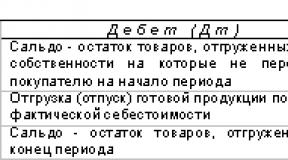

Account 43 “Finished products” has the structure:

Finished products shipped or delivered locally to customers, the payment documents for which are presented to these buyers (customers), are written off from account 43 to the debit of account 90 “Sales” subaccount 90-2 “Cost of sales” (its structure will be discussed below). At the same time, the amount of payment documents presented to buyers (customers) shows an increase in the debt of buyers for products in the debit of account 62 “Settlements with buyers and customers” and the credit of account 90, subaccount 90-1 “Revenue”.

If revenue from the sale of shipped products cannot be recognized in accounting for a certain time (for example, when exporting products), then until the revenue is recognized, these products are recorded in account 45 “Goods shipped.” Upon actual shipment, an entry is made to the debit of account 45 and the credit of account 43.

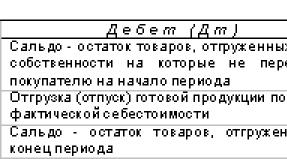

Account 45 “Goods shipped” has the following structure:

When customers are presented with payment documents for shipped products, the products recorded on account 45 are written off to account 90, subaccount 90-2 “Cost of sales”.

Account 45 “Goods shipped” also takes into account products and goods transferred to other enterprises under a commission agreement, since when selling products through an intermediary under a commission agreement, the ownership of the product does not pass to the intermediary.

When products and goods are released, they are written off from the credit of account 43 “Finished products” to the debit of account 45 “Goods shipped”. When a commission agent's report on the sale of products and goods transferred to him is received, they are written off from the credit of account 45 "Goods shipped" to the debit of account 90 "Sales" subaccount 90-2 "Cost of sales" with simultaneous reflection in the debit of account 62 "Settlements with buyers and customers" and to the credit of account 90 “Sales” subaccount 90-1 “Revenue”.

Basic entries for accounting for finished products, their shipment, work performed and services rendered:

Accounting for the movement of finished products is carried out in accordance with the chosen method of assessing finished products (see “Accounting for the movement of enterprise products and their assessment”). The difference between the actual production cost and the accounting estimate is taken into account separately.

When writing off finished products from account 43, the amount of deviations of the actual production cost related to these products from the cost at prices accepted in analytical accounting is determined by a percentage calculated on the basis of the ratio of deviations for the balance of finished products at the beginning of the reporting period and deviations for products received at warehouse during the reporting month, to the cost of these products at discount prices.

For organizations performing work or providing services, products are recognized as work performed by them for other organizations or individuals and services provided.

Accounting for the sale of completed work and services provided is carried out in a manner similar to accounting for the sale of finished products. The only difference is that the work performed and services provided are not reflected in account 43 “Finished products”. As work is performed or services are provided, direct costs directly related to the performance of work and provision of services, as well as indirect costs associated with the management and maintenance of the main production, are collected in the debit of account 20 “Main production” and the actual cost of work performed and services provided is determined. .

When selling works (services), their actual cost is written off from account 20 “Main production” by recording:

The completed work (services provided) is accepted by the customer according to a bilateral acceptance certificate, which is the basis for mutual settlements between the customer and the performer of the work (services).

When selling works (services) to customers, the following accounting entries are made:

Debit account 62 “Settlements with buyers and customers”

Credit to account 90 “Sales”, subaccounts 90-1 “Revenue” - for the sale value of work performed (services provided), including VAT;

Debit account 90-3 “Value added tax”

Credit account 68 “Settlements with the budget” - for the amount of VAT presented to customers of work (services) and accrued to the budget

Debit account 90 “Sales”, subaccount 90-2 “Cost of sales”

Credit account 20 “Main production” - for the actual cost of work performed and delivered to the customer (services provided)

Debit account 90-2 “Cost of sales”

Credit account 44 “Sales expenses” - for the amount of sales expenses associated with work performed (services provided);

Debit account 99 "Profits and losses"

Credit account 90-9 “Profit/loss from sales”

Debit account 90-9 “Profit/loss from sales”

Credit account 99 “Profits and losses” - by the amount of the financial result (profit or loss) from the sale of work performed (services provided);

Credit account 62 “Settlements with buyers and customers” - for the amount received from the customer for work performed (services provided), including VAT.

If an organization performs long-term work (construction, scientific, design, geological work, etc.), the initial and final deadlines for which usually belong to different reporting periods, it can recognize revenue from the sale of work in two ways:

- · in general for work completed and delivered to the customer;

- · for individual stages of work performed.

The first method is traditional, and accounting for the sale of works and services is carried out in accordance with the stated method.

In the second option, when the proceeds from the sale of work are determined by individual stages of completed work, the customer makes settlements with the contractor for completed stages or sets of work that have independent significance, or advances the work until its full completion in the amount of the contract value. Accounting uses account 46 “Completed stages for work in progress.” This account is intended to summarize information about stages of work completed in accordance with concluded contracts that have independent significance. Analytical accounting for account 46 “Completed stages versus unfinished ones” is carried out by type of work.

By debiting this account with the entry:

Debit account 46 “Completed stages of unfinished work”

Credit account 90 “Sales”, subaccounts 90-1 “Revenue”

They take into account the cost of stages of work completed by the organization, accepted and paid by the customer in the prescribed manner.

At the same time, the amount of costs for completed and accepted stages of work is written off from account 20 “Main production” by recording:

Debit account 90 “Sales”, subaccount 90-2 “Cost of sales”

Credit account 20 “Main production”.

Amounts of funds received from customers in payment for completed and accepted stages are reflected in the entry:

Debit account 51 “Current accounts”

Credit account 62 “Settlements with buyers and customers.”

Upon completion of all stages of the work as a whole, the cost of the stages paid by the customer is written off from account 46 “Completed stages for work in progress” by recording:

Debit account 62 “Settlements with buyers and customers”

Credit account 46 “Completed stages of unfinished work.”

The cost of fully completed work, recorded on account 62 “Settlements with buyers and customers”, is repaid from previously received advances and amounts received from the customer in the final settlement.

The organization performs work with a total cost of 3,540,000 rubles, including VAT - 540,000 rubles. According to the contract, the work is performed, handed over to the customer and paid by him in three stages.

The cost of work performed for the first stage is 944,000 rubles, for the second - 1,180,000 rubles, for the third - 1,416,000 rubles, including VAT. The cost of work performed for the first stage is 678,000 rubles, for the second - 890,000 rubles, for the third - 1,029,000 rubles.

Let's make accounting entries:

|

Account correspondence |

Amount, rub. |

|||

|

The cost of work performed on the 1st stage, accepted by the customer, is reflected |

||||

|

At the same time: the cost of work performed in the 1st stage is written off |

||||

|

The amount of VAT is reflected on the cost of work performed at the 1st stage |

||||

|

The financial result associated with the implementation of the 1st stage of work is reflected |

||||

|

Reflects the amount of funds received from the customer in payment for the accepted 1st stage of work |

||||

|

The cost of work performed at stage 2, accepted by the customer, is reflected |

||||

|

At the same time: the cost of work performed in the 2nd stage is written off |

||||

|

The amount of VAT is reflected on the cost of work performed at the 2nd stage |

||||

|

The financial result associated with the implementation of the 2nd stage of work is reflected |

||||

|

Reflects the amount of funds received from the customer in payment for the accepted 2nd stage of work |

||||

|

The cost of work performed at the last stage, accepted by the customer, is reflected |

||||

|

At the same time: the cost of work performed at the last stage is written off |

||||

|

The amount of VAT is reflected on the cost of completed work at the last stage |

||||

|

The financial result associated with the completion of the last stage of work is reflected |

||||

|

Upon completion of the work, the total cost of all stages of work performed, accepted by the customer according to the acceptance certificate, is written off |

||||

|

Advances previously received from the customer were counted toward repayment of part of the cost of completed work. |

||||

|

Received funds from the customer for the unpaid portion of the cost of completed work |

One of the difficult aspects in accounting is the reflection of operations for the sale of products (works, services).

Account 90 “Sales” is intended to summarize information about income and expenses associated with the organization’s normal activities, as well as to determine the financial result for them. This account reflects, in particular, revenue and cost of: finished products and semi-finished products of own production; works and services; purchased products; construction, installation and similar works; goods; transportation services; communication services; provision for a fee for temporary use (temporary possession and use) of their assets under a lease agreement (when this is the subject of the organization’s activities), etc.

Sub-accounts can be opened for account 90 “Sales”:

90-1 "Revenue";

90-2 “Cost of sales”;

90-3 "Value added tax";

90-4 "Excise duties";

90-9 "Profit/loss from sales".

Subaccount 90-1 “Revenue” takes into account sales revenue, while subaccount 90-2 “Cost of sales” takes into account the cost of products sold.

Subaccount 90-3 “Value added tax” takes into account the amount of value added tax due to be received from the buyer (customer).

Subaccount 90-4 “Excise taxes” takes into account the amounts of excise taxes included in the price of products (goods) sold.

Organizations that pay export duties can open a subaccount 90-5 “Export duties” to account 90 “Sales” to record the amounts of export duties.

Subaccount 90-9 “Profit/loss from sales” is intended to identify the financial result (profit or loss) from sales for the reporting month.

The amount of revenue from the sale of goods, products, performance of work, provision of services is reflected in the credit of account 90 “Sales”, the subaccount “Revenue”, and the debit of account 62 “Settlements with buyers and customers”:

Debit 62 "Settlements with buyers and customers"

Credit 90-1 "Revenue"

Revenue from the sale of products is reflected.

At the same time, the cost of goods sold, products, works, services is written off from the credit of accounts 41 "Goods", 43 "Finished Products", 45 "Goods Shipped", 20 "Main Production", etc. to the debit of account 90 "Sales", subaccount "Cost sales":

Debit 90-2 "Cost of sales"

Credit 20, 41, 43, 45...

The cost of goods sold is written off.

Entries in subaccounts 90-1 “Revenue”, 90-2 “Cost of sales”, 90-3 “Value added tax”, 90-4 “Excise taxes” are made cumulatively during the reporting year. The total debit turnover in subaccounts 90-2 “Cost of sales”, 90-3 “Value added tax”, 90-4 “Excise taxes” and credit turnover in subaccount 90-1 “Revenue” are compared monthly. Thus, the financial result from sales for the reporting month is determined, namely profit or loss. This financial result is written off monthly (with final turnover) from subaccount 90-9 “Profit/loss from sales” to account 99 “Profits and losses”. Thus, synthetic account 90 “Sales” does not have a balance at the reporting date.

At the end of the reporting year, all subaccounts opened to account 90 “Sales” (except for subaccount 90-9 “Profit/loss from sales”) are closed with internal entries to subaccount 90-9 “Profit: loss from sales”.

Analytical accounting for account 90 “Sales” is maintained for each type of goods sold, products sold, work performed, services provided. In addition, analytical accounting for this account can be carried out by sales regions and other areas necessary for managing the organization.

Sales of services

The basis for the provision of services by one organization to another organization or individual is a contract. The agreement is drawn up in two copies, one for each of the contracting parties. However, the requirement to draw up an agreement for the provision of services is not mandatory; services can be provided, for example, on the basis of an invoice. When providing services, it is necessary to prepare the appropriate primary documents. Work with legal entities is accompanied by the signing of a work acceptance certificate, in addition, an invoice is issued within 5 calendar days. When providing services to individuals, an analogue of the act may be a strict reporting form signed by the buyer - an order form or another similar document.

A work acceptance certificate is drawn up for work or services performed. This document is not unified, therefore, when drawing it up, it is necessary to remember that it must reflect all the necessary details required for primary documents.

Such details include:

Title of the document;

Date of preparation;

Measurements of business transactions (in kind and in monetary terms);

The names of the positions of the persons responsible for the execution of the business transaction and the correctness of its execution, personal signatures and their transcripts.

For example, you entered into an agreement on tax consulting services with an audit firm for a period of one year. According to the terms of the contract, the work acceptance certificate is signed monthly. At the end of the month, it is necessary to draw up a work acceptance certificate. The act must indicate exactly what services were provided. In cases where the act does not indicate a list of work performed or services provided, it is necessary, in addition to the act, to submit a report on the work done and services rendered.

The report is prepared by the executing company, it describes in detail the work performed. The report is certified by the seal of the executing company.

Sales of goods and materials at retail

Under a retail purchase and sale agreement, a seller engaged in business activities of selling goods at retail undertakes to transfer to the buyer goods intended for personal, family, home or other use not related to business activities (Article 492 of the Civil Code of the Russian Federation).

The buyer pays for the purchase, receives a KKM receipt, on the basis of which the goods are released. There is no need to issue additional documents for the buyer. At the same time, the sold goods are entered into a commodity report, which is submitted daily to the enterprise’s accounting department for processing. There is no need to issue invoices for goods sold in this way. To determine value added tax, a cash register tape is registered in the sales book. If the enterprise does not have a cash register, but it is necessary to sell the goods to an individual, you can offer to pay the invoice through Sberbank. In this case, it is necessary to issue an invoice in two copies, one of which is transferred to the buyer, the other to the accounting department of the supplier, as well as an invoice in one copy with its registration in the sales book.

Accounting for goods in retail trade can be carried out both at accounting prices (according to the cost of acquisition) and at sales prices. In organizations engaged in retail trade and keeping records of goods at sales prices, the credit of account 90 “Sales” reflects the selling value of goods sold (in correspondence with the cash and settlement accounts), and the debit - their accounting value (in correspondence with the account 41 “Goods”) with simultaneous reversal of the amounts of discounts (markups) related to the goods sold (in correspondence with account 42 “Trade margin”).

Other sales from small businesses

As noted above, an implementation that is not related to the “main” is recognized as another implementation. An example of other sales could be the sale of fixed assets, intangible assets, and materials. The most difficult among other implementations is the reflection of the disposal of fixed assets.