Documents for childbirth allowance. How to receive payments at the birth of a child. How to apply for a monthly allowance for caring for a child up to one and a half years

In the context of an acute shortage of budget funds due to the difficult economic situation in the country, the Government of the Russian Federation was forced at the end of 2015 to take a number of decisions aimed at cost reduction federal budget for social items of expenditure:

- do not conduct traditional indexing child benefits from January 1, 2016 and other social payments to families with children, and be limited to their additional indexation from February 1 to the inflation rate for the previous year;

- completely eliminate indexation for at least one year maternity capital in 2016, taking its size at the level of 2015;

- apply targeting criteria and the principles of need in the regions of the Russian Federation, which will reduce the number of recipients regional payments on a child.

In fact, these changes mean the beginning in 2016 of a new social reform in relation to families with children who receive various measures of material support from the state.

Indexation of child benefits

First of all, families with children are concerned about the issue of increasing the amount of payments per child - i.e. whether there will be an increase in connection with the indexation.

- Indexation of child benefits to the amount of projected inflation (i.e. "fast paced") annually from January 1 was first introduced back in 2008. However, one of the measures taken by the Government in 2015 to reduce the country's budget deficit was the suspension in 2016 of the current procedure for indexing social benefits.

- Instead, from February 1, 2016, child benefits will be re-indexed to actual (last year's) inflation (i.e. "at an accelerating pace") regarding the amount of child allowances, which were established from January 1, 2015.

The amount of benefits for children in 2016

In 2015, child allowances were indexed to a lower inflation rate of 5,5% and then the indexation coefficient was 1.055. But the actual inflation for the year was 12,9% , i.e. the indexation coefficient was to be 1.129.

In accordance with this, from February 1, an additional indexation of benefits by 7% will be carried out:

1.129 / 1.055 = 1.070 or 7.0%.

Given this coefficient, it is possible to compile a table of child benefits in 2016.

Table of child benefits in 2016

| Benefit Title | Amount of payments, rub. | |

|---|---|---|

| from January 1, 2016 | from February 1, 2016 | |

| Lump sum payments | ||

| Allowance for a woman when registering in early pregnancy | 543,67 | 581,73 |

| Maternity allowance | 100% of average earnings for the previous 2 years, according to the minimum wage or in the minimum fixed amount: | |

| 543,67 | 581,73 | |

| Pregnancy allowance for wives of military conscripts | 22958,78 | 24565,89 |

| One-time allowance at the birth of a child | 14497,80 | 15512,65 |

| Child benefits for adoption, guardianship and transfer to a foster family | 14497.80 or 110775* | 15512.65 or 118529.25* |

| * An increased payment is made when adopting a disabled child, a child over 7 years old or several children who are brothers or sisters (for each) | ||

| Maternal capital | 453026 | 453026 (does not increase) |

| Monthly payments | ||

| Child care allowance | 40% of the average monthly earnings for the previous 2 years per child or in the minimum amount: | |

|

|

|

| Allowance for the care of a child of a military serviceman | 9839,48 | 10528,24 |

| Payment to large families for the third and subsequent children under 3 years old | In the amount of the established regional subsistence minimum for a child | |

| Benefit for the child of a serviceman for the loss of a breadwinner | 1978,97 | 2117,50 |

The amount of maternity payments in 2016

During pregnancy and after childbirth, the state supports parents with material payments in the form of monthly and one-time child benefits.

This type of support is provided:

- employed women in the presence of insurance experience - in the form of compulsory social insurance in proportion to average earnings;

- idle- in the minimum established amount in the form of state social security (through Social Protection).

When going on maternity leave, women in Russia can expect to receive payments such as:

- Maternity Benefit (B&R)- calculated depending on the number of days of absence from work indicated in the sick leave:

- for 140 days - minimum RUB 28555.40;

- for 156 days - minimum RUB 31,818.87;

- for 194 days - minimum RUB 39569.62

- Additional allowance for maternity benefits when registering for pregnancy in a antenatal clinic up to 12 obstetric weeks - is set in a fixed amount ( RUB 581.73 from 1 February).

- One-time allowance at the birth of a child, which is also set in a fixed amount ( RUB 15512.65 from 1 February).

- Benefit for caring for a child up to 1.5 years, paid monthly and calculated as a percentage of the mother's average salary before going on maternity leave, but not less than:

- 2908.62 - for the first child;

- 5817.24 - on the second and subsequent.

Below is more detailed information about maternity benefits for B&R and for childcare up to 1.5 years.

Maternity allowance

During pregnancy, a working woman must be granted maternity leave, for which an allowance is paid. The legislation of the Russian Federation provides several options for its duration(depending on the severity of the course of childbirth and the number of children born):

- at birth 1 child:

- for uncomplicated childbirth - 140 days of vacation (70 days before and 70 after childbirth);

- in case of complicated childbirth - with postpartum leave extended to 86 days (156 days in total);

- at birth 2, 3 or more children- 194 days of vacation (84 days before and after childbirth 110 days).

These days will be paid to working women in the amount of 100% of average earnings for the last 2 full years (by multiplying the average daily earnings by the corresponding number of days).

Wherein:

- Minimum size benefits cannot be lower than the minimum wage(the minimum wage, which in 2016 is 6204 rubles) per 1 month (see above).

- Maximum size payments in 2016 will not exceed:

- for 140 days - 248164.38 rubles;

- for 156 days - 276,526.03 rubles;

- for 194 days - 343884.93 rubles.

Child care allowance

After the birth of a child, the mother has the right to receive a monthly allowance for caring for a child up to 1.5 years.

This payment is provided not only employed mothers, but non-working women, as well as the father of the child or other relatives who actually care for him.

The amount of this payment is set as follows:

- for working women- at the employer or in the Social Insurance Fund (FSS):

- is calculated by multiplying 40% of the average earnings for the previous 2 years by 30.4 (i.e. by the average number of days in a month for 12 months) and multiplied by a factor of 0.4.

- for non-working mothers- through the bodies of the Social Protection of the Population (Sobes):

- in the minimum amount, which from February 1, 2016, taking into account indexation, is 2908.62 rubles. for the first child or 5,817.24 rubles. on the second and subsequent.

After the child reaches the age of 1.5 years, there is no additional assistance for families with children, except for a monthly compensation in the amount of 50 rubles from the employer not provided.

The amount of maternity capital in 2016

In accordance with the laws signed by V. V. Putin in December 2015, the maternity capital program will be extended until December 31, 2018, however, its size in 2016 will not be indexed and will remain at the level 453 thousand 026 rubles.

At the same time, it is noted that the decision not to carry out indexation of mother's capital in 2016 is just single pass caused by a shortage of funds in the federal budget. It will recover from 2017 and will be indexed every subsequent year in the usual way:

- in 2017- approximately 6% to 480 thousand rubles;

- in 2018- another 5%, which will be 505 thousand rubles.

Changes in 2016 and latest news

In fact, since 2016, a new social reform has been implemented in Russia, which was adopted due to the existing state budget deficit. Shortly before that, during the working meetings of the Government, Dmitry Medvedev gave instructions on the formation of the federal budget for 2016 proceed from such requirements:

- reduce costs state budget for 2016-2018;

- take into account the need indexing basic social benefits;

- grants and benefits based on targeting principle and means criteria.

In this regard, as mentioned above:

- the size of maternity (family) capital as of 2016 will remain at the level of 2015, and will be indexed only from 2017.

- from February 1, 2016, a new indexation procedure for child benefits and other social benefits is being established - now they will increase annually according to the actual inflation for the past year, that is "at an accelerating pace", but not "leading" like almost a whole decade before.

- when determining the amount of maternity allowance for a mother, income for the previous two years - 2014 and 2015, should be taken into account, which will be taken into account in increasing the maximum possible amount of benefits for working women.

Conclusion

In 2016, a large number of changes took place related to the current state of the Russian economy, and the Government of the Russian Federation is taking all kinds of decisions to stabilize it.

Some decisions have a negative impact on the condition of families with children, and even more so on the condition of families with many children: benefits and other social payments per child are not properly indexed, in 2016 the size of the mother's capital will remain at the same level (453,026 rubles), and they themselves payments will be more difficult to receive, since the circle of persons to whom they relied previously will narrow due to the introduction of the criterion of need.

Let's hope that all the reforms of the state will help us get back to the previous economic level, and needy families will again become more socially protected.

Last update 05/18/2019

Families with children living in Moscow receive some of the highest regional payments, plus additional benefits and benefits.

One-time allowance for the birth of a child in Moscow

A lump sum is a one-time payment when a baby is born, provided to one of his parents. Its size in 2019 is 5,500 rubles.

In order for the allowance to be assigned, you must provide the necessary documents and declare your right to receive money for the maintenance of the baby.

Parents, both employed and unemployed, must apply to the local social security authorities with the following documents:

- statement;

- discharging from maternity hospital;

- birth certificate.

"Luzhkov's payments" at the birth of a child in Moscow

“Luzhkov benefits” can be received by young families in which spouses are not yet 30 years old. An incomplete family can also be considered young, where a parent alone raises a child. Also, this payment is due upon adoption.

The amount of payments for the first child in 2019 is 93,905 rubles.

Not later than six months after childbirth, you must contact the RUSZN with the following documents:

- statement;

- direction from the registry office;

- birth certificate;

- spouses' passports.

The application must be considered within 10 days.

Compensation for women dismissed due to the liquidation of the organization during pregnancy or maternity leave

Compensation is paid monthly in the amount of 1,500 rubles.

During the decree, the following amounts are received:

- 7 000 rub. - in 140 days;

- 7 800 rub. - for 156 days;

- 9 700 rub. - for 194 days.

An application for compensation is submitted to the RUSZN along with a marriage certificate, birth certificate, and a certificate from the registry office.

Additional compensation to Muscovites

For expenses related to the increase in food prices every month:

- parents-students up to the third year of the child - 1,875 rubles. ;

- single parents, large families, families of military conscripts, parents of disabled people - 675 rubles.

For costs associated with rising cost of living each month:

- single parents with earnings below the subsistence minimum - 750 rubles, above - 300 rubles. ;

- families of conscripts and large families - 600 rubles.

"Putin's payments" for care up to a year and a half

From January 1, 2018, low-income families in Moscow receive "Putin's payments" - a monthly allowance for a child up to 1.5 years old, born or adopted after January 1, 2018.

The amount of the allowance is equal to the child's subsistence level. In 2019, in Moscow, this is 13,787 rubles.

For the firstborn, the allowance is issued at the MFC or the department of social protection.

An important condition for receiving financial assistance is that the family income must be less than 1.5 living wages per person.

The birth of a second baby brings not only happiness for the family, but also an additional financial burden, so the question of what the payments for the second child in 2016 are of concern to many parents who plan to have another baby in the future.

The parents of the second child, as well as the first child, are entitled to one-time (one-time) and periodic payments.

Lump sum for second child

This allowance is due to any child if his parents are citizens of Russia. The amount of this allowance does not depend on the number of children in the family, that is, the parents of both the first and second child will receive the same allowance. If two or three children were born in a family at once, then the payment is due in the same amount for each child.

The exact amount in which the lump-sum allowance for the second child will be paid in 2016 is not yet known, but based on past years, we can assume that it will be about 15,000 rubles, taking into account inflation. More precisely, it will be possible to speak about the size of the allowance after the adoption of the federal budget for next year, which will occur at the end of 2015.

Pays this type of benefit employer if the parent was employed at the time of the birth of the child, with subsequent compensation by the social insurance fund. Unemployed parents can apply for benefits directly to the social security fund. The amounts of payments, both for working parents and for the unemployed, are the same.

This type of benefit is paid monthly until the child is 1.5 years old. Its size, as in the case of lump-sum payments, does not depend on which account the child was born. Its value is influenced by the size of the average earnings of the parent - the recipient of the allowance over the past two years. However, in any case, it cannot be less than 5700 rubles.

It should be noted that not only the mother of the baby can receive, but also the father or other relative who will take care of him. Relatives to whom the law gives the right to apply for child care allowance (maternity) include:

It should be noted that not only the mother of the baby can receive, but also the father or other relative who will take care of him. Relatives to whom the law gives the right to apply for child care allowance (maternity) include:

- Relatives who are subject to compulsory social insurance;

- Parents or other relatives who are in military service under a contract;

- Parents or relatives who have the status of unemployed, acquired as a result of the closure of the enterprise where they worked;

- Parents in full-time education at the time of the child's birth.

The payment of benefits is made by the employer on the basis of the documents provided. The employer is compensated by the social insurance fund. Mothers who, at the time of the birth of their second baby, did not work and were engaged in housework, will also be entitled to receive such benefits, but in a minimum amount.

In this case, the social security authorities will make payments, and the necessary package of documents is also provided there.

Maternity capital for parents of a second baby

Recall that parents have the right to receive this type of social assistance at the birth (or adoption) of a second baby. For a long time, the issue of extending the program providing for the payment of this type of social assistance in 2016 was up in the air.

Even today there is no official legislative decision, however, from press reviews covering the work of the Government, it is clear that next year the program, although in a slightly modified form, will be extended.

Even today there is no official legislative decision, however, from press reviews covering the work of the Government, it is clear that next year the program, although in a slightly modified form, will be extended.

According to representatives of the PFR, the amount of maternity capital in 2016 will be 473 412 rubles

Presumably planned changes in the program will address the following issues:

- The recipients will be low- and middle-income families. Families with a high income will not be able to count on receiving benefits in 2016.

- It is planned to expand the areas of spending maternity capital.

In addition to improving living conditions, education and a pension for the mother, it will be possible to spend it on the treatment and rehabilitation of the child. The issue of the possibility of acquiring vehicles with this money is being actively discussed. Parents who:

- Previously, such a certificate has not been issued;

- Do not have a criminal record for crimes against children and are not deprived of rights regarding the child;

- At least one of the parents has Russian citizenship.

Governor's payments

This type of additional assistance to young parents was first established by the former mayor of Moscow, Yuri Luzhkov (for which he was popularly called Luzhkov's payments) and remains to this day.

Financing of these payments is made not by federal, but by local budgets and depends on the size of the subsistence minimum, which is set for each region separately. Therefore, the amounts of payments in different regions of the country differ, the procedure for their payment is established by local governments.

Financing of these payments is made not by federal, but by local budgets and depends on the size of the subsistence minimum, which is set for each region separately. Therefore, the amounts of payments in different regions of the country differ, the procedure for their payment is established by local governments.

This type of payment is a good help for a young family. In some regions of the country, the maximum amount of gubernatorial assistance for a second child reaches 150,000 rubles. For Moscow, for example, the amount of the payment depends on the number of children in the family. The amount of payment for the second baby for Muscovites in 2016 will be 88,000 rubles (7 SGP).

The right to receive payment is given by the Moscow residence permit and the age of the parents (should not exceed 30 years). You need to apply for gubernatorial payments to the local social security authorities. The list of documents required for registration is extremely simple:

- passport of the parent applying for the allowance;

- statement;

- a document confirming the birth of the baby;

- account number for money transfer.

In St. Petersburg, a family with a second baby will receive 28,700 rubles in 2016. Residents of the Moscow region - 20,000 rubles, for twins this amount increases to 70,000 rubles.

However, it should be borne in mind that in some regions, local authorities ignored the birth of a second child, assigning payments only for the birth of a third and subsequent ones. These areas include the Altai Territory, the Lipetsk Region, Novosibirsk, the Amur Region and some others.

In order to find out if the payment for the second child is required in your region, you need to contact social security authorities or ask a question on the website of the Ministry of Labor and Social Security. Parents who live in areas where second child benefits are not established should find out if your area may have another form of support for young families with a second child.

Do you consider the amount of the allowance for the passage of a child sufficient?

- Vote

The procedure for calculating child benefits in 2016 has not changed. However, the maximums and minimums of various "children's" benefits have changed. This is due to the indexation of child benefits in 2016.

Let's say right away that the maximum amount of an employee's earnings that can be taken into account when calculating benefits in 2016 is ():

Childbirth allowance in 2016

The one-time allowance for the birth of a child in 2016 is 14,497.80 rubles. (). The allowance is paid in this amount if the child was born in January 2016.

If the child is born in February or later, the allowance will be 15,512.65 rubles.

Early pregnancy: manual 2016

The allowance for women registered in the early stages of pregnancy, if maternity leave began in January 2016, is 543.67 rubles. (Clause 2, Part 1, Article 8 of the Law of December 1, 2014 No. 384-FZ).

For those who go on vacation in February and later, the allowance will be 581.73 rubles.

Maternity allowance in 2016

The maximum daily allowance, if maternity leave began in 2016, is 1,772.60 rubles. (Article 11, Article 14 of the Law of December 29, 2006 No. 255-FZ). That is, the maximum allowance for a standard decree of 140 calendar days will be 248,164 rubles.

But the minimum allowance is calculated on the basis of the average daily earnings in the amount of 203.97 rubles. Such a minimum is taken into account when calculating benefits if:

- the woman had no salary at all in 2014 and/or 2015 (for example, the woman was on parental leave);

- a woman in 2014 and (or) 2015 did not work for you and did not bring certificates of earnings from other employers;

- the average earnings of an employee for each month of the billing period is less than the minimum wage, equal to 6204 rubles.

Another special case is that of an employee who has less than 6 months of experience by the day she goes on maternity leave. For vacation days falling in 2016, her maximum daily allowance will be as follows:

Child care allowance in 2016

We give in the table the minimum and maximum monthly benefits for caring for a child under the age of one and a half years (

Payments for the first child in 2016

Parents expecting their first child in 2016 can count on the following payments:

- One-time allowance for pregnancy and childbirth;

- Monthly allowance for caring for a child up to one and a half years;

- Payments from the regional budget.

The allowance is paid to a pregnant woman if she is registered with the local antenatal clinic no later than the 12th week of pregnancy.

Financial assistance in connection with childbirth is accrued regardless of the time at which the mother became registered.

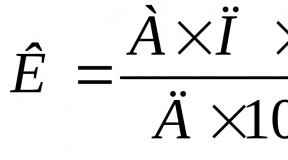

This allowance is calculated as follows:

70 days before childbirth + 70 days after childbirth = 140 calendar days (in case of complicated childbirth, another 16 days (156 days) are added); if two or three children were born, then another 54 calendar days (194 days) are added to 140 days.

Formula for calculating benefits:

(total income for 2013 + income for 2012) / total number of days in the previous two years (731) * 140 days.

Let's say the income of a working woman for 2013 was 200,000 rubles, and for 2012 - 150,000 rubles. Add these two numbers together:

200 000 + 150 000 = 350 000

The resulting figure must be divided by the number of days for 2012 and 2013 (731 days because 2012 was a leap year):

This number must be multiplied by the number of days of maternity leave:

478.796169630 * 140 = 67.031 is the amount of maternity benefit.

The amount of the allowance for a working woman is equal to 100% of the average annual earnings for the previous two years, but cannot exceed 186,986.8 rubles.

Required documents

In order to receive the allowance, the mother must submit the following documents to the personnel department of the entire enterprise:

- Application addressed to the head of the organization;

- Sick leave (issued by a doctor from the antenatal clinic).

Payments at the birth of the first child in 2016

A one-time allowance for a child, regardless of which account it is, in 2016 it is 15,382.17 rubles (in 2015 it was 14,497.8 rubles). Get maternity benefits for the first child can both employed and unemployed citizens of our country.

In order to receive a one-time allowance, working parents must submit the following documents to the personnel department of the institution in which they work:

- Application addressed to the head of the enterprise for the appointment of benefits;

- Certificate and / or certificate of the birth of the child from the registry office;

- Passports of both parents;

- A certificate received by the other parent at his work that he was not paid benefits.

All documents, except for the application, must be accompanied by photocopies of the originals.

Monthly child allowances in 2016

In 2015 monthly first child allowance in the family was 2718.34 rubles. In 2016 - 2884.16 rubles. This benefit can be applied for before the child reaches the age of two.

The allowance for caring for a child, from the moment he turns one and a half to the age of three, is paid to working parents in the amount of 50 rubles per month. Low-income families, whose total monthly income does not exceed the established subsistence level for each family member, can also apply for it. The amount of the allowance can be specified in the OSZN. You can get it by contacting the local social security with the following documents:

- application for benefits;

- Certificate from the tax service on the income of each of the family members;

- Information about the composition of the family;

- Child's birth certificate + photocopy.

Payments and benefits for single mothers

Single mothers, in addition to the above benefits, are entitled to receive compensation for food (in the event of an increase in prices) for a child under the age of three, free clothes for an infant, payment for special food until the child reaches the age of two (a certificate is taken from the local pediatrician). Benefits are provided for utility bills until the child reaches the age of 1.5 years. At the expense of state funds, children from 0 to 3 years old are provided with the necessary medicines. Every month, a single mother should receive an allowance in the amount of 1,830 rubles (if she does not work) or an increase in wages in the amount of 40% of her monthly earnings.

To apply for a grant, you must collect the following documents:

- Certificate from the local housing office stating that the child lives with the mother;

- Birth certificate;

- The passport;

- account number or savings book;

- Employment book (if the mother does not work).

Local payments

Governor's allowance for the first child are not paid in all areas of our country. The amount of payments varies depending on the region. Check out the list of subjects where benefits are paid at the expense of the regions of the Russian Federation.