Pay an advance what. What percentage of the salary is an advance. When is an employee's application required?

Payment of remuneration to employees for the performance of duties is made twice a month. The procedure and amount of payment are established by the employer independently.

The part of wages paid for the first half of the month is called advance payment.

Regulation of payments under the Labor Code of the Russian Federation

The obligation of the employer to pay part of the salary to employees twice a month is enshrined in Art. 136 of the Labor Code of the Russian Federation. The amount should not be less than the amount accrued for the actually worked half of the month. Cancellation of the legislative requirement to the employer is not carried out at the request or written application of the employees.

The obligation of the employer to pay part of the salary to employees twice a month is enshrined in Art. 136 of the Labor Code of the Russian Federation. The amount should not be less than the amount accrued for the actually worked half of the month. Cancellation of the legislative requirement to the employer is not carried out at the request or written application of the employees.

The condition for paying salaries twice a month is included in the provisions, regardless of the form of remuneration -, or otherwise. Additionally, the obligation to pay an advance is fixed in, and (if the amount of the premium is fixed).

Employees in respect of whom payments are delayed have the right to demand (Article 236 of the Labor Code of the Russian Federation). The amount is 1/300 of the refinancing rate accrued for each day the payment deadline is missed. The rate valid on the date of the transaction is used for calculation.

When is it paid in Russia?

The dates for the payment of wages and advance payments are set by the employer independently. The numbers of the month are fixed in a collective agreement or other local act and approved by order. An extract from the documents on the days of payments is annually submitted to the bank for the adjustment of settlement and cash services.

When issuing, the following rules are taken into account:

- If the due date falls on a weekend or holiday date, payment is made on the previous business day.

- The period for issuing cash is set by the company. In the standard version, this is a period of 3 to 5 days, after which the amount.

Payment of wages more than 2 times a month is not prohibited and is not a violation of labor laws. To confirm the legality of the date of settlement with employees, they are fixed in the local acts of the enterprise.

The form of advance payment can be expressed as:

- By way of payments cash through the cash desk of the enterprise. The form of cash payment is often used even if the company has a payroll project.

- Bank transfer- by transferring the amount to a bank salary card. Payments to a non-resident employee are made only in this form.

- Issuance of non-monetary funds ( in kind).

Documentary registration of payment is made in a form, convenient for executors.

Documentary registration of payment is made in a form, convenient for executors.

In the predominant number of cases, it is used.

Violation of the provisions of the Labor Code of the Russian Federation entails the imposition of penalties under Art. 5.27 of the Code of Administrative Offenses. The amount of the fine is set:

- In relation to the enterprise - from 30 to 50 thousand rubles.

- For an individual entrepreneur or official who committed a violation - from 1 to 5 thousand rubles and disqualification up to 3 years if a repeated case is detected.

You can see the procedure for processing the calculation and payment of these amounts in the 1C program in the following video:

What part can be an advance?

The amount of the advance payment is not specified by law. The basis of the calculation is the amount of wages, accrued for hours actually worked. In order for the accounting department to receive data on the days worked, closing is carried out twice a month.

In a number of enterprises with a time-based form of payment, a single percentage (40-50%) of the salary is used.

The amount of accrual may be lower or higher than the amount for the actual period worked. A discrepancy may occur if:

- Absence of an employee for a legitimate reason.

- The presence of a large number of days off in the first half of the month.

The option of accruing an advance as a percentage is not always effective. Its calculation based on hours actually worked is the most accurate expression of the amount due.

Can it be more than salary?

The issuance of an advance in an amount exceeding the amount of wages is not prohibited by law. The use of the actually accrued amount in the calculations is based on the impossibility of withholding the overpaid amount upon dismissal of an employee, calculated in excess of real earnings.

The issuance of an advance in an amount exceeding the amount of wages is not prohibited by law. The use of the actually accrued amount in the calculations is based on the impossibility of withholding the overpaid amount upon dismissal of an employee, calculated in excess of real earnings.

When overpaying, situations arise:

- The inability of the employer to withhold the amount issued in excess of the advance. The right to withhold amounts is available only in the amount of 20% of each payment (with several grounds for withholding - up to 50%) (Article 138 of the Labor Code of the Russian Federation).

- When an employee who has an overpayment is dismissed, there are difficulties in retaining.

- When calculating personal income tax, deductions to funds, difficulties arise with the calculation of amounts. The procedure for calculating the funds obliges the employer to transfer the contributions accrued on the entire amount of the payment. An advance payment relating to future months is treated as other payments related to the performance of labor duties.

Withholding overpaid amounts is made only in the following cases:

- Assumptions by the counting worker of an arithmetic error.

- Identification of violations by the employee of duties and labor discipline established by the commission on labor disputes.

- Performance by an employee of illegal actions, confirmed by a court decision.

If it is necessary to make an advance payment to a person against future rewards (at his request), the best option is to issue an interest-bearing loan.

Is personal income tax charged?

When issuing an advance, employers are not responsible for withholding and transferring personal income tax to the budget. The actual day of receipt of the rights to payment of wages is the last day of the month (the date of its accrual). The tax is calculated and withheld by the agent (employer) at the final settlement with the employee for the month (Article 226 of the Tax Code of the Russian Federation).

The transfer of personal income tax must be made on the day following the date of the emergence of the right to make the payment of the final settlement.

A special case with taxation occurs with the employer when paying an advance in excess of wages. The legislation interprets amounts unreasonably transferred to an employee as an interest-free loan. The amount is subject to personal income tax at a rate of 35% (clause 2, article 224 of the Tax Code of the Russian Federation), if the employee is a resident of the Russian Federation.

A special case with taxation occurs with the employer when paying an advance in excess of wages. The legislation interprets amounts unreasonably transferred to an employee as an interest-free loan. The amount is subject to personal income tax at a rate of 35% (clause 2, article 224 of the Tax Code of the Russian Federation), if the employee is a resident of the Russian Federation.

The employer, acting as a tax agent, must withhold tax from material benefits in the form of interest savings and transfer it to the budget. In case of non-compliance with the requirements of the law, the enterprise and the official will face a fine.

The requirement to make advance payments is enshrined in the Labor Code of the Russian Federation. The employer must comply with the terms of labor legislation, the violation of which entails the imposition of a fine. The payment is accompanied by mandatory document flow - approval of the order in personnel forms, maintenance of the time sheet and execution of payrolls.

Hello.

The legislation does not define the percentage ratio of the advance to wages.

But there are legal acts, according to which the size of the advance and wages should be approximately the same, but cannot be lower than the tariff rate for the period worked, but nothing is said that the advance cannot exceed half of the wages.

For example:

Letter of Rostrud dated 08.09.2006 N 1557-6 "Accounting advances on wages"

In accordance with Article 136 of the Labor Code, wages are paid at least every half a month on the day established by the internal labor regulations of the organization, the collective agreement, the labor contract.

The Labor Code does not regulate the specific terms for the payment of wages, as well as the size of the advance.

At the same time, it should be borne in mind that, according to Decree of the Council of Ministers of the USSR of May 23, 1957 N 566 "On the procedure for paying wages to workers for the first half of the month is determined by an agreement between the administration of the enterprise (organization) and the trade union organization at the conclusion of the collective agreement, however, the minimum amount of the specified advance must not be lower than the wage rate of the worker for the hours worked.

Thus, with regard to the specific terms of payment of wages, including the advance (specific dates of the calendar month), as well as the amount of the advance, they are determined by the internal labor regulations, the collective agreement, the labor contract.

Thus, in addition to the formal fulfillment of the requirements of Article 136 of the Labor Code on the payment of wages at least 2 times a month by the employer, when determining the amount of the advance payment, the time actually worked by the employee (actual work performed) should be taken into account.

Letter of the Ministry of Health and Social Development of the Russian Federation of February 25, 2009 No. 22-2-709 "On the timing and procedure for paying wages"

Art. 136 of the Labor Code of the Russian Federation provides for the payment of wages at least every half a month on the day established by the internal labor regulations of the organization, the collective agreement, the employment contract.

This means that with the advance method of calculating wages for each half of the month, wages should be accrued in approximately equal amounts (excluding bonus payments).

Since your work is hourly, then, accordingly, the calculation of the advance payment and wages should be made based on the period worked. If you think that your rights are being violated, you can contact the Labor Disputes Inspectorate in order to conduct an audit at your enterprise on the correct application of labor legislation when calculating advance payments and wages.

|

Back to Advance 2018

An employee has the right to receive wages twice a month in certain installments, one of which is usually called an advance payment. Such requirements are regulated by the legislation of the Russian Federation. If they are ignored, a fine is imposed. Therefore, the accountant must know exactly how many percent of the salary in 2018 is an advance.

All employers are required to pay salaries at least every half month. The part of the salary that the Labor Code of the Russian Federation obliges to pay to employees after the expiration of the crescent cannot be less than the tariff rate or salary for the time actually worked (actual work performed).

This conclusion is in the letter of Rostrud No. 1557-6. Salary must be paid no later than the 15th day after the end of the period for which it is accrued. That is, the deadline for issuing an advance is the 30th of the current month, and the salary itself is the 15th of the next month (part 6 of article 136 of the Labor Code of the Russian Federation).

An advance is a part of the salary that is accrued to staff for the performance of labor duties. The date of its issuance must be specified in internal regulations: internal rules, collective or labor agreement.

Officials of Rostrud and the Ministry of Health and Social Development recommend setting the day for issuing an advance payment in the middle of the month: the 15th or 16th.

In practice, companies can make payments on the 25th. But then, when a new employee is hired in the first days of the month, the salary will be delayed for a period of more than 15 days. And in such cases, employees have the right to temporarily stop performing their labor functions and even go to court.

For the lack of an advance on wages, employers are recognized as violators of the requirements of Art. 136 of the Labor Code of the Russian Federation. The penalty will be:

For the head of the company, a merchant: 1000 - 5000 rubles;

For a company - up to 50,000 rubles.

Additional costs can be avoided by timely provision of staff remuneration for labor. The accountant also needs to know what percentage of the salary is the advance in 2018.

When applying for a job, the applicant must be familiarized with the internal regulation, which indicates the date of the advance payment. The approximate time interval is 15 days. But it is not forbidden to transfer funds more often.

The amount and timing of the advance payment should be fixed in the organization's local documents (part 6 of article 136 of the Labor Code of the Russian Federation), for example:

Labor regulations;

Collective or labor agreements;

Regulations on wages.

The Labor Code does not provide an answer to this question. But the resolution of the Council of Ministers of the USSR No. 566 says: the amount must be determined by an internal document of the organization, and the amount cannot be lower than the tariff rate.

In practice, different calculation methods are used:

1. By the amount of time actually worked (letter of the Ministry of Labor No. 14-1 / 10 / V-660). The use of this method is possible only if it is mentioned in the local rules on salary advances.

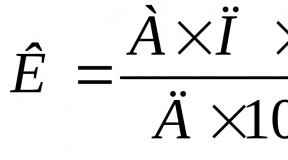

2. Fixed percentage of advance payment from salary. With this calculation option, its amount is unchanged throughout the entire working period. The most optimal bar is 50% of the salary (excluding personal income tax). Some pay only 40 percent. The formula for this calculation of the advance is given below: Advance = (SALARY + Allowances)x 50% Advance = (SALARY + Allowances)x 40%

When deciding how many percent of the salary in 2018 the advance will be, it is necessary to take into account other factors that affect the amount of wages:

The situation and complexity of the work;

Supplements for high qualifications;

Overfulfillment of the norm;

Payment for combining (substituting) positions.

Labor legislation does not prohibit in 2018 to establish a percentage of the advance payment from the salary, equal to half of the employee's allowance. Whatever its value and method of calculation, the company must necessarily issue funds in the first half of the month. And the frequency of payments is indicated in the internal regulatory documents for the organization.

Wages must be paid to the employee at least every half a month on the day established by the internal labor regulations, collective agreement, labor contract. This is a requirement of the law (part 6 of article 136 of the Labor Code of the Russian Federation). This means that the employer cannot do without the division of wages into at least 2 parts. After all, if he decides to ignore the payment of the advance part of the salary (salary for the first half of the month), then he can be fined 30,000 - 50,000 rubles for violation of labor laws, and the head or individual entrepreneur - 1,000 - 5,000 rubles (Article 5.27 Code of Administrative Offenses of the Russian Federation).

When paying an advance in cash, make the entry:

Debit 70 Credit 50 - advance payment from the cash register.

The transfer of the advance to the employee’s bank account is reflected in the following postings:

Debit 76 Credit 51 - money was transferred to pay an advance on wages;

Debit 70 Credit 76 - the bank transferred money to the salary cards of employees.

What percentage of the salary is an advance in 2017?

When transferring an advance to an individual employee account, make the following entry:

Debit 70 Credit 51 - the advance payment was transferred to the employee by a separate payment order.

When issuing an advance payment for finished products or goods, make the following entries:

Debit 70 Credit 90-1 - reflected the proceeds from the transfer of finished products (goods, works, services) on account of the salary advance;

Debit 90-2 Credit 43 (41, 20, 23) - the cost of finished products (goods, works, services) transferred as an advance on wages has been written off.

Record the transfer of other property (materials, fixed assets) against the advance payment as follows:

Debit 70 Credit 91-1 - reflected the proceeds from the transfer of other property as an advance payment;

Debit 91-2 Credit 01 (08, 10, 21 ...) - the cost of other property transferred as a salary advance was written off;

Debit 02 Credit 01 - depreciation was written off for retired property (when transferred as an advance payment of fixed assets).

|

According to the norms of labor legislation, the employer must pay wages at least 2 times a month. He can pay 3 more times, but not once.

As a rule, wages are paid 2 times a month - first an advance payment, and then a final payment is made. But many accountants and bosses do not know what part of the salary should be an advance.

Advance and salary

The advance implies a part of the salary for the first half of the month. According to the explanations of the Ministry of Labor, it should be calculated based on the time actually worked by this employee for this period. In 2018, when calculating the advance, it is worth considering not only the salary of a particular employee, but also all the additional payments and payments that are due to him, and which do not change with the same nature of work.

Do not take into account when calculating the advance:

- regional coefficients and allowances for work in the conditions of the Far North and in areas with a similar status. The fact is that they are accrued only when the final calculation of the entire amount due to this employee for the current month is made. It is impossible to make an accurate calculation for half a month, taking into account these coefficients;

- bonuses and allowances, which are of a non-permanent nature. The indicators on which premiums and other non-permanent payments are calculated become known only after the period for which the premium is to be paid has expired.

When the month is over and the accountant has made the final payroll, he must deduct the amount that has already been paid in advance.

Percentage of salary advance

None of the labor regulations specifies what part of the salary should be an advance. This must be established by the employer. As a rule, the advance is 30 - 40% of the salary. Most often, this indicator does not change from month to month. The authorities establish a specific amount that will be paid in the form of an advance to an employee in a particular position.

He must fix these nuances in the local regulatory act regulating the provisions on remuneration. Also, the amount of the advance is prescribed in the employment contract concluded with the new employee.

Each employer should have its own methodology and methods for calculating the advance. They must be enshrined in local regulations. Regardless of the chosen method, the advance payment is calculated on the basis of the time sheet.

Terms of advance payment and salary

In Art. 136 of the Labor Code of the Russian Federation says that wages must be paid at least 2 times a month. This is the employer's responsibility. If he does not comply with it, then penalties may be applied to him.

Specific terms of payments are not established, but it is said that the break between payments should not exceed 15 calendar days. Therefore, employers set the following payment mode:

- for the first half of the month worked - advance, 20 - 25;

- for the second half of the month worked - wages (final calculation), 5 - 10 of the next month.

It cannot be prescribed that wages and advances are paid between the 15th and 20th. The date must be clearly stated in the local regulation. For example, an advance payment is on the 25th, and wages are on the 10th.

This is necessary so that each employee knows exactly when he receives his earned funds. If the boss delays payment even for one day, the employee already has the right to complain to a higher authority and demand compensation. As practice shows, it is not necessary to indicate payment dates - the 15th and 30th of each month. The fact is that in some months the 30th day is the last day of the month, and the employer has an obligation to withhold income tax. When filling out the report, a serious error may occur, especially if the 30th is a day off, and the payment will be made on the first business day, but already in the next month.

The law does not prohibit making payments in favor of employees more often than 2 times a month and at a different interval. For example, in a local act, you can specify that the administration pays employees 3 times a month with a break of 10 days. But paying less than 2 times a month and with an interval of more than 15 days is prohibited.

Common mistake! A person gets a job on the 17th. The deadline for payment of advance payment and wages is set for the 20th and 5th. No one even thinks to calculate and pay an advance to a new employee, since only 3 days have been worked. All money earned will be paid to him on the 5th. But then the rule is violated - the break between payments should not exceed 15 days.

Any deviation from the norms of the Labor Code of the Russian Federation will lead to the fact that the employer will be held administratively liable under Article 5.27 of the Code of Administrative Offenses of the Russian Federation. The sanctions under this article are as follows:

- the director will be fined in the amount of 10 - 20 thousand rubles;

- if the employer is an individual entrepreneur, then the amount of the fine will range from 5 to 10 thousand rubles;

- if it is a legal entity, then you will have to pay several times more - from 50 to 100 thousand rubles.

The amount will be determined by the inspectors themselves, depending on the "severity" of the offense.

Also coming:

- material liability. For each day of delay, the employer must pay compensation in the amount of 1/150 of the key rate of the Central Bank of the Russian Federation. This obligation arises the very next day. That is, if the documents indicate that the payment should be on the 6th, then from the 7th the debt already arises;

- criminal responsibility. If deliberate non-payment of wages occurs, the director will be punished.

Failure to pay wages or advances also carries the risk of criminal penalties. According to Art. 199.1 of the Criminal Code of the Russian Federation, an employer may be held criminally liable if the following conditions are met:

- presence of personal interest in the commission of a crime. As such, property and other benefits are recognized that the violator could receive or hoped to receive;

- large sum of arrears. This is the amount exceeding 15 million rubles over the past 3 years.

If both of these conditions are met, the violator will be held liable in the form of:

- a fine in the range of 100 - 300 thousand rubles;

- penalties in the amount of 2 years of the offender's income;

- imprisonment for up to 2 years.

If the amount of arrears is recognized as especially large (that is, it exceeds 15 million rubles for the last 3 years of activity), then the punishment will be more severe:

- fine up to 400 thousand rubles;

- the equivalent of the entrepreneur's income for the last 5 years;

- imprisonment for up to 5 years.

In addition, the employees themselves can sue their unscrupulous employer. This threatens him with the payment of previously unpaid wages, compensation for its delay, as well as inspections by regulatory authorities.

How much is the advance payment from the salary according to the Labor Code of the Russian Federation

To calculate advance payments in favor of an employee, it is recommended to use one of several methods:

- by dividing the amount of the entire salary established by the labor agreement by the norm of working days in a month, followed by multiplication by the amount of days worked from the first day of the month to the date of advance payment;

- by multiplying the number of units of manufactured products by the piece rate (when using the piecework wage system at the enterprise). When calculating the amounts, it should be taken into account that personal income tax is not deducted from the advance payment;

- by multiplying the amount of the tariff rate with all surcharges and surcharges by a factor of 0.5. In this case, the advance is calculated without taking into account holidays and weekends, which is often unprofitable for employees, since in some months the advances will be miserable (in particular, in January and May);

- by dividing the amount of the tariff with the stipulated allowances and surcharges by the existing standard of working hours, followed by multiplication by the rate of time worked for the first half of the month.

If the employee is absent from work from the beginning of the month until the date of advance payment, then the latter will not be accrued to him. For example, an employee goes on vacation from the 1st. On the 20th (or on another date) he will not receive his advance payment. But if the absence was partial, then accrual and payment must be made. For example, if he was ill from the 1st to the 5th, then he will receive an advance from the 6th to the 15th.

For a better understanding it is necessary to give an example:

Employee V. works as a warehouse manager, has a salary of 46,500 rubles. She also receives an additional payment for combining positions in the amount of 5,600 rubles. When the sales plan is fulfilled, all warehouse employees receive a bonus in the amount of 25% of the salary. There are 21 working days in the current month, the advance is paid for 11 working days.

- It is necessary to take into account only the salary and the additional payment for the combination, the bonus based on the results of sales is not taken into account, since it is not clear whether it will be paid or not;

- The salary for 11 working days is 46,500 / 21 * 11 = 24,357 rubles;

- Surcharge for combining positions for the same period 5,600 / 21 * 11 = 2,933 rubles;

- The advance payment for 11 fully worked days is 24,357 + 2,933 = 27,290 rubles.

NDF is not deducted from the advance and is not paid separately to the budget.

This is how the advance is calculated in proportion to the hours worked. But the employer also has the right to set the amount of the advance as a percentage of wages. Another example:

Employee P. has a salary of 48,300 rubles. The Regulation on remuneration says that the amount of the advance is 35% of the salary. In the current month there were no bonuses and additional payments, P. does not use tax deductions.

- Advance amount 48,300 * 35% = 16,905 rubles;

- The amount of wages before tax is 48,300 - 16,905 = 31,395 rubles;

- After NDF payable 31,395 * 13% = 4,081.35 rubles;

- The amount of wages after tax is 37,313.65 rubles.

Results

Wages must be paid at least 2 times a month with an interval of no more than 15 calendar days. You can pay more often and with a shorter interval, but less often and more - you can’t.

For violation of the terms of payment, a fine is due. The dates when the employer pays parts of salaries should be specified in the relevant local act. You can not specify "from 5 to 8". A specific date must be entered. For example, "6th of every month". The salary for the first half of the month is called advance, for the second half - wages. There is no exact amount of the advance payment established in any regulatory act on labor. Therefore, the employer has the right to charge it in various ways.

Most Popular:

- for actual hours worked. For example, in the current month, the advance payment is 9 working days before the payment date, and the next month it will be 10. Therefore, the advance payment amount will be different;

- as a percentage of salary. Then the advance payment will be fixed all the time, and the amount of the final payment will change.

When calculating the advance, permanent “labor” payments are involved, for example, an additional payment for combining. And non-permanent payments are taken into account only in the final calculation. Income tax is not charged on the amount of the advance. This happens after the accountant makes the final calculation of the remaining amount of wages.

Responsibility for late payment of an advance payment is exactly the same as for non-payment of wages. If the Regulation on remuneration states that the salary for the first half of the month is paid on the 25th, then the delay begins on the 26th. Employees have the right to demand compensation from their superiors in the amount of 1/150 of the key rate of the Central Bank of the Russian Federation. If the amount of debt is recognized as large, then the employer will face criminal prosecution.

Compliance with the terms of payments to their employees is a direct obligation of all employers!

There were no cardinal changes at the beginning of 2018 in terms of calculating the amount of the deposit, therefore it is determined according to the previous 2017 scheme: in proportion to the actual hours worked by the employee.

Payment of monthly earnings in advance, Art. 136 of the Labor Code of the Russian Federation and consists in transferring money for the worked half of the month to the employee. The rest is paid after the second half of the month. Thus, the legislator insists on the calculation of the employer with a subordinate at least twice a month.

How many percent of the salary according to the Labor Code of the Russian Federation 2018?

The Labor Code, in this regard, does not establish any specific interest rates. It only indicates that the employee must deduct wages at least twice a month. And the size of the advance on wages under the Labor Code of the Russian Federation in 2018 is already determined based on the specific situation.

The advance payment, in this case, will be 50% of the total amount of income, but taking into account the deduction of tax 13% / 2 (two half months) = 7.5% (for one half). So, the percentage of the advance payment is 42.5% (50% - 7.5%).

But a certain amount of interest is not prescribed either in the employment contract or in the local acts of the organization where the person works, only the frequency of payments for work is established.

Advance payment of wages under the new rules in 2018

In 2017, changes were made by the Federal Law to labor legislation: the procedure and terms for calculating advance payments to working citizens were adjusted. Now an employee of the company must receive remuneration for work at least twice per month, while every 15th working day must be the day the advance is paid, but it can be set earlier, at the discretion of the employer.

By the way, what are deductions from wages under the Labor Code of the Russian Federation, it is told.

How much is the salary advance paid in 2018?

The topical issue of how much percentage is the advance from wages is of concern to all employees in 2018. It is calculated in proportion to the period worked. If the entire income for 30 days is 100,000 rubles, then by the 15th day the advance will be equal to 50,000 rubles, but this is without income tax (13%).

With personal income tax, the amount will be calculated as follows:

- 100 000 – 13 % = 87 000;

- 87 000/ 2 = 43 500.

The advance payment for 15 days will be 43,500 rubles.

New terms for advance payments and salaries in 2018

New deadlines have indeed appeared. This is every 15 days. The manager can set the day for paying half of the salary on any day of the month, as long as the gap between the first part and the second does not exceed 15 days.

If the day of advance deductions is a day off, then the money must be issued on the first working day before them. So, the framework for remuneration of workers is set by the legislator, and the employer chooses a specific number.

Do I need to pay personal income tax on advance payments on wages?

Personal income tax is levied on the total amount earned by the employee for a monthly period. It is defined at 13% and has not changed so far. From the advance, income tax is not withheld, but personal income tax is reflected in its amount, since advance deductions are formed taking into account the final amount of the person's income, which remains after the deduction of 13 percent tax.

Salary advance application sample

Description of the application form:

- typewritten or handwritten text on a white sheet;

- on the right, starting from the center of the sheet - the addressee (includes the name of the place of work, full name of the boss, address) and the applicant (name, address);

- below - in the center: the word "STATEMENT";

- with a paragraph indent, the content part, it can be formulated in any way, it is only important that it is clear what the applicant wants and in what size;

- it is recommended to indicate the reasons for the appeal, as they contribute to the manager's conviction of the need to establish an advance payment procedure in relation to the employee;

- at the end, a signature with a transcript, a date is affixed.

An order for the payment of an advance from wages - sample

All organizational issues at the enterprise are resolved in the form of orders issued by the person who heads it. So, in order to establish an advance payment procedure for work for subordinates, the employer creates an order about this.

It is drawn up according to the rules for the preparation of local acts established in the organization, taking into account the generally accepted rules of office work and the preparation of documents. He must also go through the approval process with certain authorized employees of the company.

Thus, remuneration in the form of advance payments has many nuances and requires good regulatory awareness of the management team in this matter.

According to the procedure for paying wages, employees must first receive a full calculation of the advance payment, and after the end of the billing period, the rest of the salary. You can read about how wages are calculated and paid in another article, this one will talk about the advance part of it, how to install it and discuss the issue of accruing personal income tax on it.

In case of delayed payment of wages, the organization may be fined, but do not forget that payments to employees should be made no more than 2 times a month, and the interval between them is no more than 14 days, in accordance with the established internal regulations in the organization (Labor Code of the Russian Federation , item 136).

Along with this, there are no specific deadlines for the payment of wages and the size of the advance in the Labor Code. Therefore, Rostrud in a letter recommended acting on the basis, which describes the procedure for paying salaries for the first half month. According to it, the amount of the advance is determined, on the basis of an agreement between the administration and the trade union, in the event of a collective agreement, while the minimum wage advance should not be lower than the employee's tariff rate for the time he has worked.

Based on the above, and also, in accordance with the Labor Code, the salary must be paid at least 2 times a month - an advance and the main part, in addition, when calculating the advance, it is necessary to take into account the time worked by the employee. Therefore, the time sheet must be done 2 times a month, for the first half a month it is submitted to calculate the advance payment, in accordance with the hours worked, and for the second - to calculate the remaining part.

Some organizations calculate the advance based on the salary scale of the employee, in the amount of 40% of the salary. Usually, such a figure approximately corresponds to the required amount of advance payment on wages, while the calculation can be made without a time sheet and is much simpler. But in this case, a nuance may arise if the employee, having not worked for the whole month, decides to quit and it is necessary to recalculate the salary due to him and, if necessary, withhold the overpaid amount.

Some organizations have attempted to sue and keep the advance from the employee, but to no avail. By decision of the Leningrad Court No. 33-5557 / 2013 dated 04.12.2013, it was ruled that Articles 137 of the Labor Code and 1109 of the Civil Code contain an exhaustive list of grounds on which an employee can be charged overpaid amounts. So, according to the legislation, when an employee receives an advance part, there are no defining concepts by which the paid advance can be withheld.