Note-calculation of vacation pay. Vacation calculation

Each employee under the Labor Code of the Russian Federation is entitled to annual paid leave and before the employee goes on vacation he needs to pay vacation pay, which can be paid using a calculation note in the T-60 form. must be issued to the employee no later than 3 days after his departure. At the end of the article there is a form for downloading, as well as a sample of filling it out.

Each employee is entitled to leave of at least 28 calendar days, which he can receive after working in the organization for 6 months. For each year, the employer must draw up a vacation schedule for, taking into account the wishes of the employee. In accordance with this schedule, employees go on vacation.

Attention! 2 weeks before the deadline, the employee writes the appropriate one, on the basis of which it is published. Based on these documents, the accounting department must calculate vacation pay and issue the amount due 3 days before departure.

The calculation is calculated and entered into the note-calculation in the T-60 form. In addition to calculating vacation pay, the statement is also filled out to justify the provision of vacation days

Form t-60 sample filling

Form T-60 has two sides: the front one is drawn up by the personnel officer, and the back one is filled in by the accounting department, it is on it that the amounts due are calculated.

Front side filling

The front side is filled out on the basis of an order by the personnel service.

At the top of the form, you must fill in information about the organization. Document number in order, personnel number of the employee, data on full name, structural unit in which he is located according to the staffing table and position.

Field “A” indicates the length of service that provides the right to legal rest, the duration of the main vacation in days, as well as the date of its start and end

Field "B" contains information about additional holidays.

In the "B" field, the total number of days of rest provided and the entire period. At the end of the sheet, the employee of the personnel service signs.

Back side filling

On the reverse side, a calculation is made, based on the data of the personnel service on the length of service of the employee and the period of rest provided.

In chapter "Vacation Pay Calculation" all accrued amounts of income for the last 12 months involved in the calculation of vacation pay are indicated. The sum of calendar days of service and the estimated value of average earnings.

In the table “Accrued”, all calculated accruals to the employee are entered. The column amount for vacation (Group 8) is equal to the product of the average daily earnings (Group 6) by the number of days of rest (Group 7). If there are additional charges, they are entered in the appropriate columns, in Gr.15 the total amount is entered.

In the “Hold” field, the deductions made are entered. Personal income tax is withheld from the amount of Gr.15, and is recorded in gr.16 (Gr.15 * 13%). In line 22, all deductions are calculated and in column 23 there will be a total value payable. The amount received is written in words and figures, and below the note is signed by the accountant.

The current legislation guarantees that an employee, having worked for 6 months in a new place, gets time to rest. At the same time, during this period, he retains wages in the amount of average earnings. To accurately determine this amount, the responsible employees of the company draw up a document, a note on the calculation of the provision of leave to the employee.

A note-calculation is drawn up for the accountant of the settlement department specifically so that he can correctly calculate the average earnings of an employee who goes on vacation, and based on this determines the amount of vacation pay.

A note on the calculation of the provision of leave to the employee is issued together with, and on its front side duplicates the information specified in the administrative document.

By law, an economic entity has the right to use the standard approved form T-60 for these purposes, or develop its own, but with the use of mandatory details.

Existing computer programs for conducting personnel and accounting include a standard form. Usually, issuing a vacation order allows you to automatically draw up the note-calculation itself.

The legislation does not set the exact time when it is necessary to generate a note-calculation. However, it must be remembered that according to the Labor Code, vacation pay must be issued to an employee 3 days before the moment he leaves for vacation, or during the same period from the date the employee writes the corresponding application.

In addition, if the vacation is provided according to a pre-approved one, then 2 weeks before the start of the vacation, the company must notify the vacationer about this. Therefore, it is best to execute the document in the interval between these two events.

Before filling out the document, the personnel officer needs to determine for what period the employee needs to be given rest, and what will be its duration. It must be remembered here that for each month worked, 2.33 days of rest are due, and a month of up to 15 days does not take part in the calculation, and more than 15 days is considered as a whole.

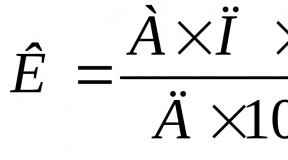

Attention! An accountant, when calculating the number of days worked, should be guided by the rule that a fully worked month is taken as 29.3 days. Fewer days of work should cause this factor to be recalculated. We recommend using , it will help you calculate

Form and sample of filling out the T-60 form

Download form T-60 in Word format.

Download in Excel format.

Download in PDF format.

A sample of filling out a note-calculation on the provision of vacation

Front side

On this side, the note on the calculation of the grant of leave is filled in by a personnel specialist.

The full name of the company is written in the upper part, and its code according to the OKPO classifier is entered in the column on the right.

After that, next to the name of the form, its serial number and the date of issue are indicated.

The following lines are required to reflect personal information about the employee who goes on vacation - full name, personnel number assigned to him, the unit in which he performs work and the title of the position according to the staffing table.

Further, the T-60 form is divided into two parts. Section A is filled in if the employee draws up. Here you need to specify for what period the rest time is provided, its duration in days, as well as the start and end dates.

Further, the T-60 form is divided into two parts. Section A is filled in if the employee draws up. Here you need to specify for what period the rest time is provided, its duration in days, as well as the start and end dates.

Attention! Section B is issued when additional leave is granted, or other types of paid leave. Their right can be established by the results of the SOUT or, for example, such as, or, etc.

In the table, it is necessary to indicate in detail the type of vacation, start and end dates, and the basis for granting.

AT section B it is necessary to sum up the overall result - the total duration of the entire holiday, the total date of start and end. If the employee takes only regular leave, then the information from this section will duplicate the information from section A.

This side is completed with the signature and personal data of the personnel specialist.

Back side

Entering information on this side of the form form T-60 is performed by the accountant after it is received by the accounting department.

Data on accrued wages for previous periods are selected from a personal account or from payroll records. After that, they are recorded in the calculation table. It contains the month and year of information for calculation line by line ( columns 1, 2), as well as the amount of salary corresponding to this time ( column 3). In the lower part, after filling, a general summation is performed with a summing up.

Data on accrued wages for previous periods are selected from a personal account or from payroll records. After that, they are recorded in the calculation table. It contains the month and year of information for calculation line by line ( columns 1, 2), as well as the amount of salary corresponding to this time ( column 3). In the lower part, after filling, a general summation is performed with a summing up.

Next, the upper right table is filled. You need to enter in it the total number of days that are used for the calculation (column 4), or hours ( column 5). After that, the average earnings are calculated ( column 6).

Attention! Average earnings should be equal to the result of dividing the total amount of wages accepted for calculation ( column 3), to the number of days or hours.

The following table consists of two identical parts. In it, you can divide the vacation into two parts if it is rolling from one month to another. Both parts include columns identical in purpose.

The following table consists of two identical parts. In it, you can divide the vacation into two parts if it is rolling from one month to another. Both parts include columns identical in purpose.

AT columns 7 and 11 Enter the duration of each period in days. AT columns 8 and 9, as well as 12 and 13 the amount of accruals for each month is shown depending on their source of funding. If an employee is entitled to any additional payments (for example, material assistance), they are reflected in columns 10 and 14.

Box 15- total, it contains the total amount of accrued vacation pay.

Then comes another table, which indicates all the required amounts of deductions. These include personal income tax ( column 16), alimony, property damage, etc.

Then comes another table, which indicates all the required amounts of deductions. These include personal income tax ( column 16), alimony, property damage, etc.

The accountant needs to independently enter the necessary names in columns 17-21. AT box 22 summed up the total on deductions. After that in column 23 the total amount to be handed out is recorded (from the result columns 15 the result is subtracted columns 23).

The same total amount must be indicated below in words, as well as the details of the document for which it was paid (number, date).

After filling out the page, the calculator signs and indicates his personal data.

Related Documents

Additional forms may be attached to the document confirming the correctness of the selection of information for the calculation:

- Vacation order in the form T-6 - to confirm the type of vacation and duration;

- Payrolls for the previous 12 months - indicating the amount of accrued wages;

- An order for the provision of material assistance - if, according to local acts of the company, an employee is additionally paid material assistance at the time of going on vacation;

- Applications of the employee or decisions of the judicial authorities to withhold part of the salary - if the employee repays material damage by paying money, or the decision to withhold was imposed by the court (alimony, damage at the previous place of work, etc.).

Every officially employed employee has the right to an annual vacation.. Before he goes on vacation, a note-calculation is drawn up, which is an official confirmation of the provision of this period and is used to calculate vacation pay.

This document in 2016 is compiled in the T-60 form, according to the letter of Rostrud No. PG / 1487-6-1 dated 02/14/13, only in a simplified form.

This form is important for:

- Accruals of vacation pay, which must be issued to the employee within 3 days after the start of the holiday;

- Providing expenses for vacation pay during the calculation of income tax for reporting to tax authorities;

- The form is proof of the reasonable number of days accrued on vacation.

An employee has a vacation of 28 calendar days at his disposal, when working at an enterprise from 6 months.

When calculating vacation pay "conditional" number of calendar days is taken, which in a full month worked corresponds to 29.4 days.

If the month is not worked out in full, then this conditional number is divided by the actual number of calendar days in the month and multiplied by the number of worked days.

Rules for the formation of the form and a sample document

Note-calculation is filled in from 2 sides- the person is filled in by a personnel officer, the reverse side is an accountant, where the calculation is made.

Front side

At the top of the form, a cap is formed from the data about the enterprise:

- Serial number of the form;

- The personnel number of the worker;

- Data on the structural unit where the employee is assigned;

- His position is indicated;

- Field "A" contains information about the length of service of the employee, using which the number of vacation days is calculated. Also, the first and last date of rest are indicated here;

- Field "B" - information on additional holidays;

- Column "B" contains the number of days provided for rest and its total duration;

- As a result, the employee filling out the document is signed.

Paying for purchases in online stores using e-wallets is very convenient. What advantages it gives and how to connect electronic read the link.

Back page

Calculations are recorded on the back, using the information of the personnel officer:

- The column "Calculation of vacation pay" contains data on accruals for each month of the year used in the deduction of vacation pay. In addition, the total number of days of seniority of the year according to the calendar is indicated and the equivalent of average earnings is calculated;

- The column "Accrued" contains the estimated accruals;

- At the same time, in gr. 8 indicates the calculated funds for the rest, which is equal to the calculation of the average earnings from the number of vacation days;

- Gr. 7 - the sum of days for rest;

- Gr 6 contains the number of average earnings;

- If there are other accruals, the following columns are filled in;

- The result is recorded in column 15;

- The Hold field contains information about holds:

- In gr. 16 withholding personal income tax from charges in group 15;

- In gr. 22 is the calculation of all withheld amounts;

- Column 23 contains data on the amount paid;

- This amount is indicated in numbers and deciphered in words;

- As a result, the accountant puts the signature.

Also it must be correctly calculated and filled out otherwise, the inspector may remove this form from the register if there are errors.

On the provision of regular holidays and the calculation of vacation pay, see this video:

Each employee of the enterprise, including his management, according to the current legislation, has the right to vacation time, which can be allocated to him on the basis of his application and vacation schedule. This period is drawn up by order, and a note is issued on the calculation of the provision of leave to the employee.

This document is used to calculate the amount of vacation pay that an employee is entitled to. For him, Rosstat established a special form T-60, which the enterprise has the right to use, or develop its own form in accordance with the needs of the company.

Standardized forms are included in all specialized programs. When periodically entering all the necessary data, the form is filled in automatically.

It is issued in the personnel department along with an order to grant leave. There are no fixed deadlines for issuing the document. There is a rule that the employee, three days before going on vacation or within the same period from the moment the application is received from him, must receive the amount of vacation pay due to him. Therefore, it is advisable to issue this document immediately after the issuance of the relevant order.

When filling it out, the personnel inspector in the calculation note indicates all the days of paid vacations (annual and additional), as well as the period of time for which they are due. According to the law, each month of work gives the employee the right to 2.33 days of vacation. After that, he endorses the document with his signature and sends it to the accounting department to calculate the payment for this rest time.

The accountant performs a selection of all the information necessary to determine the vacation information, which includes the amounts of salaries, bonuses, surcharges, etc., as well as time periods (for each full month 29.3). Next, he determines the average daily earnings and, taking into account the number of vacation days, calculates the total amount of payment for vacation days.

In the relevant columns, personal income tax and other amounts are withheld, and money for issuance is determined. The note contains the details of payment documents for the issuance or transfer of money. After signing the form by an accountant, it is filed to the payroll for a given period of time.

Note. In each organization, it must be drawn up and be up-to-date, in accordance with this plan, the employee writes within the time limits established by law, then the head issues the appropriate one. After that, the accountant makes a calculation and 3 days before the annual leave, the employee must receive vacation pay.

The procedure for filling out a note-calculation on the provision of vacation

Front side

The front side of the form is drawn up by the personnel inspector. Data is entered here in accordance with the issued vacation order.

At the top of the document, the full name of the company and its code according to the OKPO classifier are recorded. Below is the serial number of the document, the date of its execution.

Then, in the appropriate lines, you need to indicate the full name. the employee who is granted leave, his personnel number, the title of the position and the structural unit.

If an employee, according to a special assessment of working conditions, is entitled to additional days of rest (for example, due to harmful or dangerous working conditions), then their duration is indicated below, and the table is filled in. The relevant data is entered into it: the name of the vacation, its period, the start and end dates and the reason (ground) for the provision.

Then the total number of vacation days (main + additional) is indicated, after which the responsible employee puts his position, signature and last name.

Back side

This side is filled in by the accountant-calculator.

First, information is entered in the "Calculation of vacation pay" section. The left table indicates line by line information for the previous 12 months of work - year and month (columns 1 and 2) and the amount for this period taken into account when calculating average earnings (column 3). A summary is given at the end of the table.

In the right table, you need to put down the number of days (column 4) or hours (column 5) for which the calculation is made and display the average daily earnings (column 6).

Then proceed to filling tables "Accrued", which consists of two parts, corresponding to the current and future months of accruals with identical columns. So, in columns 7 and 11, the number of calendar days of vacation falling on a given month is recorded, in columns 8-10 and 12-14 - the amount of accruals when payments are made from different sources. Column 15 summarizes the total.

AT "Retained" table appropriate deductions are made in columns 16-21 (for example, personal income tax, according to writ of execution, etc.). Column 22 indicates their total amount. Column 23 is money payable to an employee.

For registration of paid leave and accrual of vacation pay in 2017, a unified form T-60 is used. The document is filled out on both sides. The first contains information about the duration of the vacation. The columns on the back of the note are for calculating vacation pay. You can download an example sample at the end of the article.

The blank has two sides. The front one is filled in by an employee of the personnel department based on the information specified in the order. The form contains the following data:

- date of signing the document, its number;

- Business name;

- OKPO code;

- information about the employee: his full name, position, personnel number;

- type of leave (main, additional or other), its duration and basis;

- signature of the employee who filled out the form.

Important! The head of the enterprise plans a vacation schedule taking into account the wishes of employees, which in 2017 is drawn up in the form of a T-7 form.

Making the second side

The second side of the form, the form is available for download below, is filled out by employees of the accounting department. Here, based on information about the length of service of the employee and the duration of rest, the amount of vacation pay is calculated. This subheading lists all payments to the employee during the year that is considered the billing period. The total number of days and the average wage per day are indicated. The sections of the note and the order in which they should be completed are listed below.

- Settlement period. The two paragraphs, combined under this section, list all the months of the year, regardless of whether they have been worked out by the employee or not yet. To be completed to provide paid leave.

- The third column indicates the full amount of payments for each month of the period. In this subheading, the entire amount received is entered, taking into account allowances or increases. The calculation in the rows of the table is not given. For convenience, below you can make marks explaining on the basis of which the amounts were calculated. When a correction factor is applied, an appropriate certificate from the accounting department is attached. The amounts indicated in this paragraph will be used to calculate the average daily earnings.

- Under the number 4, the number of days in the billing period is entered in the form. For a fully worked month, this number is 29.3. If there were sick or business trips, the formula is applied: the coefficient 29.3 is divided by the number of calendar days in this month and multiplied by the days actually worked.

- The fifth column indicates the number of hours - relevant only for employees for whom summary accounting is provided.

- Data for the sixth column - average earnings per day / per hour - are found by dividing the total earnings under item 3 by the total number of days / hours in the billing period under item 4/5.

- The seventh column of the note indicates the number of days of rest.

- Column 8 will contain the total amount of vacation pay. It is found by multiplying the number of days in paragraph 7 by the average earnings per day / per hour in paragraph 6. The amount of personal income tax and other deductions is excluded from the result.

The procedure for issuing a form

An employee is entitled to receive a paid vacation of 28 days in 2017 after he has worked for six months. Two weeks before the planned vacation, he fills out an appropriate application. Then the head issues an order in the T-6 form, and the employees of the accounting department fill in the T-60. Holiday pay is issued three days before the start of the holiday.