A note-calculation on granting leave to an employee. What is a vacation pay note? Form t 60 filling pattern

Each employee who has worked at the enterprise for more than six months can go to. The total duration of the vacation is 28 days.

A settlement note is a document that indicates the periods that apply to a particular employee:

- working year;

- annual leave.

Vacation pay is also calculated.

There is a special form of note - T-60.

The form is optional for use, but can be used in any company. Moreover, it takes into account all the mandatory inclusions.

A note is being prepared by the personnel officer:

- when issuing the next vacation for employees;

- upon dismissal (counted).

In 2016, the procedure for calculating with a vacationer is as follows:

- accepted;

- the application is endorsed by the director and transferred to the personnel officer;

- published;

- a note-calculation is drawn up;

- vacation pay is paid three days before the vacation (in case of dismissal - on the last day of work).

Who draws up the document?

The document is two-sided, its front side is filled in by a personnel officer, and the back side is filled in by an accountant. Drawing up a note-calculation is always preceded by one of the types of order:

- about dismissal;

- about vacation.

Front side filling

On the first page of the form, the personnel officer (or other employee involved in personnel matters) enters the data:

- number and date of compilation;

- Full name of the vacationer;

- his payroll number;

- position, profession (with rank);

- Department;

- beginning and end of the working year;

- and his period.

Data is also entered on if the employee is entitled to:

- type of vacation (for example, for);

- number of days and period;

- order details.

After entering the above information, the personnel officer indicates his position and signs.

Back side filling

The second page of the form is settlement, it is filled in by an accountant. In the column "billing period" paid periods of work (month and year) are entered. If an employee, for example, was on parental leave, then this period of time is not taken into account.

Periods include all official payments:

- salary;

- premium;

- allowances, etc.

All payments are summed up and the result is entered in the final line. The 4th column indicates the total number of days worked in a year. Further calculated: the total earnings are divided by the days worked.

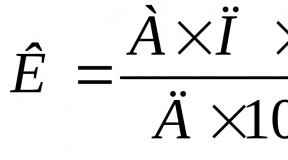

Vacation pay is calculated according to the formula:

daily wages x number of vacation days

Income tax is also calculated from vacation pay, taking into account deductions. As a result, the vacationer will receive the final amount minus tax or other obligatory payments (alimony, for example).

Calculation according to the rules of 2016

This year, vacation pay is calculated taking into account the nuances:

- if the employee has worked only, this is the term and will be the billing period;

- for the billing year, the period worked by the employee is taken - full 11 or 12 months.

The employee got a job on March 2, 2015, and wants to go on vacation only for 15 days from April 5, 2016. His working year is from 2.03.2015 to 01.03.2016. Since the year is fully worked out, vacation pay will be calculated for the full year, based on the average salary.

On average, a fully worked month gives the right to two and a half days of vacation.

It should also be noted that not all amounts paid to an employee in a year are included in the calculation. So, for example, if an employee was allocated

Note-calculation on the provision of leave- a document that confirms the fact that the employee is granted annual paid leave. It is necessary to calculate payments for this period. For these purposes, organizations use the T-60 form, which is approved by the head and.

How to fill out the T-60 form

Form T-60 is double-sided. The front side is drawn up by an employee of the personnel department, and the back side is drawn up by an employee of the accounting department.

Column "Period of work": In this column, even if the year was not fully worked out, making out part of the vacation, the whole year is written. When applying for such leave as for pregnancy and childbirth or for child care, the period is not necessary.

Column 3: The total amount of payments to the employee for each month of the entire billing period, subject to adjustments, is indicated.

Column 4: It should be noted that a "conditional" number of calendar days is used to calculate vacation pay. If the month was worked out completely, this number is 29.4 days. Otherwise, an additional calculation is applied.

Column 5: It is necessary to fill in if the employee has been established a summarized (general) accounting of working hours.

Column 6: The amount of average earnings per day (average salary) comes out by dividing the amount of accrual for the billing period by the number of calendar days of a particular billing period.

Each employee has the right to request from the management the leave laid down for him by law. For this period, he is released from his official duties, but retains his salary and position in the company. In order not to be deceived and, if necessary, to protect your rights, it makes sense to familiarize yourself with the example of calculating vacation in 2016. During this period, legislative changes related to a large number of holidays came into effect.

To calculate the amount of payment, the accountant must take into account wages and other types of employee income:

- premiums;

- allowances and surcharges;

- salaries accrued for professional excellence, etc.

Vacation calculation becomes more confusing if an employee receives bonuses. Their accounting depends on the payment period. Monthly bonuses are included in the formula if the period of their accrual coincides with the calculated one. If a person has received several bonuses, the accountant takes into account only one. Which one to choose is the decision of the employer.

Quarterly bonuses are included in the calculation of vacation days in full if they correspond to the period for which vacation days are given. Annual payments are taken into account in full if they correspond to the year for which a person takes a well-deserved holiday.

The following types of income do not need to be included in the formula:

- travel allowances;

- holiday pay;

- maternity;

- funds received during periods of strikes or downtime.

Compensation payments are not taken into account: for travel, food, material assistance. The formula does not include funds received in the form of income from dividends and shares.

You can read about the procedure for providing and how to write an application for annual paid leave in our article.

How vacation is calculated

For the billing period, the last 12 months of work in the organization are taken to determine vacation pay. If a person works in the company less, then the actual time of employment is taken as the basis.

There is a basic formula for how vacation is considered, from which you need to build on when determining the amount of payment:

Average earnings \u003d GZ / (12 * 29.3), where

GZ - annual salary (for the last 12 months);

29.3 is the average number of days in a month. This coefficient is set at the legislative level, depends on the number of holidays in a year.

If the specialist was absent from the workplace during certain periods, another formula is used to calculate vacation:

Average earnings \u003d GZ / (NIM * 29.3 + ∑NP), where

NMP - the number of months fully worked out by a person.

BH - the number of days in months where he was absent from work for periods.

BH \u003d 29.3 / D * OD, where

D is the total number of days in a month.

OD - the number of days worked by the employee.

This formula has a wider application, because in practice, many employees take time off or sick leave during the working year.

Holiday calculation in 2016: a practical example

A simplified example will help you understand the basic calculation procedure.

Petrov P.P. has been working at the enterprise for two years, over the past 12 months he has not missed a single day due to illness or personal circumstances. His earnings during this time amounted to 500,000 rubles. In September 2016, an employee is scheduled to take a week off. How much vacation pay will he get?

Average earnings \u003d 500,000 / (12 * 29.3) \u003d 1,422.07 rubles.

The amount of vacation pay \u003d 7 * 1,422.07 \u003d 9,954.19 rubles.

For a more detailed understanding of the methodology for calculating the average for a vacation, consider an example from practice.

Employee Ivanov I.I. in June 2016 took a vacation for 14 calendar days. In April, he missed the period from 15 to 22 due to illness (eight days in total). The total income for the last 12 months amounted to 600,000 rubles. Determine how much vacation pay the employee is entitled to.

We use the above formulas:

- OD \u003d 30 - 8 \u003d 22.

- BH=29.3/30*22=21.49.

- Average earnings \u003d 600,000 / (11 * 29.3 + 21.49) \u003d 1,745.25 rubles.

- The total amount of vacation pay \u003d 14 * 1,745.25 \u003d 24,433.5 rubles.

Understanding how to count vacation days will be useful not only to accounting staff, but also to employees of other departments. So they can check the actions of the employer and, if necessary, protect their rights. It is not difficult to master the calculation method: it is enough to find out all the initial data and substitute them into the formula.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

" № 6/2016

What is the peculiarity of calculating vacation pay, taking into account the explanations of the Ministry of Finance given in Letter No. 03-03-06/2/2557 of January 25, 2016? What is the accounting procedure for income tax purposes of the average earnings retained by employees during the holidays? Is it possible to attribute the costs of creating a reserve for vacation pay to indirect costs of the taxpayer? When is it necessary to reflect the amount of vacation pay in the reporting on insurance premiums if they are accrued and paid to the employee in June, and his vacation begins in July? What is the procedure for withholding personal income tax from the amounts of average earnings retained by employees - non-residents of the Russian Federation for the period of vacation?

In the last issue, we talked about the nuances of granting annual leave, taking into account the provisions of labor legislation. In continuation of the topic, we propose to consider the issues of calculating vacation pay, recognizing them for profit tax purposes, as well as issues of withholding personal income tax and calculating insurance premiums. In addition, from the presented article you will find out what clarifications regarding vacation calculations were received from the financial department.

We calculate vacation pay

Calculation of vacation pay in accordance with Art. 139 of the Labor Code of the Russian Federation. As a general rule, for all cases of determining the size of the average wage (average earnings) provided for by the Labor Code, a single procedure for its calculation is established. In this case, it is necessary to be guided by the Regulation on the peculiarities of the procedure for calculating the average wage, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 (hereinafter - Regulation No. 922). This regulatory document lists payments taken into account and not taken into account when calculating average earnings, and also establishes the features of accounting for bonuses and remuneration when calculating vacation pay, methods of calculation when increasing official salaries in an institution.

When calculating vacation pay, the average earnings include all types of payments provided for by the wage system, regardless of their sources: salary, bonuses, allowances, payments related to working conditions, etc. (Article 139 of the Labor Code of the Russian Federation, clause 2 of the Regulation No. 922).

According to clauses 3, 5 of Regulation No. 922, the following do not participate in the calculation:

- social and other payments that are not related to wages (material assistance, payment for the cost of food, travel, training, utilities, recreation, etc.);

- amounts paid for the time when the employee was not working, but his earnings were retained (vacation, days off to care for a disabled child, business trips, periods of illness and other time when the employee was released from work with full or partial pay or without payment in accordance with the legislation of the Russian Federation).

Example 1

The employee of the organization was granted leave from 05/05/2016 with a duration of 28 calendar days. The billing period is from 05/01/2015 to 04/30/2016. The following hours are excluded from the calculation period:

- holidays - from 3 to 30 August 2015;

- business trips - from 21 to 25 March 2016.

The salary of the employee is 32,500 rubles, in November 2015 he was paid financial assistance in the amount of 25,000 rubles. Wages for the hours actually worked in August 2015 amounted to 1,547.62 rubles, and in March 2016 - 24,761.90 rubles.

Calculate vacation pay.

The leave was granted to the employee from 05/05/2016, and one day falls on a non-working holiday (May 9). According to Art. 120 of the Labor Code of the Russian Federation, non-working holidays falling on the period of the annual main vacation are not included in the number of vacation days. Therefore, the last day of vacation will not be June 1, but June 2.

The employee's salary for the billing period will be equal to 351,309.50 rubles. (32,500 rubles x 10 months + 1,547.62 rubles + 24,761.90 rubles).

When calculating the average earnings, the amount of material assistance in the amount of 25,000 rubles was not taken into account. (clause 3 of Regulation No. 922). In addition, time was excluded from the billing period, as well as the amounts accrued during this time when the employee was on vacation and business trip (clause 5 of Regulation No. 922).

According to the rules of clause 10 of Regulation No. 922, if one or several months of the billing period were not fully worked out or time was excluded from it in accordance with clause 5 of the said provision, the average daily wage is calculated by dividing the amount of actually accrued wages for the billing period by the sum of the average monthly number of calendar days (29.3) multiplied by the number of complete calendar months and the number of calendar days in partial calendar months.

The number of calendar days in an incomplete calendar month is calculated by dividing the average monthly number of calendar days (29.3) by the number of calendar days of that month and multiplying by the number of calendar days falling on the time worked in that month.

In this example, the number of calendar days in the months not fully worked by the employee will be:

So, the average daily earnings of an employee will be equal to 1,102.94 rubles. (351,309.50 rubles / (10 months x 29.3 calendar days + 2.84 calendar days + 22.68 calendar days)), and the amount of vacation pay is 30,882.32 rubles. (1,102.94 rubles x 28 calendar days).

Calculation of vacation pay, taking into account the explanations of the Ministry of Finance given in Letter No. dated 01.25.201603-03-06/2/2557.

The financiers drew attention to the fact that, according to par. 6 art. 139 of the Labor Code of the Russian Federation, the employer has the right to provide for other periods for calculating the average wage, different from those established in Art. 139 of the Labor Code of the Russian Federation. In this case, two conditions must be met:

- the relevant provisions must be enshrined in a collective agreement, a local regulatory act drawn up in accordance with the norms of the Labor Code;

- the calculation rules developed by the employer should not worsen the position of employees.

However, if you apply your own procedure for calculating average earnings, the accountant will have to calculate vacation pay twice: according to the general rules in accordance with Art. 139 of the Labor Code of the Russian Federation and Regulation No. 922 and the rules established by the collective agreement. The employee needs to pay a large amount.

Example 2

Let's change the conditions of example 1. The organization has a calculation period for determining the average earnings, which is six months. Relevant provisions are enshrined in the collective agreement and the regulation on remuneration.

In this case, the billing period for calculating vacation pay is from 11/01/2015 to 04/30/2016.

The salary for this period will be equal to 187,261.90 rubles. (32,500 rubles x 5 months + 24,761.90 rubles).

The average earnings will be 1,106.88 rubles. (187,261.90 rubles / (5 months x 29.3 calendar days + 2.84 calendar days + 22.68 calendar days)), and the amount of vacation pay is 30,992.63 rubles. (1,106.88 rubles x 28 calendar days).

Let's compare the result (30,992.63 rubles) with the amount obtained in example 1 (30,882.32 rubles), where the calculation was made according to general rules. As you can see, vacation pay calculated according to the rules adopted in the organization, although not by much, is higher. Consequently, the employee is entitled to vacation pay calculated in accordance with the local acts of the employer.

Example 3

Let's change the conditions of example 1. The organization has a settlement period for determining the average earnings - two calendar years preceding the vacation. Relevant provisions are enshrined in the collective agreement and the regulation on remuneration.

The salary of an employee until 01/01/2015 is 30,000 rubles.

In addition to the periods listed in the conditions of example 1, the period of temporary disability from March 16 to March 25, 2015 should be excluded from the billing period. The salary of an employee for the time actually worked in March is 20,119.05 rubles.

Calculate vacation pay.

In this case, the billing period is from 05/01/2014 to 04/30/2016.

The employee's salary for the billing period will be 708,928.60 rubles. (30,000 rubles x 8 months + 32,500 rubles x 13 months + 20,119.05 rubles + 1,547.62 rubles + 24,761.90 rubles).

The number of calendar days in not fully worked months will be equal to:

- in March 2015 - 18.90 cal. days (29.3 / 31 x 11);

- in August 2015 - 2.84 cal. days (29.3 / 31 x 3);

- in March 2016 - 22.68 cal. days (29.3 / 31 x 24).

The average daily wage of an employee is 1,074.59 rubles. (708,928.60 rubles / (21 months x 29.3 calendar days + 18.90 calendar days + 2.84 calendar days + 22.68 calendar days)), and the amount of vacation pay - 30,088.52 rubles. (1,074.59 rubles x 28 calendar days).

When comparing the amounts of vacation pay calculated according to the general rules (in example 1 - 30,882.32 rubles) and the rules of the organization (30,088.52 rubles), it can be seen that a larger value is obtained in the first case. That is what should be paid to the employee.

We take into account vacation pay for income tax purposes

Possibility to recognize holiday pay for the purposes of application of Ch. 25 “Corporate income tax” of the Tax Code of the Russian Federation is provided for in paragraph 7 of Art. 255 of the Tax Code of the Russian Federation.

In Letter No. 03-03-06/2/19828 dated 07.04.2016, the Ministry of Finance clarified: expenses in the form of average earnings saved by employees during vacation are included in expenses for the purposes of taxing the profits of organizations in the manner prescribed by paragraph 4 of Art. 272 of the Tax Code of the Russian Federation, or are written off from the reserve for future expenses for vacation pay in the manner prescribed by Art. 324.1 of the Tax Code of the Russian Federation.

In other words, organizations have two options for accounting for amounts paid when providing employees with annual paid holidays:

- write off the accrued vacation pay as expenses at a time. According to paragraph 7 of Art. 255 of the Tax Code of the Russian Federation, when calculating income tax, labor costs include the average earnings retained by the employee during the vacation. In tax accounting, such expenses are recognized on a monthly basis based on the accrued amounts (clause 4, article 272 of the Tax Code of the Russian Federation). When determining the tax base for corporate income tax, the amount of accrued vacation pay for annual paid vacation is included in expenses in proportion to the vacation days falling on each reporting period (letters of the Ministry of Finance of the Russian Federation dated July 21, 2015 No. .2015 No. 03-03-06/40536, dated 09.07.2015 No. 03-03-06/1/39600, dated 12.05.2015 No. 03-03-06/27129);

- evenly account for the amount of vacation pay. For these purposes, a reserve is created for future expenses for paying holidays according to the rules of Art. 324.1 of the Tax Code of the Russian Federation. If the organization has decided to create such a reserve, it is necessary to prescribe the accepted method of reservation in the accounting policy for tax purposes, determine the maximum amount of deductions and the monthly percentage of deductions to the specified reserve (Letter of the Ministry of Finance of the Russian Federation of December 16, 2015 No. 03-03-06 / 2 / 73666).

The calculation of the amount of monthly deductions is given in a special document (calculation or estimate).

In order to form a reserve, he is obliged to draw up a special calculation (estimate), which reflects the calculation of the amount of monthly deductions to the specified reserve, based on information about the estimated annual amount of expenses for paying holidays, including the amount of insurance premiums for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with motherhood, compulsory medical insurance, compulsory social insurance against accidents at work and occupational diseases from these expenses (letters of the Ministry of Finance of the Russian Federation dated 07.04.2016 No. 03-03-06/2/19828, dated 01.04.2013 No. 03 -03-06/2/10401). At the same time, the percentage of deductions to the specified reserve is determined as the ratio of the estimated annual amount of expenses for vacation pay to the estimated annual amount of expenses for labor remuneration.

Here is the formula for calculating the amount of monthly deductions to the reserve:

In this case, the percentage of deductions to the reserve is determined by the following formula:

Below is a sample of a special document (estimate), which reflects the calculation of the amount of monthly deductions to the vacation reserve.

I approve

Director of Matrix LLC

Borisov O. S. Borisov

31.12.2015

Estimated reserve for future expenses for vacation pay for 2016

| Index | ||

|---|---|---|

| Estimated amount of vacation pay excluding mandatory insurance premiums* | ||

| The amount of insurance premiums accrued on the estimated amount of vacation pay (820,000 rubles x 30.2%)** | ||

| Limiting amount of deductions to the reserve (820,000 + 247,640) rub. | RUB 1,067,640 |

|

| Estimated amount of labor costs for the year (excluding vacation pay)*** | RUB 9,850,000 |

|

| The amount of insurance premiums accrued on the estimated amount of labor costs (9,850,000 rubles x 30.2%) | RUB 2,974,700 |

|

| The estimated amount of labor costs for the year, taking into account mandatory insurance premiums (9 850 000 + 2 974 700) rub. | RUB 12,824,700 |

|

| Percentage of deductions to the reserve for future expenses for vacation pay (1,067,640 rubles / 12,824,700 rubles x 100%) |

Chief Accountant Potapov V. P. Potapov

* The estimated amount of vacation pay can be calculated either as the product of the average salary of employees of the organization and the average number of vacation days, or based on data from the previous year.

** The rate of insurance contributions to non-budgetary funds applied in the organization is 30%, the rate of insurance premiums for compulsory social insurance against industrial accidents and occupational diseases corresponds to the I class of occupational risk - 0.2%. There are no employees with incomes exceeding the maximum value of the base for calculating insurance premiums.

*** This indicator can be formed either by summing up the annual salaries of the organization's employees according to the staffing table, or using the data of the previous year.

Note

The reserve for vacation pay cannot be used to cover the cost of paying compensation for unused vacation. This is due to the fact that the cost of wages retained by employees during the vacation provided for by the legislation of the Russian Federation (clause 7 of article 255 of the Tax Code of the Russian Federation) and monetary compensation for unused vacation in accordance with the labor legislation of the Russian Federation (clause 8 of article 255 of the Tax Code Russian Federation) are different types of labor costs (letters of the Federal Tax Service for Moscow dated 04.06.2014 No. 16-15 / 054509, the Ministry of Finance of the Russian Federation dated 03.05.2012 No. 03-03-06 / 4/29).

Is it possible to attribute the costs of creating a reserve for vacation pay to indirect costs of the taxpayer?

Employers determine the basis for calculating insurance premiums separately for each individual from the beginning of the billing period after the end of each calendar month on an accrual basis (part 3 of article 8 of Federal Law No. 212-FZ).

Payment of contributions to the PFR, FFOMS and FSS accrued on vacation pay is made no later than the 15th day of the month following the month in which vacation pay is accrued (part 5 of article 15 of Federal Law No. 212-FZ, clause 4 of article 22 of Federal Law No. 125-FZ).

Note

The calculation of insurance premiums from the amounts of vacation pay is carried out by the payer of insurance premiums - the organization in the period in which the indicated amounts were accrued, regardless of the period of their actual payment to employees (letters of the Ministry of Labor of the Russian Federation dated 04.09.2015 No. 17-4 / Vn-1316, 17 -4/B-448).

Monthly mandatory payments on insurance premiums are calculated during the settlement (reporting) period following the results of each calendar month, based on the amount of payments and other remuneration accrued from the beginning of the settlement period until the end of the corresponding calendar month, and the rates of insurance premiums minus the amounts of monthly mandatory payments calculated from the beginning of the billing period to the previous calendar month inclusive. This procedure is established in Part 3 of Art. 15 of Federal Law No. 212-FZ.

What is the period for reflecting the amount of vacation pay in the reporting on insurance premiums if they are accrued and paid to the employee in June, and his vacation begins in July?

In the Letter of the Ministry of Labor of the Russian Federation of August 12, 2015 No. 17-4 / OOG-1158, a reference is made to paragraph 1 of Art. 11 of Federal Law No. 212-FZ, according to which, for organizations, the date of making payments and other remunerations in favor of employees is determined as the day these payments and remunerations are accrued. Taking into account this norm, the calculation of insurance premiums is carried out by the payer of insurance premiums - the organization in the period in which the payments were accrued. Consequently, when accruing vacation pay to an employee in June of the current year, their amount is included in the reporting on insurance premiums for the six months.

Similar clarifications were provided in the Letter of the Ministry of Labor of the Russian Federation of June 17, 2015 No. 17-4 / V-298, which considered the issue of reflecting vacation pay in a situation where vacation begins in April and payments are made in March. The Ministry of Labor recommended that vacation pay accrued to an employee in March of this year be included in the reporting on insurance premiums for the first quarter.

Holidays and personal income tax

When paying vacation pay, it is necessary to calculate and withhold personal income tax from their amount.

Taking into account the above norms, the Ministry of Finance came to the conclusion: the income of employees of the organization who are not recognized as tax residents of the Russian Federation in accordance with Art. 207 of the Tax Code of the Russian Federation received from sources outside the Russian Federation are not subject to personal income tax.

In conclusion, once again we draw your attention to some important points:

- in a collective agreement, a local normative act, periods for calculating the average wage may be provided, different from those established in Art. 139 of the Labor Code of the Russian Federation, provided that this does not worsen the situation of employees (Letter of the Ministry of Finance of the Russian Federation dated January 25, 2016 No. 03-03-06 / 2/2557);

- expenses in the form of average earnings saved by employees during the holidays are included in expenses for the purposes of taxing the profits of organizations in the manner prescribed by paragraph 4 of Art. 272 of the Tax Code of the Russian Federation, or are written off from the reserve for future expenses for vacation pay in the manner prescribed by Art. 324.1 of the Tax Code of the Russian Federation (Letter of the Ministry of Finance of the Russian Federation dated April 7, 2016 No. 03-03-06/2/19828);

- insurance premiums from the amounts of vacation pay are calculated by the payer of insurance premiums - the organization in the period in which the indicated amounts were accrued, regardless of the period of their actual payment to employees (letters of the Ministry of Labor of the Russian Federation dated 04.09.2015 No. 17-4 / Vn-1316, 17- 4/B-448, No. 17-4/OOG-1158 dated August 12, 2015, No. 17-4/B-298 dated June 17, 2015);

- Personal income tax withheld from vacation pay must be transferred to the budget no later than the last day of the month in which they are paid (clause 6, article 226 of the Tax Code of the Russian Federation).

Federal Law No. 212-FZ dated July 24, 2009 “On Insurance Contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, and the Federal Compulsory Medical Insurance Fund”.

Federal Law No. 125-FZ of July 24, 1998 “On Compulsory Social Insurance against Occupational Accidents and Occupational Diseases”.

A note-calculation according to the unified form T-60 is used to calculate vacation pay and other payments to an employee when providing him with annual paid, educational or other types of leave.

The unified form T-60 was approved by the Decree of the State Statistics Committee of Russia dated 01/05/2004 No. 1. The use of a note-calculation in the form that you develop yourself is not prohibited.

In general, the provision of leave to an employee consists of the following actions:

- the employer issues an order (instruction) to grant leave to the employee;

- then there is a calculation, payment of vacation pay;

- at the final stage, it is necessary to enter information about the vacation in personnel documents.

A sample of filling out a unified form T60

Note-calculation has two sides. The front side of the form consists of basic information about the employee and the leave granted. On the other side of the form, the vacation pay is directly calculated.

On the first page, you must fill in the employee's data: full name, structural unit, position. Then it is necessary to fill in the columns on what basis the leave is granted and its duration: a) annual paid leave and b) annual additional (other) leave.

In column 3, you must enter the total amount of payments to the employee separately for each month of the period (as a general rule, the period is 12 months), taking into account all adjustments - without any calculations. For example, in February, an employee received a salary increase, and in April he received a quarterly bonus - in the certificate you indicate the total amount.

When filling out column 4, it must be taken into account that the average monthly number of calendar days is used when calculating vacation pay. In 2016 there are 366 calendar days. Of this number, 119 days are days off, and 247 working days with a five-day working week. The accepted average monthly number of calendar days is 29.3 days. If the employee has not fully worked for a month, then an additional calculation must be made. To do this, divide the average monthly number of days (29.3) by the actual number of days in the month and multiply by the days worked. For example, an employee was sick for 4 days in August 2016. In this case, the number of days worked in August will be: (29.3: 31) x (31 - 4) = 25.5 days.

You fill in column 5 if the employee has a summarized accounting of working hours.

In column 6, you must indicate the average daily or hourly earnings. How to calculate it? If the billing period has been fully worked out, the calculation looks like this: divide the employee's earnings for the billing period by 12 and by the average monthly number of calendar days - 29.3.

The vacation pay that must be paid to the employee is calculated as follows: the average daily earnings must be multiplied by the number of vacation days from column 7 and subtracted from the received amount of personal income tax and other deductions.

Check out the sample form to fill out the form correctly and avoid mistakes. A sample of filling out the unified form T-60 is given below:

The current form of the unified form T-60