Russian Standard Bank to open a current account. Basic rules of Russian Standard Bank (RSB) for issuing an online credit card. Amount of payment or commission

Russian Standard Bank is the largest in the Russian Federation, it is almost on the very first lines in issuing and servicing credit cards in the Russian Federation. RSB issues and serves them. The bank also provides such services as deposits of individuals, various transfers, various kinds of savings and savings accounts, as well as payments and the recently appeared Internet banking service.

Type of loan or loan

Russian Standard also issues credit cards of international standard, such as Visa, Master Card, American Express. This organization issues various kinds of express loans to buy a certain product.

There are several types of loans. Below are each type of loan and an explanation:

consumer credit. Russian Standard Bank provides consumer loans up to 1 million rubles for the purchase of various household goods. The repayment period cannot exceed 48 months. The interest rate for this type of loan will be from 19% per annum. This type of loan can be issued via the Internet (on-line), this is possible if you make a purchase in an online store.

Cash loan. It can be obtained in the amount of up to 300 thousand rubles, for a period of not more than 48 months, and the interest rate will be from 36% per annum.

Russian Standard Bank issues credit cards with a certain limit. For each client, such a limit is set individually, it depends on the reputation of the client, and his level of income. The maximum limit is 750 thousand rubles. The repayment period is up to 5 years, and the interest rate starts from 28%.

For modern people who want to use the services of this bank, you can order a card online in Russian Standard. This is done very simply on the official website of this organization.

Russian Standard has the exclusive right to issue American Express credit cards in Russia. The cards of this bank are very common and popular all over the planet, so their holders get a lot of useful and profitable. With them, the client can, for example, receive discounts around the world in various hotels, shops, cafes and restaurants.

For modern and advanced people, there is an opportunity to apply and receive an online Russian Standard card via the Internet (online). After, if your application is approved, a bank employee will call you and call you to the office to complete the procedure for issuing a credit card.

Receive new blog articles straight to your inbox:

Updated January 2020

Detailed information about opening a current account in Russian Standard. What documents are required for registration, the cost of opening and servicing. How to fill out an online application for cash settlement for individual entrepreneurs and LLCs on the rsb.ru website - a visual guide. Tariffs offered by the bank, with a list of services provided.

General

information Acquiring Salary

project

Currency

control

Corporate

cards

Opening:

Service:

Payment:

Opening speed:

2-3 working days

License:

2289 from 11/19/2014

Internet bank:

Mobile bank:

The documents:

Passport, PSRN / PSRNIP, TIN (+ decision, charter, order of the general director, location of the company for LLC)

Cash acceptance:

Up to 500 thousand rubles. - 0.25%, up to 1 million rubles. - 0.2%, over 2 million rubles. - 0.15%

Cash withdrawal:

Up to 600,000 rubles. - 2%, up to 2 million rubles. - 5%, over 2 million rubles. - ten%

Acquiring:

Types: trade and Internet; Cards accepted: Visa, MasterCard, MIR, American Express, Diners Club, JCB, UnionPay; commission: up to 100,000 rubles - 2.2%, up to 300,000 rubles - 2%, over 300,000 rubles - 1.8%

Support:

Free

payroll project:

Issuing a salary card: 0 rubles, maintenance: 3,000 rubles, crediting salary: 0.0%, speed: up to 1 day

Opening an account in in. currency:

1 700 rubles

Account management

800 rubles

Resident Operations Agent:

0.12%, minimum 500 rubles.

Registration of the contract:

Payment:

Corporate cards:

Types: MasterCard; opening: from 500 rubles; service: from 1000 rubles.

- Fast registration with the departure of a specialist

- Bank personal service

- Free corporate card service

- Merchant and Internet acquiring with a convenient commission

- Prepaid cards for employees and customers

- Organization of credit during the purchase process

K5M

Reviews

Russian Standard cooperates primarily with medium and large businesses. For them, it provides various unique services, such as assistance in organizing a loyalty program and lending to customers during the purchase process. A small company can open a simple account that includes only the most necessary services. The account is issued without visiting the bank.

Advantages

Positive aspects of opening a current account in Russian Standard:

- Single tariff for cash and settlement services

- Free account management in the absence of turnover

- Settlement accounts in rubles and foreign currency

- Free cash can be deposited

- Preferential percentage of cash withdrawals for payroll

- The commission for withdrawing and depositing cash depends on the average monthly turnover of the transaction

- You can connect an acquiring service and a payroll project to your current account

- Free internet banking

- SMS service - notifications about account transactions

Tariffs

| Standard | |

| Account opening | |

| Account opening | 2 000 rub |

| Certification of a package of documents for opening an account for an individual entrepreneur / legal entity | - |

| Checking if copies match the original | - |

| Certification of the sample signature on the card | - |

| Remote maintenance | |

| Connecting to the Internet Banking System | is free |

| Departure of a specialist | - |

| Subscription fee for Internet banking | is free |

| SMS informing | - |

| Account management and payment orders | |

| Account management | 800 rub per month |

| Payment order via Internet bank | 30 rub for 1 piece |

| Payment order on paper | 150 rubles for 1 piece |

| Cash transactions | |

| Acceptance of cash to the account | 0,15-0,25% |

| Payroll cash withdrawal | 0,5% |

| Cash withdrawal from legal entity account | 2-10% |

| Withdrawing cash from an individual account | 2-10% |

You will learn how to enter your personal account on the official Russian Standard website online. Detailed instructions for convenient and quick access to www.rsb.ru with screenshots and video instructions. A visual guide to recovering a forgotten password to a personal bank account. We provide only the most up-to-date information.

About bank

Russian Standard is one of the largest private banks in Russia. Founded in 1993 under the name Agroopttorg. After the 1998 crisis, it was bought by Rustam Tariko, who also owned the Russian Standard vodka brand. The bank was one of the first to develop consumer lending and credit cards in Russia. The bank was able to attract large foreign investments through cooperation with American Express and the International Finance Corporation. However, in 2018, there were reports of large bank debts to investors.

Rustam Tariko continues to control all the shares of the bank through the companies controlled by him. The head office of Russian Standard is located in Moscow. The bank has a fairly large regional network - it includes more than 150 offices for customer service in 85 cities. The bank's general license number is dated November 19, 2014.

The main specialization of Russian Standard remains consumer lending and issuance of credit cards. In particular, RSB is the main representative of American Express and Diners Club payment systems in Russia and Ukraine. For legal entities, the bank offers settlement and cash services, acquiring, lending in stores and some other services.

Account opening

Step 1. Go to the website of Russian Standard Bank. In the "For business" section, click on the link "Banking for corporate clients":

Select the item "Settlement and cash services":

Step 2. Familiarize yourself with the offer for cash settlement and the conditions of the bank. To fill out an application, click on the button in the block on the right:

Step 3. Fill in the information about the organization and provide contacts. Click on the "Submit" button:

An employee of Russian Standard will call you back and help you complete the documents in order to open a current account.

Required documents

- Charter registered with the IFTS

- Memorandum of Association registered with the IFTS

- Legal entity registration certificate

- Certificate of registration with the tax authority.

- Extract from the Unified State Register of Legal Entities, certified by the seal of the tax authority or a notarized copy

- Location letter

- Licenses

- Decision (protocol) on the establishment of a legal entity

- Certificate from the Federal State Statistics Service indicating the codes: OKPO, OKATO, OKGU, OKFS, OKOPF, OKVED

- Copies of protocols (orders) confirming the powers of the persons indicated in the Signature Card

- Documents proving the identity of the persons indicated in the Signature Card

- Customer profile

- Account opening application

- Certificate of state registration as an individual entrepreneur

- Identification document of an individual

- Certificate of registration with the tax authority

- Card with samples of signatures and seal imprint

- Extract from the USRIP, certified by the seal of the tax authority or a notarized copy

- Certificate from the Federal State Statistics Service indicating the codes: OKPO, OKATO, OKOGU, OKFS, OKOPF, OKVED

- Licenses (patents)

- Notary - a document confirming the appointment to the post by the justice authorities of the constituent entity of the Russian Federation

- Lawyer - a document certifying his registration in the register of lawyers and a document confirming the establishment of a lawyer's office

- Account opening application

- Bank account agreements

- Questionnaire of a client - an individual entrepreneur

Application

- Questionnaire of a client of a legal entity - a resident / non-resident of the Russian Federation

- The Procedure for Performing the Procedures for Acceptance for Execution, Revocation, Return (Cancellation) of Clients' Orders on Transfer of Funds

- Tariffs of Russian Standard Bank JSC for settlement and cash services for legal entities and individual entrepreneurs

Reviews

Russian Standard was at first my lender, I took loans here as an individual. face, and now I registered with them as an individual entrepreneur. They opened a current account for me in three days, they checked everything on the docks themselves, they didn’t chase copies, they did it right on the spot. Communication is polite, positive, you have to wait, so coffee, tea, everything is as it should. I hope the account will work in the same way as it was met, while everyone likes it.

They helped me a lot in Russian Standard when I came to open a current account in their branch for my small individual entrepreneur. Since I opened the pc for the first time, I was immediately given the entire list of documents that needed to be brought to the bank. And treated with care and attention! Still, it's nice that a stranger was met as a native. Now it’s not scary to come to the office, I have my own personal manager who will prompt and explain everything.

He opened his current account in the Russian Standard with a long-term aim. The business plans included a salary project and acquiring. I just studied all the offers of banks, this bank is definitely mine. Now together we go through all the ways to install equipment and learn acquiring. They train my employees for free, the employee was attentive. Even the stupid questions of my cashiers are not offended, repeating several times. I myself learned a lot about such payment, now I have an inside look at it as a specialist. And everything is fine in maintaining an account, credits and transfers are not delayed, the manager sends all statements at once, the Internet bank is set up and works without failures.

OOO Vashdom

Our company is engaged in renting out rooms and apartments. We are successfully cooperating with Russian Standard. One of our products in the bank is a current account. The bank assigned us its employee, who always helps with documents and other issues. We are always in touch, which is very helpful, as it happens that emergency situations can happen. Since we ourselves have a staff, we understand how important a good and competent staff is. This is exactly what this bank does. Therefore, I would like to once again express my gratitude for the mutually beneficial cooperation, which promises to be quite long.

Kristina

I decided to try my hand at business. I was advised to open a current account, as it is much more convenient to do business with it. Of course, at first I spent some time on this to understand all the subtleties. But they told me in more detail directly at Russian Standard Bank. The specialist girl consulted me, also explaining what documents would be needed. I didn’t manage to collect everything at once, so I notified the bank about the approximate dates. When everything was already in hand, they opened an account for me quite quickly. This happened after all the paperwork had been completed.

Vladimir

Opened an account as an individual entrepreneur. I don’t use it especially often, but I needed it for my business. I had to prepare a certain list of documents and papers for this opening to take place. Even for an individual entrepreneur there are a lot of them, but, of course, the bank follows the necessary laws. It's good that I got a competent employee who prepared the entire list of necessary documents for me. Because I know that such questions are often delayed, because all the time I have to deliver certain papers. Therefore, thanks to the high professionalism of the specialist, I did not have to wait long for the entire design.

Good afternoon everyone. I submitted a request to open a bank account. I was informed that it would be necessary to deal with acquiring. Therefore, I needed to contact the employees who are responsible for this moment. I called the managers to quickly resolve my issue. They accepted my application, so now I'm waiting. In addition, another specialist suggested to me what papers and documents should be prepared. Everything was sent directly to the mail, which is very convenient. I just want to be contacted soon. Thanks to.

Initially, I had a Gold Card from this bank and became its regular customer. Therefore, when it came time to open a current account, I looked at just a few other banks, but settled on Russian Standard. I already know some specialists in the bank, so I asked for guidance on opening an account. Everything is basically nothing, but the presence of acquiring was disappointing. They explained to me that it is necessary if I open a current account here. Well, okay, because I don’t want to separately go to another bank specifically for this procedure.

Our firm recently opened a current account with Russian Standard. I am mostly responsible for the financial side, so I decided to leave a review from us. Opened fairly quickly. I contacted the department in advance by phone to send a list of all the necessary papers. Within a couple of minutes I had everything. When the documents were ready, our courier delivered them. We didn't expect to get a call back so quickly. The set up took a minimum of time. It left a positive impression, thank you.

I've been meaning to start working for myself for a long time. Naturally, I spent a lot of time on this. Including choosing for a long time the banks where I should open a current account. I found a sample letter on the Internet and filled it out for myself, and then sent it to the banks that suited me. Several banks responded, including this one. I liked his conditions more, so at first we had email correspondence. It came with a list of required papers. Therefore, with the documents, I then went to the office. By the way, I saved a lot of time. The department accepted all the documentation, saying that they would contact me. Now I'm waiting for the final stage.

Choosing a bank to open a current account is a responsible and important matter. Today, the banking services market is full of proposals for servicing legal entities. The total number of banks in Russia is more than 800, and almost every one of them offers a cash settlement service (cash settlement service).What you should pay attention to when making your choice in favor of a particular financial institution:

1. Reliability of the bank.

2. Location.

Most clients prefer banks located close to their place of work.

4. Deadlines for opening an account.

1. "Sberbank of Russia", OJSC

To open an account for a legal entity in Sberbank of Russia, in addition to the standard package of documents, it is necessary to provide the original lease agreement.

The account opening procedure will take from one to three days.

The cost of opening an account is 2000 rubles.

The fee for the most popular packages "Basis", "Active", "Optima" will be from 2200 to 3100 rubles / month.

The current account of Sberbank is a tariff package that initially includes a certain set of services, such as:

- account management;

- Client - bank;

- making electronic payments;

- acceptance/disbursement of cash (from 0.7% to 1.6% depending on the purpose);

- issuance of account statements, duplicate statements upon request (free of charge).

Pros:

- a large network of branches;

- many cash transactions;

- notarization of constituent documents is not required when opening accounts;

- low cost of operations and services.

- low quality of service;

- availability of queues during operations in branches (not all branches have an electronic queue);

- long processing of requests (up to 10 days);

- poor technical support.

2. "Gazprombank", JSC

OAO "Gazprombank" is one of the three largest financial institutions in Russia with a well-developed network of subdivisions.

Terms of consideration of documents - up to 14 days.

It should be noted that "GPB" requires notarization of constituent documents.

Maintaining a current account in a bank is classic: payment is made not in a “package”, but for each transaction performed separately.

Account opening fee - 2500 rubles. Account maintenance is free. The cost of a payment order is 13 - 100 rubles. Cash withdrawal - from 0.3 to 1% of the amount.

Pros:

- comfortable service;

- a wide range of services;

- payment on the fact only for completed transactions.

- it is necessary to provide an extended package of documents;

- long period of documentation verification;

- it is possible to leave the Security Service of the Bank at the address of registration of the legal entity. faces

- outdated technologies (the "Client-Bank" program does not work with Windows 8).

3. "VTB 24", CJSC

Opening a current account at VTB 24 Bank will take a little time (up to three days, often less) and a little effort: when opening an account, employees do not ask unnecessary questions, do not check the location of the office.

The bank offers a package form of cash settlement with a wide range of services. The first month the client is served as part of the starter package, then he has the right to switch to the most suitable one, depending on the specifics of the work.

For opening an account, VTB 24 charges a fee of 2,000 rubles.

R / s service - 1200 rubles.

Payments in electronic form / on paper: 25 rubles / 60 rubles.

For the issuance of cash, VTB 24 takes 1% (the amount is limited - 500,000 rubles per month).

The cost of the most balanced package of services "Business BKO" is 3000 rubles. The same fee, but an expanded list of services, is also provided in the "Borrower" package for legal entities using bank loans.

- quality service;

- fast processing of requests;

- the ability to change the service package for free;

- provision of services upon request of information from the Unified State Register of Legal Entities;

- deferral of payment for cash settlement up to 20 days.

Flaws:

4. "Rosselkhozbank", OJSC

In order to open a settlement account for an LLC in Rosselkhozbank, you have to pay 2,000 rubles.

Monthly maintenance of the account will be 800 rubles. When a client uses RBS (remote banking), maintaining an account is cheaper - 200 rubles per month. Payment of payment orders - 30-60 rubles.

- the possibility of accruing interest on the balance of the account;

- available rates.

- not the lowest rates for services.

5. Alfa-Bank OJSC

OJSC "Alfa-Bank" is a private bank of the Russian Federation, which is part of the "Alfa-Group". It has a sufficient number of branches in Moscow and other large cities of the Russian Federation.

Having decided to open a current account with a bank, you can use the services for booking an account online, which will allow you to immediately receive account details. The bank also provides a free service - a manager's visit to open an account if it is not possible to visit a branch. The cost of opening an account is 0 rubles. Payment of payment orders - 0 rubles - in electronic form, 150 rubles - on paper.

Package service, the price of packages is from 555 to 6900 rubles per month. When paying in advance, a discount of 25% is provided. The bank also offers the issuance of an Alfa-Cash card, which is linked to a current account.

- convenient services;

- quality service.

- high cost of services;

- high control and exactingness to client documents and operations.

6. FC "Opening" (former "NOMOS - Bank")

You can become a client and open a settlement account of an LLC with Otkritie Bank without leaving your office by filling out an application on the bank's website for a specialist to visit.

The cost of opening an account is 1000 rubles.

Maintaining an account - 800 rubles without using the Client-Bank, with the use of remote banking systems - 200 rubles.

Payment of payment orders - 22 - 30 rubles.

The commission for cash withdrawal is "tied" to the amount, for example:

withdrawal of cash from the Client's accounts (up to 1,000 thousand rubles per month) - 11,400 rubles

- end-to-end service in any branch in the city where the account was opened;

- SMS informing on the movement of funds on the account;

- the possibility of establishing an overdraft facility;

- personal client manager.

- few offices.

7. "Promsvyazbank", OJSC

Opening an account for a legal entity at the tariffs of Promsvyazbank will amount to 590-990 rubles.

Maintaining an account will cost from 550 rubles to 14,300 rubles per month.

Payment can also be made in advance for three months, six months, a year, while the cost of the service will decrease.

Currently, until August 31, 2014, Promsvyazbank is holding a promotion to open an account for free and save up to 21% on annual maintenance. Customers are offered a choice of different tariff packages. The bank also offers free connection and maintenance of the PSB system - online with a high degree of protection through the use of USB keys.

Pros:

- the ability to book an account and receive details online.

- high degree of protection of payments when using RBS.

- high rates for cash withdrawal: from 0.4% to 12% of the amount.

8. "Rosbank", OJSC

Joint Stock Commercial Bank Rosbank OJSC is a universal commercial bank.

For customers with an annual turnover of up to 60 million rubles, Rosbank offers six tariff packages.

The bank also provides preferential rates for cash settlement services when purchasing other banking products or services, such as: a salary project, a deposit, a loan or a bank card.

The average cost of opening an account with Rosbank is 1200 - 1500 rubles.

Maintaining an account - 450 - 1300 depending on whether the remote banking system is used or not.

- a unified approach to billing - the client pays only for what he chose, there are no imposed / unnecessary "options".

- accrual of interest on the balance of funds on the account over 300,000 rubles in the amount of 2 - 4%.

- preferential tariffs/conditions can only be obtained by "connecting options to the load".

- high "price" cash advance: from 0.5% to 10%

9. "

Raiffeisen Bank, CJSC

The bank offers legal entities comprehensive package services depending on the turnover and size of the company.

The package of services for a developing company "Basic" provides for a monthly payment - 1200 rubles, while opening, maintaining an account and servicing the "Client-Bank" are included in the package price.

Payment orders in the amount of 20 pieces per month are also included in the package, moreover, their cost is 25 rubles in electronic form and 120 rubles on paper.

- as part of the package, trading terminals can be provided for use and a salary project is offered on preferential terms.

- loyal conditions for a novice entrepreneur

- many imposed "options"

10. Russian Standard Bank, CJSC

Opening a current account will cost 1500 rubles.

Service - 500 - 2500 rubles.

The cost of payment of PP 25-70 rubles.

- moderate account opening/maintenance fee

- Settlement and cash services for legal entities are carried out only in Moscow.

*Price policy for RKO depends on the regions. All rates are given as an average for the country.

Among the services provided by Russian Standard Bank, the acquiring service is also of interest. It allows you to make non-cash payments using an electronic terminal. Among the advantages, it can be noted that acquiring at Russian Standard Bank is connected in a fairly short time - after 2 calendar days.

The acquiring service for individual entrepreneurs and LLCs in Russian Standard Bank is represented by two types - merchant and Internet. Its choice depends on the specifics of your business. In addition, tariffs may differ - what it depends on and how you can apply for connecting the service will be described in detail in this article.

Benefits of acquiring at Russian Standard Bank

By making an acquiring connection, you can evaluate the advantage of Russian Standard Bank over other organizations:

- An extensive list of serviced cards and payment systems. Russian Standard allows you to accept non-cash payments from any banks, including those located outside the Russian Federation and use all known payment systems for payment - WebMoney, QIWI, Yandex.Money.

- Russian Standard cares about the safety of its clients' funds and provides reliable protection for your funds. The security system is certified by Trustwave, which is the pride of the bank.

- Ability to track all transactions. At any time, you can request information on all operations with cards, being anywhere in the world. This is achieved thanks to the OMS online service, which you will get access to when acquiring is connected.

- Information support with the necessary material. Russian Standard provides its customers with comprehensive information so that you can train your employees to work with the terminal.

- 24/7 support. You can contact the representatives of the bank at any time in case of problems. Bank employees will troubleshoot and advise you on any issues in a short time.

- Modern technologies. The constant introduction of technological innovations provides acquiring from the Russian Standard with universality. The service is available for any companies, regardless of their type of activity.

Merchant acquiring in Russian Standard Bank

You can apply for acquiring at the RSB bank and get an instant response (about 15 minutes). If your application is approved, POS-terminals will be delivered to you - this takes no more than three calendar days. An employee of Russian Standard arrives to connect the equipment, he will also bring a package of documents for concluding a contract for the provision of services. You can also call the hotline at any time.

Acquiring will have a beneficial effect on the activities of your company. It will appear as follows:

- An increase in the number of buyers - your goods and services will be able to be purchased by those who are used to paying by bank transfer.

- The turnover will increase. According to studies, people spend 1.5 times more money through electronic terminals than when paying for goods or services in cash.

- Counterfeiting is very common in trade. But it is possible only with the sale of banknotes. You protect yourself from a significant risk by introducing an electronic terminal into the purchase and sale process that allows you to pay with plastic cards.

- Acquiring allows you to reduce the cost of the collection service. Cashless payment spends much less time and reduces the likelihood of errors in settlements with the buyer to a minimum.

- Competitiveness. Acquiring is able to recommend you as an entrepreneur who keeps up with the times, compete with other companies and look presentable in their eyes.

- Acquiring allows you to improve the level of service. Its implementation shows that you care about your customers.

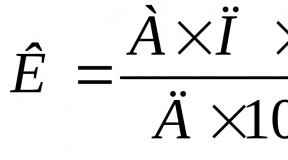

Tariffs for merchant acquiring at Russian Standard Bank

The bank provides several tariffs. The cost of acquiring at Russian Standard Bank depends on various factors. The table clearly demonstrates the application of tariffs.

Pos terminals

Russian Standard is ready to offer several types of POS-terminals:

Terminal service

You will need to pay 1,000 rubles (the amount including VAT) for connecting each POS terminal. A bank specialist will set it up and provide service.

Internet acquiring at Russian Standard Bank

If you sell your services or goods online, an Internet acquiring service is available to you. It does not require special equipment. All you need is an internet connection. Internet acquiring at Russian Standard Bank allows you to increase business turnover.

The advantages of Internet acquiring are as follows:

- Russian Standard is ready to choose the best service option for each client. The Bank provides a high-level service, which includes individual work with each client.

- Simple decoration. You do not need to go to a bank branch. From the moment of submitting an application on the Russian Standard website until the moment of connection, no more than 2 days will pass.

- Ensuring the safety of funds. The Bank assumes all obligations to provide security to its customers. It is regulated by the PCIDSS certificate and is based on the use of the latest 3d Secure technologies.

To facilitate the business activities of customers, many banks are actively developing settlement and cash services. One of the most popular is the maintenance of a current account. A current account in Russian Standard Bank can be opened on favorable terms, which will appeal to owners of small and medium-sized businesses.

Service Benefits

Russian Standard is a Russian financial institution founded in 1999. The headquarters is located in Moscow.

RSB payment details:

Thanks to an honest policy, over the entire period of its existence, the bank has managed to join the trust of consumers and break into the ranks of the largest commercial institutions in the Russian Federation. Today it provides a lot of services for both individuals and entrepreneurs.

As for sole proprietorships and LLCs, there are special conditions for them.:

Tariff plan

Settlement account in Russian Standard Bank is not divided into tariff plans. Service is carried out at a single tariff without the provision of service packages. The cost of operations may vary, depending on regional characteristics. For clarity, we can cite the following table, which will be relevant for Muscovites and St. Petersburg residents for 2018:

| Index | Cost (in rubles) or percentage of the amount |

| RS opening | 2 000 |

| Service fee, including access to the Internet service | 800 per month |

| Subscription fee for users of paper service | 5,000 per month |

| Fee subject to no turnover for the past month | 0 |

| Monthly fee if there is no turnover during the year | 1 500 |

| Closing an account | 0 |

| Commission charged for external payments (with RBS) | 30 rubles per piece. |

| Commission for external transfers (hard copy) | 150 rubles per piece. |

| Interest accrual on account balance | 5% |

| Issuance of a checkbook | 50 |

| Services of collectors | by agreement |

| Cash withdrawal from an ATM | 2–10% |

| Cash withdrawal for salary payments | 0,5% |

Opening a current account

The procedure for opening an account is not burdened with any difficulties. It involves collecting the necessary documents and choosing the appropriate connection method. The most popular variation of receiving RKO services by sending a questionnaire on the Internet. The sequence of its actions will be as follows:

Based on the instructions, it is easy to understand how to register an account online, but not all customers want to use this particular method. Therefore, in RSB there are also opportunities for opening a RS by contacting a bank branch or calling a call center. Having given preference to the first option, it is worth preparing the entire list of papers in advance.

For IP it will be like this:

Document requirements for legal entities in Russian Standard Bank have their own characteristics.

They include:

Other Options

A current account in Russian Standard Bank additionally includes a service for remote management of it, but also in a number of other services designed for comfortable business. The most popular are:

Checking details

RS details are the "key" to the account that allows you to identify the user, make withdrawals, deposits and transfers of funds. Often there is also a situation when an entrepreneur needs to indicate it to fill out reports or other similar documents. Therefore, it is worth considering all possible ways to check, so that in the future there will be no problems finding the necessary combination: