The time wage system is subdivided into. Time wages: description, types and features. Varieties of time payment

A time-based wage system is a form in which an employee's wages are calculated from a salary or tariff rate, taking into account the hours actually worked.

Salary is the established amount of remuneration for the performance of labor duties, accrued for a fully worked month.

Daily or hourly rate - a fixed amount paid for a day or hour worked.

Areas of use

As a rule, the time-based form of remuneration is used when wages are set for management staff, office employees, and workers serving the main production of divisions. But this is not a complete list of areas of application of PSOT.

This mode of settlement with personnel is used precisely in those areas of activity that are focused on the quality of the work performed, and not on the quantity of products produced or services rendered. This approach to the remuneration system encourages employees to constantly improve, improve their skills, and systematically take training courses and trainings. After all, the higher the level of knowledge, the more earnings.

PSOT is mainly used in the following areas of activity:

- The work of a specialist is regulated by a certain rhythm or cycle.

- Work is carried out on conveyor production lines.

- Activities for the repair and maintenance of equipment, machines, units.

- Those types of work in which the quality is more valuable than the amount of work performed.

- The type and areas of activity in which it is impossible to determine the quantitative factor of the work performed, or the implementation of this procedure is irrational, is difficult.

- The type of work, the result of which is not the main indicator of his labor activity.

For example, PSOT is established for medical workers, teachers and teaching staff, accountants, personnel officers. In most cases, the salaries of state and municipal employees are also determined according to this regime.

In simple words, it is quite difficult to calculate the quality of work of an accountant or personnel officer in the reporting month. After all, no one will count how many orders for the organization were prepared, how many reports were drawn up, how many documents were drawn up and how many entries were recorded in the accounting. Moreover, it is irrational to evaluate the quality of the performed operations. It will take an incredible amount of time. In addition, it turns out that if in the reporting month there were fewer of the same orders, then the earnings should be lower.

Time wages: registration of labor relations

The conditions for the accrual and payment of remuneration must be established when an employee is hired. They are prescribed in the employment contract, drawn up in two copies. The employment contract must stipulate the amount of salary or tariff rate, allowances and bonuses.

If a time-based wage system is used, the amount of remuneration for a fully worked month should not be less than the established minimum wage. The federal minimum wage from 01/01/2019 is 11,280 rubles.

If, however, in the subject of the Federation in which the company operates, a regional minimum wage is established, then when setting the minimum remuneration for an employee, it is necessary to focus on it. So, for example, in St. Petersburg, the Regional agreement on the minimum wage dated November 28, 2018 No. 332 / 18-C establishes a minimum remuneration for the performance of labor duties in a fully worked month in the amount of 18,000 rubles, while the tariff rate (salary) of a worker is 1- th category should not be less than 13,500 rubles, which is significantly higher than the federal value.

Time-based form of remuneration: varieties

Time wages are not always payments based on a fixed salary. There are the following varieties:

- simple time-based;

- time premium.

In a simple form, time wages depend on the established tariff rate (salary) and on the actual hours worked. It is rational to establish such a payment regime for specialists whose work is not focused on the final result. Also, PSOT in a simple form is mainly established in relation to workers whose work is aimed at maintaining the main production.

If a simple PSOT is established for an employee, then you should not count on additional types of surcharges. For example, no bonus or incentive payments are provided.

With a simple PSOT, there is a simple and understandable dependence on the actual hours worked and the norm of the general mode of operation. For example, an employee who has worked the norm of working hours in full can count on a full salary. And having worked out only a part of the established norm, a specialist can only claim a proportional amount of the official salary.

A similar calculation procedure is provided if a tariff rate is established for an employee, and daily or hourly does not matter. The number of days or hours worked is calculated, and then the result is multiplied by the approved rate. Such is the distinguishing feature.

The main advantage of a simple PSOT is its stability. That is, the employee is confident that he will receive his salary regardless of the quality of work. But this mode of calculation has a significant drawback. The hired specialist completely lacks any motivation. In simple words, you can work carelessly and not take any active steps - the salary will be the same.

It is in order to increase the motivation and interest of employees in work that the employer adds a premium supplement to the salary or tariff rate. This approach forms a separate type of PSOT.

Bonus-time wages are the accrual of remuneration based on the tariff rate, as well as bonuses set as a percentage of the official salary. The amount of the bonus is established in the regulation on bonuses, the collective agreement of the organization or the order of the head. Sometimes this procedure for calculating remuneration is called piece-time wages. This is not entirely correct, since the piecework system assumes a salary that depends on the result of the work, and not on the amount of time worked.

Time wages: examples

The employee is given a salary of 30,000 rubles. He has a standard five-day work week with an eight-hour workday. In May 2018, the employee worked 15 days. According to the schedule - 20 working days. Determine the salary to be paid:

We will use the conditions of example 1 with the change that the employee is not set a salary, but a daily tariff rate of 1500 rubles.

Let's add a condition. In addition to the salary, the employee, by order of the head, established a bonus for May in the amount of 10% of the salary.

Piecework and time wages

Unlike the system we are considering, piecework wages provide for the payment of remuneration for the final result of the work:

- production of a certain number of products;

- the number of operations performed;

- amount of work achieved.

With this form of payroll, the employee is interested in producing a larger volume of final products, so the employer does not need to analyze how efficiently working time is used. As a rule, this form of payroll is used to accrue remuneration to employees of the main production.

Key differences

Let's define the significant differences between the two systems of remuneration:

|

Evaluation criterion |

Piecework SOT |

Time-based SOT |

|---|---|---|

|

Scope of application |

Areas of activity in which the quantity of products produced, the volume of work performed or services rendered is valued higher than quality indicators. |

Types of work that are focused on the quality of the activities carried out, or work is aimed at ensuring and maintaining the production process. |

|

The impact of labor productivity on earnings |

It has a direct impact on wages. In simple words, the more the employee did, made, did, the greater the amount of remuneration for work. |

There is no effect of labor productivity on wages. The amount of payments depends only on the hours worked. However, the employer may provide bonus surcharges for certain indicators. |

|

Who benefits from it |

To a greater extent, this is beneficial to the employer, since only the result is paid: manufactured products, services rendered, work performed. However, such a payment regime is also beneficial for the employee himself, as it attracts him to work harder in order to receive a decent salary. |

A large benefit of PSOT is determined in favor of hired specialists. After all, the quality of work does not matter. The employee will receive his salary regardless of how he worked, and whether he worked at all or was only present at the workplace. For the employer, of course, such a payment regime is unprofitable. However, there are some types of professions for which other SOTs are not applicable. |

|

Stability of earnings |

In both cases, earnings cannot be called stable and guaranteed. Since in both cases there is a direct dependence on something. For example, wages according to SSOT depend on the quantity of products produced. And on PSOT it has a direct dependence on the hours worked. And if a specialist was absent from the workplace for the entire billing period, regardless of the reasons, then there will be no salary, because he did not work, and he has nothing to pay. |

|

|

The presence of employee motivation |

Motivation is present, since the employee has a direct interest in doing more work in order to get a higher salary. |

If bonus payments are not provided for in the regulation, then the specialist is not at all motivated to work efficiently. |

|

Quality of work |

In both cases, the quality leaves much to be desired. In a piece-rate SOT, the worker is interested in doing more, therefore, certain quality indicators are lost. When, as in PSOT, there is no dependence on quality at all. Of course, the employer can establish additional bonus payments for the quality of work. |

|

Time wages are one of the forms of remuneration for employees of an enterprise, the size of the final salary for which depends on the time actually worked by them. The amount of earnings can additionally be influenced by working conditions and the level of qualification of the employee.

This form of payment, for example, is used in conveyor production, enterprises engaged in equipment maintenance. The use of a time-based system is also advisable in organizations where the result of labor cannot be determined or it requires additional costs.

Varieties of time payment

Hourly pay implies the need to take into account the time worked by employees. For this, a time sheet is used. The rates used in the organization of tariff rates and salaries are reflected in the Regulations on remuneration. An enterprise can pay salaries to employees in accordance with the following types of tariff rates:

- day;

- salary.

The organization may establish a time-based form of remuneration of the following forms:

- simple;

- time-bonus;

- piecework.

Simple time payment

This type is the most attractive for the employee, since the amount of his salary will not depend on the quality of the work performed. But enterprises are reluctant to use a simple payment format, as this reduces the level of motivation of employees.

When using this system, the enterprise takes into account only the time that the employee worked in fact. The calculation formula depends on the selected tariff rate.

Hourly pay

When calculating wages, the responsible person takes into account the number of hours worked by the employee. The final amount payable per month is determined by the following formula:

ZP month = Cost per hour worked x Total hours worked per month

Example

A specialist is paid 200 rubles for each hour of work. In March, he worked 22 working days of 6 hours each (with the exception of March 7 - on the eve of the holiday, the duration was reduced by an hour). So, in a month he worked 21 x 6 + 5 = 131 hours. Then the amount of his salary will be: 200 x 131 = 26,200 rubles.

daily rate

If the company uses a simple time-based wage system with a daily wage rate, then the time sheet indicates the number of days worked. And for the calculations, the formula is used:

ZP month = Daily rate x Number of days worked per month

Example

A specialist receives 1000 rubles per day. In March, he worked 22 days, and in February - 17. Then for February he will receive 1000 x 17 \u003d 17,000 rubles, and for March - 1000 x 22 \u003d 22,000 rubles.

monthly salary

Simple hourly pay can be calculated based on the monthly salary. For a fully worked month, the employee receives a salary in full. If on some days he was absent, then the following formula will be used for the calculation:

ZP month = Salary * Number of days actually worked / Number of working days

Example

The specialist has a monthly salary of 22,000 rubles. In March, he worked only 20 out of 22 working days. For a month he will receive: 22,000 x 20 / 22 = 20,000 rubles.

Time bonus salary

Time-bonus wages are a type of time-based wages, suggesting the possibility of using bonuses. Additional payments allow stimulating employees to achieve high qualitative or quantitative indicators. The head of the enterprise can apply the following types of bonuses:

- fixed amounts;

- as a percentage of salary.

But the time-bonus system of remuneration is not used at all enterprises. Its main disadvantage is the need to constantly monitor employees to determine the effectiveness of their work. But such a salary is calculated very simply - a bonus is added to the amount of the salary for the time actually worked.

Piecework wages

This system is also called time-based with a normalized task. The employee receives a payment consisting of the following parts:

- payment for actual hours worked;

- a bonus for completing the task (this may be a set sales volume, high quality of the goods produced, saving the enterprise's resources).

Such time wages encourage employees to work actively. They become interested in achieving concrete results.

Conclusion

The time-based wage system is a tool that allows you to provide the most comfortable conditions for cooperation between the employee and the employer. The choice of a suitable salary format will increase the productivity and quality of the tasks, which means it will increase the level of profit received at the enterprise.

According to the Labor Code of the Russian Federation, there are different ways of remuneration of employees. Each employer has the right to choose the one that best suits him. True, it must be taken into account that the working conditions of workers must comply with the requirements that the law imposes on employers when preferring one or another system of calculating and issuing wages. In other words, not every work can be paid piecework and not always a salary is due for work. This article will focus on time payment, its features, varieties, disadvantages and advantages.

What is the difference between time wages and other systems

Before proceeding to a detailed analysis of the "time clock", it should be noted that it is widespread in all developed countries. In Russia, more than 30% of workers are paid by the time method.

What is the essence of the time payment system? In the case of "part-time work", the salary of an employee depends on the time actually worked by him, but only if all the functions assigned to him are effectively performed. In order for a company to be able to pay staff according to this principle, it must comply with a number of certain conditions, such as:

- control over the time actually worked by each person;

- awarding wage categories and qualifications to employees based on the results of their education and work experience;

- determination of the amount of salaries based on the functions performed.

Let's decipher the concept. Time wage is a type of wage that is received by an employee with a certain qualification for the time he actually worked.

Attention! Time payment can be applied both to the main staff and to temporary employees and part-time employees.

In turn, the "time" can be of several types: simple, mixed, with a normalized task and time-bonus.

"Time-lapse" as a payment method: types and features

According to the Labor Code of the Russian Federation, wages for employees are set by the employer. At the same time, he is obliged to be guided by the letter of the law, the wage systems and regulations adopted within the company, the collective agreement, as well as the conditions prescribed in individual employment contracts. Before introducing a new payment system at an enterprise or switching from one type of accrual and issuance of wages to another, the employer must agree and approve this with the trade union body, if any.

There are several types of time payment:

- Simple. This is the salary of the employee in its pure form for the time worked by him de facto. The basis here is the tariff rate. To calculate a simple "time clock" you can take different periods: hours, days, weeks or a month.

- Time-bonus payment with a normalized task. This method of payment includes the nuances of both "time work" and piecework payment. Thanks to this form of payment, employees can be sure that both they themselves, at their individual workplaces, and the structural department as a whole will be provided with specific tasks. Thus, several goals are achieved at once: higher quality of finished products, saving material resources, as well as collective, and therefore more fruitful work. Ultimately, the salary of employees includes both "time work" for reliably worked time, and an addition for the result, that is, the fulfillment of the set plan.

- Time bonus system. Here, in addition to a simple "time off", the manager can assign an employee a bonus. The amount of bonuses is determined individually, depending on the qualitative and quantitative indicators of labor. For employees, this method of payment is quite often an excellent motivator, because if the bonuses are economically justified and worthy, then employees work with tripled energy.

- mixed system. It consists of elements of "time-consuming" and piece-rate payment. Here it is briefly worth explaining what a "piecework" system is. Its meaning lies in the fact that payments are made to the employee for a specific amount of goods or services sold in a certain period of time. As a rule, this method of payment is used when the quantity of manufactured products or services rendered can be measured in units. In other words, the higher the amount of work done, the higher the salary. Actually, the main plus of the “deal” is that the salary directly depends on the final results of the work performed. Therefore, in order to increase the efficiency of labor, the employer does not need to make special efforts during the transaction, since the “self-motivator” of employees is turned on. True, piecework pay also has disadvantages: in pursuit of quantity, employees often sacrifice quality, and besides, in the event of any production problems, for example, equipment breakdown, employees do not receive any compensation payments.

Advantages and disadvantages of time wages

The main positive side of the “temporary work” is the cohesion of the team. In addition, with a time-based wage system, the employer may not particularly closely monitor the quality of products, since it is already quite high. The special working atmosphere, usually present in enterprises that practice a time-based pay system, prevents the outflow of labor, so the staff turnover in such companies is much lower.

Despite the fact that the advantages of "temporary" in many cases are more than obvious, it also has certain disadvantages.

For example, since the amount of work performed is not of particular importance, there is no motivation for higher labor productivity, that is, employees in some cases can simply “sit out their pants” at work.

To avoid this, many employers have to pay increased attention to the control of the volume of output, as well as incur losses due to unstable productivity.

Conditions for the introduction of a time-based payment system at the enterprise

In order for a company to be able to introduce time wages, it is necessary that it be able to provide the following conditions:

- keep time records of the time actually spent by employees at their workplace;

- develop and apply standards and maintain conditions to ensure higher productivity;

- carry out billing of all employees who are on the "temporary work".

For a competent calculation of time wages, accountants should use such documents as the timesheet and payroll, and with the tariff rate prescribed in it and the amount of additional payments due to him.

Who uses time payment

Separately, it is worth mentioning who most often uses the time-based wage system. As a rule, these are those enterprises and organizations that are engaged in provision of various types of services population.

Also, quite often, employers use the "temporary" in relation to certain categories of highly qualified specialists, such as engineers, doctors, lawyers, etc.

Thus, the time-based wage system, despite some of its shortcomings, is the most preferable for many employers. It allows you to save wages, keep employees from moving to other companies and at the same time ensure a fairly high quality of work performed.

For effective activity, the management of the company must take appropriate actions that encourage employees to be interested in their own business. Labor motivation is one of the most important functions of personnel management.

Labor motivation- a set of stimulating forces for the growth of the productive power of labor.

These motivating forces include not only material benefits, but also moral ones, expressed in job satisfaction, in the prestige of work, in the fulfillment of internal human attitudes, moral needs.

The main forms of stimulating the work of employees at the enterprise are:- financial incentives, including wages, bonuses, additional wages, discounts for services, granting additional rights, benefits, etc.;

- pecuniary punishment reduction, deprivation of bonuses, reduction of wages, fines, partial, full or increased amount of compensation for damage caused to the enterprise, etc.;

- moral encouragement employees by expressing gratitude, awarding badges of distinction, promotion to new, prestigious positions at work, including in informal groups outside of work (circles, creative, public associations), granting additional rights (free work), involving in enterprise management, etc. . P.;

- moral punishment for omissions and shortcomings in work by issuing remarks, reprimands, deprivation of benefits and advantages, removal from prestigious positions, deprivation of honorary titles and, as a last resort, dismissal from work.

Wages are the main source of incentives and income for those working in the enterprise. Therefore, its size is regulated by the state and the heads of enterprises.

Wage- this is a part of the social product, which is given out in cash to the employee in accordance with the quantity and quality of the spent.

Basic salary— remuneration for work performed in accordance with established labor standards (tariff rates, salaries, piece rates).

Additional salary- remuneration for work in excess of the established norm, for labor success and for special working conditions (compensation payments).

Organization of wages

The organization of remuneration is understood as a set of measures aimed at remuneration for work depending on its quantity and quality. When organizing work, the following activities should be taken into account: labor rationing, tariff regulation of wages, the development of forms and systems of remuneration by bonuses to employees. Labor rationing is based on the establishment of certain proportions in the labor costs required to manufacture a unit of output or to perform a given amount of work in certain organizational and technical conditions. The main task of labor rationing is the development and application of progressive norms and standards.

The main elements of the tariff regulation of wages: tariff rates, tariff scales, tariff and qualification guide.

Tariff rate- expressed in monetary terms, the absolute amount of wages per unit of working time (there are hourly, daily, monthly).

Tariff scale- a scale consisting of tariff categories and tariff coefficients that allow you to determine the salary of any employee. Different industries have different scales.

Tariff and qualification guide- a regulatory document, in accordance with which each tariff category is subject to certain qualification requirements, i.e., all the main types of work and professions and the necessary knowledge for their implementation are listed.

Salary elements

Currently, the main elements of remuneration are salary schemes and types of wages. The minimum wage (formulation of the Ministry of Labor of the Russian Federation) is a social norm and represents the lowest limit of the cost of unskilled labor, based on 1 month.

Wages of engineers and employees determined by staffing, i.e., based on the salary scheme and the number of employees in each group.

Salary fund students determined from the number and benefits which they receive. The wages of workers, pieceworkers and time workers are calculated separately. Workers' wages determined on the basis technical regulation, i.e., based on the development of norms for the cost of working time per unit of output. Labor cost rates include time rates, production rates, and service rates. The production rate is a task for a worker-pieceworker in the production of products of the required quality per unit of time under certain conditions. The norm of time is the length of working time (hours, days) during which a worker must produce a certain amount of output. The service rate determines the number of mechanisms that a given worker (or several) must service during a shift.

In modern conditions, labor relations in firms are built on the basis of labor contracts.

Employment contracts are in the form:- labor agreement- a legal act regulating social and labor relations between employees and employers; is at the level of the Russian Federation, the subject of the Russian Federation, the territory, industry and profession. An employment agreement is established between the contractor and the customer, the employee and the employer.

- collective agreement- a legal act regulating social and labor relations between employees of the organization and the employer; provides for the rights and obligations of the parties in the field of social and labor relations at the enterprise level.

Real wage- the number of goods and services that can be purchased with a nominal wage.

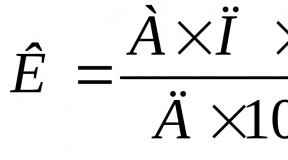

Real wage = (nominal wage) / ()

The study of the dynamics of wages is carried out using indices.The individual wage index can be determined by the formula:

Wages can be paid for both hours worked and hours not worked.

To determine the amount of remuneration, taking into account its complexity and working conditions for various categories of workers, the tariff system is of great importance.

Tariff system- this is a set of norms, including tariff-qualification directories, tariff rates, official salaries.

The Tariff and Qualification Guide contains detailed characteristics of the main types of work, indicating the requirements for the qualification of the contractor.

Tariff rate- this is the amount of payment for labor of a certain complexity, produced per unit of time.

There are two main systems of remuneration: piecework and time.

Piecework payroll

piecework wage system produced at piece rates in accordance with the quantity of products (works, services) produced. It is subdivided into:

1. Direct piecework(an employee's salary is set at a predetermined rate for each type of service or product produced);

Example: the hourly rate of a worker is 30 rubles. The norm of time for the manufacture of a unit of production is 2 hours. The price per unit of production is 60 rubles. (30 * 2). The worker made 50 parts.

- Calculation: 60 rubles. * 50 parts = 3000 rubles;

2. piece-progressive(an employee's output within the limits of the norm is paid at established rates, in excess of the norm, payment is made at increased piece rates).

Example: the price per unit of production at a rate of 100 units is 40 rubles. Over 100 units the price increases by 10%. In fact, the worker made 120 units.

- Calculation: 40 * 100 + (40 * 110% * 20) = 4880 rubles;

3. Piecework premium(salary consists of earnings at basic rates and bonuses for fulfilling the conditions and established bonus indicators).

Example: the price per unit of production is 50 rubles. According to the regulation on the bonus payment of the enterprise, in the absence of marriage, a bonus of 10% of earnings is paid. In fact, the worker made 80 units.

- Calculation: 50 * 80 + (4000 * 10%) = 4400 rubles;

4. Indirect piecework(earnings depend on the results of the work of employees).

Example: the remuneration of an employee is set at 15% of the salary accrued to the team. The brigade's earnings amounted to

15000 rub.

- Calculation: 15000 * 15% = 2250 rubles;

5. chord(the amount of payment is set for the whole complex of works).

Time-based form of remuneration

Time-based is such a form of remuneration in which wages are accrued to employees according to the established tariff scale or salary. for actual hours worked.

With time wages Working time earnings are determined by multiplying the hourly or daily wage rate by the number of hours or days worked.

The time-bonus system of remuneration has two forms:

1. simple time-based(hourly rate multiplied by the number of hours worked).

Example: the salary of an employee is 2000 rubles. In December, out of 22 working days, he worked 20 days.

- Calculation: 2000: 22 * 20 = 1818.18 rubles;

2. Time-bonus(percentage allowance is set to monthly or quarterly wages).

Example: the salary of an employee is 2000 rubles. The terms of the collective agreement provide for the payment of a monthly bonus in the amount of 25% of wages.

- Calculation: 2000 + (2000 * 25%) = 2500 rubles.

Remuneration of labor of managers, specialists and employees is made on the basis of official salaries established by the administration of the organization in accordance with the position and qualifications of the employee.

In addition to remuneration systems, remuneration to employees of organizations based on the results of finished work can be established. The amount of remuneration is determined taking into account the results of the work of the employee and the duration of his continuous work experience in the organization.

The administration of the enterprise may make additional payments in connection with deviations from normal working conditions in accordance with applicable law.

Night time is considered from 22:00 to 06:00 in the morning. It is fixed in the report card every hour of night work, paid at an increased rate.

To work at night are not allowed: teenagers under 18 years old, pregnant women, women with children under the age of three, disabled people.

Payment for work at night is made in the amount of 20% of the tariff rate of a time worker and piece worker, and in multi-shift work - in the amount of 40%.

Overtime is considered work in excess of the established working hours. Overtime work is documented by orders or tables. Overtime work must not exceed four hours on two consecutive days or 120 hours per year.

Overtime work is paid for the first two hours at least one and a half times, and for the following hours - at least twice the size. Overtime compensation is not permitted.

On holidays, work is allowed, the suspension of which is impossible due to production and technical conditions.

If a weekend and a holiday coincide, the day off is transferred to the next working day after the holiday. At the request of an employee working on a holiday, he may be granted another day of rest.

Work on a holiday is paid at least twice the amount:

- pieceworkers - at least at double piecework rates;

- employees whose work is paid at hourly or daily rates - at least double the hourly or daily rate;

- employees receiving a monthly salary - not less than a single hourly or daily rate in excess of the salary.

The amount of additional payments for combining professions in the same organization or performing the duties of a temporarily absent employee is established by the administration of the organization.

When performing work of various qualifications, the work of time workers, as well as employees, is paid for work of a higher qualification. The labor of piecework workers is at the rates of the work performed.

When an employee is transferred to a lower-paid job, he retains his previous average earnings for two weeks from the date of transfer.

In cases where, as a result of the transfer of an employee, earnings are reduced for reasons beyond his control, an additional payment is made up to the previous average salary within two months from the date of transfer.

Downtime is documented with a sheet of downtime, which indicates: downtime, causes and perpetrators.

Downtime due to the fault of the employee is not paid, and not through the fault of the employee - in the amount of 2/3 of the tariff rate of the category established for the employee.

Downtime can be used, i.e. workers receive a new task for this time or are assigned to another job. The work is formalized by issuing work orders and the work order number and hours worked are indicated on the idle sheet.

Distinguish marriage: correctable and irreparable, as well as marriage through the fault of the employee and the fault of the organization.

Marriage through no fault of the employee is paid in the amount of 2/3 of the tariff rate of a time worker of the corresponding category for the time that should be spent on this work according to the norm.

Marriage is formalized by act. If the worker allowed the marriage and corrected it himself, then the act is not drawn up. When the marriage is corrected, other workers are issued a piece work order with a note about the correction of the marriage.

Salary for unworked time

Payment for unworked time includes: payment for annual leave, basic and additional, payment for study holidays, payment of compensation for leave upon dismissal, payment of severance pay upon dismissal, payment for downtime through no fault of the employee, payment for forced absenteeism, payment for preferential hours for nursing mothers .

The procedure for granting and paying for annual and additional holidays

Annual paid leave is granted to employees with a duration of at least 24 working days per six-day working week or at least 28 calendar days. In the first year of an employee's work at the enterprise, he can be granted leave no earlier than 6 months after the start of work.

Temporary and seasonal workers are entitled to paid leave on a general basis. But if temporary workers under an employment contract have worked up to 4 months, and seasonal workers - up to 6 months, then they are not entitled to leave. Home workers are granted leave on a general basis.

Employees who have taken absenteeism without a valid reason, paid leave is reduced by the number of days of absenteeism.

Some categories of employees enjoy the right to extended leave. These categories include: younger workers

18 years old, employees of educational institutions, children's institutions, research institutions, other categories of employees whose vacation duration is established in accordance with legislative acts.

Additional annual leave is granted to: employees with irregular working hours, employees of the Far North and equivalent areas, employees employed in jobs with harmful working conditions.

If an employee falls ill while on vacation, the vacation is extended for sick days.

If an employee falls ill while on additional leave, the leave shall not be extended or rescheduled for another period.

When the maternity leave expires during the period of the next vacation, the latter is interrupted and provided at any other time at the request of the employee.

If an employee quits before the end of the working year in which he has already received a vacation, then the amount for unworked days of vacation is withheld from him.

Deductions for disabled vacation days are not made in the following cases: if the employee is not entitled to payments upon dismissal, the employee is called up for military service, the organization’s staff is reduced, as well as in the event of liquidation, retirement, sending to study, absenteeism for more than four months in a row due to temporary disability, inconsistency of the employee with the position held.

Example: calculation for the time of the next vacation, when all months of the billing period have been fully worked out.

The employee goes on vacation in May. Vacation is calculated on the basis of the three previous months: February, March, April.

- Salary per month - 1800 rubles.

- The average number of days in a month is 29.6.

- The average daily wage is:

- (1800 + 1800 + 1800): 3: 29.6 = 60.8 rubles.

- Vacation pay will be:

- 60.8 * 28 = 1702.4 rubles

The actually accrued amounts of regular and additional vacations, compensations for used vacations are included in production and distribution costs.

Organizations for the accrual of vacations can create a reserve, which is recorded on account 96 "Reserve for future expenses". When forming a reserve, a posting is made: the debit of account 20 "Main production" and the credit of account 96 "Reserve for future expenses". With the actual departure of employees on vacation: the debit of account 96 and the credit of account 70 "Calculations for wages". The percentage of deductions to the reserve is determined as the ratio of the amount needed to pay for vacations in the coming year to the total payroll fund for the coming year.

Example: the annual payroll fund of the organization is 90,000,000 rubles, the amount for vacation pay is 6,300,000 rubles, the percentage of monthly deductions to the reserve for vacations is 6,300,000: 90,000,000 * 100% \u003d 7%.

Monthly deductions to the reserve for wages are calculated according to the formula: 3P + FSS + PF + MHIF: 100% * Pr,

- where ZP - actual wages accrued for the reporting period;

- FSS - contributions to the Social Insurance Fund of the Russian Federation;

- PF - contributions to the Pension Fund of the Russian Federation;

- MHIF - contributions to the Compulsory Medical Insurance Fund of the Russian Federation;

- Pr - the percentage of monthly deductions.

Calculation of temporary disability benefits

The basis for the payment of benefits is a certificate of incapacity for work issued by a medical institution. The allowance for temporary disability is issued from the first day of payment of the disability. In case of domestic injury, the allowance is issued from the sixth day of incapacity for work. If the injuries were the result of a natural disaster, the benefit is paid for the entire period of incapacity for work.

The allowance for temporary disability due to work injury and occupational disease is paid in the amount of full earnings, and in other cases - depending on the duration of continuous work experience, counting minor dependent children. So, with an experience of less than 5 years - 45% of the actual salary, from 5 to 8 years - 65% and over 8 years - 85%.

The calculation of the amount of temporary disability benefits paid is based on average earnings. To calculate average earnings, you need to add up the amounts that were accrued to the employee for the previous 12 months, and divide the result by the number of days worked during this period. This procedure is established by Article 139 of the Labor Code of the Russian Federation.

If in the billing period the employee did not receive a salary or worked at all, then the average earnings are calculated based on payments for the previous period equal to the billing period. If an employee has not yet worked at the enterprise for 12 months, only those months when he has already worked should be taken into account.

Women's allowance registered in medical institutions in the early stages of pregnancy.

For the payment of benefits, women are issued a certificate from the antenatal clinic on registration. The allowance is paid simultaneously with the maternity allowance. In the event of liquidation of an organization, a one-time allowance is paid at the expense of the Social Insurance Fund of the Russian Federation in the amount of a monthly minimum wage. The allowance is paid out of social insurance funds.

In the conditions of modern market relations, wages are the main means of motivating employees.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and IS FREE!

In various classifications, there are dozens of ways to calculate the earnings that an employee should receive based on the results of his activities.

There are two most common and universal forms: and time-based. They do not contain critical contradictions, and it cannot be said that one is the opposite of the other.

What is it based on?

Both forms are based on the accounting of the time spent by the employee at the workplace.

With time-based payment, this time is directly the unit of payment, and with piecework it determines the amount of earnings per unit of labor.

Concept, essence and features

What determines the amount of earnings?

The time-based form of accrual of earnings to an employee is based on the fact that the amount of payment depends on the amount of time spent by him in production, the tariff rate, the task given to the employee for the period of time taken into account, and the quality of the work performed.

When is it appropriate to switch from piecework to hourly wages?

The transition from piecework to hourly wages in production is carried out if:

- the work performed by the employee is not subject to rationing;

- the organization of accounting for performed operations entails unjustified difficulties.

In what cases is it applied?

Time wages are suitable for administrative and service personnel, part-time employees.

To maximize the profits of an enterprise operating according to such a system, it is necessary to make a number of adjustments to the organization of labor:

- maintain strict control over the time worked by each employee, as well as the time and reasons for his downtime;

- develop a flexible classification system for employees based on their experience and length of service and change the tariff in a timely manner, if necessary;

- organize the work of employees in such a way as to minimize downtime;

- use clearly defined tasks for employees of each category.

Subject to these rules, the work of personnel working on a time-based form of payment will be as effective as possible.

Pros and cons

To date, most of the enterprises in countries that are intensively developing the economy of production have switched to a time-based form of remuneration.

This payment scheme has a number of advantages, namely:

- optimization of labor organization and reduction of labor costs for the production of a unit of output,

- increasing the professionalism of employees, as this will allow them to qualify for higher tariff rates;

- control of each workplace and the general course to minimize downtime in production.

However, the time-based form has a significant drawback: the low flexibility of the tariff system does not allow taking into account the difference in the number and quality of tasks performed by employees of the same qualifications and the same type of activity.

Kinds

The payroll form, taking into account the time spent by the employee at the enterprise, is divided into several varieties, which are commonly called systems.

There are four of these systems:

- simple time-based;

- time-bonus;

- mixed (time-piecework);

- time-bonus with job rationing.

Simple time system

When calculating according to the classical time-based system, an employee's earnings (WP) are directly dependent on the time worked by him (twork) and the tariff rate (TS), that is, the category for which the employee works.

ZP=TC*trab

The time worked is calculated depending on the method of calculation adopted at a particular enterprise.

He can be:

- hourly;

- daily;

- monthly.

In this case, hours, days or months will appear in the calculation formula.

Example:

I.I. Ivanov works as an expert part-time at a tariff rate of 300 rubles / hour, 3 hours a day, 5 days a week and receives a monthly calculation.

Ivanov will work for a month: 3 × 5 × 4 = 60 hours.

His earnings per day will be: 3 × 300 = 900 rubles, and per month 60 × 300 = 18,000 rubles.

Time-bonus system

When calculating according to the time-bonus system, not only the time actually spent on production is taken into account, but also the quality of the work performed and (if possible) the number of tasks completed.

Based on the results of processing these indicators, the employee is awarded a bonus.

ZP \u003d ZPpovr + Pr,

ZP - earnings of an employee according to the time-based bonus system, including ZPpovr - earnings according to the classical time-based scheme and Pr - bonus.

The amount of bonus payments to employees is determined by the documents in force at the enterprise:

- bonus regulations;

- leadership order.

Example:

I.I. Ivanov worked 60 hours a month, his wage rate is 300 rubles per hour. For a job well done, he was rewarded in the amount of 15% of the tariff earnings. How much did the employee receive per month?

First, let's calculate how much he would have received without a bonus: 60 × 300 = 18,000 rubles.

The amount of the premium will be: 18,000 × 0.15 = 2,700 rubles.

In total, Ivanov earned a month: 18,000 + 2,700 = 20,700 rubles.

Time-bonus system with a normalized task

This scheme is appropriate if the company accurately calculates the time during which each employee completes the task.

The calculation of earnings in this case is similar in essence to the time-based bonus system, but the amount of payment that the employee will receive based on the results of work will depend on the completion of the task given to him.

mixed system

The mixed (time-piecework) system of accrual of earnings is a synthesis of time-based and piecework forms.

The peculiarity is that part of the time the employee works piecework and receives the appropriate payment, while the remaining part, free from piecework, is calculated for him at time rates.

On the basis of what documents earnings are calculated?

The main documents necessary for accruing earnings to an employee with a time-based form of payment are a time sheet and a personal card.

Time sheet

If the time spent at the workplace is controlled manually, then the time sheet should be filled out in the T-12 form, if on a computer, then in the T-13 form (approved by the Decree of the State Statistics Committee of the Russian Federation No. 1 of January 5, 2004).

Personal card

The employee's personal card is filled out in accordance with the T-2 form, it indicates the tariff rate at which the employee works. It also marks the transition to an increased tariff rate.

How is time wages implemented in the enterprise?

For the rational use of time wages in production, a number of prerequisites are necessary.

Application conditions

An enterprise can switch and continue to work effectively according to this form if:

- there is no possibility (and need) to increase the quantities of manufactured products. If the production volumes are increased, this will lead to marriage and a decrease in quality,

- the production process is strictly regulated, tasks have been developed for each employee,

- the enterprise operates in a conveyor mode, and the functions of employees are mainly focused on monitoring the devices and ensuring the continuity of the conveyor.

In what documents is it reflected?

The form of payment, according to which the company makes the calculation, should be reflected in a number of documents:

- collective agreement;

- agreements concluded at the sectoral, intersectoral and professional levels,

- internal regulations (regulations on wages, on the payment of bonuses, allowances, calculation of coefficients).

Regulations on wages

The accrual of bonuses, the calculation of coefficients and additional payments is approved by the General Director.

It includes general provisions (terms), explains how the tariff rate is calculated, to what extent and on what basis funds are deducted from employees' earnings, and bonuses or other additional payments are paid.

Labor contract

In, which the employee concludes with his employer, indicates:

- what system of time calculation will be applied;

- the size of the tariff rate according to the tariff scale adopted at the enterprise;

- days on which payments will be made.

The transition of the enterprise to this form of remuneration

To transfer an enterprise to the method of calculating wages based on hours worked, the employer must develop a number of necessary documents:

- transition provision;

- new staffing;

- internal normative act of the enterprise.