Why does the bank increase the credit limit? Increase in the credit limit on the card from the bank Debit card MasterCard Standart "Molodezhnaya"

A credit limit is money that a debt lends to a bank. It is renewable: when the client uses it and returns the money, he can use it again. This process can go on ad infinitum.

A credit limit is needed to borrow money when you need it. On the one hand, it is very convenient: if you need money, you do not need to run around and look for it, collect a pile of documents for applying for a loan, and so on.

Here it is enough to use your credit card and make the necessary purchase. On the other hand, the presence of money always encourages the client to purchase, sometimes not quite necessary for him. It is easier to spend money than to return it back - because of this, disputes arise about the infinity of debt repayment.

What is a credit limit?

This is a set amount of money that the bank has given to the owner of the credit card for permanent use. When you receive a credit card, it already has the Nth amount of money. Even without replenishing their own funds, a person can already make purchases and withdraw cash. The borrowed amount must be returned on time so as not to pay extra interest and penalties.

When granting a limit, the bank also provides a grace period. This is the period of time during which the client can use the money from the card and not pay any interest. As a standard, it reaches 50-60 days, and the methods of its calculation may vary by bank.

Proper use of this option will allow you to use borrowed funds free of charge and repeatedly. If the client does not fit into the grace period, the bank begins to accrue interest.

Thus, the credit limit:

- Installed on a credit card.

- At his expense, you can make purchases or withdraw cash.

- The money must be returned within the stipulated time.

- The limit is renewable.

Credit card without credit limit: myth or reality?

When ordering a credit card, the bank provides a credit limit. If the bank refuses the limit, then the card is simply not issued. But there are cards with a zero credit limit. Most often they are called debit. An example is Binbank's Visa Platinum card.

This card is an instant issue debit/credit card (or in nominal form). At the time of issue, the card is issued with a zero limit. Within a couple of days, by decision of the credit committee of the bank, a credit limit may be set on it, of which its owner will be notified by call or SMS.

In this case, the card will become a credit card. But also the limit may not be set, and the client can only use it as a debit card (or credit card with a zero limit). In fact, all bank cards are credit cards. To make it easier to distinguish between them, they singled out credit cards with a zero limit and called them debit cards.

What limit can be set on a credit card?

The size of the limit depends on the solvency of the client. As in the calculation of the amount of loans, all income and expenses of clients will be taken into account here. If solvency allows, then the bank offers an increased limit (from 100 tr.), and if not very much, then an average one (50-100 thousand rubles). If the client is not solvent, then the limit may be denied to him. The principle of calculation also differs by banks. As a general rule, a card payment should not exceed 25% of income, minus other payments.

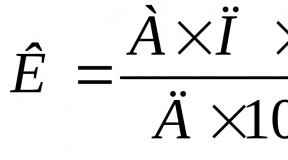

For example, a client receives 50 tr. He has a loan for which he pays 10 tr. per month, a child for whom the expense is based on the minimum wage, for example, 8 tr. Total net income per month is:

Net income = 50 tr. - 10 tr. - 8 tr (per child) - 8 tr (for yourself) = 24 tr.

Based on the requirement “no more than 25% of income”, the minimum card payment remains:

Minimum payment = 24 tr. * 25% = 6 tr.

If the minimum payment is 10% of the limit, then the limit can be granted in the amount of about 60 tr.:

Credit limit=6 tr. * 10 = 60 tr.

The presence of real estate in the property, a car, a contribution can help increase the credit limit.

Credit Limit Calculator

The credit limit depends on your net income and the minimum payment

You can calculate the limit on a special calculator

What card limit will you be approved for?

Average income, months

Expenses, months

Min. payment

up to 950000 rubles

How to increase the credit limit?

This can be done differently in different banks. For example, you can apply to VTB 24 by attaching a certificate of income, availability of property, sources of additional income. Within 3 days, the bank makes a decision to increase the limit or refuse it. In Binbank, the limit is increased by the bank unilaterally with its constant use and return without delay. Thus, the limit increases:

- When providing documents confirming solvency.

- With active use of bank funds.

Where can I see the credit limit?

- It is prescribed in individual conditions upon receipt of a credit card.

- When requesting a balance at an ATM, the receipt will indicate the amount of funds, taking into account the credit limit. For example, a client has 1 tr. their money and 50 tr. limit - the balance will show 51 tr.

- At the bank branch on the card statement.

- In Internet banking. For example, in Binbank it will be listed in the "Cards and Accounts" section in the upper left corner.

In their programs, banks indicate the maximum allowable value of the credit limit. When considering an application received from a client, a credit institution places a certain amount of borrowed funds on the card balance, which constitute the limit on the card.

In 99% of cases, a potential borrower receives a card with a limit of 50-60% of the maximum allowable value. If this name of credit cards provides for a limit of 300,000 rubles, then a first-time client can count on receiving a card with a preliminary limit of 50,000-150,000 rubles at best.

At the same time, credit institutions indicate in their agreements that it is allowed to change the size of the credit limit upwards under certain conditions.

How is a credit limit set?

Much depends on the program of the bank. There is a type that provides for a simplified design (the so-called "quick cards") with a minimum package of documents. The limit on such cards is not large, and the bank receives security guarantees due to the high annual rate and severe penalties. Such cards do not use the limit increase mechanism, since almost all clients are approved for the same amount of borrowed funds.

For other cards, for which a package of documents is required, two customers with the same credit card can have a significantly different limit. With the maximum limit of 300,000 rubles (approximate amount), the bank approved a card with a limit of 150,000 rubles for one holder, and 70,000 rubles for another. This means that the bank, when considering customer applications, was based on the following indicators:

- Total work experience - including the length of service at the last place of work.

- Income Level - A higher income client will be approved for a higher credit limit.

- A package of documents - banks operate on the principle - "more documents - higher credit limit".

- Credit history - the absence of a credit history is equated to a damaged credit history, therefore, the final limit for such a client will be less.

If the bank has approved a card with a limit that is not the maximum, then the bank allows an increase in the amount of borrowed funds in the process of using the card. This circumstance may be specified in the user agreement at the discretion of the credit institution. And in each case, the increase in the limit depends on how the holder uses the credit card.

There is a category of privileged clients to whom the bank makes an initial offer. Such clients, as a rule, have an open deposit in the bank or they are participants in the payroll project of a large corporate client.

In relation to these citizens, the bank immediately sets the maximum credit limit with many additional card options. Such clients automatically earn the trust of the bank, so they can count on the maximum possible amount of borrowed funds.

How and by how much the limit is increased

There is no specific algorithm for increasing the credit limit. Each organization has its own rules in this regard. There are some of the most common conditions, compliance with which is likely to lead to a change in the amount of borrowed funds.

After receiving the card, the borrower must use it to the maximum so that the bank sees the movement of funds on the account and the client's interest in raising the limit. At the first stages of using the card, compliance with the rules for the targeted use of borrowed funds, timely payment of the minimum mandatory payment and repayment of the total amount of debt is positively assessed.

For example, on a client card, the credit limit is 70,000 rubles with a grace period of 50 days. If, at the first stages of using the card, purchases are made for significant amounts with spending the main part of the limit, the bank will see that the client has the needs and the opportunity to pay off the debt on time.

With several successful purchases for a total of 30,000-35,000 rubles and subsequent repayment of the debt, the bank will increase the credit limit, as the client has proven a sufficient level of reliability.

But the correct and frequent use of the card, with the prevention of violations and delays, does not guarantee the holder an increase in the credit limit on the card. This preference is implemented only at the discretion of the bank, which puts a number of criteria into the client assessment mechanism. Therefore, the limit will be increased if the holder meets the following 5 conditions:

- Uses the card every day or makes purchases for significant amounts.

- Places its own funds on the balance sheet, amounting to 20-25% of the credit limit.

- Does not allow even the shortest delays.

- Does not cash out the credit limit, unless this possibility is expressly provided for in the user agreement.

- Timely fulfills its obligations to the credit institution.

How much the limit is increased for the first time - the bank decides on its own. As a rule, these are not large amounts, rarely reaching 10-15% of the borrowed funds already placed on the balance of the card. With the same intensive use of the card, transactions for significant amounts and timely repayment of the resulting debt, the credit limit will periodically increase until it reaches the maximum limit.

Additional way to increase the limit

There is another option for increasing the limit - at the initiative of the cardholder, who must arrive at the office of his bank with documents and draw up an application that will indicate a request to increase the limit. This option is relevant when the holder's income has increased, and he will be able to document this fact.

The client provides the bank with certificates in the form of 2-NDFL or in another form, depending on the type of activity. The bank evaluates the documents received, looks at the movement of funds on the card, analyzes the number and size of recent transactions.

If no violations are found, the card limit is increased by a certain percentage. This form of interaction is used by such banks as:

- Alfa Bank;

- Opening;

- Promsvyazbank;

- Sovcombank;

- Rosbank;

- National Bank "Trust";

- Russian Standard Bank;

- Uralsib;

- Credit Europe Bank;

- Rosgosstrah Bank;

- MTS Bank;

- Eastern Express Bank.

How to find out if the limit has been increased

Unilaterally, that is, without the consent of the client, the credit limit is increased on cards of such banks as: Sberbank of Russia, VTB Group, Rosselkhozbank, Binbank, Citibank, Tinkoff, Raiffeisenbank, Gazprombank, Moscow Credit Bank, Renaissance Credit Bank, Unicreditbank, Vostochny Bank , Home Credit Bank.

The total period for obtaining the possibility of increasing the credit limit on the cards of these organizations is 3 months. During this period, the client must not allow delays and other violations of the contract, and use the card in intensive mode. The bank will increase the credit limit by sending a notification to the user.

How to increase the credit limit on an otp bank card

Decided to get a credit card? Favorable loans c. Home credit and finance bank how to increase the credit limit on a bank card, vtb24 credit card, issue a vtb24 card now. Limit up to 300,000 rubles. Which banks give credit cards? Free selection of a loan on favorable terms. Fill out an online application! How to increase your credit limit. Details on increasing the credit limit on Sberbank cards. bank requirements. How to increase the credit limit on the card from the bank, Privatbank offers to double - Privatbank offers to double the limit on the credit card in the Russian Privatbank - how to increase the limit.

If we consider the change in the maximum limits set for credit cards. How to increase the credit limit - is it possible to increase the credit limit on a Tinkoff bank card? Zhenya was given a bigger limit - how to increase the credit limit on a card from a bank, citibank credit cards with a credit limit of up to 600 thousand. Discounts on purchases up to 20%! Loan up to 450,000 rubles without references without interest 55 days. Fill out an application for a card online solution instantly a credit card of the avant-garde bank up to 50 days of credit for purchases for free. Internet banking for free. Like Oleg Tinkov and his bank. 76 comments on “How Oleg Tinkov and his bank Tinkoff Credit Systems (TCS) are a scam. How to increase the credit limit on an otp bank card, cash loan, credit - cash loan without certificates and guarantors, credit cards, loan application how to increase the credit limit on an otp bank card, deposits at 10.4%. Spring interest deposit - favorable conditions for the growth of your savings!

How to increase the credit limit on an otp bank card, credit cards - credit cards of moskomprivatbank, credit cards of privatbank, moskomprivatbank otp bank: loans, addresses - now customers applying for credit cards in Moscow branches of an otp bank can - how to increase the credit limit on an otp bank card where you can order and arrange. Would you like to order a credit card online and receive it by mail? There are such options. MTS Bank credit card limit up to 1.5 million rubles. The rate is from 17% per annum. 0% on credit - up to 50 days! Alfa Bank credit cards for any purpose. Favorable credit conditions. Apply online in 10 minutes. Credit cards with a limit fill out an application - get, perhaps, the best offers! Approval 90% for: JSC OTP Bank | frequently asked. This section contains questions that are most often asked by customers from the bank. Tinkoff bank credit cards! Grace period up to 55 days. Credit card up to 300,000 rubles.

I have a credit card from OTP Bank, which I have been using for 2 years. I have never had any delinquencies or debts on this card. On the credit card of OTP Bank, I have a credit limit in the amount of UAH 10,000. Now I need money and I would like to increase the amount of the credit limit on the OTP bank credit card. What should I do if I want to increase the credit limit on the OTP bank card?

| + Write your comment |

- about 5 days ago

Dear visitors! We will improve the commenting form so that you can share your comments more conveniently. All comments that were written earlier, we posted below.

#6 ANDREY 02/03/2019 11:31

AND HOW IN OTP SMART YOU CAN INCREASE THE CREDIT LIMIT.

0 #5 Oksana 23.08.2018 09:29

Vitaly wrote:

OTP Bank will not be able to increase your credit limit without your contacting the branch. You can also increase the credit limit in OTP Bank through Internet banking OTP Smart. If you are not connected to OTP Smart, then go with the card to the branch.

0 #4 Vitaly 21.08.2018 07:28

I need to increase the credit limit on an existing credit card. How to do it? Where can I go or can it be done online?

1 #3 Elena 08.02.2018 11:09

The easiest way is to try to increase the credit limit online, through Internet banking, this is the most convenient. But on such sites there are failures in work and then you will not succeed. And if such a situation arises, then you will definitely have to contact the bank and the bank employee will arrange everything for you. Going to the bank is the most reliable and effective way to increase your credit limit.

1 #2 Olga 08.02.2018 10:37

Initially, you need to contact the bank employees and update your information in the database. Perhaps your income has changed, and then the limit will automatically close more. Exactly what you will have to contact the bank.

0 #1 Anna 01/31/2018 08:01

If you already have an OTP bank credit card and you are actively using it, you can increase the credit limit on the card by contacting an OTP bank branch.

If, according to the calculations of OTP Bank, your income allows you to increase the limit to a certain level, then it will be increased to you.

21.05.2015, 17:42

Natalia (Komsomolsk)

Hello! I would like to increase my credit card limit! How can I do this?

Natalia, according to the Rules for issuing and servicing bank cards in OTP Bank, you have the right to send a proposal to the Bank to increase the credit limit.

Such an offer may be sent in one of the following ways:

by submitting a written application in the prescribed form;

— by contacting the CC of the Bank or IVR by phone.

However, the Bank reserves the right to refuse to increase the credit limit without giving reasons. To clarify information about the possibility of increasing the credit limit on your card, you can contact the Contact Center at a free round-the-clock phone number 8-800-200-70-01 or via Skype otpbank_russia.

OTP Bank cards have a credit limit of up to 1.5 million rubles. It is set individually for each borrower.

The maximum available amount on the card depends on several parameters: a person’s credit history, his monthly income, presented during paperwork, etc.

If you receive an OTP Bank card for the first time, then the limit for you will be set lower than for those clients who have already turned to them for help.

On the official website of the organization, you can use a special calculator and calculate how much will be provided for you (these data will be approximate).

In your case, you can ask the specialists of OTP Bank for exact information about the size of the limit when applying for a credit card (or a regular loan) in one of its branches.

You can learn about the possibility of increasing the credit limit in OTP Bank:

- By contacting the bank office in your city.

- By calling the help center at 8-800-200-70-01 (works around the clock, the call is free).

- Calling via Skype to the number otpbank_russia .

- By sending an email request to [email protected].

The decision to increase the credit limit in each specific case depends on the borrower's risk level, which is determined by the results of scoring (solvency assessment system).

If the client responsibly repays the debt, often uses a credit card for non-cash payments, then the chances of approval of his application are high.

When applying for a credit card, the client must familiarize himself with the conditions for its activation and maintenance. OTP Bank, one of the TOP-50 largest banks in the Russian Federation, specializes in retail lending, and is also among the top ten credit card issuers. Therefore, this financial institution guarantees high-quality service and the most affordable loan processing programs.

What information is on the map?

A credit card acts as a convenient payment instrument, with which you can quickly cash out funds at an ATM, pay for goods in a retail network or online store, and pay for the use of services.

A client who has issued and received a plastic card for the first time should carefully study the information posted on it. Most of the information on the front and back of the card is confidential. To conduct financial transactions, you need to remember that the card contains the following information:

- Card number.

- End date of the validity period. The credit card is considered active until the date indicated on it. Upon expiration, the card may be reissued.

- Name and surname of the owner.

- International payment system logo.

- A magnetic strip that should not be demagnetized or damaged.

- A place for the signature of the cardholder, without which it is not considered valid.

- Secret CVC-code (CVV-code) on the back of the card, which is responsible for confirming payments when paying through Internet services.

When issuing a card, a bank employee will definitely instruct the client: what data cannot be disclosed to third parties and what data must be entered when paying for an order online. In case of difficulties with using the card, OTP customers can seek help from bank employees. You can find the nearest branch using a detailed online map. By calling the hotline, you can get advice around the clock:

What is a pin code?

Each personal card issued to the client is not activated at the initial stage of use, which means that it cannot be used to pay on the Internet. To activate the card, follow the operator's instructions by calling: 8-800-200-70-02. After activating the card, the client is prompted to create a pin code.

Credit card activation is free of charge. Commission and interest are charged only in case of using credit funds.

The client can agree to a pin code generated and offered by the system, or independently select the desired set of numbers. Creating a secret entrance is a free service. It is impossible to carry out a financial transaction without a pin-code.

What is a credit limit?

All OTP credit cards have a credit limit. In other words, CL is the maximum amount that the bank can issue to the owner of this card. When making purchases or other cash expenditures, funds are withdrawn from the credit balance. After returning the spent money to the bank, as well as reimbursement of interest for using credit funds, the card balance is automatically replenished.

Credit funds are credited to the card in the national currency: Russian ruble.

When drawing up a contract for servicing and issuing a card, a bank employee informs the client about the amount of the credit limit. Forgetting this information, the client can clarify the data using online banking. In your personal account, you can not only clarify the credit limit, but also view information: how much money has already been spent. You can try to increase the limit by contacting the help desk by calling the number: 8-800-200-70-01.

Withdrawal percentage

The primary purpose of a credit card is to provide the client with the opportunity to make cashless payments for purchases made on the Internet. Nevertheless, OTP cardholders can withdraw money at an ATM of any bank that cooperates with the MPS: Visa or Mastercard. At the same time, it is important to take into account that the bank charges a higher percentage for cash withdrawals than for using funds when paying for online goods.

When using bank funds, it is necessary to take into account that from the moment of payment for the purchase on the Internet, the so-called grace period is activated. The billing period is valid for 55 days. During this time, the borrower can return the money to the bank without interest surcharge. However, the effect of this period does not apply to cashing out funds through an ATM.

What is the minimum payment?

With the active use of a credit card, it is important to take into account that for individuals the conditions are prescribed in the contract, according to which a certain amount is debited monthly to pay off the debt. You can deposit funds to repay the loan in several payments or in one amount. This amount is not fixed and may vary depending on the total debt.

How to pay by card in a store or online?

When making a purchase in the online store, the bank does not charge a commission. Only the amount that was indicated in the check is debited from the card. Cards of international payment systems (VISA, Mastercard) are suitable for paying for goods around the world.

To pay for an order on the Internet, you must specify the following information in the data entry fields: card number, card validity period, CVV code.

Thanks to credit funds, you can pay at a stationary store, restaurant or, for example, at a gas station. The principle of accruing interest for debiting funds through the terminal is similar to accruing interest when paying on the Internet.

How to pay off credit debt

The client does not bear any obligations to the OTP bank, if from the moment of activation of the card no payment has been made at the expense of credit funds. If the cardholder used the funds, it is necessary to regularly make payments to repay the loan, focusing on the account statement. In addition, the amount indicated in the payment must be paid in full no later than the date indicated in the statement.

Credit card holders can pay off the debt in full ahead of schedule. To carry out this operation, you must adhere to the following recommendations:

- From the moment of making a decision on early repayment of the loan, stop using credit funds.

- Specify the full amount of the debt in a convenient way: when contacting the bank; during a call to the hotline; using internet banking.

- Pay off debt in full.

- If there is a debt, repay the debt, taking into account the commission and interest, on the next payment date.

- After depositing funds, contact the bank staff to verify that the funds have been credited.

You can deposit the amount to pay off the debt at a bank branch or using various online services.

The OTP credit card does not visually differ from most plastic cards and is linked to international payment systems. Thanks to a credit card, customers can make purchases on the Internet or pay for services through terminals with the ability to return credit funds to their balance within 55 days without interest.