Accounting program 1c accounting 8. Basic enterprise accounting: pros and cons. Video training for programmers

“1C: Accounting 8” is the most popular accounting program that can take accounting automation to a whole new level. A convenient product and services connected to it will allow you to effectively perform the tasks of the accounting department of any business.

1C is continuously improving its software and services in order to offer a modern and universal accounting solution that meets user expectations.

What is “1C: Accounting 8”?

“1C: Accounting 8” is a professional accountant’s tool with which you can keep records, prepare and submit mandatory reports. The program combines all the achievements of previous versions and new solutions based on the experience of working together with numerous users and partners of the 1C company.

Clear accounting in accordance with legislation and business needs, saving time when making settlements with counterparties, processing documents and business transactions, effective user support combined with high comfort of work - these are just some of the key features of 1C: Accounting 8.

|

ALL ACCOUNTING IN ONE PROGRAM |

||

Advantages of the 1C:Accounting 8 program

Suitable for your business. The accounting program can be used in any commercial structure, regardless of the type of activity and scale - from individual entrepreneurs without employees to multi-industry holdings. “1C: Accounting 8” allows you to keep records in companies engaged in wholesale, retail, commission and online trade, contract work, professional and personal services, manufacturing, and construction.

Various taxation systems are supported. Accounting is carried out in accordance with the current legislation of the Russian Federation. The 1C company closely monitors changes and innovations in the legal field, improving and updating the program in accordance with legal requirements.

Several versions to choose from. Use the version of the program that best suits your business needs.

“1C: Accounting 8. Basic version” is a ready-made solution for automating accounting and tax accounting on one computer. There are specialized options for aspiring entrepreneurs and small businesses:

- “1C: Simplified 8” - pre-configured for accounting according to the simplified tax system;

- “1C:Entrepreneur 2015” - with a simple interface designed for entrepreneurs who keep records on their own and do not have knowledge in the accounting field;

- “1C: Accounting for 1” is the most affordable version of the program, designed for one enterprise or individual entrepreneur with “linking” to the user’s tax identification number.

“1C: Accounting 8 PROF” is a professional solution for stable and growing businesses with the ability to operate multi-user, including via the Internet, the ability to configure and support a web client.

“1C: Accounting 8 KORP” is the version with the widest functionality, including accounting for separate divisions.

For those who want to explore the capabilities of the program before purchasing it, “1C: Accounting 8. Educational version” is intended. This program has a number of technical limitations and is not suitable for full-fledged accounting.

There is a simple transition from one version to another with full preservation of accumulated data. For example, as your business grows, you can quickly and on preferential terms switch from the basic version to 1C: Accounting 8 PROF.

Quick to learn, easy to use. The system of hints built into 1C:Accounting 8 works as a tutorial and allows you to get started right away. Hints will help you correctly fill out company information and set up accounting parameters. After completing the initial settings, a significant part of the data in the documents is filled in automatically, saving you time and minimizing the number of errors. When preparing reports, special algorithms will automatically check the correctness of the source documents, the completeness of filling out the reporting forms, and even check the control relationships between the forms according to the Federal Tax Service methodology.

Flexibility and customization. The accounting program implements accounting schemes that are used in most organizations. At the same time, “1C: Accounting 8” provides flexible settings for the individual characteristics of the business and the accounting principles adopted by the company. The program allows you to create new directories and change the forms of documents, text, tabular and graphic reports.

Convenient preparation and sending of reports. The program includes regulated reports for submission to regulatory government agencies. Accounting statements, tax returns and calculations, reports to social extra-budgetary funds, reporting on personalized accounting to the Pension Fund, statistical reporting, tax certificates are easily generated and uploaded electronically. The accountant's built-in calendar will help you prepare the necessary reports on time, and the built-in 1C-Reporting functionality will ensure that they are sent to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat directly from the 1C: Accounting 8 program.

Working with the program

"1C: Accounting 8 PROF"- a ready-made solution that can be immediately used to record business transactions in any commercial organization, be it a large manufacturing enterprise or an individual entrepreneur. At the beginning of working with the Start Assistant program, it organizes step-by-step input of all the necessary data: information about the organization, accounting policies, program settings, etc. Upon completion of the Start Assistant, you can immediately enter documents into the database.

Working with the program "1C: Accounting 8 PROF" consists of registering business transactions using documents. Postings are generated automatically. Tax accounting in “1C: Accounting 8” is carried out simultaneously with accounting.

To enter initial balances and reflect rare and corrective transactions that are not automated by configuration documents, manual entry of accounting entries is used. To make it easier to enter repetitive transactions, it is recommended to use standard transactions.

Organization of accounting and tax accounting

Accounting and tax accounting in "1C: Accounting 8 PROF" implemented in accordance with the current legislation of the Russian Federation. The program includes a chart of accounts, configured in accordance with the Order of the Ministry of Finance of the Russian Federation “On approval of the chart of accounts for accounting of financial and economic activities of organizations and instructions for its application” dated October 31, 2000. No. 94n.

To reflect business transactions in tax accounting for income tax, as well as to account for permanent and temporary differences in order to comply with the provisions of PBU 18/02 “Accounting for income tax calculations,” a tax accounting chart of accounts is used. In order to facilitate the comparison of accounting and tax accounting data, the Chart of Accounts for tax accounting is close in structure and composition to the Chart of Accounts for accounting.

To maintain tax accounting in organizations with the simplified tax system, a separate Chart of Accounts for tax accounting is used. The program also provides for a taxation system in the form of a single tax on imputed income for certain types of activities in accordance with Chapter 26.3 of the Tax Code of the Russian Federation.

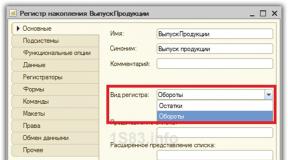

Tax accounting for income tax

All transactions are reflected not only in accounting, but also in tax accounting. According to primary documents in the process of working with the program "1C: Accounting 8 PROF" Postings are generated in tax accounting. To summarize information based on transactions in tax accounting accounts, appropriate tax accounting registers are formed. The income tax return is filled out automatically.

Simplified taxation system

To keep records under the simplified taxation system (STS), the program uses the Book of Income and Expenses of organizations and individual entrepreneurs (IP) using the simplified taxation system. The book of income and expenses is generated automatically. Organizations using the simplified tax system can use as an object of taxation:

- income;

- income reduced by expenses.

Accounting for activities subject to UTII

Regardless of whether an organization uses the simplified tax system or the general taxation system, some types of its activities may be subject to a single tax on imputed income (UTII). IN "1C: Accounting 8 PROF" provision is made for separating the accounting of income and expenses associated with activities subject to and non-taxation of UTII. Expenses that cannot be attributed to a specific type of activity at the time they are incurred can be allocated automatically.

Keeping records of the activities of several organizations

In a programme "1C: Accounting 8 PROF" You can keep accounting and tax records of the economic activities of several organizations. Accounting for each organization can be maintained in a separate information base. At the same time, “1C: Accounting 8” provides the ability to maintain accounting and tax records for several organizations in a common information base. Moreover, each organization can have its own accounting policy and apply its own taxation regime.

Keeping records of several organizations in one information base is usually used in situations where the economic activities of these organizations are closely interconnected: in this case, in current work, you can use general lists of goods, contractors (business partners), employees, own warehouses, etc., and compulsory reporting should be generated separately.

Thanks to the ability to keep records of the activities of several organizations in a single information base, the configuration can be used both in small organizations and in holdings with a complex organizational structure.

Accounting for inventories

Accounting for goods, materials and finished products in “1C: Accounting 8” is implemented in accordance with PBU 5/01 “Accounting for inventories” and guidelines for its application. In accordance with the accounting policy of the organization, the following methods of assessing inventories are supported:

- At average cost.

- At the cost of the first acquisition of inventories (FIFO method).

- at the cost of the most recent acquisition of inventories (LIFO method).

To evaluate inventories using FIFO and LIFO methods in "1C: Accounting 8" PROF version maintenance of party records is provided. The presence of this feature allows for differentiated accounting of inventories of the same item, received at different times and at different prices. The batch is formed automatically when the inventory is capitalized. If there is no need for batch accounting, it can be disabled.

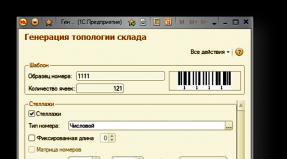

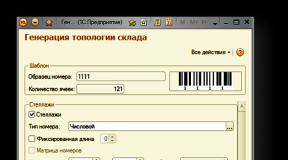

Warehouse accounting (Accounting by storage locations)

In a programme "1C: Accounting 8 PROF" it provides for the registration of operations for the movement of goods between warehouses, for inventory, the receipt of goods, as well as for their write-off. For warehouses, you can maintain quantitative or quantitative-total accounting. In the first case, the valuation of goods and materials for accounting and tax purposes does not depend on the warehouse from which they were received. If there is no need for warehouse accounting, it can be disabled.

In "1C: Accounting 8" inventory data is recorded, which is automatically verified with accounting data. Based on the inventory, the identification of surpluses and write-off of shortages is reflected.

Accounting for trade transactions

In a programme "1C: Accounting 8 PROF" automated accounting of transactions of receipt and sale of goods and services, as well as transactions of return to the supplier and return from the buyer. When selling goods, invoices are issued, invoices and invoices are issued.

For retail trade, technologies for working with both automated and non-automated retail outlets are supported. Write-off of goods at a manual point of sale occurs periodically, based on the results of the inventory. For different retail outlets, it is possible to organize accounting under different taxation regimes (UTII and non-UTII). Various payment methods are supported. It is possible to record payments by payment cards, bank loans, and cash. Retail goods can be accounted for at purchase or sales prices.

All wholesale trade transactions are accounted for in terms of contracts with buyers and suppliers.

For imported goods, data on the country of origin and the cargo customs declaration number are taken into account.

Accounting for commission trade

In 1C: Accounting 8, accounting for commission trade is automated, both in relation to goods taken on commission from the consignor and transferred for further sale to the commission agent. It is also possible to reflect transactions on the transfer of goods to a subcommission. The program provides various options for calculating commissions:

- percentage of the sale amount;

- percentage of total sales of consignment goods;

- fixed amount (not calculated).

When generating a report to the principal or registering a commission agent’s report, you can immediately make a calculation and reflect the deduction of the commission.

Accounting for container transactions

IN program "1C: Accounting 8" operations for accounting for returnable reusable packaging are automated. Debt to suppliers and debt from customers for returnable packaging is accounted for in a separate settlement account. The specifics of taxation of such transactions and settlements with suppliers and customers are taken into account.

Accounting for banking and cash transactions

“1C: Accounting 8” implements accounting for the movement of cash and non-cash funds. It supports entering and printing payment orders, incoming and outgoing cash orders. Transactions for settlements with suppliers, buyers and accountable persons, depositing cash into a current account and receiving cash by check are automated. When recording transactions, payment amounts are automatically divided into advance and payment.

Based on cash documents, a cash book of the established form is formed.

A mechanism for exchanging information with programs such as “Bank Client” has been implemented.

Accounting for settlements with counterparties

In “1C: Accounting 8”, accounting of settlements with suppliers and customers can be carried out in rubles, conventional units and foreign currency. Exchange rate and amount differences for each transaction are calculated automatically.

Settlements with counterparties can be carried out under the agreement as a whole or for each settlement document (shipment, payment, etc.). The method of settlement is determined by a specific agreement.

When preparing receipt and sales documents, you can use both general prices for all counterparties and individual prices for a specific contract.

Accounting for fixed assets and intangible assets

"1C: Accounting 8 PROF" allows you to keep records of fixed assets and intangible assets in accordance with PBU 6/01 “Accounting for fixed assets” and PBU 14/2000 “Accounting for intangible assets.” All basic accounting operations are automated: receipt, acceptance for accounting, depreciation, modernization, transfer, write-off. It is possible to distribute the amounts of accrued depreciation for a month between several accounts or objects of analytical accounting. For fixed assets used seasonally, it is possible to use depreciation schedules.

Accounting for production activities (main and auxiliary production)

In "1C: Accounting 8", the calculation of the cost of products and services of main and auxiliary production, accounting for the processing of customer-supplied raw materials, accounting for workwear and special equipment is automated. During the month, accounting for released finished products is carried out at the planned cost, and at the end of the month the actual cost of the manufactured products and services provided is calculated.

The range and quantity of materials and components for transfer to production can be automatically calculated based on data on manufactured products and information on consumption standards (specifications).

For complex technological processes involving intermediate stages taking into account the release of semi-finished products, warehouse accounting of semi-finished products and automatic calculation of their cost are supported.

Accounting for indirect costs

To account for general business expenses, the use of the “direct costing” method is supported. This method provides that general business expenses are written off in the month they are incurred and are fully charged to the cost of goods sold. If the organization does not use the direct costing method, then general business expenses are distributed between the cost of manufactured products and work in progress. When writing off indirect costs, it is possible to use various methods of distribution among product groups (services). For indirect costs, the following distribution bases are possible:

- output volume,

- planned cost,

- salary,

- material costs.

Transportation costs may be written off in proportion to the cost of goods sold.

VAT accounting

IN "1C:Accounting 8" automated filling of the purchase book and sales book, tracking of difficult situations during sales using the “zero” VAT rate, during construction using economic methods, as well as when the organization performs the duties of a tax agent. VAT amounts for indirect expenses can be distributed among sales transactions subject to VAT and exempt from VAT. For organizations whose business activities do not involve complex sales operations at a VAT rate of 0%, without VAT, etc., it is possible to maintain simplified VAT accounting (without the use of regulatory documents).

The special mechanism “VAT Accounting Assistant” is designed to simplify the reflection of regulatory transactions for value added tax. “Assistant” allows you to control the order and relevance of generated regulatory documents.

Payroll accounting, personnel and personalized accounting

“1C: Accounting 8” keeps records of personnel movements, including records of employees at their main place of work and part-time employees, and the formation of unified forms in accordance with labor legislation.

Automated calculation of wages for employees of the enterprise based on salary and the maintenance of mutual settlements with employees up to the payment of wages, as well as the calculation of taxes and contributions regulated by law, the taxable base of which is the wages of employees of organizations, and the generation of relevant reports (on personal income tax, unified social tax, contributions to the Pension Fund), including preparation of reports for the PFR personalized accounting system.

When performing calculations, the presence at the enterprise is taken into account:

- disabled people

- tax non-residents.

The program includes a “Payroll Assistant”, which is designed to simplify the reflection of HR and payroll accounting transactions. The “Assistant” shows the sequence of actions that must be performed in this section of accounting, from hiring an employee to generating payroll accounting entries.

Final operations of the month

Routine operations performed at the end of the month are automated, including currency revaluation, write-off of deferred expenses, determination of financial results, etc.

“1C:Accounting 8” includes a set of “Calculation References” reports, reflecting calculations related to carrying out routine operations to close the month: “Distribution of indirect expenses”, “Calculation of income tax”, etc.

Standard Accounting Reports

"1C: Accounting 8" includes a set of standard reports designed to analyze data on account balances and turnover and transactions in various sections for accounting and tax accounting. These include a balance sheet, a chess sheet, an account turnover sheet, account turnover, an account card, account analysis, sub-account analysis, turnover between sub-accounts, summary entries, general ledger, diagrams.

The program provides users with extensive options for customizing reports: selecting data using comparison operations (“equal to”, “not equal to”, “in the list”, etc.); setting up selection by subconto, by subconto details, grouping by subconto details; customization of report headers and footers.

Regulated reporting

The 1C:Accounting 8 program provides for the automatic generation of mandatory (regulated) reporting for submission to the owners of the organization and regulatory government bodies: accounting forms, tax returns, reports for statistical bodies and government funds. Provision is made for generating reports in electronic form.

The program supports both current reporting forms and those in force in previous reporting periods. You can search for reporting forms in accordance with the selected period.

Ergonomic user interface

New modern interface design "1C: Accounting 8 PROF" provides:

- possibility of mass input of information (function “input by line”);

- convenient tools for working with large dynamic lists;

- maximum use of available screen space to display information;

- design style mechanism.

Configuration

The standard configuration of “1C: Accounting 8” can be changed and customized to the accounting features of a particular organization. For this purpose, the “Configurator” launch mode is provided, which provides:

- Setting up the system for various types of accounting.

- Implementation of any accounting methodology.

- Organization of any directories and documents of any structure.

- Customizing the appearance of information entry forms.

- Configuring the behavior and algorithms of the system in various situations using the built-in language.

- Wide design possibilities for creating printed forms of documents and reports using various fonts, frames, colors, and designs.

- Possibility of visual presentation of information in the form of diagrams.

- Quickly change configuration using visual development tools.

Scalability

« 1C: Accounting 8» can be used in the following options:

- Single-user - for personal use.

- File - for multi-user work, ensuring ease of installation and operation.

- A client-server version of work that provides reliable storage and efficient processing of data when a large number of users work simultaneously.

- The distributed infobase option ensures identical infobase configurations and allows data exchange without additional programming.

Integration with other systems

"1C: Accounting 8" provides data exchange with other applications through text files, DBF files and XML documents, downloading currency rates from the Internet, address classifier, etc.

The 1C program first appeared on the market in the early 90s. It was intended for accounting purposes. Since then, the legendary 1C: Accounting program has been developing dynamically, taking into account changes in legislation, as well as the needs and wishes of users.

The 1C platform is also being updated. Approximately every 3-4 years a new, improved version of 1C:Enterprise is released. Thanks to the fact that 1C keeps up with the times, the company has won the recognition of specialists, and the number of its users today exceeds 5 million people.

Since regular updating of products and keeping them up to date is a requirement not only of the 1C company, but also a real necessity, each of the users, one way or another, was faced with installing a new version of 1C programs.

In this article, we will explain in accessible language the structure of the 1C:Enterprise program and look at its varieties. A brief overview of all generations of 1C will also be made, incl. the latest version of the program and its main innovation - the “Taxi” interface. The article will answer the question “to be or not to be” of the new version of 1C on your computer.

How does 1C work?

“1C:Enterprise” is a whole “family” of programs designed to automate accounting in a wide variety of organizations.

All 1C programs have a common basis, a foundation, which, in the language of the 1C company, is called technology platform or simply platform.

The 1C:Enterprise platform performs several important tasks. Firstly, it is the environment in which all types of 1C programs are launched and run. Such applications are called application solutions or configurations.

Most popular configurations

- 1c accounting

- 1C: Trade Management

- 1C: Salaries and personnel management

- 1C: Accounting of a government institution and 1C: Salaries and personnel of a budgetary institution for budgetary organizations.

All 1C application solutions have the same type of interface and follow general operating principles. Moreover, programs can work together and also exchange data.

For example, an accountant calculated salaries for employees in the “1C: Salaries and HR Management” configuration. Then he uploads the data to 1C: Accounting, receiving ready-made documents and transactions for all accruals, deductions and payments.

“1C:Enterprise” is a technological platform on the basis of which various 1C configurations are developed and operate.

Secondly, the technology platform contains a special environment for creating new and “refining” existing application solutions. This part of the platform is called configurator In the configurator mode, the program is also configured and updated, in other words, the program is administered. Programmers work there.

Scheme of the 1C:Enterprise platform device

To get started, both in the 1C application solution and in the configurator, you need to launch the 1C:Enterprise platform.

In the program launch window there are two buttons in the upper right corner:

- “1C:Enterprise” button – launches the application solution (configuration) in user mode;

- “Configurator” button – enters the configurator.

In the 1C:Enterprise environment, the concept of “version” refers specifically to the technology platform. The 1C technology platform has several versions developed for different operating systems.

Versions of 1C for different operating systems

The most widely used version is “1C:Enterprise”, designed to work in the Windows environment.

Other versions of the application can run on Linux or OS X operating systems.

In addition, there are versions of 1C programs that even work on tablets, iPads and smartphones running Android, iOS and Windows Phone operating systems.

Versions of 1C for different “generations” of the program

Most often, the concept of “version 1C” refers to a kind of “generation” of the platform. Each release has a number, usually two digits (for example, 8.0, 8.1, 8.2, and 8.3). The same number is assigned to a configuration running on this platform (for example, “1C: Accounting 8.2” or “1C: Accounting 8.3”).

1C platform for the MS DOS operating system

The first version of the application was developed for the MS DOS operating system in 1991 and was called “1C: Accounting 3.0”. Subsequently, versions 4.0 and then 5.0 appeared.

Platform 1C version 6.0

In 1995, “1C: Accounting 6.0” appeared based on the Windows 95 operating system. The application allowed automatic generation of accounting entries and had an interface that was improved in terms of convenience.

Platform 1C version 7 (7.0, 7.5, 7.7)

Next, the so-called “seven” was released. Its first versions 7.0 and 7.5 were improved, and in 1999 the final version 7.7 was released, which became widespread and is still loved by many users.

In addition to the previously known “1C: Accounting”, configurations designed for a variety of fields of activity appeared on the basis of the new platform, for example, “1C: Trade and Warehouse 7.7”, “1C: Salaries and Personnel 7.7”, “1C: Clothing Allowance 7.7”.

A full-fledged configurator has been developed for technical specialists.

Interface "1C: Accounting 7.7". The main menu, the main element of the program window, is located at the top.

Platform 1C version 8 (8.0, 8.1, 8.2)

In 2002, the first trial version of the G8 appeared, numbered 8.0, the further evolution of which led to the release of versions 8.1 and 8.2.

The platform has acquired a more comfortable interface compared to the “seven”:

- Appeared Function panel. It is located under the main menu and consists of bookmarks: Enterprise, Bank, Cashier, Purchase etc. The G8's function panel picturesquely filled the central part of the window, formerly the gray workspace of the G7.

- The list of main menu items has changed. Now each menu item has become intended for a specific area of work. For example, in the “1C: Accounting 8” menu the following items appeared: Bank, Cashier, Purchase, Sale, Warehouse, Production, OS.

- The program supported work in two modes: “separate windows” and “bookmarks”. Each document or reference book was opened in a separate window, as in the “seven”, or in bookmarks, as in a modern browser.

Interface 1C: Accounting 8.2. The function panel is located under the Main Menu

The technical characteristics of the platform have been significantly improved. Now it is possible to work in the program via the Internet, in “cloud computing mode” or “in the cloud”. To do this, you do not need to install the 1C:Enterprise platform on your computer; it is enough to have access to the Internet. This technology was named by the developer 1C:Fresh. A user working in the cloud is freed from the need to constantly install platform and configuration updates.

Platform 1C version 8.3

Platform 8.3 was released in 2012. New Internet services have appeared (1C: Counterparty and 1C: PARK-Riski).

Internet services allow you to:

- Automatically fill in the details of counterparties using TIN;

- Quickly check information about counterparties, assess their reliability, and obtain information about upcoming audits of the organization;

- Fill in the details of your own organization using the TIN when you first start the program.

The main direction of expanding the functionality of the platform was integration with various Web technologies.

In 2013, an innovation appeared - mobile platform 8.3 for iOS and Android. In addition, the application interface has changed dramatically.

Instead of the Main Menu appeared Section panel. The section names correspond to different areas of accounting, for example, Bank and cash desk, Purchase and sale, Manufacturing. And the sections Administration, Directories and accounting settings are intended for maintenance and configuration of the program.

Interface "1C: Accounting 8.3". The section bar, the main element of the program window, is located at the top.

The final version 8.3 included a new user interface concept called "Taxi". Today "Taxi" is the main (recommended) interface.

Features of the Taxi interface

- Modern design, similar in appearance to a Web document. For example, buttons appeared Favorites, Go to home page(similar to the Home button in a browser);

- Using a new color palette, “transparency” effect, “flying” interface;

- Use of large font;

- The section bar has moved to the left side of the screen;

- “Flexibility” of the program, allowing you to design your own workspace.

Interface "Taxi" in "1C: Accounting 8.3". The section panel is on the left.

Platform 1C version 8.4

The 1C company has already announced the release of a new platform 8.4. The date of its appearance is not yet known.

Today, 1C clients work in a variety of configurations and versions of the program. Some still work in the "seven", because... the company provides service for some 7.7 configurations. But still, the overwhelming majority of users and administrators answer the question “Should I install a new version?” in the affirmative.

Beginning of work:

In this lesson we will start working in our database. Let's fill in the details of our organization. Let's choose the functionality we need. The 1C Accounting 8 program contains many functions and not all of them may be needed. For example, we will not consider the possibility of retail trade, we will not consider agency accounting, intangible asset accounting and some other transactions. Accordingly, so that the interface is not loaded with functions that are not intended to be used, we will disable them. In the future, it is possible to enable them when the need arises.

Accounting parameters in the 1C Accounting 8 program can also be selected by determining how we will account for certain operations. Let's see how they are configured in our program.

Then we will set up the accounting policy. The legislation provides for the possibility of choosing certain accounting methods. This requirement is established in the accounting policies of the enterprise and is usually formalized by an order for the enterprise.

Next, consider the Chart of Accounts. In the 1C Accounting 8 program, the Chart of Accounts complies with the Order of the Ministry of Finance “On approval of the chart of accounts and instructions for its use.” Nevertheless, the user of the 1C Accounting 8 program sometimes needs to enter some of his own accounts and subaccounts into the system. 1C Accounting 8 supports this feature. I will show you how new accounts are added to the chart of accounts.

In conclusion, we will look at how to set personal settings for the 1C Accounting 8 program. You constantly have to fill out various details in documents. Often the user works with a specific set of details. In order to simplify work, personal settings indicate the data that will be supplied to documents automatically. If necessary, the user will be able to change and edit them.

Initial filling of information about a legal entity

You can start filling out the details of our organization by clicking on the link on the initial page “Fill in the details of the organization”. You can also go to the “Main” section of the “Organizations” directory. In the future, we will be able to change our details through this section. In the “Organizations” directory, you can use the “Create” command.

This command opens the initial page of the assistant for creating a new organization. It is necessary to choose who our organization is - a legal entity or an individual entrepreneur - we will select “Legal Entity”.

The organization creation form opens and the system issues several information messages. At this stage, information messages do not interest us. Let's close them.

You can fill in the details in two ways:

- manually starting with the name of the organization and then all the details;

- automatically - when Internet support is connected, I indicate the organization’s TIN. At the command “Fill in by INN”, the system, based on data from the Unified State Register of Legal Entities, fills in all the details known to it (names, codes, address, full name of the manager).

Details to fill out

|

Full name: |

Limited Liability Company "Finvolk" |

|

Short title: |

LLC "Finvolk" |

|

Legal and postal address: |

121096 g.Moscow, st. Filevskaya 2nd, 7/19, building 6, TARP ZAO premises |

|

INN/KPP |

7730581431 / 773001001 |

|

OGRN |

1087746515427 |

|

OKPO |

85797879 |

|

OKVED |

74.12 - Activities in the field of accounting |

|

40702810638000067179 |

|

|

Bank |

OJSC "SBERBANK OF RUSSIA" MOSCOW |

|

044525225 |

|

|

30101810400000000225 |

|

|

TIN/ Checkpoint Bank |

|

|

CEO |

GusarovDmitry Ivanovich |

Note. When we open the address input tab, we can see a warning in red about the need to load the address classifier. This classifier is used to fill out addresses in a special format and is required for reporting to the Federal Tax Service.

You can download the classifier immediately by clicking the “Download” button and indicating the regions that we need for downloading. Download the classifier from the 1C company website or from the 1C:ITS disk. Also, if Internet support is available, it is possible in the “Administration” “Support and Maintenance” section to select a different mode for filling out the address classifier. The classifier is not loaded into the program, but “Use the 1C web service to enter and check addresses.” I will choose this option for myself.

What is the difference? Legal entities and individuals in the program1C Accounting 8 there may be relatively little that is special in small companies. And if you load a classifier, especially for all regions of the Russian Federation, this will significantly increase the size of the database, which will lead to a decrease in performance. Therefore, it makes sense to use the 1C web service to enter and check addresses and not inflate the database in size.

We also indicate the chief accountant and cashier.

You can upload your company logo and a facsimile of your seal and signature into the 1C Accounting 8 program. These images will be supplied in the form of an invoice, making it easier to bill clients. The procedure for creating a fax print is provided at the corresponding link.

Let's move on to the next tab - pension fund details. My system automatically filled in the registration number, the name of the Pension Fund and the payment details for contributions.

The details of the Social Insurance Fund are also filled in - the registration number in the Social Insurance Fund, subordination code, name of the department and payment details are indicated.

On the “Statistics Codes” tab, codes are indicated for the all-Russian classifier of organizational and legal forms, the all-Russian classifier of forms of ownership and the all-Russian classifier of types of economic activity. These data are provided in the information letter from the statistics agency on registration.

I will not indicate anything about the taxpayer attribute “The company is the largest taxpayer.” Click the record button.

The organization's details are saved in the system. If you noticed the name of the organization - it was originally marked with an asterisk - this is a sign that the data has been modified. After recording, the asterisk disappeared.

Now we need to provide the bank details of our organization.

Click on the “Bank Account” hyperlink. The “Create” command opens a form for creating a current account for our organization. Fill in the data and click the “Save and close” button. The 1C Accounting 8 program will create a current account and automatically assign it the “Use as main” attribute. If you have several accounts, you can similarly enter information about them and designate one as the main one.

My company details are now complete. You can click the “Record and close” button and proceed to the next stage of setting up functionality and accounting parameters.

Selecting functionality

Let's start setting up the functionality. Go to the “Main” - “Functionality” section. We have full functionality enabled. If not, we'll turn it on full. Let's go through all the tabs and uncheck unnecessary boxes.

On the first tab “Bank and cash desk” we will not need “Calculations in conventional units”, we will not take into account “Monetary documents (tickets, vouchers, strict reporting forms)”, we will not use calculations using “Payment cards” and “Payment requirements” "

Let's go to the "Inventory" tab. Let’s remove the flags “Workwear and special equipment”, “Returnable packaging”, “Import operations” and “Item selection”

On the “Fixed assets and intangible assets” tab, we will uncheck the “Intangible assets” flag.

On the “Trade” tab, we will not use the capabilities of “Retail trade” and trade in “Alcohol products”. We will not use intermediary operations, we will not use “Shipment without transfer of ownership.” Leave the other three checkboxes enabled.

“Batch issuance of acts and invoices” can be used when you are a lessor or mass services are provided to a relatively large number of people. In this case, it is possible to indicate a list of persons to whom similar services are provided and the service itself. The system will automatically generate a set of documents for such buyers. “Management of offset of advances and repayment of debt” - let's look at how to use this opportunity in cash documents for advances, in documents that affect settlements with suppliers and customers. When you set this flag, we will have the opportunity to tell the system to read out or not to read out advances, to read out automatically, or to read out according to a specific debt document.

On the “Production” tab, we will leave the flag of the same name turned on, since we will be producing products. Our company is a manufacturing company.

If in the future we need to use any functionality, we go to the appropriate section and set the required flag. After this, in the 1C Accounting 8 program it will be possible to create the corresponding documents.

We are done with the functionality of the program. Let's close this window and move on to the accounting settings.

Setting up accounting parameters

Accounting parameter settings apply to the entire program. If our program keeps records for several legal entities, then the settings will apply to all legal entities.

On the “Income Tax” tab, using the hyperlink of the same name, we will check the income tax rates. The rate to the budget of the constituent entities of the Russian Federation may differ from 18%. Set the required value.

The “VAT” tab indicates whether it is necessary to maintain separate VAT accounting.

Let's go to the "Bank and cash desk" tab. Here it is necessary to indicate whether we will take into account cash flows according to cash flow items. Our company is small. We do not have to prepare and submit Form 4 “Cash Flow Statement”. Owners also do not require the submission of a Cash Flow Statement. We can remove this flag. If preparation of such a report is required. We leave the flag and using the link “Cash flow items” we can go to the corresponding directory. This directory contains items of cash receipts and expenditures. If the “Keep records by cash flow items” flag is selected, you will need to select the appropriate item in monetary documents. The system warns that removing the flag may result in data loss.

The “Calculations” tab indicates the payment period by the buyer and the payment period to suppliers. The corresponding debts will be considered overdue in the 1C Accounting 8 program if the debt date is greater than that specified in the agreement or in this parameter. It wouldn't be a bad idea to spend at least 1 day here.

Go to the “Inventory” tab. What's interesting here? Firstly, we will not keep records by batch. We will also not take into account inventories at storage locations. If this flag is checked, then you will need to select a method for accounting for inventory items in warehouses. Namely, take into account only the quantity or take into account inventory items by quantity and amount. The next flag is “Is write-off of inventories allowed if there are no balances according to accounting data.” If you remove it, the 1C Accounting 8 program will control the availability of inventory items in the warehouse at the time of documenting the consumption of inventory items. We will leave this flag enabled.

- do not display anything - only the name of the inventory items will be displayed,

- column “Code” - the system code of the “Nomenclature” directory is used,

- column “Article” - the article is used, which can be specified manually.

Let's select "Article".

The “Trade” tab only indicates whether it is necessary to load data from the “Trade and Warehouse 7.7” configuration.

On the “Production” tab, set the flag “Costs are recorded by departments”.

On the “Salaries and Personnel” tab, we indicate that we will keep records of salaries and personnel in this program. We will keep records of settlements “For each employee.” Let’s turn on the flags “Keep records of sick leave, vacations and executive documents of employees” and “Automatically recalculate the “Payroll” document when editing.”

We will choose to maintain “Full” personnel records.

Click the “Save and close” button

Setting up accounting policies

You can access the accounting policies of our organization from the “Organizations” directory element using the “Accounting Policies” hyperlink or from the “Main” section using the “Accounting Policies” hyperlink.

In the window that opens, we can set the date from which the accounting policy is applied. We have set the start date of the year by default. This suits us. For example, if an organization applied a simplified taxation system and in the middle of the year switched to a general taxation regime, then the beginning of the month is indicated when the organization switched to a general taxation system.

Tab “Income Tax” - uncheck the flag “PBU 18/02 “Accounting for income tax calculations” is applied. Our company is small - it has the right not to apply PBU 18/02. We will select the “Linear” method for calculating depreciation in tax accounting. This method will be applied in tax accounting to all fixed assets. You can also choose a nonlinear method. “Methods for determining direct production costs in tax accounting” - here you fill in the methods for determining direct costs. We won't change anything here. Just make sure that the register is filled out for the current year. We will not use the “Nomenclature Implementation Groups” directory for now.

Let's go to the "VAT" tab. Let’s remove the flags “The organization is exempt from paying VAT” and that “Separate accounting of incoming VAT is maintained.” Set the flag “Calculate VAT on shipment without transfer of ownership” and indicate the procedure for registering invoices for advance payments. In the 1C Accounting 8 program it is possible to select one of the proposed values. We will focus on what the program offers by default - we will “Register invoices when receiving an advance.”

On the “UTII” tab, the flag for applying this taxation regime and the base for the distribution of expenses by type of activity are set.

On the “Inventories” tab we indicate how we will account for inventories. We will take them into account at average cost. The FIFO (first in, first out) value is also available.

On the Costs tab, you must specify the main cost accounts. The default is 26. Let’s select account 20.01 “Main production” as the main cost accounting account. This value will be substituted by default in many documents related to cost accounting of production activities. On account 20 we will take into account production costs and output. Let's check the "Product Release" flag. The “Performance of work, provision of services to customers” flag will be removed. Click the “Indirect costs” button to set up the distribution of indirect costs. We will include general business expenses “in the cost of sales (direct costing). That is, credited to 90.08. It is possible to select the option “Include in the cost of products, works, services.” Then we will have to distribute expenses to the 20th account “Main production”. This distribution is configured using the hyperlink “Methods for distribution of indirect costs”. If we open it, we will see an empty directory. We will have another 25 account “General production expenses”. We will need to distribute it to account 20. Click on the “Create” button and indicate that the distribution setting is valid from January 1 of the current year. Cost account 25 will be distributed in proportion to the “Planned Cost of Production”.

The “Reserves” tab indicates whether the 1C Accounting 8 program needs to create reserves for doubtful debts in accounting and tax accounting. We will not create them.

Before printing our accounting policy, you need to record the entered data. By clicking the “Print” button, you can print the order on the accounting policy and its attachments (selected from the print button menu). Applications may include:

- accounting policies for accounting,

- working chart of accounts,

- forms of primary accounting documents,

- forms of accounting registers,

- accounting policy for tax accounting,

- forms of tax accounting registers.

The composition of the accounting policy sections, as well as the list of documents and registers, depends on the functionality used and other program settings.

The list of forms of primary documents contains both regulated forms of primary documents (for example, a universal adjustment document, a cash receipt order, etc.) and other forms implemented in the program (for example, an act for the performance of work, the provision of services, certificates and calculations etc.).

Our accounting policy has been created.

Chart of accounts

The configuration includes a chart of accounts for accounting of financial and economic activities of organizations, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

The chart of accounts is common to all organizations whose records are maintained in the information base.

You can add new accounts and subaccounts to the chart of accounts. When adding a new account, you need to set its properties:

- setting up analytical accounting,

- tax accounting (income tax),

- accounting by departments,

- currency and quantitative accounting,

- signs of active, passive and active-passive accounts;

- signs of off-balance sheet accounts.

Analytical accounting settings are types of subaccounts that are set as properties of accounts. For each account, analytical accounting can be maintained in parallel using up to three types of subaccounts. You have the opportunity to independently add new subaccounts.

Tax accounting is carried out simultaneously with accounting in the accounting accounts. The accounting accounts on which tax accounting data are registered are determined by the Tax accounting (for income tax) attribute.

An account can be prohibited from being used in transactions (the Account is a group checkbox and cannot be selected in transactions). Accounts prohibited for use in postings are highlighted in the chart of accounts with a yellow background.

You can get additional information about the selected account:

- get acquainted with the description of the accounting account - the Account Description button;

- view entries in the posting journal - Posting journal button.

You can display and print the accounting chart of accounts by clicking the Print button in the form of a simple list of accounts or a list with a detailed description of each account.

Personal settings

Personal settings are available in the “Main” section, the last hyperlink is “Personal settings”. You can specify "Primary Department". This value will be inserted into documents by default to facilitate entry. When the user works primarily with one value, this can greatly simplify document entry.

Leave the “Show accounting accounts in documents” flag turned on.

The working date can take the following values:

Current computer date - the computer will provide the current date in documents,

Another date - if we enter documents backdated, which often happens, we can specify a different date. For example, March 31 of the current year. Now, when creating a new document, this exact date will be entered.

The “Request confirmation when closing the program” flag. If it is installed, when closing the 1C Accounting 8 program, the additional confirmation question will be closed.

Next are Directories. Documentation. Operations.

05.23.2014

The 1C "Enterprise Accounting" program or configuration is intended for automated accounting - accounting and tax, including the preparation of mandatory (regulated) reporting on the activities of the organization. Accounting and tax records are maintained in accordance with the current legislation of the Russian Federation.

Keeping records in the "1C: Accounting 8" program solves all the tasks of the accounting service of an enterprise and is fully responsible for accounting at the enterprise, including, for example, issuing primary documents, accounting for sales, etc. This application solution can also only be used for accounting and tax accounting.

The configuration is supported by the Chart of Accounts for accounting, corresponding to the Order of the Ministry of Finance of the Russian Federation "On approval of the chart of accounts for accounting of financial and economic activities of organizations and instructions for its application" dated October 31, 2000 No. 94n (as amended by Order of the Ministry of Finance of the Russian Federation dated 05/07/2003 No. 38n) .

The composition of accounting accounts, the organization of analytical, currency, and quantitative accounting on the accounts comply with the requirements of the law for maintaining accounting records and reflecting the data of the enterprise’s activities in reporting. If necessary, users can independently create and configure additional subaccounts and various sections of analytical accounting.

Consistency with previous versions of the program

The new edition of the 1C configuration “Accounting 8” was developed on the basis of the “Accounting Enterprise” configuration edition 6,7.7,8.0,8.1,8.2, etc.

- the preservation of the accounting and tax accounting methodology is ensured

- The data accumulated in previous editions is preserved when switching to a new edition.

Primary accounting and standard operations

To compile business transactions in the 1C "Enterprise Accounting" accounting program, the main way to reflect accounting is by entering and submitting documents to the program, which must necessarily correspond to the primary accounting documents (invoices, invoices, etc.). In addition, it is possible to directly enter individual transactions manually.

And for group entry of transactions, it is quite possible to use standard operations - a simple automation tool that can be easily and quickly configured by the user.

Quick start when mastering

The program effectively processes the “Organization Information Entry Assistant” designed to fill in initial information about the organization.

This kind of “Start Assistant” is designed to enter the basic information necessary to start working with the program.

Based on the correspondence of accounts or the content of business transactions, the correspondence directory will tell the accountant how to reflect this or that operation in the program.

The program contains an up-to-date electronic manual “Quick Mastery of 1C: Accounting 8”, intended for novice users of the program, which helps to quickly master the basic principles and techniques of working with the program.

The “Accountant's Calendar” is also pleasing - it is an automatic notebook that notifies the accountant and user in advance of the deadlines for paying taxes and submitting reports provided for by law.

The delivery package for the 1C Accounting program includes a demonstration base.

It has already introduced a small number of documents describing the main economic activities of various organizations. For more convenient navigation through the documents of the demonstration database, the “Guide to the Demonstration Database” of accounting is also intended.

You can keep records of the economic activities of several organizations simultaneously in one database

The 1C:Accounting 8" configuration allows for accounting and tax accounting of the economic activities of several organizations. Accounting for each organization can be maintained in a separate information base.

At the same time, the configuration provides the opportunity to use a common information base for maintaining records of several institutions - legal entities. This is convenient if their economic activities are closely related to each other in a holding and united by one owner: you can use common lists of goods, contractors (business partners), employees, warehouses (storage places), you can receive general reports, etc., and at the same time mandatory generate reports separately.

How to keep records under different taxation systems

The 1C Accounting program for commercial organizations and individual entrepreneurs supports the following Taxation Systems:

- general system (OS) taxation (income tax for organizations in accordance with Chapter 25 of the Tax Code of the Russian Federation),

- simplified taxation system (STS)(Chapter 26.2 of the Tax Code of the Russian Federation),

- taxation system in the form of a single tax on imputed income (UTII)

For individual entrepreneurs we support:

- general taxation system(Personal income tax in accordance with Order of the Ministry of Finance of the Russian Federation dated August 13, 2002 No. 86n/BG-3-04/430),

- simplified taxation system(Chapter 26.2 of the Tax Code of the Russian Federation),

- simplified taxation system based on a patent(Article 346.25.1 of the Tax Code of the Russian Federation),

- taxation system in the form of a single tax on imputed income for certain types of activities (Chapter 26.3 of the Tax Code of the Russian Federation).

The program can take into account inventories (MPI)

Accounting for goods, materials and finished products is implemented in accordance with PBU 5/01 “Accounting for inventories” and fully complies with the methodological instructions for its application. The following methods for valuing inventories upon disposal are supported:

- at average cost,

- at the cost of the first acquisition of inventories (FIFO method).

To support FIFO valuation methods for inventory accounts, batch accounting is maintained. Different assessment methods can be applied independently for each organization. In the accounting and tax accounting of an organization, the methods for assessing inventories are the same.

Maintaining warehouse records

Warehouses can be kept in quantitative or quantitative-total accounting.

The valuation of goods and materials for accounting and tax purposes does not depend on the warehouse from which they are received. Warehouse accounting can be disabled if it is not necessary.

The program can reflect the results of various inventories, automatically verified with accounting data. Based on the inventory, the identification of surpluses and write-off of shortages is reflected.

Accounting for trade transactions

This accounting is well automated - accounting for transactions of receipt and sale of goods, works and services. When selling goods, invoices are issued, invoices and invoices are issued. All wholesale trade operations are accounted for in terms of contracts with buyers and suppliers. For imported goods, data on the country of origin and the number of the cargo customs declaration (CCD) are taken into account.

For retail trade, both operational reflection of retail sales and reflection of sales based on inventory results are supported. Retail goods can be recorded at purchase or sales prices. For retail sales, payments with bank loans and the use of payment cards are supported.

The reflection of returns of goods from the buyer to the supplier is automated.

There is support for using several types of prices, for example: wholesale, small wholesale, retail, purchase, etc. This simplifies the reflection of receipt and sales transactions and the gross profit is determined using reports almost immediately.

Accounting for commission trade and agency agreements

The program supports accounting for commission (agency) sales and purchase agreements.

Accounting for the sale of goods and services through a commission agent (agent) has been automated. Reflection of transactions involving the transfer of goods to a subcommission is supported.

When generating a report to the principal or registering a commission agent’s report, you can immediately make a calculation and reflect the deduction of the commission.

Implemented accounting of agency services on the part of the agent (provision of services on its own behalf, but at the expense of the principal) and on the part of the principal (provision of services through the agent).

Accounting for commission (agency) purchases of goods and services has been automated, both on the side of the commission agent (agent) and on the side of the principal (principal). The specifics of document preparation for VAT accounting for such operations are taken into account. When generating a report to the principal, you can immediately make a calculation and reflect the withholding of the commission.

Container accounting operations

Operations for accounting for returnable reusable “packages by price” have been automated. The specifics of taxation of such transactions and settlements with both suppliers and buyers are taken into account.

Cash and Bank

Accounting is in place for the movement of cash and non-cash funds and foreign exchange transactions. It supports entering and printing payment orders, incoming and outgoing cash orders. Implemented accounting of monetary documents.

Based on cash documents, a cash book of the established form for cash registers (KKT) is formed.

Accounting for the paying agent's funds has been implemented and a separate cash book is maintained.

Transactions for settlements with suppliers, buyers and accountable persons are automated (including the transfer of funds to employee bank cards or corporate bank cards), depositing cash into a current account and receiving cash by cash check, purchasing and selling foreign currency. When reflecting transactions, payment amounts are automatically broken down into advance and payment. Operations with storage and movement of enterprise securities.

Payment orders for the payment of taxes (contributions) can be generated automatically.

A mechanism has been implemented for exchanging information with programs such as “Bank Client” for working with the bank servicing the enterprise, which significantly accelerates the turnover of non-cash funds.

Accounting for settlements with counterparties

On the accounts of settlements with counterparties, analytical accounting is maintained in the context of counterparties, contracts and settlement documents. Automatic offset of the advance is supported both for the agreement as a whole and for a specific mutual settlement document. The method of repaying the debt under the contract can be indicated directly in the payment documents.

The method of offset of advances is indicated in the documents of both receipt and sale.

Accounting for payments by suppliers and buyers can be carried out in rubles, conventional units and foreign currencies. Exchange differences for each transaction are calculated automatically.

Settlements with counterparties in the program are always carried out accurate to the primary settlement document. When preparing receipt and sales documents, you can use both general prices for all counterparties and individual prices for a specific contract.

The configuration supports accounting for provisions for doubtful debts in accounting and tax accounting.

Accounting for fixed assets (FPE) and intangible assets (IMA)

Accounting for fixed assets and intangible assets is carried out in accordance with PBU 6/01 “Accounting for fixed assets” and PBU 14/2007 “Accounting for intangible assets”. Basic accounting operations have been automated: receipt, acceptance for accounting, depreciation (depreciation), modernization, transfer, write-off, inventory. It is possible to distribute the amounts of accrued depreciation for a month in tax accounting between several accounts or objects of analytical accounting.

Accounting for main and auxiliary production

The calculation of the cost of products and services produced by the main and auxiliary production, accounting for the processing of customer-supplied raw materials, accounting for workwear, special equipment, inventory and household supplies are automated. During the month, accounting for released finished products is carried out at planned cost.

At the end of the month, the actual cost of manufactured products and services provided is calculated.

Accounting for semi-finished products

For complex technological processes involving intermediate stages with the release of semi-finished products, warehouse accounting of semi-finished products and automatic calculation of their cost are supported.

Accounting for indirect costs

1C: “Accounting 8” supports the accounting of various expenses that are not directly related to the production of products, the provision of work, services - indirect expenses. At the end of the month, indirect expenses are automatically written off.

To account for general business expenses, the use of the “direct costing” method is supported. This method provides that general business expenses are written off in the month they are incurred and are fully included in the expenses of the current period. If the organization does not use the direct costing method, then general business expenses are distributed between the cost of manufactured products and work in progress.

When writing off indirect expenses, it is possible to use various methods of distributing products (services) to different product groups. For indirect costs the following distribution bases are possible:

- output volume,

- planned cost,

- salary,

- material costs,

- revenue,

- direct costs,

- individual items of direct costs.

Accounting for value added tax (VAT)

VAT accounting is implemented in accordance with the norms of Chapter. 21 Tax Code of the Russian Federation. Automated filling of the purchase book and sales book. For VAT accounting purposes, separate accounting is carried out for transactions subject to VAT and those not subject to taxation in accordance with Art. 149 NKRF.

Complex economic situations are monitored in accounting for VAT during sales using the VAT rate of 0%, during construction using an economic method, as well as when an organization performs the duties of a tax agent.

Amounts of VAT on indirect expenses in accordance with Art. 170 of the Tax Code of the Russian Federation can be distributed among sales transactions subject to VAT and exempt from VAT.

There is a “VAT Accounting Assistant” that controls the procedure for performing routine operations.

Payroll accounting, personnel and personalized records of enterprise employees

In "1C: Accounting 8" records are kept of the movement of personnel, including accountants at the main place of work and part-time. At the same time, internal part-time work is supported optionally, that is, support can be disabled if this is not accepted at the enterprise. The formation of unified forms of labor legislation is ensured.

The following operations are automated:

- calculating wages to employees of the enterprise based on salary with the ability to indicate the method of reflection in accounting separately for each type of accrual;

- maintaining mutual settlements with employees up to the payment of wages and transferring wages to employees’ card accounts;

- deposit;

- calculation of taxes and contributions regulated by law, the taxable base of which is the wages of employees of organizations;

- generation of relevant reports (on personal income tax, taxes (contributions) from the payroll), including preparation of reports for the PFR personalized accounting system.

When performing calculations, the presence of disabled people and tax non-residents at the enterprise is taken into account.

Tax accounting for income tax

Tax accounting for income tax is carried out on the same accounts as accounting. This simplifies the comparison of accounting and tax accounting data and compliance with the requirements of PBU 18/02 “Accounting for income tax calculations.” Based on tax accounting data, tax registers and income tax returns are automatically generated.

The report “Analysis of the state of tax accounting for income tax” is intended to identify tax accounting errors and take into account differences in the valuation of assets and liabilities.

Simplified taxation system

Automated accounting of economic activities of organizations using a simplified taxation system. Tax accounting under the simplified tax system is carried out in accordance with Chapter. 26.2 of the Tax Code of the Russian Federation. The following taxation objects are supported:

- income, income

- income reduced by expenses.

The book of income and expenses is generated automatically.

The report “Analysis of the state of tax accounting according to the simplified tax system” is intended to analyze the structure of income and expenses of tax accounting according to the simplified tax system.

Accounting for activities subject to a single tax on imputed income

Regardless of whether an organization uses the simplified tax system or the general taxation system, some of its activities may be subject to a single tax on imputed income (UTII). The program provides for the separation of accounting for income and expenses related to activities subject to and not subject to UTII.

Expenses that cannot be attributed to a specific type of activity at the time they are incurred can be allocated automatically at the end of the period.

Accounting for income and expenses of individual entrepreneurs – personal income tax payers

Accounting for income and expenses of individual entrepreneurs applying the general taxation system is carried out in accordance with the Procedure for accounting for income and expenses and business transactions for individual entrepreneurs, approved by order of the Ministry of Finance of the Russian Federation dated August 13, 2002 No. 86n/BG-3-04/430, chapters 23 and 25 Tax Code of the Russian Federation.

The book of accounting of income and expenses and business transactions is automatically generated in the form approved by order of the Ministry of Finance of the Russian Federation dated August 13, 2002 No. 86n/BG-3-04/430, and a personal income tax return.

Patent system

In accordance with Article Chapter 26.5 of the Tax Code of the Russian Federation, individual entrepreneurs carrying out certain types of activities have the right to switch to a simplified taxation system based on a patent.

The simplified tax system based on a patent can be used by entrepreneurs using a general or simplified taxation system. For each patent, a separate Income Book is kept in a special form.

Final operations of the month

Routine operations performed at the end of the month are automated, including currency revaluation, write-off of deferred expenses, determination of financial results, and others. The Month Closing Assistant allows you to determine the necessary routine month closing operations and perform them in the correct sequence and without errors.

The configuration includes a set of reports “References-Calculations”, reflecting calculations related to carrying out routine operations to close the month: “Distribution of indirect expenses”, “Calculation of income tax and others”.

Standard Accounting Reports

The configuration provides the user with a set of standard reports that allow you to analyze data on balances, account turnover and transactions in a wide variety of sections.

When generating reports, the grouping, selection and sorting of information displayed in the report is configured, based on the specifics of the organization’s activities and the functions performed by the user. The reports comply with legal requirements for accounting registers.

Express accounting check

Express accounting check helps the accountant, the user of the program, to obtain summary detailed information about the correctness of the data at any time. All checks are combined into groups:

- accounting policies,

- analysis of the state of accounting,

- cash transactions,

- maintaining a sales book for VAT,

- maintaining a purchase book for VAT.

The report on the results of the express check is accompanied by conclusions and comments for each check performed, which contain:

- subject of control,

- result of checking,

- possible causes of errors,

- recommendations for troubleshooting.

Regulated reporting

The program includes mandatory (regulated) reports intended for submission to the owners of the organization and regulatory government bodies, including accounting forms, tax returns, reports for statistical authorities and government funds.

For tax returns, a check is provided for the control ratios used by the Federal Tax Service.

The following types of formation and submission of regulated reporting provided for by law are supported:

- in printed form, including with a two-dimensional barcode;

- in electronic form with uploading to a storage medium;

- via telecommunication channels.

The principle of submitting reports through telecommunication channels consists of preparing the necessary forms of regulated reporting, signing them with an electronic digital signature (EDS) of the subscriber and then sending them to the regulatory authorities through a special operator directly from the 1C: Accounting 8 program.

Service capabilities

Control and elimination of error situations

"1C: Accounting 8" provides developed means of monitoring the user's work at various stages of working with the program:

- control of the correctness and completeness of the entered data,

- control of balances when writing off (moving) material assets,

- control of modification and deletion of documents entered before the “edit ban date”,

- control of the integrity and consistency of information when deleting data.

The program provides for downloading reference books and classifiers:

- BIK classifier (directory of bank identification codes of payment participants on the territory of the Russian Federation),

- address classifiers of the Federal Tax Service,

- exchange rates from the RBC website.

Data Search

The configuration implements full-text search according to the information base data. The search can be carried out using several words, using search operators, or using an exact phrase.

Managing access to credentials

The ability to introduce restrictions on access to the credentials of individual organizations (legal entities) has been implemented. A user with limited access rights does not have the opportunity not only to change in any way, but even to read data that is closed to him.

Use of commercial equipment

"1C: Accounting 8" supports working with cash registers (fiscal registers).

Working with distributed information bases

To work with distributed information bases, the configuration includes exchange plans to automate the exchange of data between information bases.

Online user support

Users of the program can directly, while working with the program, prepare and send opinions to 1C about the use of the program, contact the technical support department, as well as receive and view responses from the technical support department. Users can also take part in a survey of program users conducted by 1C in order to study problems that arise during operation.

Automatic configuration update

The configuration includes a configuration update assistant that allows you to obtain information about the latest updates posted on the customer support site on the Internet and automatically install detected updates. If you have already received an update file, the assistant allows you to update using an update delivery file (.cfu) or a configuration delivery file (.cf) from any local or network directory.

Transition to "1C Accounting 8" from previous versions

"1C:Accounting8" contains tools for transferring data from "1C:Accounting7.7", as well as from the "Simplified Taxation System" configuration of the "1C:Enterprise 7.7" program system.